The global Pre-Painted Galvanized Iron (PPGI) coil market is experiencing robust growth, driven by rising demand in construction, automotive, and home appliance industries. According to a report by Mordor Intelligence, the PPGI market was valued at USD 31.67 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 5.8% from 2024 to 2029. This expansion is fueled by increasing urbanization, infrastructure development, and the material’s superior corrosion resistance and aesthetic versatility. As demand surges across Asia-Pacific, the Middle East, and Africa, a select group of manufacturers have emerged as leaders in production capacity, technological innovation, and global reach. Based on market presence, export volume, and product quality, the following nine companies represent the top PPGI coil manufacturers shaping the industry’s future.

Top 9 Ppgi Coil Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 1250mm PPGI Steel Coil 275G Pre Painted Galvanized Coils DIN

Domain Est. 2022

Website: ppgi-coil.com

Key Highlights: Shandong Rigang Steel Industry Co., Ltd quality manufacturer from China. We can supply: PPGI Steel Coil : http://www.ppgi-coil.com/supplier- ……

#2 PPGI Steel Coil

Domain Est. 2024

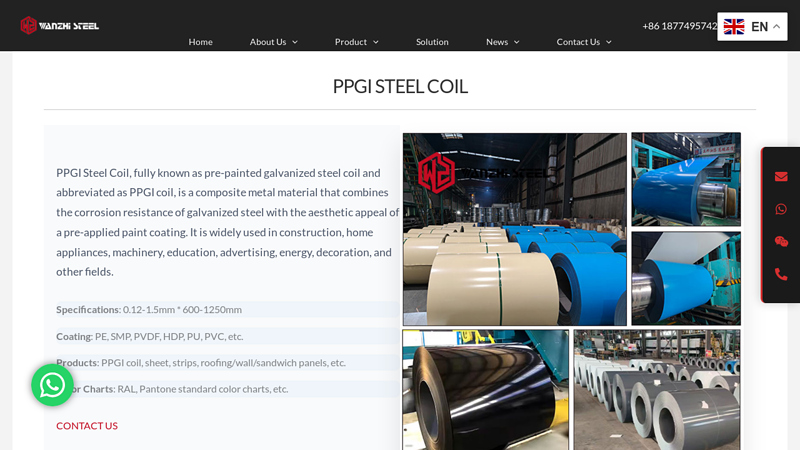

Website: wanzhigalvanized.com

Key Highlights: Wholesale price, diverse patterns/colors/styles of PPGI Steel Coil solutions. Customizable with select specifications available in stock….

#3 PPGI Steel Coil Supplier

Domain Est. 2010

Website: sunnyda-house.com

Key Highlights: Sunnyda is a professional PPGI steel coil manufacturer in China, providing affordable, durable, high-strength products….

#4 Prabhat Global

Domain Est. 2017

Website: prabhatglobal.com

Key Highlights: Top PPGI steel coil manufacturers in India. Prabhat Global Colour-Coated offers premium-quality, durable steel coils for diverse industries….

#5 China PPGI Steel Coil Manufacturer

Domain Est. 2018

Website: cosasteel.com

Key Highlights: COSASTEEL is a PPGI coil , galvanized coil, aluzinc coil manufacturer in China. We cooperate with PPG, Beckers, valspar, Nippon and other well-known paint ……

#6 PPGI coil Supplier Price For Sale

Domain Est. 2021

Website: wanzhisteels.com

Key Highlights: Our PPGI coil is of high quality and competitive price, welcome to visit our factory anytime to place bulk order for color coated steel coil….

#7 PPGI Steel Coil Manufacturers, Suppliers in China. PPGIsteelcoil.com

Domain Est. 2022

Website: ppgisteelcoil.com

Key Highlights: PPGIsteelcoil.com is located in Qingdao City, Shandong province, China which is a professional high-tech company to supplies all kinds of China Products….

#8 Prepainted Galvanized Steel PPGI Coil

Domain Est. 2023

Website: jiuzhou-metal.com

Key Highlights: PPGI (Pre-Painted Galvanized Iron) steel coil is a high-quality metal material widely used in construction and industrial applications. It is typically cold- ……

#9 PPGI Sheets & Coils

Domain Est. 2010

Website: fortran.in

Key Highlights: As a leading PPGI sheet supplier and PPGI steel coil supplier, Fortran Steel is committed to delivering high-quality products that meet international standards….

Expert Sourcing Insights for Ppgi Coil

2026 Market Trends for PPGL/PPGI Coils: Key Drivers and Projections (H2 2026 Outlook)

The global market for Pre-Painted Galvanized/Galvalume Iron (PPGI/PPGL) Coils is poised for continued evolution in 2026, shaped by macroeconomic forces, technological advancements, and shifting regional dynamics. Heading into the second half of 2026 (H2 2026), the market is expected to navigate a complex landscape characterized by stabilization after recent volatility, persistent demand drivers, and emerging challenges.

1. Demand Recovery and Sectoral Shifts:

* Construction Resilience: The primary driver, construction (especially non-residential: warehouses, factories, commercial buildings), is expected to show moderate growth in H2 2026. Rebound in industrial infrastructure projects and ongoing demand for cold storage facilities will support PPGI/PPGL consumption. Residential construction will remain a factor, albeit potentially more subdued in some high-interest rate economies.

* Appliance Stability: Demand from the white goods sector (refrigerators, washing machines, ACs) is projected to be relatively stable, driven by replacement cycles and gradual global economic recovery. Energy efficiency regulations continue to favor the use of coated steel.

* Automotive & Transportation: While not a primary market, niche applications in vehicle bodies (trailers, panels) and transportation infrastructure (bus shelters, station roofing) will contribute steady, incremental demand.

* Regional Divergence: Growth will be uneven. Southeast Asia (Vietnam, Indonesia, India) and the Middle East are expected to be hotspots due to rapid urbanization and infrastructure development. China’s demand may stabilize or grow modestly, contingent on its property sector recovery. Demand in North America and Western Europe will be steady but potentially constrained by economic headwinds.

2. Supply Chain and Raw Material Dynamics:

* Raw Material Costs: H2 2026 will likely see relative stability in key input costs (HDG/HDGL base metal, pigments, resins) compared to the extreme volatility of 2022-2023. However, prices are expected to remain at elevated levels compared to pre-pandemic norms. Fluctuations in zinc, iron ore, and energy costs will remain key watchpoints.

* Capacity Expansion: New production capacity, particularly in Southeast Asia and India, will come online or ramp up in H2 2026. This increased supply could lead to intensified competition, especially in export markets, potentially pressuring margins for producers in established regions.

* Logistics Normalization: Global freight costs and supply chain disruptions are expected to be significantly normalized by H2 2026, improving predictability for international trade.

3. Technological and Quality Advancements:

* Performance Focus: Demand for higher-performance coatings (e.g., polyurethane (PU), polyvinylidene fluoride (PVDF), silicone polyester (SMP) with enhanced durability, corrosion resistance, and weatherability) will grow, especially in harsh environments (coastal, industrial) and for long-life infrastructure.

* Sustainability Push: Environmental regulations and corporate ESG goals will drive investment in:

* Eco-friendly Coatings: Increased adoption of low-VOC (Volatile Organic Compounds) and bio-based resin formulations.

* Energy Efficiency: Development of cool roof coatings (high solar reflectance) to reduce building energy consumption.

* Recyclability: Emphasis on the inherent recyclability of steel and lifecycle assessments.

* Digitalization & Customization: Producers will leverage digital tools for better process control, quality assurance, and offering more customized coil solutions (colors, finishes, embossing) to meet specific customer needs.

4. Competitive Landscape and Pricing:

* Increased Competition: New entrants and expanded capacity will intensify competition, particularly in the Asia-Pacific region. Price competition, especially for standard products, is likely to be a key feature in H2 2026.

* Differentiation by Value: Leading producers will focus on differentiation through superior quality, technical service, reliability, and value-added solutions (e.g., pre-fabricated panels) rather than just price.

* Pricing Pressure: While raw material costs may stabilize, the combination of competitive pressure and potential softer demand in some segments could limit significant price increases, squeezing margins for less efficient players.

5. Key Challenges for H2 2026:

* Geopolitical Uncertainty: Ongoing conflicts and trade tensions (e.g., US-China, regional disputes) could disrupt supply chains and impact trade flows.

* Economic Volatility: Inflationary pressures and the risk of recessions in major economies could dampen construction and consumer spending.

* Environmental Compliance: Meeting increasingly stringent environmental regulations globally requires continuous investment.

* Substitution Threats: While limited, competition from alternative materials (e.g., advanced composites, aluminum in specific applications) remains a long-term consideration.

H2 2026 Outlook Summary:

The PPGI/PPGL coil market in H2 2026 is expected to be one of moderate growth, stabilization, and heightened competition. Demand will be underpinned by resilient construction and appliance sectors, particularly in developing economies. While raw material and logistical pressures should ease compared to previous years, producers will face challenges from new capacity entering the market and sustained focus on cost and sustainability. Success will depend on operational efficiency, technological innovation (especially in performance and sustainability), geographic diversification, and the ability to offer value beyond the basic product. Price volatility is expected to decrease, but margin pressure from competition will persist. The market is transitioning towards a “new normal” characterized by steady, demand-driven growth rather than the boom-bust cycles of recent years.

Common Pitfalls Sourcing PPGL/PPGI Coils (Quality & Intellectual Property)

Sourcing Pre-Painted Galvanized/Galvalume Iron (PPGL/PPGI) coils involves navigating several critical risks, particularly concerning quality consistency and intellectual property (IP) protection. Failing to address these pitfalls can lead to production delays, product failures, legal disputes, and reputational damage.

Inconsistent or Substandard Quality

One of the most prevalent challenges in sourcing PPGL/PPGI coils is ensuring consistent, high-quality material. Many suppliers—especially in competitive low-cost markets—may compromise on raw materials, coating processes, or quality control to reduce prices.

- Variations in Coating Thickness and Adhesion: Inconsistent application of the zinc/aluminum-zinc (Galvalume) layer or the pre-painted topcoat can lead to premature corrosion, chipping, or peeling. Buyers often discover quality deviations only after fabrication or in the field.

- Poor Color and Gloss Uniformity: Especially critical in architectural and consumer-facing applications, color batch inconsistencies or fading due to UV degradation can result in customer complaints and rejected shipments.

- Inadequate Testing and Certification: Some suppliers provide falsified or incomplete mill test certificates (MTCs). Without third-party verification (e.g., SGS, Bureau Veritas), buyers risk receiving coils that don’t meet ASTM, JIS, or EN standards.

- Hidden Defects: Surface scratches, edge damage, or coil set (permanent coil deformation) may not be apparent upon initial inspection but can disrupt downstream processing like roll-forming or stamping.

Intellectual Property Infringement and Brand Misuse

PPGL/PPGI coils often feature proprietary coating technologies, color systems, or licensed branding (e.g., Colorcoat, Galvalume®). Sourcing from unverified suppliers increases the risk of IP violations.

- Unauthorized Use of Patented Technologies: Some manufacturers covertly use patented coating formulations (e.g., polyester, PVDF, SMP) without licensing, exposing buyers to legal liability if the final product is challenged.

- Counterfeit Branding: Suppliers may falsely label generic coils as branded products (e.g., “equivalent to”知名品牌), misleading buyers and infringing on trademarks.

- Lack of Traceability and Documentation: Without proper licensing agreements or material origin documentation, buyers cannot prove due diligence in IP compliance, especially in regulated markets like the EU or North America.

- Gray Market Diversion: Coils intended for specific regions or customers may be diverted through unauthorized channels, undermining brand control and warranty validity.

To mitigate these risks, buyers should conduct thorough supplier audits, require independent quality testing, verify IP rights and certifications, and include clear contractual terms on compliance and liability.

Logistics & Compliance Guide for PPGL Coil

Overview of PPGL Coil

Pre-Painted Galvanized Steel (PPGL) coils are widely used in construction, automotive, and appliance industries due to their corrosion resistance, aesthetic finish, and durability. Proper logistics and compliance measures are essential to maintain product quality and meet international trade requirements.

Packaging and Handling Requirements

PPGL coils must be packaged securely to prevent mechanical damage, moisture exposure, and surface scratching during transit. Standard packaging includes:

– Inner plastic wrapping with VCI (Vapor Corrosion Inhibitor) film

– Outer steel or cardboard strapping with edge protectors

– Wooden or steel pallet base for stability

– Waterproof tarpaulin or container cover for sea freight

Coils should be stored and handled in a dry, ventilated area. Lifting must be done using appropriate coil cradles or C-hooks to avoid deformation.

Transportation Modes and Best Practices

Marine Freight (Containerized):

– Use 20’ or 40’ dry containers for optimal protection

– Ensure coils are properly secured with dunnage and blocking to prevent shifting

– Monitor container humidity to avoid condensation

Overland Transport (Truck/Rail):

– Use flatbed trailers with side rails or specialized coil carriers

– Secure loads with heavy-duty straps and corner protectors

– Avoid open transport in rainy or high-humidity conditions

Air Freight (Limited Use):

– Typically used for urgent, small-volume shipments

– Requires lightweight, reinforced packaging due to cost and size constraints

Storage and Environmental Conditions

- Store in covered, dry, and well-ventilated warehouses

- Maintain relative humidity below 70% to prevent white rust

- Keep coils off the ground using pallets or skids

- Avoid direct contact with concrete floors to reduce moisture absorption

Stacking should be limited to 3–4 coils high, depending on coil weight and diameter, to prevent bottom deformation.

International Trade Compliance

Export Documentation:

– Commercial Invoice

– Packing List

– Bill of Lading (B/L) or Air Waybill (AWB)

– Certificate of Origin

– Inspection Certificate (if required by destination country)

Regulatory Standards:

– Ensure compliance with ASTM A755/A755M (Standard Specification for Steel Sheet, Zinc-Aluminum-Magnesium Alloy-Coated)

– Adhere to RoHS and REACH regulations for chemical content (e.g., chromate-free passivation)

– Confirm conformity with destination country building or industrial standards (e.g., EN 10169 in Europe, JIS G3312 in Japan)

Customs and Tariff Considerations

- HS Code for PPGL Coil: Typically 7210.70 or 7225.99, depending on coating type and specifications

- Verify tariff rates and import duties in the destination country

- Be aware of anti-dumping or countervailing duties in markets such as the USA, EU, or India

- Provide accurate technical specifications (coating weight, paint type, thickness, width) to avoid misclassification

Quality Assurance and Inspection

- Conduct pre-shipment inspection (PSI) to verify dimensions, coating quality, and packaging

- Use third-party inspection agencies if required by buyer or regulatory body

- Retain mill test certificates (MTC) and quality control reports for traceability

Environmental and Safety Regulations

- Comply with IMDG Code for sea transport of coated steel products (non-hazardous, but proper labeling required)

- Follow OSHA or local safety standards for handling heavy coils

- Ensure disposal of packaging materials (e.g., plastic, wood) adheres to local environmental regulations

Risk Mitigation and Insurance

- Insure shipments against damage, theft, and moisture-related defects

- Include clauses for force majeure and liability in contracts

- Monitor weather routes and port conditions to avoid delays

Conclusion

Effective logistics and compliance management for PPGL coils ensures product integrity, regulatory adherence, and customer satisfaction. By following standardized packaging, transport, documentation, and safety protocols, suppliers and distributors can minimize risks and maintain competitiveness in global markets.

Conclusion for Sourcing PGCC/PPGI Coils:

Sourcing Pre-Painted Galvanized Iron (PPGI) coils requires a strategic approach that balances quality, cost, supplier reliability, and compliance with technical specifications. After evaluating various suppliers, market trends, and application requirements, it is evident that selecting the right PPGI coil supplier significantly impacts the performance, durability, and aesthetic finish of end products—especially in construction, home appliances, and industrial manufacturing.

Key considerations such as zinc coating weight, paint type (e.g., polyester, PVDF), surface finish, color consistency, and adherence to international standards (e.g., ASTM, JIS, EN) must be prioritized. Additionally, evaluating suppliers based on production capacity, quality control processes, logistical capabilities, and after-sales support ensures long-term supply chain stability.

In conclusion, establishing partnerships with reputable, certified suppliers—whether domestic or international—while maintaining rigorous quality checks and fostering long-term relationships, will result in a reliable and cost-effective PPGI coil sourcing strategy. Continuous market evaluation and staying updated with technological advancements in coating and steel processing will further enhance sourcing efficiency and product quality.