The global prefabricated buildings market, driven by rising demand for cost-effective, sustainable, and rapidly deployable structures, is experiencing robust growth—with particular expansion in niche segments such as equine facilities. According to Mordor Intelligence, the global modular construction market was valued at USD 110.73 billion in 2022 and is projected to grow at a CAGR of 6.8% from 2023 to 2028. A key contributor to this trend is the increasing adoption of prefabricated stables in equestrian centers, private farms, and agricultural operations seeking durability, faster installation, and scalable designs. As sustainability and construction efficiency become top priorities, manufacturers are innovating with steel, timber, and hybrid modular solutions tailored to climatic resilience and animal welfare standards. Against this backdrop, the following nine prefabricated stables manufacturers have emerged as industry leaders, combining advanced manufacturing techniques with data-informed design to meet growing global demand.

Top 9 Prefabricated Stables Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Chart Stables & Equestrian Buildings

Domain Est. 1997

Website: chartstables.co.uk

Key Highlights: We’re one of the UK’s largest & longest established manufacturers of timber stables, field shelters & American barns. Trusted by generations of equestrians….

#2 DB Stable – Horse Stable Supplier & Factory

Website: dbhorsestable.com

Key Highlights: As a premier horse stable supplier, we provide durable, fully customizable indoor use and portable stables, horse fences, and arena products. Our solutions are ……

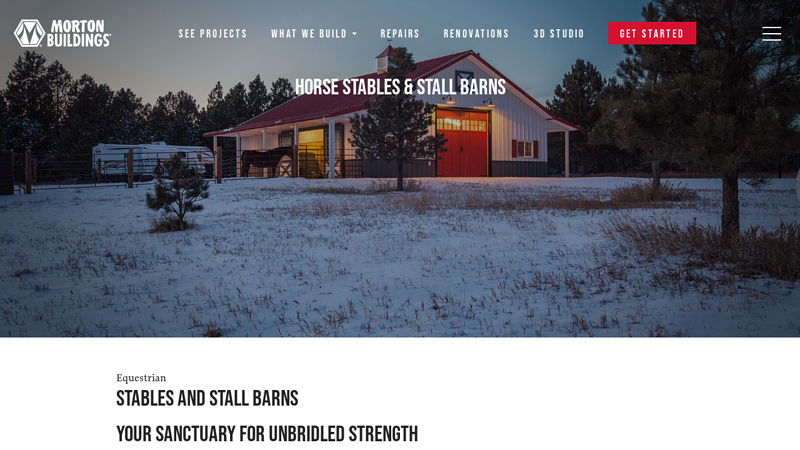

#3 Horse Stables & Stall Barns

Domain Est. 1995

Website: mortonbuildings.com

Key Highlights: Morton Buildings is dedicated to helping you create a custom stall barn that is safe, functional, and attractive….

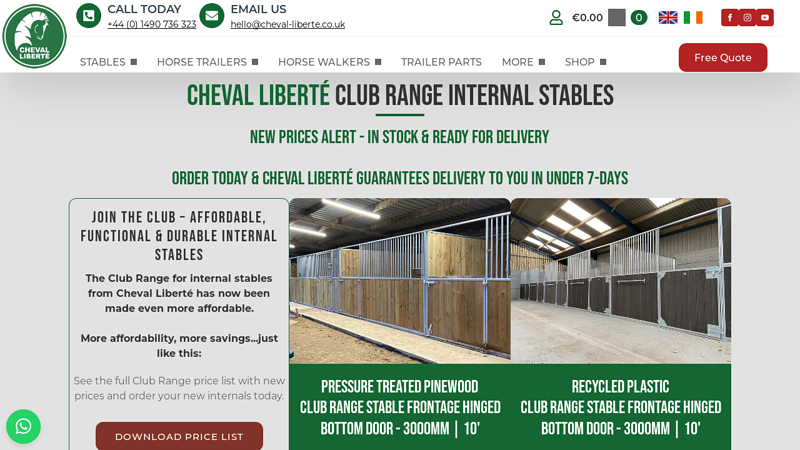

#4 Horse Trailers, Stables, Barns, Internal Stables

Domain Est. 2005

Website: cheval-liberte.co.uk

Key Highlights: For all your equestrian essentials including horse trailers, internal and external stables, temporary stables, parts, and accessories….

#5 Metal Horse Barn Steel Buildings

Domain Est. 2006

Website: sunwardsteel.com

Key Highlights: Rating 4.3 (50) Sunward’s steel horse barn buildings offer strength and speed in construction. Perfect for stables and arenas. Create spacious barn for your horses….

#6 Modular Barns

Domain Est. 2010

Website: arosagrande.hr

Key Highlights: Modular barns and field shelters with heavy-duty construction, perfect for free-range livestock and flexible compartment setups….

#7 Horse Shelters

Domain Est. 2014

Website: solutionstables.com

Key Highlights: We manufacture real Australian paddock shelters made for local conditions using only Australian materials. The shelters are designed for a quick setup….

#8 Quality Horse Stable Steel Buildings

Domain Est. 2018

Website: mavericksteelbuildings.com

Key Highlights: Rating 4.8 (52) Maverick Steel Buildings provides steel building kits including agricultural steel buildings, horse arenas, garage buildings, barns, workshops, and more….

#9 Prefabricated Horse Stable Panels

Website: guerillasteelstables.com.au

Key Highlights: Rating 5.0 (13) Jan 2, 2026 · Australian-made modular horse stable panels built from Duragal® RHS steel and formply, engineered for strength, airflow, and long-term ……

Expert Sourcing Insights for Prefabricated Stables

H2: 2026 Market Trends for Prefabricated Stables

The global prefabricated stables market is poised for significant evolution by 2026, driven by shifting consumer preferences, technological advancements, and broader trends in sustainable agriculture and equestrian activities. This analysis explores key market dynamics expected to shape the industry in the coming years.

1. Rising Demand for Sustainable and Eco-Friendly Construction

Environmental consciousness is increasingly influencing construction choices across sectors, including equine infrastructure. By 2026, prefabricated stables made from sustainable materials—such as FSC-certified timber, recycled steel, and low-carbon composites—are expected to gain substantial market traction. Manufacturers are responding with energy-efficient designs, incorporating features like solar panel readiness, rainwater harvesting systems, and improved insulation. Regulatory pressures and green building certifications (e.g., LEED, BREEAM) will further incentivize eco-conscious stables, particularly in Europe and North America.

2. Growth in Equestrian Sports and Recreational Riding

The equestrian industry is witnessing steady growth, especially in emerging markets such as Southeast Asia, the Middle East, and Latin America. Increased participation in horseback riding for sport, leisure, and therapy is driving demand for high-quality, accessible stable facilities. Prefabricated stables offer a cost-effective and scalable solution for private owners, riding schools, and therapeutic centers. Modular designs allow for easy expansion, making them ideal for growing facilities.

3. Technological Integration and Smart Stables

By 2026, smart technology integration is expected to become a differentiator in the prefabricated stables market. Features such as automated ventilation systems, remote stable monitoring via mobile apps, integrated lighting controls, and IoT-enabled feeding systems will appeal to tech-savvy farm owners. These innovations not only improve animal welfare but also enhance operational efficiency, particularly for large-scale equine operations.

4. Shorter Lead Times and Cost Efficiency Driving Adoption

One of the primary advantages of prefabricated stables—reduced construction time and lower labor costs—will continue to fuel market growth. With supply chain improvements and localized manufacturing, delivery and assembly times are expected to shorten further. This makes prefabricated options especially attractive in regions experiencing labor shortages or harsh weather conditions that limit traditional building windows.

5. Customization and Design Flexibility

Modern consumers demand both functionality and aesthetic appeal. Manufacturers are responding with customizable layouts, finishes, and architectural styles that blend with rural or luxury landscapes. By 2026, online configurator tools will likely become standard, enabling buyers to visualize and adjust stable designs digitally before production, enhancing customer satisfaction and reducing errors.

6. Regional Market Expansion

While North America and Western Europe remain dominant markets due to high equestrian participation and disposable income, growth in Asia-Pacific and the Middle East will accelerate. Countries like India, China, and the UAE are investing in equestrian infrastructure, supported by government initiatives and rising interest in equestrian sports. These regions will drive demand for affordable, high-quality prefabricated solutions.

7. Challenges: Regulatory Hurdles and Perception Issues

Despite growth, the market faces challenges. Varying building codes across regions can complicate modular design standardization. Additionally, some traditional horse owners remain skeptical about the durability and insulation performance of prefabricated units. Education campaigns and case studies showcasing long-term performance will be crucial for market penetration.

Conclusion

By 2026, the prefabricated stables market will be defined by sustainability, innovation, and increasing customization. As demand for efficient, scalable, and environmentally responsible equine housing grows globally, manufacturers who embrace technology, modular flexibility, and green practices will lead the industry. Strategic partnerships with equestrian organizations, agricultural bodies, and green building councils will further strengthen market positioning in this evolving landscape.

Common Pitfalls When Sourcing Prefabricated Stables: Quality and Intellectual Property Risks

Sourcing prefabricated stables offers efficiency and cost benefits, but buyers must navigate several critical pitfalls—particularly concerning quality and intellectual property (IP)—to avoid costly setbacks.

Quality-Related Pitfalls

Poor Material Standards

Many suppliers use subpar materials to cut costs, such as untreated wood prone to rot, thin-gauge steel vulnerable to rust, or low-grade fasteners. These compromises reduce structural integrity and lifespan, especially in harsh weather conditions.

Inadequate Construction and Workmanship

Prefabricated stables may suffer from inconsistent manufacturing, including misaligned panels, weak joints, or improper sealing. Poor assembly instructions or lack of precision can lead to on-site fitting issues, delays, and safety hazards.

Lack of Compliance with Building Codes

Some prefabs are not designed to meet local building, fire, or animal welfare regulations. Using non-compliant structures can result in failed inspections, fines, or forced modifications after delivery.

Insufficient Weatherproofing and Insulation

Inadequate sealing, ventilation, or insulation can compromise animal comfort and health. Buyers may discover leaks, condensation, or extreme internal temperatures after installation, requiring expensive retrofits.

Inconsistent Quality Control Across Batches

Mass-produced units may vary significantly between production runs, especially when sourced internationally. Without third-party inspections or clear quality benchmarks, buyers risk receiving inconsistent or defective products.

Intellectual Property (IP) Risks

Use of Counterfeit or Copied Designs

Some manufacturers replicate patented or copyrighted stable designs without authorization. Buyers who unknowingly purchase such products may face legal liability, reputational damage, or product seizure.

Lack of Design Ownership Clarity

Custom or semi-custom stables may involve unclear IP ownership. If the supplier retains rights to design elements, buyers may be restricted from reproducing, modifying, or even publicly showcasing the structure.

Infringement of Third-Party Patents

Suppliers may use patented construction methods, ventilation systems, or modular components without licensing them. Buyers could be implicated in infringement claims, especially if the stable is later resold or used commercially.

Weak or Absent IP Protections in Contracts

Many sourcing agreements fail to address IP ownership, usage rights, or indemnification clauses. This leaves buyers exposed if disputes arise over design originality or unauthorized use of proprietary features.

Mitigating these pitfalls requires thorough due diligence, clear contractual terms, third-party quality inspections, and legal review of design rights before finalizing any purchase.

Logistics & Compliance Guide for Prefabricated Stables

Product Classification and HS Codes

Prefabricated stables are typically classified under international trade codes based on materials (e.g., steel, wood, or aluminum). Common Harmonized System (HS) codes include:

– 9406.90: Prefabricated buildings, including wooden or metal structures not elsewhere specified.

– 7308.90: Prefabricated structural components of iron or steel.

– 4412.99: Plywood or veneered panels used in timber-framed stables.

Accurate classification is essential for customs clearance, duty assessment, and import/export declarations. Consult local customs authorities or a licensed customs broker to confirm the correct code for your specific product.

Transport and Packaging Requirements

Prefabricated stables are usually shipped flat-packed or in modular kits. Key logistics considerations include:

– Packaging: Components must be securely packed using weather-resistant wrapping, wooden crates, or palletized bundles to prevent damage during transit.

– Loading & Securing: Use appropriate strapping, dunnage, and bracing to avoid shifting during road, sea, or rail transport.

– Labeling: Clearly label packages with handling instructions (e.g., “This Side Up,” “Fragile”), component IDs, and site assembly sequences.

– Shipping Modes: Choose road freight for regional deliveries, sea freight for international shipments, and air freight only for urgent, high-value components.

Import/Export Documentation

Ensure all required documentation is prepared and accurate:

– Commercial Invoice

– Packing List

– Bill of Lading or Air Waybill

– Certificate of Origin

– Import/Export Licenses (if applicable)

– Customs Declaration Forms

For exports to the EU, UK, or North America, additional declarations may be required under REACH (chemical safety), CE marking standards, or EPA regulations.

Regulatory Compliance and Standards

Prefabricated stables must comply with building, safety, and environmental regulations in the destination country:

– Building Codes: Verify alignment with local structural standards (e.g., IBC in the U.S., Eurocodes in Europe) for wind, snow, and seismic loads.

– Fire Safety: Use fire-retardant materials where required; comply with local fire classification standards (e.g., EN 13501 in EU).

– Environmental Regulations: Ensure treated wood complies with restrictions on preservatives (e.g., no arsenic or chromium in CCA-treated timber per EU Biocidal Products Regulation).

– Electrical & Ventilation (if applicable): If stables include lighting or ventilation systems, compliance with local electrical codes (e.g., NEC, IEC) is mandatory.

Site Preparation and Installation Compliance

- Foundation Requirements: Provide clients with clear guidelines on site leveling, drainage, and foundation types (e.g., concrete slab, ground screws) compliant with local zoning and planning laws.

- Permitting: Advise customers to obtain necessary building permits; in many jurisdictions, permanent stables require approval from local authorities.

- Assembly Standards: Include detailed, multilingual assembly manuals and recommend installation by certified professionals where required.

Warranty and After-Sales Compliance

- Clearly define warranty terms, including coverage duration, excluded damages (e.g., weather, misuse), and return policies.

- Maintain records of shipped components for traceability and recall readiness.

- Comply with consumer protection laws (e.g., EU Consumer Rights Directive, U.S. Magnuson-Moss Warranty Act) regarding warranties and dispute resolution.

Sustainability and Disposal

- Provide information on recyclability of materials (steel, aluminum, wood).

- Follow WEEE or similar directives if electronic components are included.

- Offer guidance on responsible end-of-life disposal or disassembly for relocation.

By adhering to this guide, manufacturers and distributors can ensure smooth logistics operations and full regulatory compliance when delivering prefabricated stables globally.

In conclusion, sourcing prefabricated stables offers a practical, time-efficient, and cost-effective solution for equestrian facilities, farms, and private horse owners. The benefits of quick assembly, customizable designs, durable materials, and low maintenance make prefabricated stables a compelling alternative to traditional construction. By carefully evaluating suppliers, comparing product quality, considering local climate requirements, and ensuring compliance with building regulations, buyers can secure a high-quality stable that meets both functional and aesthetic needs. With proper research and due diligence, prefabricated stables provide a reliable, scalable, and long-term housing solution for horses, combining modern manufacturing advantages with equestrian expertise.