The global mechanical switch market, driven by rising demand in consumer electronics, automotive, and industrial applications, is experiencing robust growth. According to a 2023 report by Mordor Intelligence, the mechanical switches market is projected to grow at a CAGR of over 6.8% from 2023 to 2028. Similarly, Grand View Research estimates that the global tactile switch market—closely linked to press switches—was valued at USD 4.2 billion in 2022 and is expected to expand at a CAGR of 6.3% through 2030. This sustained growth is fueled by advancements in miniaturization, increased durability requirements, and the proliferation of smart devices. As demand intensifies, a select group of manufacturers has risen to prominence, setting industry benchmarks in performance, reliability, and innovation. The following list highlights the top 10 press switch manufacturers leading this expanding market.

Top 10 Press Switch Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 CCSDualSnap

Domain Est. 1996

Website: ccsdualsnap.com

Key Highlights: A leader in the design and manufacturing of pressure, temperature & flow sensing technology for Aerospace, Defense & Industrial markets….

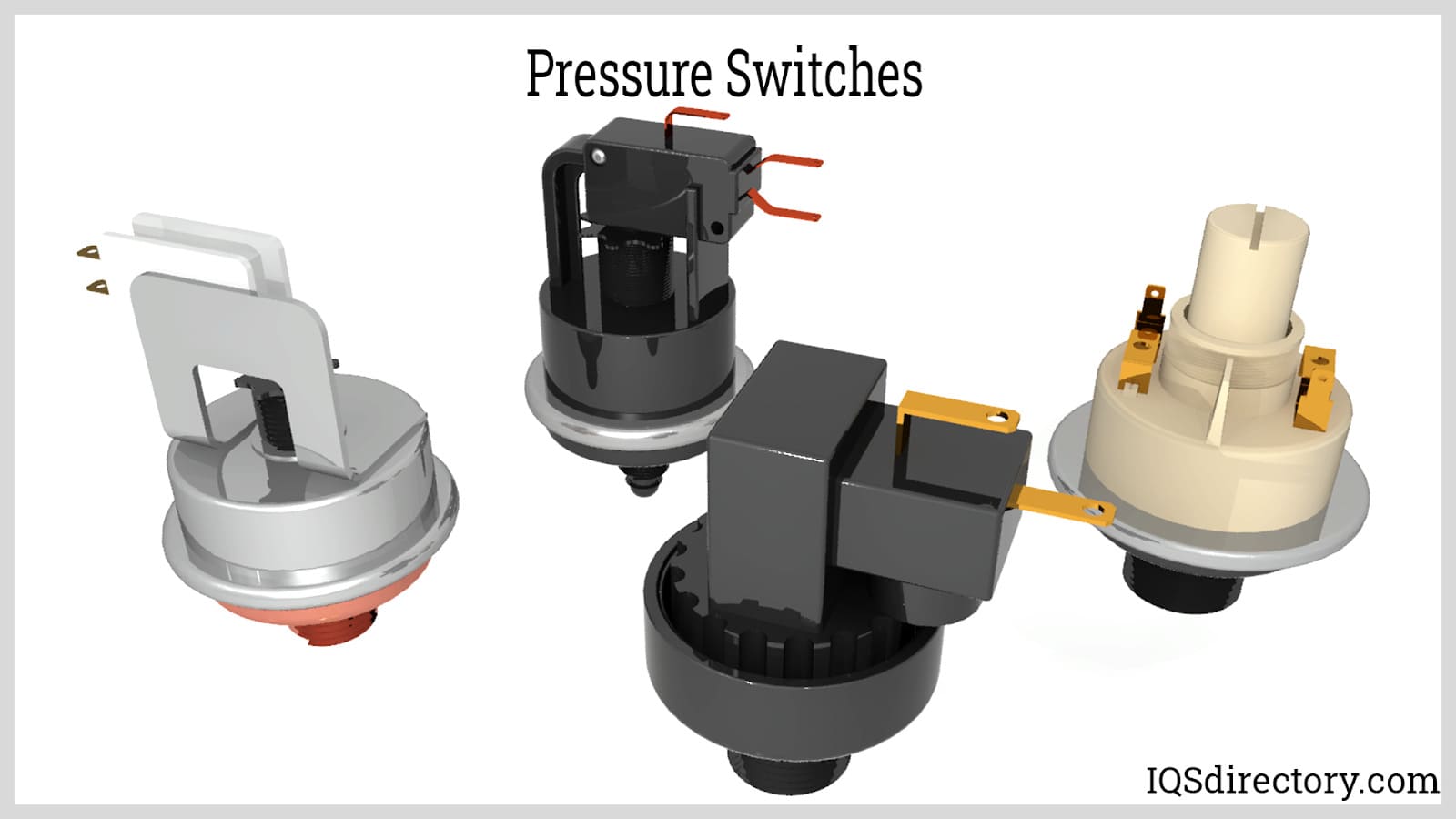

#2 Pressure Switch Manufacturers

Domain Est. 2002

Website: pressure-switches.net

Key Highlights: We design and manufacture advanced pressure switches that serve as critical components in monitoring and controlling industrial processes….

#3 NKK Switches

Domain Est. 1996

Website: nkkswitches.com

Key Highlights: NKK provides complete design solutions from value added services and assembly to system design and application support….

#4 ONPOW

Domain Est. 2018

Website: onpowbutton.com

Key Highlights: Manufacture and sales of button switch products, signal indicator products, switch products and related accessories….

#5 SUCO ESI North America Pressure Switches & Transducers

Domain Est. 2021

Website: sucoesi.com

Key Highlights: SUCO ESI North America delivers high-performance pressure switches, sensors, and clutches engineered for reliability in demanding industrial, mobile, ……

#6 Pressure Switches & Sensors

Domain Est. 1995

Website: norgren.com

Key Highlights: Pressure switches and sensors can be used to automatically monitor pressure levels in a pneumatic system, or be used for more complex monitoring functions….

#7 World Magnetics

Domain Est. 1997 | Founded: 1947

Website: worldmagnetics.com

Key Highlights: Since 1947, the Henry G. Dietz Company has designed and built heavy duty low pressure switches, vacuum switches, and differential switches for many demanding ……

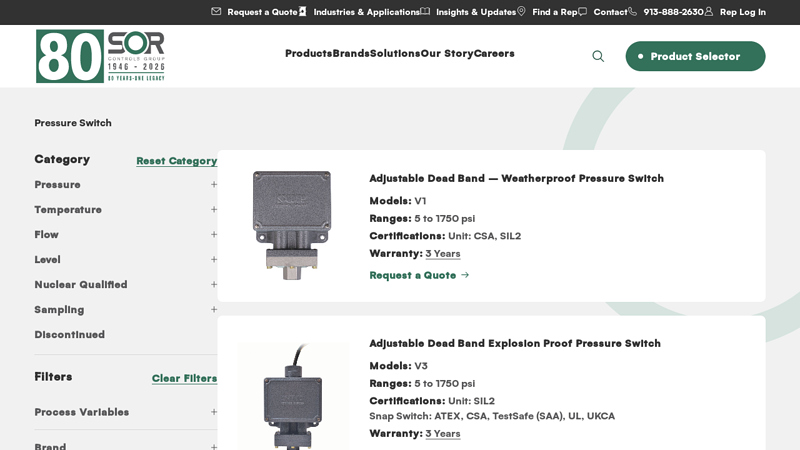

#8 Pressure Switches

Domain Est. 1997

Website: sorinc.com

Key Highlights: Pressure Switch ; Adjustable Dead Band – Weatherproof Pressure Switch · V1 · Certifications: Unit: CSA, SIL2 ; Adjustable Dead Band Explosion Proof Pressure Switch….

#9 Compact Adjustable, Vacuum and General Purpose Switches …

Domain Est. 1997

Website: neodyn.com

Key Highlights: Neo-Dyn provides a myriad of adjustable switches, pressure switches, hazardous area switches, vacuum switches, temperature switches & more!…

#10 Whitman Controls

Domain Est. 1998

Website: whitmancontrols.com

Key Highlights: Whitman Controls manufactures pressure, vacuum, temperature, and liquid level switches and sensors-Trusted for 50+ years with high-quality solutions….

Expert Sourcing Insights for Press Switch

H2 2026 Market Trends for Press Switches

As we look toward the second half of 2026, the press switch market is poised for significant transformation driven by technological innovation, sustainability demands, and evolving industrial and consumer applications. These trends are reshaping design, materials, integration, and market dynamics for both traditional and next-generation press switches.

1. Integration with Smart and IoT-Enabled Systems

Press switches are increasingly becoming integral components of smart devices and Industrial Internet of Things (IIoT) ecosystems. In H2 2026, expect widespread adoption of press switches embedded with sensors and wireless connectivity (e.g., Bluetooth LE, Zigbee) that enable real-time monitoring, predictive maintenance, and remote diagnostics. This trend is especially strong in industrial automation, smart home appliances, and medical equipment, where feedback on actuation frequency, force, and environmental conditions enhances performance and safety.

2. Demand for Miniaturization and High Reliability in Electronics

With consumer electronics continuing to shrink in size while increasing functionality, press switches must follow suit. By H2 2026, manufacturers will prioritize ultra-compact, high-cycle-life switches with precise tactile feedback for wearables, hearables, and portable medical devices. Advances in micro-electromechanical systems (MEMS) and thin-film technologies will enable smaller, more durable switches capable of withstanding harsh environments and repeated use.

3. Growth in Electric Vehicles (EVs) and Automotive Applications

The EV market’s expansion will drive strong demand for press switches in interior controls, battery management systems, and charging infrastructure. In H2 2026, automotive-grade press switches will emphasize IP67+ sealing, EMI resistance, and long-term reliability under temperature extremes. Haptic feedback integration and customizable actuation force will enhance user experience in dashboard and center console interfaces.

4. Sustainability and Material Innovation

Environmental regulations and corporate ESG goals will accelerate the shift toward eco-friendly materials. By late 2026, expect increased use of recycled plastics, lead-free soldering, and biodegradable components in press switch manufacturing. Additionally, design-for-recyclability will become a key differentiator, with modular designs allowing easier disassembly and material recovery.

5. Rise of Tactile Feedback and Human-Machine Interface (HMI) Enhancement

As touchscreens dominate interfaces, physical press switches are being reimagined to provide superior tactile confirmation. In H2 2026, advanced haptic actuators integrated into press switches will deliver programmable feedback (e.g., varying click strength, vibration patterns), improving usability in noisy or visually distracting environments across industrial, medical, and consumer applications.

6. Supply Chain Resilience and Regionalization

Ongoing geopolitical and logistical challenges will push manufacturers to diversify supply chains. By late 2026, we anticipate increased regional production of press switches in North America, Europe, and Southeast Asia to reduce dependency on single-source suppliers and mitigate risks. This shift supports faster time-to-market and compliance with local content regulations.

7. Adoption in Emerging Applications

Beyond traditional sectors, press switches will gain traction in robotics, drone controls, AR/VR gear, and smart furniture. These applications require lightweight, low-power, and highly responsive switching solutions, fostering innovation in capacitive-hybrid designs and force-sensing technologies.

Conclusion

In H2 2026, the press switch market will be characterized by smarter, smaller, and more sustainable solutions driven by digitalization and evolving end-user needs. Companies that invest in IoT integration, material science, and regional supply chains will be best positioned to capture growth in this dynamic landscape.

Common Pitfalls When Sourcing Press Switches (Quality, IP Rating)

Sourcing press switches—especially for industrial, automotive, or consumer applications—requires careful attention to quality and Ingress Protection (IP) ratings. Overlooking key factors can lead to product failure, safety hazards, or increased costs over time. Below are common pitfalls to avoid:

Inadequate Quality Assurance Processes

One of the most frequent issues is selecting suppliers without rigorous quality control systems. Low-cost manufacturers may cut corners on materials, tolerances, or testing procedures. Always verify if the supplier adheres to international standards such as ISO 9001 and conducts batch testing. Absence of documented quality processes increases the risk of inconsistent performance and premature switch failure.

Misunderstanding IP Rating Requirements

Many buyers assume a higher IP rating is always better, but over-specifying can unnecessarily increase costs. Conversely, under-specifying—such as using an IP65 switch in a submersible application requiring IP68—leads to water or dust ingress. Ensure the IP rating matches the actual environmental conditions (e.g., humidity, dust, washdowns) where the switch will be deployed.

Ignoring Long-Term Reliability and Lifecycle Testing

Some press switches perform well initially but degrade quickly under repeated actuation or extreme temperatures. Suppliers may provide basic functional tests but lack data on mechanical lifespan (e.g., 500,000 cycles). Always request lifecycle test reports and consider real-world usage conditions like vibration, thermal cycling, and load type (resistive vs. inductive).

Overlooking Material Compatibility

The switch housing and contact materials must be compatible with the operating environment. For example, using standard plastics in high-UV or chemical-exposed areas can lead to brittleness or corrosion. Similarly, contact materials like silver alloy may oxidize in humid environments, increasing contact resistance. Verify material specs against your application’s chemical and temperature exposure.

Inconsistent IP Certification Claims

Not all IP ratings are independently verified. Some suppliers self-certify or use misleading labels (e.g., “IP67-like”). Always request third-party test reports from accredited laboratories. Without certification, there’s no guarantee the switch will perform as advertised under real-world conditions.

Poor Sealing Design Despite High IP Rating

Even with a high IP rating, poor design—such as inadequate gasket placement or improper housing sealing—can compromise protection. Inspect sample units for uniform gasket compression, proper wire gland integration, and seamless housing joints. Design flaws can render the IP rating ineffective, especially after repeated use or thermal expansion.

Failure to Consider Supply Chain Stability

High-quality press switches often rely on specialized components (e.g., precious metal contacts, molded elastomers). Suppliers with unstable supply chains may substitute materials without notice, affecting performance and IP integrity. Evaluate the supplier’s component sourcing strategy and ability to maintain consistency over time.

Avoiding these pitfalls requires due diligence in supplier selection, clear specification of requirements, and verification through testing and certification. Prioritizing quality and accurate IP compliance ensures reliable, long-term performance in your application.

Logistics & Compliance Guide for Press Switch

This guide outlines the essential logistics and compliance considerations for managing Press Switch products, ensuring smooth operations, adherence to regulations, and successful delivery.

Shipping & Handling Procedures

All Press Switch units must be securely packaged using anti-static materials and standard industrial packaging to prevent damage during transit. Shipments should be labeled with clear handling instructions, including “Fragile” and “Do Not Stack.” Coordinate with certified freight carriers experienced in handling electronic components, and ensure proper insurance coverage is in place for high-value shipments.

Import & Export Regulations

Ensure compliance with international trade laws when shipping Press Switch products across borders. Verify correct HS (Harmonized System) codes—typically 8536.50 for electrical switches—and maintain accurate commercial invoices, packing lists, and certificates of origin. Adhere to export control regulations such as EAR (Export Administration Regulations), particularly when shipping to restricted destinations or for dual-use applications.

Product Certification Requirements

Press Switch units must meet applicable safety and performance standards before market distribution. Key certifications include:

– CE Marking: Required for sale in the European Economic Area, confirming compliance with EU directives (e.g., Low Voltage Directive, RoHS).

– UL/CSA Certification: Mandatory for North American markets to ensure electrical safety.

– RoHS & REACH Compliance: Confirm that materials used in Press Switches are free from restricted hazardous substances.

Maintain up-to-date technical documentation and Declaration of Conformity (DoC) for all certified products.

Inventory Management & Traceability

Implement a barcode or RFID-based tracking system to monitor Press Switch inventory from receipt to shipment. Maintain lot numbers and batch records to support traceability in case of recalls or quality audits. Conduct routine cycle counts and audits to ensure inventory accuracy and prevent stockouts or overstocking.

Environmental & Disposal Compliance

Dispose of defective or end-of-life Press Switch units in accordance with local and international environmental regulations. Follow WEEE (Waste Electrical and Electronic Equipment) directives in applicable regions, ensuring proper recycling through authorized e-waste handlers. Document all disposal activities for audit purposes.

Documentation & Record Retention

Retain all logistics and compliance-related documents—including shipping manifests, customs filings, test reports, and compliance certificates—for a minimum of five years. Store records in a secure, accessible digital format to support regulatory audits and internal reviews.

Training & Compliance Oversight

Provide regular training for logistics and operations staff on compliance protocols, packaging standards, and regulatory updates. Assign a compliance officer to oversee adherence to all logistics and regulatory requirements and conduct periodic internal audits to identify and correct gaps.

Conclusion for Sourcing a Push Switch:

In conclusion, sourcing the appropriate push switch requires a careful evaluation of application requirements, electrical specifications, environmental conditions, mechanical durability, and compliance standards. By identifying key factors such as actuation force, contact configuration, IP rating, and material quality, organizations can ensure reliable performance and longevity of the switch within the intended system. Additionally, partnering with reputable suppliers and considering total cost of ownership—rather than just unit price—leads to better long-term outcomes. A well-sourced push switch not only enhances product functionality and user experience but also contributes to overall system safety and efficiency.