The global power tools market is experiencing robust growth, driven by rising demand across construction, manufacturing, and DIY sectors. According to Grand View Research, the market was valued at USD 41.3 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 5.8% from 2024 to 2030. This growth is fueled by technological advancements, including the shift toward cordless and lithium-ion battery-powered tools, as well as increasing investments in infrastructure development worldwide. Additionally, expanding industrial automation and the growing preference for ergonomic, high-efficiency tools are reshaping manufacturer strategies. As competition intensifies, a select group of manufacturers lead the industry in innovation, global reach, and product diversity. Here’s a look at the top 10 power tools manufacturers shaping the future of the trade.

Top 10 Power Tools Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 FEIN Power Tools, Inc.

Domain Est. 1995

Website: fein.com

Key Highlights: As a power tool specialist, FEIN is a strong partner in demanding metalworking and woodworking applications, representing the highest quality around the world….

#2 Metabo

Domain Est. 1997

Website: metabo.com

Key Highlights: Metabo is a manufacturer of power tools and supplier of accessories for professional users. Visit us at www.metabo.com….

#3 Milwaukee® Tool

Domain Est. 2000

Website: milwaukeetool.com

Key Highlights: Milwaukee Tool is the most respected manufacturer of heavy-duty power tools, hand tools, instruments, and accessories….

#4 Power Tools – Cordless & Electric

Domain Est. 1997

Website: dewalt.com

Key Highlights: Browse power tools, including automotive tools, drills, pneumatic tools and more. Get tools that are guaranteed tough from DEWALT….

#5 Power Tools

Domain Est. 1997

Website: mactools.com

Key Highlights: Free delivery · 30-day returnsMac Tools offers high-quality power tools for efficiency in the shop – air tools, impact wrenches and cordless tools, surface prep ……

#6 Power Tools

Domain Est. 1998

Website: craftsman.com

Key Highlights: From drills to saws, experience precision and power for both DIY and advanced DIY tasks. Equip yourself with reliable tools that deliver exceptional results….

#7 WEN

Domain Est. 1999 | Founded: 1951

Website: wenproducts.com

Key Highlights: Free delivery over $25 · 30-day returnsRemember WEN? We’ve been providing reliable power tools since 1951. Shop woodworking, generators, lawn and garden, drill presses, lathes, an…

#8 Rockwell Tools

Domain Est. 2000

Website: rockwelltools.com

Key Highlights: With a perfect combination of industry-leading speed and precise control, we’ve created the ultimate lineup of oscillating tools, hands down….

#9 Ingersoll Rand Cordless & Air Power Tools

Domain Est. 2001

Website: powertools.ingersollrand.com

Key Highlights: Explore Ingersoll Rand power tools, expertly crafted to handle a variety of tasks including drilling, fastening, cutting, grinding, sanding, and much more….

#10 Festool United States

Domain Est. 2004

Website: festoolusa.com

Key Highlights: Festool USA: German-engineered power tools and accessories for the toughest demands, such as plunge-cut saws, circular saws, jigsaws, cordless drills, ……

Expert Sourcing Insights for Power Tools

H2: 2026 Market Trends for Power Tools

The global power tools market is poised for significant transformation by 2026, driven by technological innovation, shifting consumer demands, and evolving industrial applications. Key trends shaping the landscape include:

1. Dominance of Cordless & Battery Advancements:

Cordless tools will solidify their market leadership, fueled by continued improvements in lithium-ion battery technology. Expect widespread adoption of higher-voltage platforms (e.g., 36V/40V max) offering greater power and runtime. Fast-charging capabilities and increased battery lifespan will enhance productivity, especially in professional and DIY segments. Battery platform compatibility across tool brands and product lines will become a key competitive differentiator.

2. Smart Tools & IoT Integration:

Connected power tools equipped with sensors, Bluetooth, and Wi-Fi will gain traction. Features like usage tracking, performance analytics, maintenance alerts, and asset management via mobile apps will be standard, particularly in commercial and industrial settings. This data-driven approach improves tool utilization, reduces downtime, and supports predictive maintenance.

3. Sustainability & Circular Economy Focus:

Environmental regulations and consumer demand will push manufacturers toward sustainable practices. This includes designing for durability, repairability, and recyclability. Battery recycling programs, reduced packaging waste, and lower carbon footprints in manufacturing will become critical. Tools built for longer lifespans and modular designs (e.g., replaceable components) will appeal to eco-conscious users.

4. Growth in E-Commerce & Direct-to-Consumer (DTC) Models:

Online sales channels will expand rapidly, driven by convenience, competitive pricing, and enhanced digital experiences (e.g., AR/VR for product visualization). Brands will invest in DTC platforms to control customer relationships, gather data, and offer personalized services like subscription-based tool access or battery leasing.

5. Expansion in Emerging Markets:

Asia-Pacific, Latin America, and Africa will be key growth engines due to urbanization, infrastructure development, and rising disposable incomes. Localized product offerings, affordable tool kits, and distribution partnerships will be essential for market penetration.

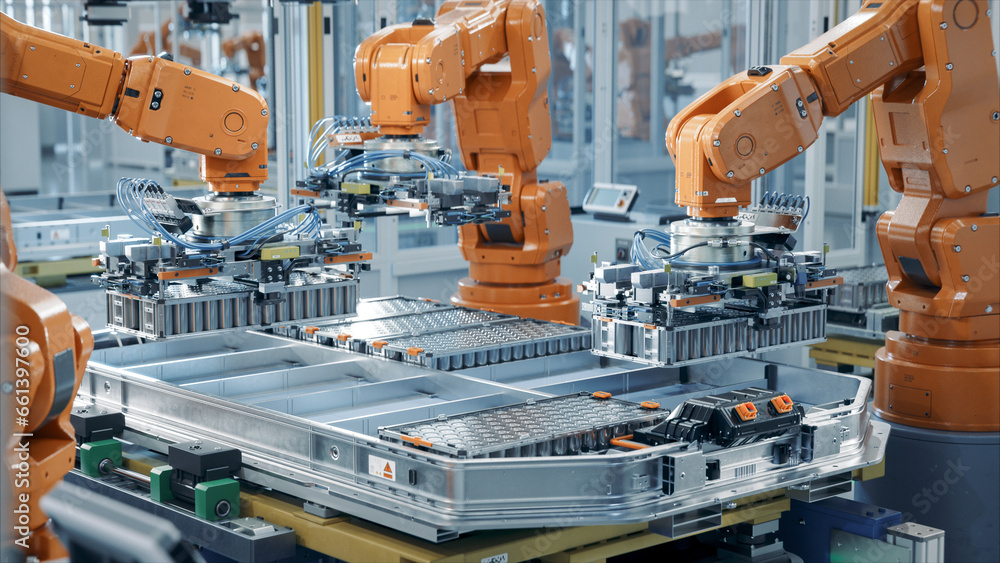

6. Automation and Robotics Integration:

In industrial and construction environments, power tools will increasingly interface with automation systems and robotics. This includes robotic arms using power tools for repetitive tasks, enhancing precision and safety while reducing labor costs.

In summary, the 2026 power tools market will be defined by smarter, greener, and more connected solutions, with a strong emphasis on user-centric design and digital integration across both consumer and professional segments.

Common Pitfalls Sourcing Power Tools (Quality, IP)

Sourcing power tools from global suppliers, especially from regions like Asia, can offer significant cost advantages. However, buyers often encounter critical challenges related to product quality and intellectual property (IP) protection. Overlooking these pitfalls can lead to financial losses, reputational damage, and legal complications.

Inconsistent or Substandard Quality

One of the most common issues when sourcing power tools is variability in build quality. Suppliers may deliver samples that meet specifications, but mass-produced units often fall short. Common quality problems include:

- Use of inferior materials (e.g., low-grade motors, plastic gears instead of metal)

- Poor assembly and finish, leading to premature failure or safety hazards

- Inaccurate performance metrics (e.g., advertised RPM or torque not matching real-world performance)

- Lack of safety certifications, increasing liability risks

To avoid this, conduct thorough factory audits, perform batch testing, and use third-party inspection services before shipment.

Intellectual Property (IP) Infringement Risks

Power tools are often protected by patents, trademarks, and design rights. Sourcing from manufacturers who replicate branded tools (e.g., knock-offs of DeWalt, Makita, or Bosch designs) exposes buyers to serious IP violations. Risks include:

- Seizure of goods by customs due to counterfeit claims

- Legal action from brand owners, even if the buyer claims ignorance

- Damage to brand reputation when selling infringing products

Always verify that the supplier owns the designs or has proper licensing. Conduct IP clearance searches and include IP indemnity clauses in supplier contracts.

Misrepresentation of Technical Specifications

Suppliers may exaggerate technical capabilities to win business. This includes inflating power ratings, battery life, or compatibility claims. Without independent verification, buyers may receive tools that underperform or fail in demanding applications.

Solution: Require third-party test reports and conduct hands-on performance evaluations in real-world conditions.

Lack of Compliance with Regional Safety Standards

Power tools must meet regional safety regulations such as UL (USA), CE (Europe), or CCC (China). Non-compliant tools cannot be legally sold and may pose fire or injury risks.

Ensure suppliers provide valid certification documents and test reports from accredited labs. Regular compliance audits are essential.

Supply Chain and After-Sales Support Gaps

Many low-cost suppliers lack robust after-sales support, warranty programs, or spare parts availability. This leads to customer dissatisfaction and higher long-term costs.

Prioritize suppliers with clear warranty terms, technical support, and a service network.

Final Recommendation

To mitigate these risks, perform due diligence on suppliers, invest in quality control processes, protect your IP proactively, and build long-term relationships with reputable manufacturers. Sourcing power tools successfully requires balancing cost with compliance, quality, and legal safety.

Logistics & Compliance Guide for Power Tools

Overview

This guide outlines the essential logistics and compliance considerations for the safe and legal transportation, storage, and distribution of power tools. Adhering to these guidelines ensures regulatory compliance, minimizes risks, and supports efficient supply chain operations.

Regulatory Compliance Requirements

International Regulations

Power tools shipped across borders must comply with international standards and regulations, including:

– IEC 62841 Series: International safety standards for hand-held motor-operated electric tools.

– RoHS (EU): Restriction of Hazardous Substances in electrical equipment. Prohibits certain substances like lead, mercury, and cadmium.

– REACH (EU): Registration, Evaluation, Authorization, and Restriction of Chemicals. Requires disclosure of Substances of Very High Concern (SVHC).

– CE Marking: Mandatory for products sold in the European Economic Area, indicating conformity with health, safety, and environmental standards.

North American Requirements

- UL/ETL Certification (USA/Canada): Safety certification by Underwriters Laboratories or Intertek, based on standards such as UL 62841.

- FCC Compliance (USA): For power tools with electronic components, compliance with electromagnetic interference (EMI) regulations is required.

- Health Canada & CSA Standards: Canadian regulatory body requirements and Canadian Standards Association certifications.

Other Regional Regulations

- PSE Mark (Japan): Required for electrical products entering the Japanese market.

- KC Mark (South Korea): Certification for electrical safety and electromagnetic compatibility.

- CCC Mark (China): Mandatory product certification for specified products sold in China.

Packaging and Labeling Standards

Packaging Requirements

- Use durable, shock-resistant packaging to prevent damage during transit.

- Include internal cushioning (e.g., foam inserts, molded pulp) to secure tools and accessories.

- Clearly mark packages as “Fragile” and “This Side Up” where applicable.

Labeling Requirements

- Product name, model number, and serial number.

- Safety warnings and pictograms (e.g., risk of electric shock, moving parts).

- Compliance marks (CE, UL, FCC, etc.).

- Manufacturer and importer contact details.

- Battery-specific labeling (if applicable): UN38.3 certification for lithium-ion batteries.

Transportation and Logistics

Domestic and International Shipping

- Classify power tools correctly under the Harmonized System (HS) Code (e.g., 8467.21 for electric hand tools).

- Prepare accurate commercial invoices, packing lists, and certificates of origin.

- For air freight, ensure compliance with IATA Dangerous Goods Regulations if shipping with lithium batteries.

Battery Transport Considerations

- Lithium-ion batteries must be shipped at ≤30% state of charge.

- Batteries installed in tools must be protected from short circuits and physical damage.

- Packages must display proper lithium battery handling labels.

Storage Conditions

- Store in dry, temperature-controlled environments (typically 10°C to 30°C).

- Avoid direct sunlight and high humidity to prevent corrosion and insulation damage.

- Maintain organized inventory with FIFO (First In, First Out) rotation.

Customs Clearance Procedures

Required Documentation

- Bill of Lading or Air Waybill.

- Commercial Invoice with detailed product description, value, and HS code.

- Packing List.

- Certificates of Conformity (CE, UL, etc.).

- Material Safety Data Sheet (MSDS), if applicable.

Tariff and Duty Management

- Accurately classify products using correct HS codes to determine applicable duties.

- Leverage Free Trade Agreements (e.g., USMCA, CETA) where eligible to reduce tariffs.

- Maintain records for audit and compliance verification.

Environmental and End-of-Life Compliance

WEEE Directive (EU)

- Producers must register with national WEEE authorities.

- Provide take-back and recycling options for end-of-life tools.

- Label products with the “crossed-out wheeled bin” symbol.

Battery Recycling (Global)

- Comply with local battery take-back and recycling laws (e.g., EU Battery Directive, U.S. state regulations).

- Use recyclable packaging materials and minimize waste.

Quality Assurance and Traceability

Serial Number Tracking

- Maintain traceability from manufacturing to end-user through serialized product tracking.

- Support recalls and warranty claims with accurate data logs.

Supplier Compliance

- Require suppliers to provide test reports and certification documentation.

- Audit supply chain partners for adherence to safety and environmental standards.

Conclusion

Effective logistics and compliance management for power tools involves adherence to global safety standards, proper packaging and labeling, accurate documentation, and environmental responsibility. Proactive compliance reduces delays, avoids penalties, and enhances customer trust in your products.

Conclusion for Sourcing Power Tools Supplier:

After a thorough evaluation of potential suppliers, the recommended power tools supplier offers an optimal balance of quality, reliability, cost-efficiency, and after-sales support. Their proven track record in manufacturing durable and high-performance tools, compliance with international safety standards, and strong reputation in the industry make them a trustworthy partner. Additionally, their flexible MOQs, competitive pricing, timely delivery, and responsive customer service align well with our operational needs and strategic goals.

By establishing a long-term relationship with this supplier, we can ensure consistent product quality, reduce supply chain risks, and achieve greater procurement efficiency. It is therefore recommended to proceed with finalizing the supplier agreement, beginning with a trial order to further validate performance before scaling up. This strategic sourcing decision will support our commitment to delivering reliable tools to our customers while maintaining cost and quality standards.