The global polyurethane floor covering market is experiencing robust expansion, driven by rising demand for durable, chemical-resistant, and low-maintenance flooring solutions across commercial, industrial, and residential sectors. According to Grand View Research, the global polyurethane coatings market—of which flooring is a significant segment—was valued at USD 23.6 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030. This growth is fueled by increasing construction activities, stringent environmental regulations promoting low-VOC materials, and the superior performance of polyurethane systems in high-traffic and hygienic environments such as hospitals, laboratories, and food processing facilities. With innovations in seamless, anti-static, and rapid-cure formulations, polyurethane floor coverings are gaining traction over traditional epoxy and concrete finishes. As demand escalates, a competitive landscape of global manufacturers is emerging, combining technological advancement with sustainable manufacturing practices to capture market share. The following list highlights the top 10 polyurethane floor covering manufacturers positioned at the forefront of this evolving industry.

Top 10 Polyurethane Floor Covering Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

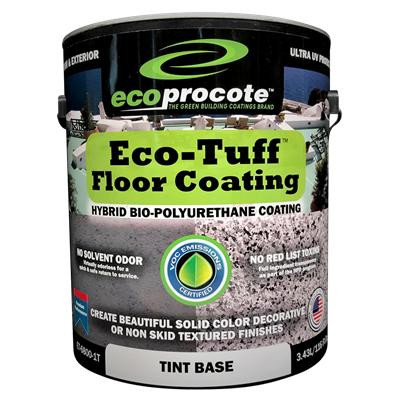

#1 Polyurethane Coating

Domain Est. 2000

Website: crownpolymers.com

Key Highlights: Crown Polymers is a leading manufacturer with over 30 years of expertise in high-performance epoxy and urethane floor coatings and concrete repair systems….

#2 Endura Paint

Domain Est. 2002

Website: endurapaint.com

Key Highlights: Endura is a manufacturer of high performance polyurethane and epoxy industrial coatings. Product lines include, industrial paint systems, ……

#3 Polyurea coatings, polyurethane coatings and industrial floorings

Domain Est. 2014

Website: tecnopolgroup.com

Key Highlights: Tecnopol – Manufacturer of polyurea and polyurethane waterproofing, flooring and insulation systems….

#4 New Sikafloor® Polyurethane Range

Domain Est. 1995

Website: sika.com

Key Highlights: Sika, as the leading producer of polyurethane resin-based sealants, adhesives and flooring products, takes the health and safety of users of Sikaflex®, ……

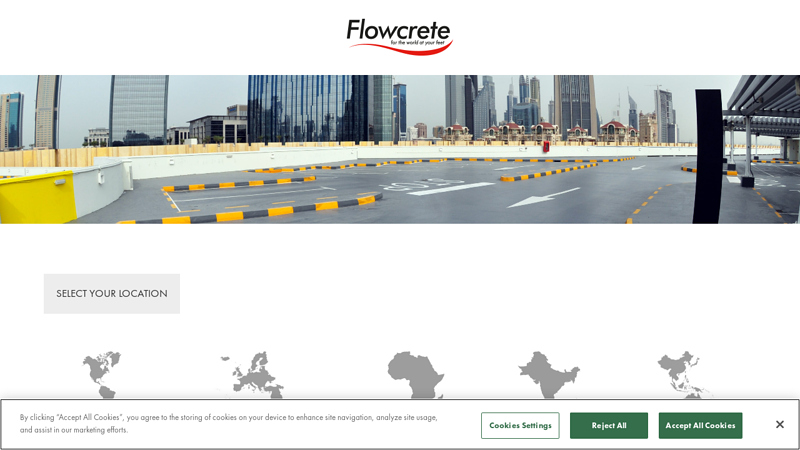

#5 World Leading Manufacturer of High Performance Seamless Resin …

Domain Est. 1996

Website: flowcrete.com

Key Highlights: World Leading Manufacturer of High Performance Seamless Resin Flooring Solutions | Flowcrete | Epoxy, Polyurethane & MMA Resin Flooring….

#6 High Performance Flooring

Domain Est. 1998

Website: industrial.sherwin-williams.com

Key Highlights: Sherwin-Williams High Performance Flooring offers durable, seamless resinous systems for commercial and industrial applications. Get in touch with us today!…

#7 Polyurethane for Floors & Protective Coatings

Domain Est. 2009

Website: xtremepolishingsystems.com

Key Highlights: 3-day delivery 15-day returnsPolyurethane floor coatings provide excellent resistance to chemicals, abrasions, and surface wear. They are commonly used in industrial, manufacturing…

#8 Polycoat Products

Domain Est. 1996

Website: polycoatusa.com

Key Highlights: Polycoat Products delivers innovative polyurethane coatings and elastomer solutions for waterproofing, adhesives, composites and more….

#9 Huntsman Polyurethanes

Domain Est. 1997

Website: huntsman.com

Key Highlights: Huntsman Polyurethanes is a global leader in MDI-based polyurethanes, serving over 3,000 customers in more than 90 countries….

#10 Polyurethane-Based Recreational Coatings & Protections

Domain Est. 1998

Website: advpolytech.com

Key Highlights: APT is a leader in polyurethane-based concrete protection & recreational coatings products. For tracks, sport surfaces, parking garages & more….

Expert Sourcing Insights for Polyurethane Floor Covering

H2: 2026 Market Trends for Polyurethane Floor Covering

The global polyurethane floor covering market is projected to experience notable growth and transformation by 2026, driven by evolving industrial demands, sustainability initiatives, and technological advancements. Key trends shaping the market include:

-

Rising Demand in Commercial and Industrial Sectors

Polyurethane floor coatings are increasingly favored in commercial, industrial, and automotive facilities due to their durability, chemical resistance, and low maintenance. The expansion of manufacturing plants, cold storage units, and pharmaceutical facilities—especially in emerging economies—will continue to boost demand. These environments require seamless, anti-static, and abrasion-resistant flooring solutions, where polyurethane outperforms traditional materials. -

Emphasis on Sustainability and Low-VOC Formulations

Environmental regulations and consumer preferences are pushing manufacturers toward eco-friendly polyurethane solutions. By 2026, water-based and low-VOC (volatile organic compound) polyurethane coatings are expected to gain significant market share. Innovations in bio-based polyols and recycled content integration are enhancing the sustainability profile of these floor coverings, aligning with green building certifications such as LEED and BREEAM. -

Growth in the Residential and Luxury Renovation Segment

While traditionally used in industrial settings, polyurethane flooring is gaining traction in high-end residential applications. Its aesthetic versatility—offering a range of colors, textures, and gloss levels—makes it attractive for modern homes, retail spaces, and hospitality venues. The seamless finish and ease of cleaning further support adoption in design-conscious markets. -

Regional Market Expansion in Asia-Pacific and Latin America

Asia-Pacific is anticipated to be the fastest-growing region, fueled by rapid urbanization, infrastructure development, and rising investments in industrial real estate—particularly in China, India, and Southeast Asia. Similarly, Latin America is witnessing increased adoption due to expanding construction activities and modernization of industrial facilities, supported by foreign direct investment. -

Technological Advancements and Product Innovation

Ongoing R&D efforts are resulting in next-generation polyurethane flooring with enhanced properties such as faster curing times, improved UV resistance, and antimicrobial additives. Self-leveling and moisture-tolerant formulations are also improving ease of installation and reducing project timelines, making polyurethane a more competitive option against epoxy and other resinous systems. -

Impact of Supply Chain Dynamics and Raw Material Costs

Fluctuations in the prices of key raw materials like isocyanates and polyols, influenced by crude oil markets and geopolitical factors, could impact profit margins. However, vertical integration and strategic sourcing partnerships are enabling major players to mitigate risks and maintain pricing stability.

In summary, by 2026, the polyurethane floor covering market will be shaped by a convergence of performance demands, sustainability imperatives, and regional economic growth. Stakeholders who invest in innovation, environmental compliance, and market-specific strategies are likely to capture significant opportunities in this evolving landscape.

Common Pitfalls Sourcing Polyurethane Floor Covering (Quality, IP)

Sourcing polyurethane floor coatings requires careful attention to both quality assurance and intellectual property (IP) considerations. Overlooking these aspects can lead to performance failures, legal risks, and financial losses. Below are key pitfalls to avoid:

Inadequate Verification of Product Quality and Specifications

One of the most frequent issues is assuming that all polyurethane floor coverings meet required performance standards. Buyers may fail to verify technical data sheets (TDS), leading to the selection of substandard products. Key quality pitfalls include:

- Misaligned Performance Claims: Suppliers may exaggerate properties such as chemical resistance, abrasion resistance, or UV stability. Without third-party test reports or independent lab verification, these claims may not hold in real-world conditions.

- Inconsistent Batch Quality: Low-cost manufacturers may lack consistent quality control, resulting in variations in curing time, color, or mechanical strength between batches.

- Improper Formulation for Application Environment: Using a floor coating not suited for specific conditions (e.g., high moisture, heavy traffic, or extreme temperatures) leads to premature degradation and failure.

Failure to Validate Supplier Credentials and Technical Expertise

Choosing suppliers based solely on price or availability—without assessing their R&D capabilities, technical support, or track record—can compromise project outcomes. Pitfalls include:

- Lack of Technical Support: Some suppliers cannot provide adequate guidance on surface preparation, application methods, or curing conditions, increasing the risk of improper installation.

- Unproven or Generic Formulations: Suppliers may offer “generic” polyurethane systems not optimized for specific industrial or commercial uses, resulting in poor adhesion or durability.

Ignoring Intellectual Property (IP) Risks

Polyurethane formulations often involve proprietary chemistry protected by patents, trade secrets, or trademarks. Sourcing without due diligence on IP can expose buyers to legal liability:

- Use of Counterfeit or Copycat Products: Some suppliers offer cheaper alternatives that replicate branded formulations without authorization, potentially infringing on patents or registered trademarks.

- Unclear IP Ownership in Custom Formulations: When working with suppliers on custom blends, failure to define IP ownership in contracts may result in disputes or loss of exclusivity.

- Export/Import Compliance Issues: Using a formulation protected by IP in one country but not another can lead to customs seizures or legal action if the product is distributed across borders.

Overlooking Long-Term Performance and Warranty Terms

Short-term cost savings can be offset by long-term maintenance and replacement costs if the coating fails prematurely. Pitfalls include:

- Insufficient Warranty Coverage: Some warranties exclude common failure modes (e.g., improper installation, substrate issues) or are voided by minor deviations in application.

- Lack of Real-World Validation: New or untested formulations may not have proven longevity, especially in aggressive environments like food processing or chemical plants.

Inadequate Due Diligence on Raw Material Sourcing

The quality of polyurethane coatings depends heavily on the purity and consistency of raw materials (e.g., isocyanates, polyols). Sourcing from suppliers who use inferior or untraceable feedstocks increases the risk of:

- Volatile Organic Compound (VOC) Non-Compliance: Coatings may exceed environmental regulations, leading to project delays or fines.

- Supply Chain Disruptions: Overreliance on single-source or geopolitically sensitive raw materials can impact availability and pricing.

To mitigate these risks, buyers should conduct thorough supplier audits, request performance test data, verify IP status, and ensure contractual clarity on quality, warranties, and intellectual property rights.

Logistics & Compliance Guide for Polyurethane Floor Covering

Overview

Polyurethane floor coverings are durable, seamless, and widely used in industrial, commercial, and healthcare environments. Due to their chemical composition and application requirements, proper logistics handling and regulatory compliance are critical throughout transportation, storage, installation, and disposal.

Regulations and Standards

Polyurethane floor coverings are subject to various international, national, and regional regulations concerning health, safety, and environmental protection. Key standards include:

– REACH (EU): Registration, Evaluation, Authorisation, and Restriction of Chemicals. Requires disclosure of Substances of Very High Concern (SVHC) in polyurethane formulations.

– RoHS (EU): Restriction of Hazardous Substances; generally not directly applicable but relevant if electrical components are integrated.

– VOC Emissions: Comply with EU Directive 2004/42/EC and U.S. EPA regulations on volatile organic compounds (e.g., SCAQMD Rule 1113).

– LEED & BREEAM: Certifications that may require low-emission or sustainable flooring materials.

– OSHA (U.S.): Governs worker safety during installation, especially regarding isocyanate exposure and ventilation.

– GHS/CLP: Global Harmonized System for labeling and safety data sheets (SDS); mandatory for hazardous components like uncured resins.

Transportation Requirements

- Packaging: Ensure containers are sealed, labeled, and resistant to punctures or leaks. Use original manufacturer packaging where possible.

- Hazard Classification: Uncured polyurethane resins often contain isocyanates and solvents, which may be classified as hazardous goods (e.g., UN 1866, Class 3 Flammable Liquid). Check SDS for classification.

- Documentation: Shipments must include:

- Safety Data Sheets (SDS) compliant with GHS

- Proper shipping name, UN number, hazard class

- Transport emergency card (TREM card) if required

- Temperature Control: Avoid exposure to extreme temperatures. Store and transport between 10°C and 30°C (50°F–86°F) to prevent premature curing or viscosity changes.

- Segregation: Keep away from oxidizers, acids, and moisture-sensitive materials during transport.

Storage Guidelines

- Environment: Store in a cool, dry, well-ventilated area, protected from direct sunlight and moisture.

- Temperature: Maintain between 15°C and 25°C (59°F–77°F) to preserve product stability.

- Shelf Life: Adhere to manufacturer’s expiration date. Most polyurethane systems have a shelf life of 6–12 months when stored properly.

- Containers: Keep sealed and upright. Avoid contamination from dust, water, or incompatible materials.

- Segregation: Store away from ignition sources and incompatible chemicals (e.g., amines, alcohols, water).

Handling and Installation Safety

- Personal Protective Equipment (PPE): Mandatory use of:

- Nitrile gloves

- Chemical-resistant apron

- Safety goggles or face shield

- Respiratory protection (NIOSH-approved for organic vapors and isocyanates)

- Ventilation: Ensure adequate mechanical ventilation during application, especially in confined spaces.

- Mixing and Application: Follow manufacturer’s instructions precisely. Inaccurate mixing ratios can lead to incomplete curing and off-gassing.

- Training: Installers must be trained in chemical handling, emergency response, and waste management procedures.

Waste Disposal and Environmental Compliance

- Waste Classification: Uncured materials, contaminated applicators, and leftover mixtures may be hazardous waste due to isocyanate or solvent content.

- Disposal: Dispose in accordance with local, state, and federal regulations (e.g., U.S. EPA, EU Waste Framework Directive). Use licensed hazardous waste handlers where applicable.

- Spill Response: Contain spills immediately using inert absorbents (e.g., sand, vermiculite). Never use water. Clean residue with appropriate solvents and dispose as hazardous waste.

- Recycling: Cured polyurethane flooring is typically not recyclable. Explore mechanical grinding for reuse as fill material where permitted.

Documentation and Recordkeeping

Maintain the following records for compliance audits:

– Safety Data Sheets (SDS) for all components

– Shipping manifests and hazardous material declarations

– Training records for personnel

– Waste disposal manifests

– Product batch numbers and certificates of compliance

– VOC emission test reports (if applicable)

Emergency Preparedness

- Spill Kits: Keep on-site with appropriate absorbents, PPE, and disposal bags.

- First Aid: Treat skin contact with mild soap and water; flush eyes for 15 minutes. Seek medical attention for inhalation or ingestion.

- Emergency Contacts: Post local poison control, fire department, and manufacturer emergency hotline numbers.

Conclusion

Compliance with logistics and regulatory standards ensures the safe and effective use of polyurethane floor coverings. Adherence to chemical handling, transportation, and disposal protocols protects workers, end-users, and the environment while avoiding legal and financial penalties. Always consult product-specific SDS and local authorities for up-to-date requirements.

Conclusion for Sourcing Polyurethane Floor Covering

In conclusion, sourcing polyurethane floor covering presents a highly viable and beneficial solution for commercial, industrial, and high-traffic residential environments. Its exceptional durability, chemical resistance, seamless finish, and low maintenance requirements make it a superior choice compared to traditional flooring options. When sourcing, it is essential to consider factors such as product quality, compliance with environmental and safety standards (e.g., VOC emissions), installer expertise, and lifecycle cost-effectiveness.

Partnering with reputable suppliers and certified manufacturers ensures the performance and longevity of the flooring system. Additionally, evaluating site-specific requirements—such as exposure to moisture, abrasion, or thermal cycling—will guide the appropriate selection of polyurethane formulations (aromatic vs. aliphatic, moisture-cured vs. reactive).

Overall, investing in high-quality polyurethane flooring through a strategic sourcing approach not only enhances functional performance and aesthetic appeal but also contributes to long-term cost savings and sustainability goals. With proper specification and installation, polyurethane floor coverings offer a resilient, seamless, and visually pleasing solution tailored to demanding applications.