The global power connector market is experiencing robust growth, driven by rising demand across automotive, industrial, renewable energy, and consumer electronics sectors. According to Mordor Intelligence, the market was valued at USD 17.8 billion in 2023 and is projected to reach USD 25.6 billion by 2029, growing at a CAGR of approximately 6.2% during the forecast period. This expansion is fueled by increasing electrification trends, the proliferation of electric vehicles (EVs), and the integration of smart technologies in infrastructure and manufacturing. As reliability and efficiency become critical in power transmission, manufacturers are innovating to deliver compact, high-current, and thermally resilient connectors. In this evolving landscape, a select group of power connector manufacturers have emerged as leaders, combining technological expertise, global reach, and scalable production to meet the demands of next-generation applications. Here are the top seven companies shaping the future of power connectivity.

Top 7 Power Connector Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Connectors, Cables, Optics, RF, Silicon to Silicon Solutions

Domain Est. 1995

Website: samtec.com

Key Highlights: Samtec is the service leader in the electronic interconnect industry and a global manufacturer of Connectors, Cables, Optics and RF Systems, ……

#2 Connectors

Domain Est. 1994

Website: molex.com

Key Highlights: Molex offers a wide variety of Board-to-Board Connectors for microminiature, high-speed, high-density, and high-power applications….

#3 Electrical and Electronic Connectors

Domain Est. 1996

Website: hirose.com

Key Highlights: Connector Selector Categories, Applications, Customer Support, Partners, Locations, Contact Us, Privacy Policy | Terms of Use | Membership Agreement…

#4 LEMO – The Original Push-Pull Connector

Domain Est. 1998

Website: lemo.com

Key Highlights: LEMO offers complete connectivity services for high-performance solutions such as cable assembly, customised solutions and signal integrity services….

#5 Positronic

Domain Est. 2001

Website: connectpositronic.com

Key Highlights: At Positronic, we build high reliability power and signal connectors. But our true call is to provide certainty. Rock solid, mission-critical performance….

#6 Power Connector

Domain Est. 2003

Website: powerconnector.com

Key Highlights: Use parametric search tools to browse the entire line of PCI connectors in one place, including specialty connectors not found in our other product series….

#7 Winchester Interconnect

Domain Est. 2016

Website: winconn.com

Key Highlights: Let’s Build It Together. From concept to production, we design and manufacture tailored interconnect systems for demanding, high-performance applications….

Expert Sourcing Insights for Power Connector

H2: 2026 Market Trends for Power Connectors

The global power connector market in 2026 is poised for robust growth, driven by escalating power demands, technological innovation, and the proliferation of electrified systems across key industries. Building on the momentum of previous years, several dominant trends are shaping the landscape, with H2 2026 expected to reflect maturation in key areas and acceleration in others.

1. Sustained Growth in Electric Vehicles (EVs): The EV sector remains the primary growth engine. By H2 2026, widespread adoption of 800V architectures (vs. legacy 400V) will drive demand for high-voltage, high-current connectors capable of handling 1000V+ and currents exceeding 800A. Key trends include:

* Increased Use of Aluminum: To reduce weight and cost, aluminum conductors and housings in EV charging connectors (especially CCS2, NACS) and battery pack interconnects will become more prevalent, requiring advanced plating and termination technologies.

* Bidirectional Charging (V2X): As Vehicle-to-Grid (V2G) and Vehicle-to-Home (V2H) gain traction, connectors enabling reliable, high-power bidirectional flow (like ISO 15118-20 compliant systems) will see increased demand.

* Miniaturization & Integration: Connectors within battery packs, power electronics (inverter, DC-DC), and onboard chargers will continue to shrink and integrate, demanding higher current density and improved thermal management.

2. Data Center Power Density & Efficiency:

* High-Power Direct Current (DC) Distribution: The shift towards higher-power computing (AI/ML GPUs, 5G infrastructure) necessitates efficient power delivery. H2 2026 will see wider adoption of high-current, low-voltage DC connectors (e.g., 48V systems) replacing traditional AC distribution within racks and cabinets, driven by improved efficiency (reduced conversion losses).

* Pluggable High-Current Connectors: Demand will surge for robust, hot-pluggable connectors handling 300A+ for server power supplies and GPU modules. Reliability under continuous high load and advanced thermal management (e.g., enhanced cooling fins, liquid cooling integration) will be critical differentiators.

* Standardization & Interoperability: Standards like the Open Compute Project (OCP) Open Rack v3 and similar initiatives will push for greater connector standardization to improve serviceability and supply chain resilience.

3. Renewable Energy & Grid Modernization:

* Solar Inverter & Storage Integration: As solar PV and battery energy storage systems (BESS) proliferate, demand for reliable, high-current DC connectors (MC4 and next-gen variants) for panel strings and storage rack interconnects will remain strong. Connectors with enhanced environmental protection (IP68/IP69K), fire safety, and arc-fault detection capabilities will be prioritized.

* Grid-Edge Applications: Smart grid components, EV charging infrastructure, and microgrids will require rugged, secure connectors for power and communication, often in harsh outdoor environments.

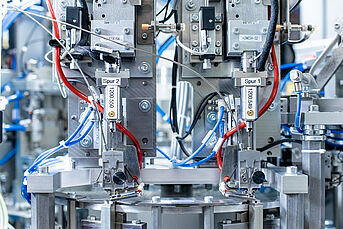

4. Industrial Automation & Robotics:

* High-Power Density & Reliability: Factory automation and collaborative robots (cobots) demand compact, high-power connectors for motors, drives, and power tools. Connectors must withstand vibration, dust, oil, and frequent mating cycles. M12 and M8 circular connectors with high-current variants will dominate.

* Integrated Power & Data (HPPD): The trend towards combining power and high-speed data (e.g., Power over Ethernet – PoE++ for industrial cameras/sensors, or hybrid connectors) will accelerate, simplifying cabling and reducing footprint.

5. Key Enabling Technologies & Materials:

* Advanced Materials: Wider adoption of high-temp thermoplastics (e.g., PPS, PPA, LCP) and liquid crystal polymers (LCP) for improved thermal stability, creep resistance, and miniaturization. Enhanced copper alloys and plating (e.g., high-strength brass, selective gold/nickel plating) for lower resistance and higher current density.

* Smart Connectors: Integration of sensors (temperature, current monitoring) and communication capabilities (e.g., via embedded ICs) for predictive maintenance, fault detection, and system diagnostics, particularly in EVs and critical data center applications.

* Sustainability Focus: Increased emphasis on recyclability, reduced use of hazardous materials (RoHS, REACH), and designs enabling easier disassembly. Aluminum usage (as mentioned) is a key part of this trend.

6. Supply Chain & Regional Dynamics (H2 2026 Outlook):

* Resilience & Diversification: Continued focus on supply chain resilience, with manufacturers diversifying sourcing and manufacturing locations (e.g., Southeast Asia, Mexico) to mitigate geopolitical risks and logistics disruptions.

* Regional Leadership: Asia-Pacific (driven by China, Japan, S. Korea) will remain the largest market and manufacturing hub. North America will see strong growth driven by EV and data center investments. Europe will maintain significance, particularly in automotive and industrial automation.

Conclusion for H2 2026:

The power connector market in the second half of 2026 will be characterized by consolidation of key technology shifts (800V EVs, 48V DC in data centers) and accelerated innovation in materials, integration, and intelligence. Success will depend on manufacturers’ ability to deliver higher power density, enhanced reliability under extreme conditions, improved efficiency, and sustainable solutions tailored to the demanding requirements of EVs, data centers, renewables, and industrial automation. Competition will intensify, favoring players with strong R&D, vertical integration capabilities, and robust supply chains.

Common Pitfalls When Sourcing Power Connectors (Quality, IP Rating)

Sourcing power connectors involves critical considerations that directly impact product safety, reliability, and performance. Two of the most common pitfalls relate to quality inconsistencies and incorrect or misunderstood Ingress Protection (IP) ratings.

Poor Quality Components

One of the most frequent issues in power connector sourcing is compromising on quality to reduce costs. Low-quality connectors may use substandard materials such as inferior-grade plastics or copper alloys, leading to several problems:

- Overheating and Melting: Poor conductivity and high resistance in low-grade metals can cause connectors to overheat during operation, posing fire hazards.

- Premature Failure: Weak mechanical design or poor plating (e.g., inadequate nickel or tin plating) results in corrosion, contact wear, and intermittent connections.

- Non-Compliance with Standards: Cheap connectors often fail to meet recognized standards (e.g., UL, IEC, RoHS), increasing liability and risking product recalls.

- Inconsistent Manufacturing: Sourcing from unreliable suppliers may result in batch-to-batch variability, making quality control difficult.

To avoid this, always verify supplier credentials, request certifications, and conduct sample testing under real-world conditions.

Misunderstanding or Incorrect IP Ratings

Ingress Protection (IP) ratings define a connector’s resistance to dust and moisture, but they are often misinterpreted or misrepresented:

- Overstated Claims: Some suppliers advertise connectors with high IP ratings (e.g., IP67 or IP68), but these ratings may only apply under specific test conditions (e.g., mated only, short immersion time) or may not be independently verified.

- Mating Dependency: Many connectors only achieve their rated IP protection when fully mated with the correct counterpart. A standalone connector may not be sealed.

- Environmental Mismatch: Selecting a connector with insufficient IP rating for the application (e.g., using IP44 in outdoor, high-humidity environments) leads to contamination, short circuits, and failure.

- Lack of Testing Documentation: Suppliers may not provide test reports or evidence supporting their IP claims, leading to assumptions that can result in field failures.

To mitigate this risk, request third-party test reports, confirm IP ratings apply to both mated and unmated states as needed, and ensure the rating aligns with the actual operating environment (e.g., washdown, submersion, dust exposure).

Logistics & Compliance Guide for Power Connectors

This guide outlines key logistics and compliance considerations for the handling, transportation, import/export, and use of power connectors. Adherence to these guidelines ensures safety, regulatory compliance, and efficient supply chain operations.

Regulatory Compliance

Ensure all power connectors meet applicable international, regional, and national standards. Common requirements include:

– Safety Standards: IEC 60320, UL 60320, CSA C22.2 No. 21, EN 55035 (EMC)

– RoHS Compliance: Restriction of Hazardous Substances (EU Directive 2011/65/EU)

– REACH: Registration, Evaluation, Authorization, and Restriction of Chemicals (EC 1907/2006)

– Conflict Minerals: Compliance with Dodd-Frank Act (Section 1502) and EU Conflict Minerals Regulation

– Country-Specific Approvals: CE marking (Europe), UKCA (UK), KC (Korea), PSE (Japan), CCC (China)

Documentation such as Declarations of Conformity (DoC), test reports, and certificates must be maintained and provided upon request.

Product Labeling & Packaging

Proper labeling and packaging are essential for compliance and safe handling:

– Clearly mark connectors with rating information (voltage, current, temperature)

– Include manufacturer name, model number, and compliance marks (e.g., CE, UL)

– Use static-dissipative or anti-static packaging where applicable

– Ensure outer packaging is durable and labeled with handling instructions (e.g., “Fragile,” “Do Not Stack”)

– Include multilingual labels for international shipments, when required

Import/Export Documentation

Prepare accurate documentation to facilitate smooth customs clearance:

– Commercial Invoice

– Packing List

– Bill of Lading or Air Waybill

– Certificate of Origin

– Regulatory Certifications (e.g., DoC, test reports)

– Export Control Classification Number (ECCN), if applicable

– Import licenses or permits for restricted destinations

Verify export control regulations (e.g., EAR in the U.S.) to ensure no licensing is required for shipment.

Transportation & Handling

Follow best practices for safe and efficient transportation:

– Use ESD-safe containers and pallets for electrostatic-sensitive connectors

– Secure loads to prevent shifting during transit

– Avoid exposure to extreme temperatures, moisture, and contaminants

– Comply with IATA, IMDG, or ADR regulations if hazardous materials (e.g., certain plating chemicals) are present

– Maintain traceability via batch/lot numbers and barcodes

Storage Conditions

Store power connectors in controlled environments:

– Temperature: 10°C to 30°C (50°F to 86°F)

– Relative Humidity: 30% to 60%

– Keep away from direct sunlight and chemical vapors

– Use first-in, first-out (FIFO) inventory management

– Protect from dust and physical damage

End-of-Life & Environmental Responsibility

Dispose of or recycle non-conforming or obsolete connectors responsibly:

– Follow WEEE (Waste Electrical and Electronic Equipment) directives in applicable regions

– Partner with certified e-waste recyclers

– Maintain records of disposal and recycling activities

Audit & Recordkeeping

Maintain comprehensive records for traceability and compliance audits:

– Supplier and material certifications

– Incoming inspection reports

– Shipping and receiving logs

– Non-conformance reports (NCRs)

– Compliance documentation (retained for minimum 5–10 years, depending on jurisdiction)

Regular internal audits should verify adherence to all logistics and compliance procedures.

By following this guide, organizations can ensure power connectors are managed safely, legally, and efficiently throughout the supply chain.

Conclusion for Sourcing Power Connectors:

After a thorough evaluation of technical specifications, availability, cost, reliability, and supplier credibility, it is recommended to proceed with sourcing power connectors from a supplier that offers a balanced combination of high-quality materials, compliance with relevant industry standards (such as UL, CE, or IEC), and consistent supply chain performance. Key factors such as current rating, voltage capacity, durability, environmental resistance, and ease of integration into existing systems were critical in the selection process.

Prioritizing reputable manufacturers or distributors with proven track records ensures long-term reliability, reduces risk of failure, and supports scalable production needs. Additionally, establishing strong supplier relationships can lead to better pricing, technical support, and lead time optimization. In conclusion, strategic sourcing of power connectors not only enhances product performance and safety but also contributes to overall supply chain efficiency and cost-effectiveness.