The global power steering module market is experiencing steady growth, driven by increasing vehicle production, rising demand for fuel-efficient and safer vehicles, and the adoption of advanced driver-assistance systems (ADAS). According to Mordor Intelligence, the power steering market was valued at USD 19.8 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 5.2% through 2029. Similarly, Grand View Research reports that the global electric power steering (EPS) market size reached USD 17.3 billion in 2022 and is expected to expand at a CAGR of 7.1% from 2023 to 2030, fueled by the shift toward electric vehicles and stricter fuel economy regulations. As automotive manufacturers prioritize steering responsiveness, energy efficiency, and integration with automated driving systems, the competition among power steering module suppliers is intensifying. In this evolving landscape, a select group of manufacturers has emerged as leaders in innovation, scalability, and global reach—shaping the future of vehicle steering technology.

Top 10 Power Steering Module Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Global Steering Systems

Domain Est. 2009

Website: globalsteering.com

Key Highlights: Global Steering Systems is the world’s leading manufacturer of steering components for automotive giants like Ford Motor Company, Jeep, Lucid Motors, and ……

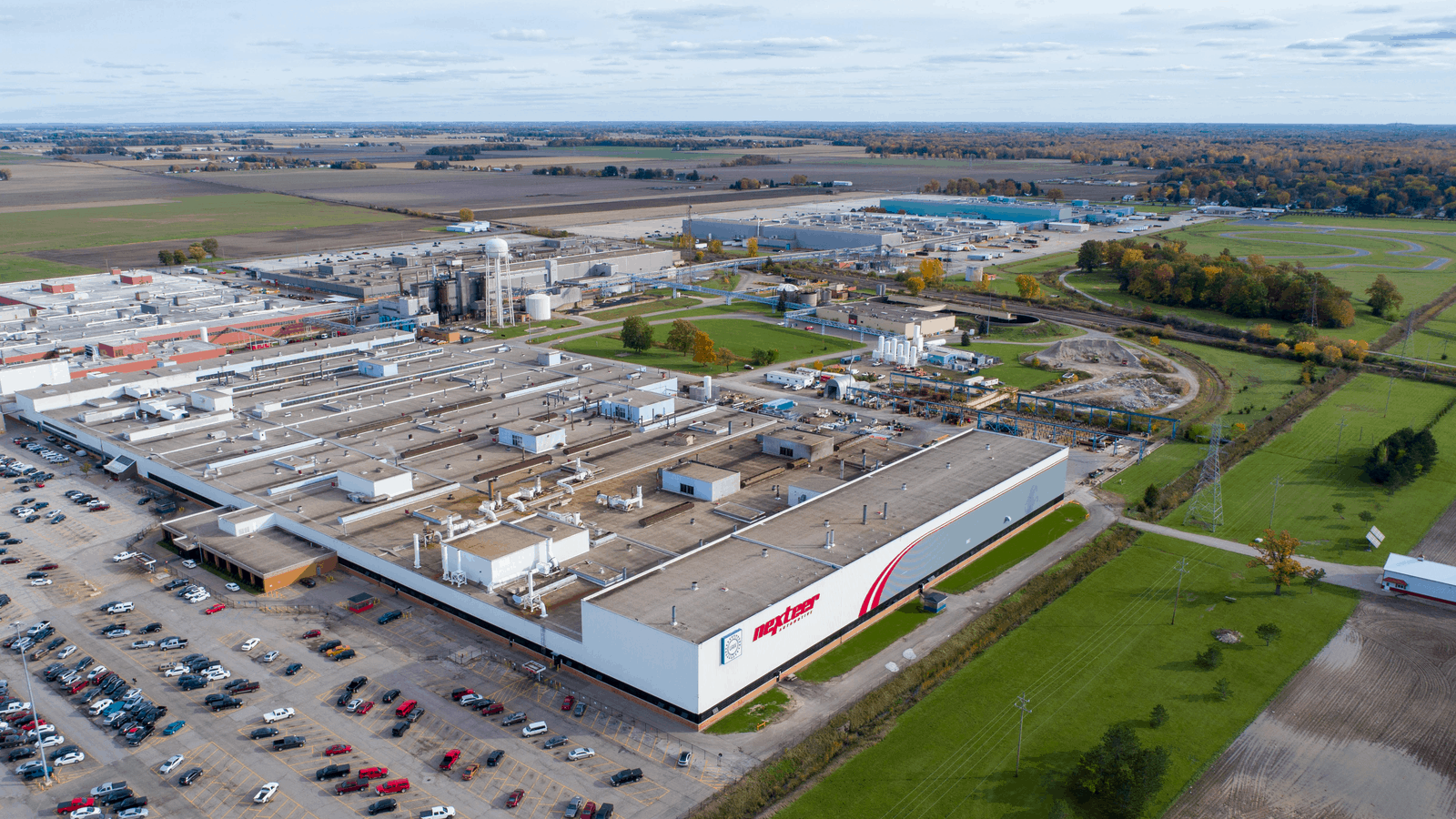

#2 Nexteer

Domain Est. 2009

Website: nexteer.com

Key Highlights: Nexteer is a global leading motion control technology company accelerating mobility to be safe, green and exciting….

#3 Individual Steering Systems for Automotive Industry

Domain Est. 2019

Website: thyssenkrupp-automotive-technology.com

Key Highlights: thyssenkrupp is one of the largest manufacturers in the world of steering columns and steering systems. As a partner of the automotive industry we stay for ……

#4 Electric Power Steering

Domain Est. 1996

Website: nsk.com

Key Highlights: Electric power steering – Energy-saving EPS – designed to reduce the amount of wheel turning and effort needed and to improve steering effectiveness by ……

#5 Power Steering Motors (1st – 3rd Generations)

Domain Est. 1997

Website: nidec.com

Key Highlights: Nidec is developing and manufacturing high-performance EPS motors by utilizing our motor design, control and mass production technologies that we have ……

#6 MAVAL Industries

Domain Est. 1998

Website: mavalgear.com

Key Highlights: Our premium line of NEW aftermarket steering components are proven to deliver high performance and endurance, from the company that has set the standard for ……

#7 Electric power steering (EPS)

Domain Est. 1999

Website: infineon.com

Key Highlights: By using an electric motor to assist the driver in steering the vehicle, EPS offers lower energy consumption as well as easier and more responsive driving….

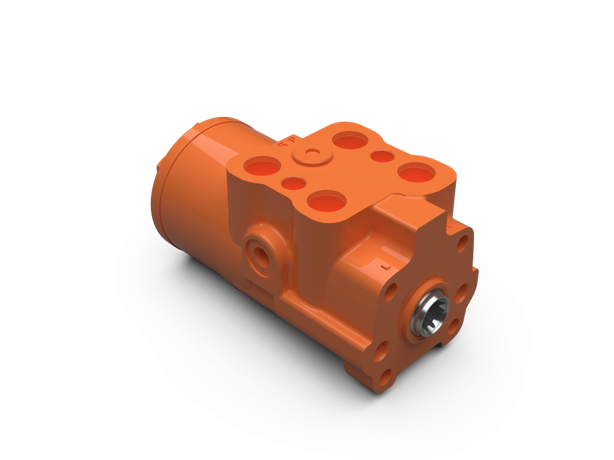

#8 White Drive Motors and Steering

Domain Est. 2005

Website: whitedriveproducts.com

Key Highlights: White is a global leader in the design, development, and manufacturing of orbital motors and steering solutions. With decades of experience, we serve industries ……

#9 AAE

Domain Est. 2007

Website: crpautomotive.com

Key Highlights: Explore AAE’s high-quality new and reman power steering products for import and domestic vehicles. Brought to you by CRP Automotive….

#10 Turn One

Domain Est. 2016

Website: turnonesteering.com

Key Highlights: Turn One manufactures high performance power steering components for street and race vehicles. Drive confidently with Turn One!…

Expert Sourcing Insights for Power Steering Module

H2: 2026 Market Trends for Power Steering Modules

The global power steering module market is poised for significant transformation by 2026, driven by advancements in automotive technology, increasing demand for electric vehicles (EVs), and evolving safety and efficiency standards. The shift toward electrification and automation in the automotive sector is reshaping the design, functionality, and demand for power steering systems, particularly with the growing adoption of Electric Power Steering (EPS) modules.

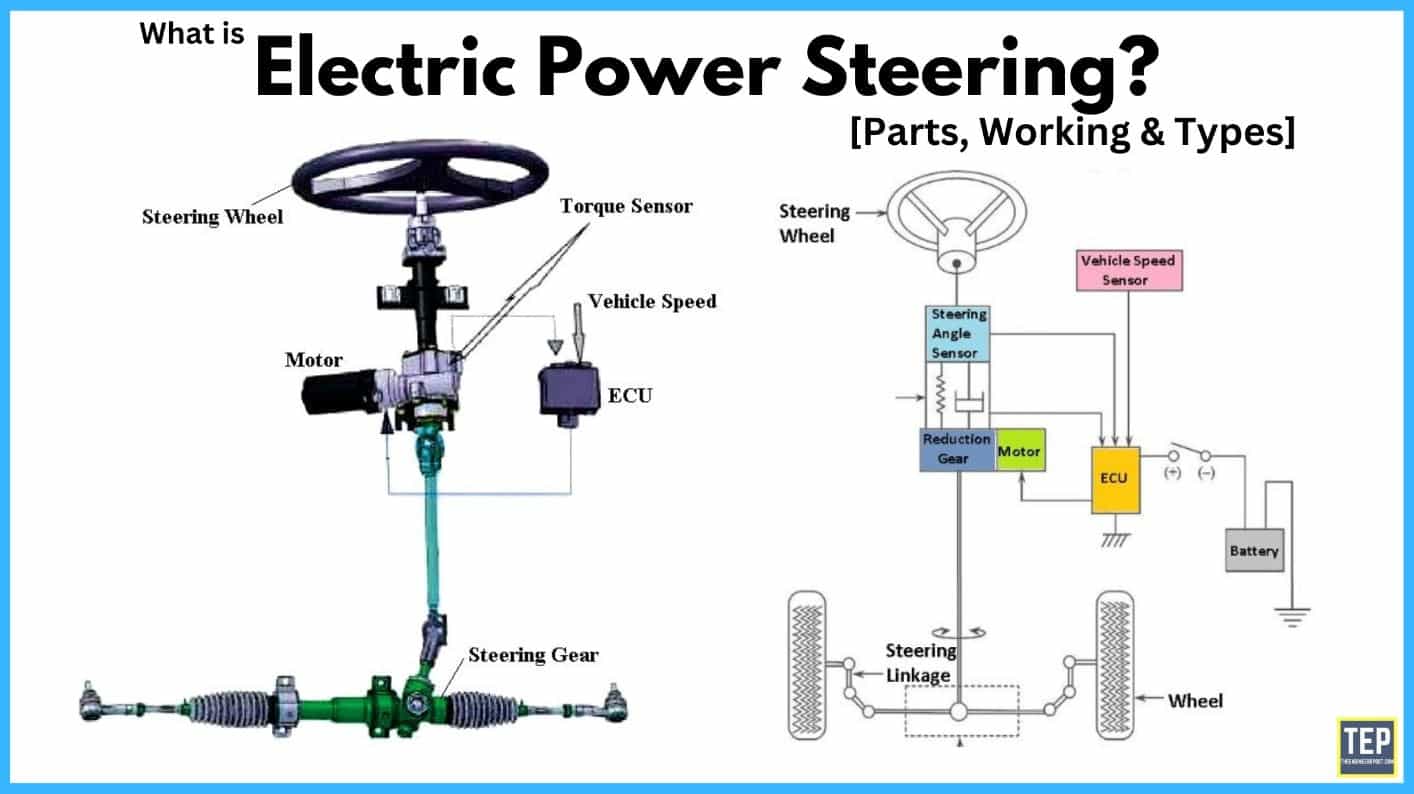

One of the most prominent trends in 2026 is the continued dominance of EPS systems over traditional Hydraulic Power Steering (HPS). EPS modules offer superior fuel efficiency, reduced CO₂ emissions, and enhanced integration with advanced driver assistance systems (ADAS) such as lane-keeping assist and autonomous driving features. As global emissions regulations tighten—especially in regions like Europe and China—automakers are increasingly favoring EPS to meet stringent environmental targets.

Moreover, the surge in electric and hybrid vehicle production is accelerating demand for compact, energy-efficient steering solutions. EPS modules are inherently compatible with EV architectures due to their reliance on electric motors rather than engine-driven pumps. By 2026, it is projected that over 70% of new light vehicles produced globally will be equipped with EPS, up from approximately 60% in 2022.

Another key trend is the integration of steer-by-wire (SbW) technology, which eliminates mechanical linkages between the steering wheel and wheels. While still in early commercialization stages, SbW systems—considered the next evolution beyond EPS—are expected to gain traction by 2026, particularly in premium and autonomous vehicles. This transition supports modular vehicle platforms and enables innovative interior designs, further boosting interest from OEMs.

Regionally, Asia-Pacific remains the largest market for power steering modules, driven by robust automotive manufacturing in China, Japan, and India. Meanwhile, North America and Europe are witnessing strong growth due to rising EV adoption and regulatory support for smart mobility solutions.

In conclusion, the 2026 power steering module market will be characterized by technological innovation, electrification, and deeper integration with vehicle automation systems. Suppliers and OEMs that invest in lightweight, intelligent, and scalable EPS and SbW platforms are likely to lead the evolving landscape.

Common Pitfalls Sourcing Power Steering Modules (Quality, IP)

Sourcing Power Steering Modules (PSMs), especially for electric or electro-hydraulic systems, involves navigating complex technical and legal challenges. Overlooking these can lead to significant quality issues, warranty claims, intellectual property (IP) disputes, and supply chain disruptions.

Quality-Related Pitfalls

Inadequate Supplier Qualification

Failing to thoroughly assess a supplier’s manufacturing capabilities, quality management systems (e.g., IATF 16949 certification), and track record in automotive electronics can result in inconsistent product quality. Suppliers without robust process controls may deliver modules with high defect rates, particularly in critical areas like motor control or sensor integration.

Insufficient Validation and Testing

Relying solely on supplier-provided test data without independent validation exposes buyers to risk. PSMs must undergo rigorous environmental (temperature, vibration), electrical (overvoltage, EMI), and functional testing. Skipping real-world durability testing or failing to align on test protocols can lead to field failures under actual operating conditions.

Component Sourcing and Counterfeit Risk

PSMs contain high-value semiconductors and sensors. Suppliers may source substandard or counterfeit electronic components to cut costs. Without strict component traceability and incoming inspection processes, these parts can compromise module reliability and safety, potentially leading to steering failures.

Lack of Robustness in Design for Manufacturing (DFM)

Modules designed without input from manufacturing partners may be difficult to produce consistently. Issues like poor solder joint design, inadequate thermal management, or fragile connectors can increase failure rates during assembly or in-service, especially in harsh under-hood environments.

Intellectual Property (IP)-Related Pitfalls

Unlicensed Use of Proprietary Technology

Many PSMs incorporate patented control algorithms, motor designs, or communication protocols (e.g., CAN bus integration). Sourcing from suppliers who do not hold proper IP licenses—or who reverse-engineer components—can expose the buyer to infringement claims, product recalls, or litigation from original equipment manufacturers (OEMs) or IP holders.

Ambiguous Ownership of Design Modifications

When customizing a PSM for a specific application, unclear agreements on IP ownership of modifications can lead to disputes. If the supplier retains rights to design changes, the buyer may face limitations in future sourcing, scalability, or competitive differentiation.

Inadequate Protection of Sensitive Specifications

Sharing detailed performance requirements or system integration data without robust non-disclosure agreements (NDAs) and data protection clauses risks exposing proprietary vehicle architecture. This is especially critical in competitive markets where steering system performance is a differentiator.

Reverse Engineering and Clone Modules

Some low-cost suppliers offer “compatible” PSMs that closely mimic OEM designs. These may infringe on protected circuit layouts, firmware, or mechanical designs. Using such modules, even unknowingly, can result in legal liability and damage to brand reputation due to reliability issues.

To mitigate these risks, buyers should conduct thorough due diligence, establish clear IP agreements, perform independent quality audits, and ensure full supply chain transparency when sourcing Power Steering Modules.

Logistics & Compliance Guide for Power Steering Module

This guide outlines the essential logistics and compliance considerations for the safe, efficient, and legally compliant handling, transportation, storage, and distribution of Power Steering Modules (PSMs), critical components in automotive steering systems.

Regulatory Compliance

Ensure adherence to international, national, and regional regulations relevant to automotive parts. Key areas include:

– DOT (U.S. Department of Transportation): Compliance with Federal Motor Vehicle Safety Standards (FMVSS), particularly FMVSS No. 126 (Electronic Stability Control) if the PSM integrates ESC functions.

– ECE Regulations (Europe): Conformity with UNECE regulations such as R79 (Steering Equipment) for safety and performance.

– REACH & RoHS (EU): Verify that materials used in the PSM are free from restricted hazardous substances (e.g., lead, cadmium, hexavalent chromium).

– China GB Standards: Compliance with applicable GB standards for automotive components.

– Country-Specific Homologation: Confirm local certification requirements (e.g., INMETRO in Brazil, KC in Korea, PSE in Japan) when exporting.

Packaging Requirements

Proper packaging is critical to prevent damage during transit and storage:

– Use anti-static, corrugated packaging with sufficient cushioning (e.g., foam inserts) to protect sensitive electronic components.

– Seal modules in moisture barrier bags (MBBs) if electronic control units (ECUs) are integrated.

– Clearly label packages with:

– Part number and serial number (if applicable)

– Handling symbols (e.g., “Fragile,” “This Side Up,” “Do Not Stack”)

– ESD-sensitive warnings

– Barcodes/QR codes for traceability

Transportation Guidelines

Adhere to best practices for safe and efficient transport:

– Mode of Transport: Use enclosed, climate-controlled vehicles (trucks, containers) to protect against moisture, temperature extremes, and contaminants.

– Temperature Control: Maintain ambient temperatures between 5°C and 35°C (41°F–95°F); avoid freezing or excessive heat.

– Vibration & Shock Protection: Secure loads with dunnage and load bars; use shock-absorbing pallets where necessary.

– Stacking Limits: Do not exceed manufacturer-specified stacking heights to prevent crushing.

– Hazardous Materials: If the module contains hydraulic fluid or batteries, comply with IATA/IMDG/ADR regulations as applicable.

Storage Conditions

Store PSMs in a controlled environment to maintain integrity:

– Temperature: 10°C to 30°C (50°F–86°F)

– Humidity: 30% to 60% relative humidity; avoid condensation

– Cleanliness: Store in a dust-free, dry warehouse away from chemicals and direct sunlight

– Shelf Life: Observe manufacturer-recommended shelf life; rotate stock using FIFO (First In, First Out) principle

– Static Control: Store in ESD-safe areas with grounded shelving if modules contain electronic components

Import/Export Documentation

Maintain accurate documentation for customs and regulatory clearance:

– Commercial Invoice

– Packing List

– Certificate of Origin

– Bill of Lading or Air Waybill

– Compliance Certificates (e.g., ISO/TS 16949, ISO 14001, product-specific certifications)

– Material Declarations (e.g., IMDS submission for automotive materials)

Traceability & Serialization

Implement robust traceability systems:

– Assign unique serial numbers or barcodes to each module.

– Maintain records of manufacturing batch, date, and supplier data.

– Utilize ERP or warehouse management systems (WMS) to track modules throughout the supply chain.

Environmental & Sustainability Compliance

Follow environmental regulations and sustainability practices:

– Recycle packaging materials where possible.

– Properly dispose of defective or end-of-life modules in compliance with WEEE (Waste Electrical and Electronic Equipment) directives.

– Partner with certified recyclers for responsible end-of-life handling.

Quality & Audit Preparedness

Ensure readiness for compliance audits:

– Maintain up-to-date quality management system (QMS) documentation per IATF 16949.

– Conduct regular internal audits of logistics and storage processes.

– Train personnel on handling, compliance, and safety procedures.

By following this guide, organizations can ensure the reliable, compliant, and efficient movement of Power Steering Modules from manufacturing to end-use, minimizing risk and supporting automotive safety standards.

Conclusion for Sourcing Power Steering Module:

After a thorough evaluation of available suppliers, technical specifications, cost considerations, and quality assurance standards, it is concluded that sourcing the power steering module from a reputable, ISO/TS 16949 certified supplier with a proven track record in automotive components is essential to ensure reliability, safety, and long-term performance. The final selection should balance cost-efficiency with stringent quality requirements, taking into account factors such as OEM compatibility, warranty terms, delivery timelines, and after-sales support. Additionally, establishing a dual-source strategy may mitigate supply chain risks and enhance production continuity. By aligning the sourcing decision with overall vehicle safety and performance goals, the selected power steering module will contribute significantly to the drivability, customer satisfaction, and brand reputation of the vehicle.