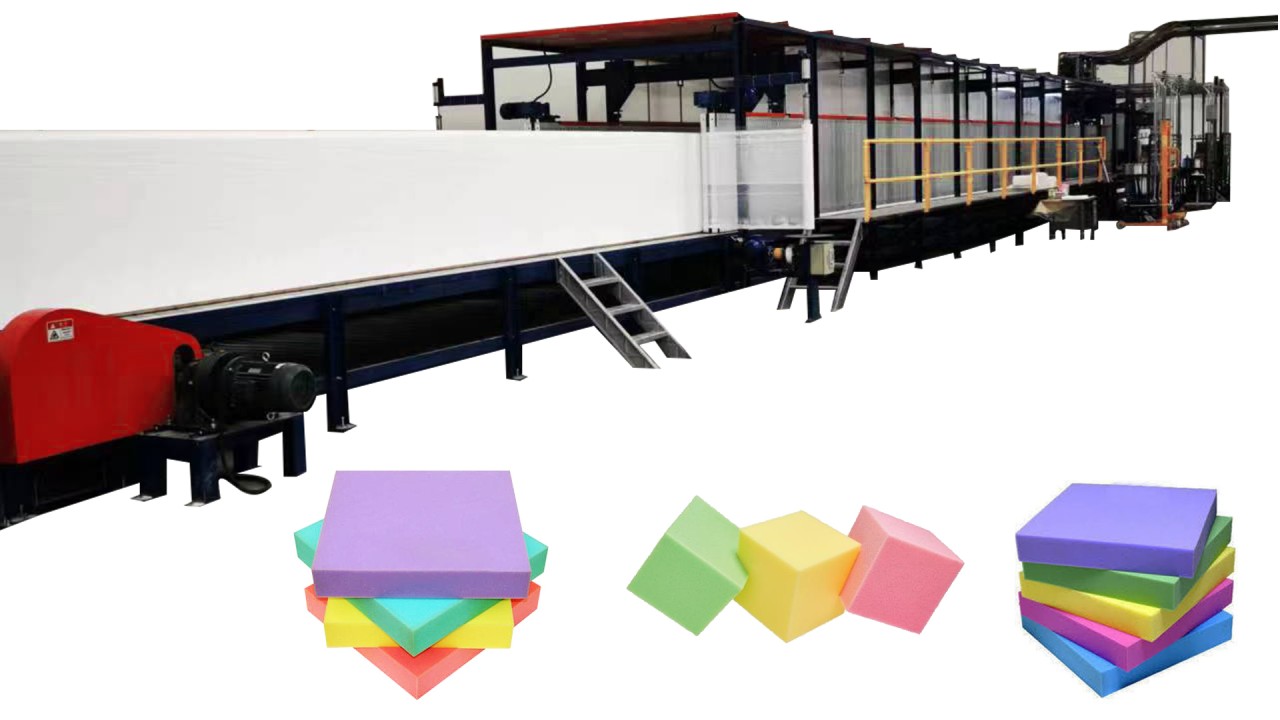

The global polyurethane foam market is experiencing robust growth, driven by increasing demand across industries such as construction, automotive, furniture, and appliances. According to Grand View Research, the market was valued at USD 63.8 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 5.2% from 2024 to 2030. This growth is fueled by the material’s superior insulation properties, lightweight nature, and energy efficiency, making it a preferred choice in both industrial and consumer applications. Advancements in manufacturing processes and rising environmental regulations are also pushing manufacturers to develop more sustainable, bio-based foam alternatives. As competition intensifies and innovation accelerates, identifying the leading polyurethane foam producers becomes critical for supply chain optimization and strategic sourcing. Based on market share, technological capabilities, and global reach, here are the top 10 polyurethane foam manufacturers shaping the industry landscape in 2024.

Top 10 Polyurthane Foam Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Foam Factory, Inc.

Domain Est. 2000

Website: foambymail.com

Key Highlights: The most competitive foam supplier on the market. We carry mattresses, toppers, seats, cushions, sound proofing foams, memory foam, eggcrate, anti-static ……

#2 Find a Foam Producer

Domain Est. 2008

Website: certipur.us

Key Highlights: Looking for molded polyurethane foam manufacturers? Here is a list of foam producers registered in the CertiPUR-US program….

#3 Polyurethane Foam Association: Come Learn With PFA!

Domain Est. 1994

Website: pfa.org

Key Highlights: The Polyurethane Foam Association represents FPF manufacturers and suppliers to the industry. PFA funds research on critical industry topics….

#4 General Plastics

Domain Est. 1996

Website: generalplastics.com

Key Highlights: General Plastics is certified and equipped to offer polyurethane foam solutions, providing part design support and design production from start to finish….

#5 SWD Urethane

Domain Est. 1996

Website: swdurethane.com

Key Highlights: Working our way from being contractors, to distributors, to full-scale manufacturers, we’ve honed our spray foam expertise from the inside out….

#6 Polyurethane Foam

Domain Est. 1993

Website: carpenter.com

Key Highlights: Carpenter produces our own polyol, and offers polyurethane foam in blocks, rolls, and custom specifications….

#7 Huntsman Polyurethanes

Domain Est. 1997

Website: huntsman.com

Key Highlights: Huntsman Polyurethanes is a global leader in MDI-based polyurethanes, serving over 3,000 customers in more than 90 countries….

#8 Spray Polyurethane Foam Alliance

Domain Est. 1997

Website: sprayfoam.org

Key Highlights: Elevate your business with Spray Polyurethane Foam Alliance: The leading trade association for the Spray Foam Industry. Access official technical resources, ……

#9 FSI – Global Polyurethane Systems House

Domain Est. 2010

Website: fsi.co

Key Highlights: As a leading polyurethane systems house, we develop sustainable chemical solutions for a wide range of industries….

#10 Polyurethane Foam

Domain Est. 2012

Website: solutions.covestro.com

Key Highlights: Our extensive range of high-performance polyurethane raw materials offer solutions for flexible, rigid and integral skin foams….

Expert Sourcing Insights for Polyurthane Foam

H2: 2026 Market Trends for Polyurethane Foam

The global polyurethane foam market is poised for significant evolution by 2026, driven by technological innovation, sustainability mandates, shifting consumer demands, and regional industrial growth. As industries increasingly prioritize energy efficiency, lightweight materials, and environmental responsibility, polyurethane foam (PU foam) is expected to maintain its strategic importance across construction, automotive, furniture, and packaging sectors.

-

Sustainable and Bio-Based Foam Development

A major trend shaping the 2026 market is the accelerated shift toward eco-friendly polyurethane foams. Manufacturers are investing heavily in bio-based polyols derived from renewable sources such as soybean oil, castor oil, and recycled carbon feedstocks. Regulatory pressures—especially in the EU and North America—and corporate sustainability goals are compelling producers to reduce reliance on fossil-fuel-based raw materials. By 2026, bio-based PU foams are projected to capture a larger market share, particularly in consumer-facing industries seeking greener alternatives. -

Stringent Environmental Regulations and VOC Reduction

Environmental regulations targeting volatile organic compounds (VOCs) and global warming potential (GWP) are influencing foam formulation and production. Governments are enforcing tighter emissions standards, prompting a transition from traditional blowing agents (e.g., HFCs) to low-GWP alternatives like hydrofluoroolefins (HFOs) and water-blown technologies. The 2026 market will likely feature widespread adoption of compliant systems, with innovation focused on maintaining thermal performance while reducing environmental impact. -

Growth in Construction and Insulation Demand

The construction sector remains the largest consumer of rigid polyurethane foam, used extensively in insulation for walls, roofs, and refrigeration units. With global emphasis on energy-efficient buildings and net-zero carbon targets, demand for high-performance insulation materials will surge by 2026. Emerging markets in Asia-Pacific and the Middle East, along with retrofitting initiatives in Europe and North America, will drive volume growth. Polyurethane’s superior R-value per inch positions it favorably against competing insulants. -

Automotive Industry Transformation

In the automotive sector, PU foam is essential for seating, dashboards, noise insulation, and lightweighting. As electric vehicles (EVs) gain market share, manufacturers are prioritizing weight reduction to extend battery range. Flexible and integral skin foams will see increased use in EV interiors. Additionally, recyclable and modular foam designs are emerging, aligning with circular economy principles. By 2026, partnerships between foam suppliers and EV OEMs are expected to intensify. -

Advancements in Recycling and Circular Economy Models

End-of-life management of PU foam waste is gaining attention. Chemical recycling technologies—such as glycolysis, pyrolysis, and enzymatic breakdown—are advancing, enabling the recovery of polyols from post-industrial and post-consumer foam waste. Industry collaborations and extended producer responsibility (EPR) schemes are likely to scale by 2026, fostering closed-loop recycling systems. This trend will improve the environmental footprint of PU foam and enhance brand reputation. -

Regional Market Dynamics

Asia-Pacific will remain the fastest-growing region due to urbanization, industrial expansion, and rising disposable incomes—particularly in China, India, and Southeast Asia. North America and Europe will focus on innovation and regulatory compliance, with steady market growth. Meanwhile, Latin America and the Middle East will expand moderately, supported by infrastructure development and growing middle-class consumption. -

Price Volatility and Supply Chain Resilience

Fluctuations in feedstock prices—especially for MDI and polyols, influenced by crude oil markets—will continue to challenge profitability. By 2026, leading manufacturers are expected to adopt diversified sourcing, vertical integration, and digital supply chain tools to mitigate disruptions and improve cost predictability.

In conclusion, the 2026 polyurethane foam market will be defined by sustainability, innovation, and adaptability. Companies that invest in green chemistry, recycling infrastructure, and smart manufacturing will be best positioned to capitalize on emerging opportunities and comply with evolving global standards.

Common Pitfalls Sourcing Polyurethane Foam (Quality, IP)

Sourcing polyurethane (PU) foam involves navigating complex technical specifications and intellectual property (IP) considerations. Overlooking critical factors can lead to performance failures, supply chain disruptions, or legal exposure. Below are key pitfalls to avoid:

Quality-Related Pitfalls

Inadequate Specification Clarity

Failing to define precise technical requirements—such as density, compression set, tensile strength, flame retardancy (e.g., UL 94, FMVSS 302), and environmental resistance—can result in foam that does not meet application needs. Generic descriptions like “flexible foam” are insufficient; detailed performance criteria must be communicated.

Insufficient Testing and Validation

Relying solely on supplier data sheets without independent testing or first-article inspections risks receiving substandard material. Real-world performance (e.g., aging, temperature cycling, load-bearing) may differ from lab results. Always conduct application-specific validation.

Inconsistent Batch-to-Batch Quality

PU foam properties can vary significantly between production runs due to raw material fluctuations or process inconsistencies. Suppliers without robust quality management systems (e.g., ISO 9001) may deliver non-conforming batches. Require certificates of conformance (CoC) and implement incoming quality control.

Overlooking Environmental and Regulatory Compliance

Many PU foams contain restricted substances (e.g., certain flame retardants, VOCs, or catalysts). Non-compliance with REACH, RoHS, Prop 65, or TSCA can lead to shipment rejections or legal liability. Verify compliance documentation and request material declarations.

Misunderstanding Foam Types and Formulations

PU foam is highly customizable—differences in isocyanate (MDI vs. TDI), polyol type, additives, and processing (slabstock vs. molded) drastically affect performance. Sourcing the wrong type (e.g., using open-cell for sealing) leads to functional failure. Engage technical experts early.

Intellectual Property (IP)-Related Pitfalls

Unlicensed Use of Proprietary Formulations

Many high-performance PU foams are protected by patents or trade secrets (e.g., specific catalyst systems, blowing agents, or nano-additives). Sourcing generic equivalents without due diligence may infringe IP, leading to litigation or supply termination. Conduct freedom-to-operate (FTO) analysis when possible.

Ambiguous Supplier Agreements on IP Ownership

Failure to define IP rights in sourcing contracts can lead to disputes. For custom-developed foams, clarify whether formulations, tooling, or process innovations belong to the supplier, buyer, or are jointly owned. Include confidentiality and non-disclosure clauses.

Reverse Engineering Risks

Attempting to replicate a competitor’s foam formulation based on reverse engineering exposes companies to trade secret misappropriation claims. Even analytical results (e.g., from FTIR or GC-MS) may not reveal proprietary processes protected under IP law.

Supplier Lock-In Due to Patented Technologies

Some suppliers rely on patented technologies (e.g., water-blown low-emission foams). Sourcing from such suppliers may create dependency and limit alternative sourcing options. Evaluate IP landscape to ensure long-term supply flexibility.

Inadequate Due Diligence on Supplier IP Practices

Working with suppliers who use infringing raw materials or processes can expose buyers to contributory infringement claims. Audit supplier IP compliance, especially for critical or high-volume applications.

By proactively addressing these quality and IP pitfalls, organizations can ensure reliable supply, regulatory adherence, and protection against legal and operational risks when sourcing polyurethane foam.

Logistics & Compliance Guide for Polyurethane Foam

Introduction to Polyurethane Foam Handling

Polyurethane foam (PU foam) is a versatile material widely used in insulation, packaging, furniture, automotive, and construction industries. While generally safe when processed and handled correctly, its logistics and compliance requirements involve attention to chemical components, physical properties, shipping regulations, and environmental considerations. This guide outlines key logistics and compliance protocols for the safe and legal transportation, storage, and handling of polyurethane foam in various forms—prepolymer components, liquid precursors (isocyanates and polyols), and finished foam products.

Regulatory Classification and Identification

Polyurethane foam itself is typically classified as a non-hazardous solid material once fully cured. However, its raw components—especially isocyanates such as methylene diphenyl diisocyanate (MDI) or toluene diisocyanate (TDI)—are hazardous chemicals regulated under multiple international and national frameworks.

- UN Numbers and Hazard Classes:

- Liquid isocyanates (e.g., MDI, TDI): UN 2298 or UN 2299, Class 6.1 (Toxic Substances), Packing Group II or III.

- Polyol blends: Often non-hazardous but may be classified as flammable liquids (Class 3) if containing volatile organic compounds (VOCs).

-

Cured polyurethane foam: Generally not regulated as hazardous under transport regulations (e.g., ADR, IMDG, IATA).

-

GHS Classification:

- Isocyanates: Acute toxicity (inhalation), skin and respiratory sensitization, specific target organ toxicity.

- Safety Data Sheets (SDS): Must be provided for all chemical precursors per OSHA HazCom (29 CFR 1910.1200), REACH (EU), and WHMIS (Canada).

Packaging and Container Requirements

Proper packaging ensures safety during transport and prevents chemical degradation or exposure.

- Liquid Components (Isocyanates and Polyols):

- Use UN-certified drums (steel or HDPE), intermediate bulk containers (IBCs), or tank containers.

- Drums must be tightly sealed and equipped with pressure relief devices if necessary.

-

Inner liners may be required to prevent reactions with container materials.

-

Cured Foam Products:

- Compress and wrap to reduce volume; use moisture-resistant packaging (e.g., polyethylene film).

-

Protect from physical damage using corner boards, stretch wrap, or palletization.

-

Temperature Sensitivity:

- Isocyanates must be stored and transported between 15–25°C (59–77°F); freezing or overheating can cause crystallization or degradation.

- Use temperature-controlled containers if ambient conditions exceed safe ranges.

Transportation Regulations (Road, Sea, Air)

Transport requirements vary by mode. Compliance with ADR (road), IMDG (sea), and IATA/ICAO (air) is critical.

- Road (ADR – Europe):

- Hazardous precursors require placarded vehicles, driver training (ADR certification), and transport documents listing UN number, proper shipping name, class, and packaging group.

-

Non-hazardous cured foam may be transported as general freight.

-

Marine (IMDG Code):

- Liquid isocyanates must be declared, stowed away from heat sources and incompatible materials (e.g., acids, oxidizers).

-

Proper container ventilation may be required.

-

Air (IATA Dangerous Goods Regulations):

- Most isocyanates are forbidden on passenger aircraft; limited quantities may be allowed on cargo aircraft with special approval.

- Finished foam is generally accepted as non-restricted cargo.

Storage Guidelines

Safe storage minimizes risks of fire, chemical degradation, and exposure.

- Isocyanates and Polyols:

- Store in a cool, dry, well-ventilated area away from direct sunlight and heat sources.

- Keep containers tightly closed and segregated from moisture, acids, alkalis, and amines.

-

Use grounded containers to prevent static discharge.

-

Finished Foam:

- Store indoors, elevated off the floor, and protected from moisture and UV exposure.

-

Avoid compression stacking unless designed for it; use pallets and shrink wrap.

-

Shelf Life:

- Isocyanates: Typically 6–12 months; moisture exposure shortens shelf life.

- Polyols: 12+ months if stored properly.

- Check manufacturer’s recommendations and test for reactivity if near expiration.

Occupational Health and Safety (OHS)

Exposure to uncured isocyanates poses significant health risks.

- Personal Protective Equipment (PPE):

- Chemical-resistant gloves (nitrile or neoprene), safety goggles, respirators with organic vapor cartridges (for isocyanates), and protective clothing.

-

Use local exhaust ventilation or fume hoods during mixing or processing.

-

Exposure Limits:

- OSHA PEL for TDI: 0.02 ppm (8-hour TWA); ACGIH TLV: 0.005 ppm (ceiling).

- Monitor air quality and implement medical surveillance for workers handling isocyanates.

Environmental and Disposal Compliance

Polyurethane foam and its precursors require responsible lifecycle management.

- Spill Response:

- For isocyanate spills: Evacuate area, use absorbents (inorganic, non-cellulosic), avoid water. Follow SDS emergency procedures.

-

Contaminated materials must be treated as hazardous waste.

-

Waste Disposal:

- Cured foam: Often disposed of in landfills; recycling options include mechanical grinding for rebonded foam or chemical recycling (glycolysis).

-

Unused or contaminated isocyanates: Classified as hazardous waste; dispose via licensed hazardous waste handlers.

-

Environmental Regulations:

- Comply with EPA (USA), Environment Agency (UK), and ECHA (EU) rules on VOC emissions, chemical reporting (e.g., TRI in USA), and waste handling.

- REACH registration applies to isocyanate producers and importers in the EU.

International Trade and Documentation

Cross-border shipments require accurate documentation.

- Required Documents:

- Commercial invoice

- Packing list

- Safety Data Sheet (SDS)

- Dangerous Goods Declaration (for hazardous components)

- Certificates of Origin (if applicable)

-

Import permits (some countries restrict isocyanate imports)

-

Customs Classification:

- HS Code examples:

- Isocyanates: 2929.10 or 2929.11

- Polyols: 3824.71 or 3901.10

- Flexible foam: 3904.21 or 3904.22

- Rigid foam: 3904.30

Verify with local customs authorities for accuracy.

Sustainability and Regulatory Trends

Stay ahead of evolving regulations.

- Flame Retardants:

-

Some halogenated flame retardants used in PU foam are restricted under RoHS, REACH SVHC, or California Proposition 65. Use alternatives where possible.

-

Circular Economy:

-

Increasing focus on recyclability; consider design for disassembly and chemical recycling partnerships.

-

Carbon Footprint and EPDs:

- Environmental Product Declarations (EPDs) may be required in construction sectors; monitor lifecycle emissions.

Conclusion and Best Practices

Effective logistics and compliance for polyurethane foam hinge on differentiating between hazardous precursors and non-hazardous finished products. Key best practices include:

- Always verify the hazard classification of materials using up-to-date SDS.

- Train personnel on handling, emergency response, and regulatory requirements.

- Maintain accurate documentation for transport and customs.

- Partner with certified carriers experienced in handling hazardous chemicals.

- Monitor regulatory changes in target markets (e.g., EU Green Deal, EPA initiatives).

By adhering to this guide, businesses can ensure the safe, legal, and efficient movement of polyurethane foam across the supply chain.

In conclusion, sourcing polyurethane foam requires a comprehensive evaluation of material specifications, supplier reliability, cost-efficiency, and compliance with environmental and safety standards. The selection should align with the intended application—whether for insulation, cushioning, or automotive use—ensuring optimal performance and durability. Partnering with reputable suppliers who offer consistent quality, certifications (such as ISO, VOC emissions standards, or fire resistance ratings), and sustainable production practices enhances long-term value. Additionally, considering factors like lead times, scalability, and logistical support contributes to a resilient supply chain. Ultimately, a strategic sourcing approach to polyurethane foam balances performance requirements with economic and environmental responsibilities, supporting both product excellence and sustainability goals.