The global shrink film market is experiencing robust growth, driven by increasing demand for flexible packaging across food & beverage, pharmaceutical, and consumer goods industries. According to Grand View Research, the global shrink film market size was valued at USD 8.67 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 4.2% from 2024 to 2030. Polyolefin-based shrink films, in particular, are gaining market share due to their superior clarity, strength, and recyclability compared to traditional PVC alternatives. This shift is supported by tightening environmental regulations and rising sustainability initiatives among brand owners. As demand for high-performance, eco-friendly packaging solutions grows, polyolefin shrink wrap manufacturers are scaling production, investing in R&D, and expanding their global footprint. In this evolving landscape, nine key players have emerged as leaders, combining technological innovation, wide product portfolios, and strategic market positioning to capture significant shares of this expanding sector.

Top 9 Polyolefin Shrink Wrap Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Mr. Shrinkwrap

Domain Est. 1997

Website: mrshrinkwrap.com

Key Highlights: Mr Shrinkwrap is the trusted source for shrink wrap, shrink wrap supplies and shrink wrapping equipment from top manufacturers including Ripack and Shrinkfast ……

#2 Our performance: polyolefin shrink films

Domain Est. 2000

Website: bollorefilms.com

Key Highlights: Polyolefin shrink films Bolphane and Bolfresh are innovative solutions to pack food products, display items and industrial goods….

#3 Product Information:Fancywrap|Plastic Film Company|GUNZE

Website: gunze.co.jp

Key Highlights: ”Fancywrap”, the shrink film of Gunze is made by multi-layer technology using PS, PET, polyolefin resin. This film is used for PET beverage bottles, ……

#4 Polyolefin Shrink Wrap Film

Domain Est. 1996

Website: usi-laminate.com

Key Highlights: A very strong, soft film that conforms to difficult shapes and sizes. Designed for use on manual and automatic equipment….

#5 Shrink Wrap Films

Domain Est. 1996

Website: shorr.com

Key Highlights: Protect products and pallets with Shorr’s line of durable, reliable shrink wrap films and shrink wrap machines. Machine servicing also available….

#6 Shrink Film Options

Domain Est. 1997

Website: clysar.com

Key Highlights: Explore Clysar’s wide range of high-performance polyolefin shrink films for packaging applications. Compare proven films and value-added features….

#7 Shrink Film

Domain Est. 1998

Website: itape.com

Key Highlights: IPG began producing polyolefin shrink film in 1993. Over the past 25 years, we have been shrink wrapping products throughout the world….

#8 Polyolefin Shrink Wrap

Domain Est. 2011

Website: uspackagingandwrapping.com

Key Highlights: 30-day returnsPolyolefin Shrink Wrap is clear, durable, and FDA approved for food use. Order rolls online now at U.S. Packaging & Wrapping….

#9 Shrink Wrap

Domain Est. 2016

Expert Sourcing Insights for Polyolefin Shrink Wrap

H2: Market Trends in Polyolefin Shrink Wrap for 2026

As the global packaging industry evolves in response to environmental regulations, technological advancements, and shifting consumer preferences, the polyolefin shrink wrap market is poised for significant transformation by 2026. Polyolefin shrink films—primarily made from polyethylene (PE) and polypropylene (PP) resins—are widely used across food and beverage, pharmaceuticals, consumer goods, and industrial sectors due to their clarity, strength, and shrink performance. The following analysis outlines key market trends shaping the polyolefin shrink wrap landscape in 2026.

1. Sustainability and Regulatory Pressure Driving Innovation

Environmental concerns and tightening global regulations are accelerating the shift toward sustainable packaging. By 2026, polyolefin shrink wrap manufacturers are increasingly adopting recyclable, mono-material structures and incorporating post-consumer recycled (PCR) content. The European Union’s Single-Use Plastics Directive and extended producer responsibility (EPR) schemes are pushing companies to redesign films for recyclability. This trend is mirrored in North America and parts of Asia-Pacific, where brand owners are demanding shrink films that align with zero-waste and circular economy goals.

2. Growth in E-commerce and Demand for Durable Packaging

The continued expansion of e-commerce is boosting demand for high-performance polyolefin shrink wraps that offer superior puncture resistance, tamper evidence, and product protection. As logistics networks become more complex, shrink films with enhanced durability and UV resistance are gaining traction. Polyolefin films are preferred over PVC in this space due to their non-toxicity, lighter weight, and recyclability—key attributes for online retail packaging.

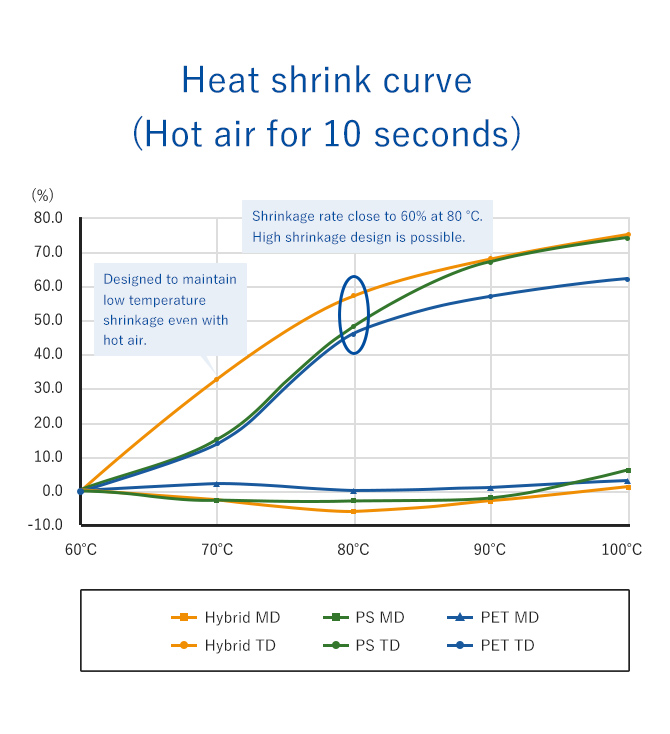

3. Technological Advancements in Film Performance

Innovation in co-extrusion and polymer modification technologies is enabling thinner, stronger, and more energy-efficient shrink films. By 2026, manufacturers are introducing high-clarity, high-shrink polyolefin films with improved sealing properties and lower heat activation temperatures—reducing energy consumption during application. Additionally, the integration of functional additives, such as anti-fog and anti-static agents, is expanding applications in fresh produce and electronics packaging.

4. Shift Toward Bio-based and Compostable Alternatives

While still in early stages, R&D efforts are focused on developing bio-based polyolefins and hybrid materials that maintain performance while reducing carbon footprint. Although fully compostable polyolefin alternatives are not yet mainstream, partnerships between chemical companies and packaging firms are expected to yield commercially viable solutions by 2026. However, cost and infrastructure limitations remain barriers to widespread adoption.

5. Regional Market Dynamics

Asia-Pacific is expected to lead global demand growth in 2026, driven by rising consumer spending, urbanization, and food retail modernization in countries like India, Indonesia, and Vietnam. In contrast, North America and Europe will emphasize sustainable innovation and regulatory compliance, with steady but moderate volume growth. Latin America and the Middle East present emerging opportunities, particularly in beverage multipack packaging.

6. Consolidation and Strategic Partnerships

The competitive landscape is seeing increased consolidation among resin suppliers and film producers. Strategic partnerships between material science companies and brand owners are fostering co-development of customized shrink film solutions. These alliances aim to enhance supply chain resilience and accelerate time-to-market for sustainable innovations.

Conclusion

By 2026, the polyolefin shrink wrap market will be defined by sustainability, performance optimization, and digital transformation in manufacturing. Companies that invest in recyclable materials, lightweighting, and closed-loop systems will gain a competitive edge. While challenges around cost and infrastructure persist, the shift toward eco-efficient polyolefin films is irreversible, positioning the sector for long-term growth aligned with global environmental objectives.

H2: Common Pitfalls When Sourcing Polyolefin Shrink Wrap (Quality and Intellectual Property)

Sourcing polyolefin shrink wrap can present several challenges, particularly concerning product quality and intellectual property (IP) risks. Being aware of these pitfalls helps buyers make informed decisions and avoid costly mistakes.

1. Inconsistent Material Quality

A major issue in sourcing polyolefin shrink wrap is variability in film thickness, clarity, and shrink performance. Low-quality suppliers may use recycled or substandard resins, leading to weak seals, poor shrinkage, or film breakage during application. This inconsistency can disrupt packaging lines and damage brand reputation.

2. Misrepresentation of Specifications

Some suppliers may exaggerate performance claims—such as tensile strength, shrinkage ratio, or temperature resistance—without providing verifiable test data. Buyers should insist on third-party lab reports and sample testing before placing bulk orders.

3. Lack of Compliance with Industry Standards

Polyolefin shrink films used in food, pharmaceutical, or medical packaging must comply with FDA, REACH, or other regulatory standards. Sourcing from non-compliant suppliers can lead to product recalls or legal liability, especially if hazardous additives are present.

4. Intellectual Property Infringement

Using patented formulations, manufacturing processes, or proprietary technologies without authorization can expose buyers to IP litigation. Some suppliers—especially in regions with weak IP enforcement—may offer “generic” versions of branded shrink films that infringe on existing patents.

5. Unlicensed Use of Branding or Technology

Beware of suppliers claiming affiliation with well-known polymer manufacturers (e.g., ExxonMobil, Dow) or using logos and trademarks without authorization. This may indicate counterfeit products or unauthorized production, raising both quality and legal concerns.

6. Inadequate Traceability and Documentation

Reliable sourcing requires complete documentation of resin sources, manufacturing processes, and quality control procedures. Lack of transparency can hinder root-cause analysis in case of failures and increase IP and compliance risks.

7. Hidden Costs from Poor Performance

While low initial pricing may be attractive, poor-quality shrink wrap often leads to higher operational costs due to downtime, waste, and damaged goods. Total cost of ownership should be evaluated, not just purchase price.

To mitigate these risks, buyers should conduct thorough due diligence, request certifications, perform on-site audits if possible, and work with legally vetted suppliers who respect IP rights and maintain consistent quality standards.

Logistics & Compliance Guide for Polyolefin Shrink Wrap

Overview of Polyolefin Shrink Wrap

Polyolefin shrink wrap is a versatile, eco-friendly packaging film widely used in various industries for bundling, unitizing, and protecting products. Made from polyethylene and polypropylene resins, it offers excellent clarity, strength, and shrink characteristics when heat is applied. Due to its recyclability and lack of plasticizers (like PVC), it is often the preferred choice for sustainable packaging solutions. Understanding the logistics and compliance requirements for shipping and handling this material is essential for safe, efficient, and legally compliant operations.

Storage and Handling Requirements

Polyolefin shrink wrap should be stored in a cool, dry environment away from direct sunlight and sources of heat to prevent premature shrinkage or deformation. Rolls must be kept on pallets and stored vertically whenever possible to avoid edge damage and core crushing. Handling should be done with care using appropriate equipment (e.g., forklifts with roll clamps or shaft attachments) to prevent stretching, punctures, or core damage. Exposure to moisture is generally not a concern, but prolonged damp conditions may affect cardboard cores or labels.

Packaging and Transportation

Shrink wrap rolls are typically packaged on sturdy cardboard or plastic cores and stretch-wrapped onto pallets for transport. Each pallet should be clearly labeled with product details, lot numbers, and handling instructions (e.g., “This Side Up,” “Protect from Heat”). During transit, loads must be secured to prevent shifting, and vehicles should be temperature-controlled when possible to avoid heat exposure. Avoid stacking heavy items on top of shrink wrap pallets to prevent core deformation. Use clean, dry trailers free of contaminants to maintain product integrity.

Regulatory Compliance and Safety

Polyolefin shrink wrap is generally considered non-hazardous under OSHA and GHS guidelines. However, Safety Data Sheets (SDS) should be available and reviewed as part of workplace safety protocols. The material is not classified as hazardous for transport under DOT (49 CFR), IMDG, or IATA regulations, allowing for standard freight classification. Always confirm classification with the manufacturer’s documentation. In the EU, compliance with REACH and RoHS regulations is required—ensure that the film contains no restricted substances and that suppliers provide appropriate declarations.

Environmental and Recycling Compliance

Polyolefin shrink wrap is recyclable and typically falls under resin identification code #2 (HDPE) or #4 (LDPE), depending on the formulation. It should not be disposed of in general waste where recycling infrastructure exists. Facilities must adhere to local waste management regulations and encourage downstream recyclability by minimizing contamination (e.g., avoiding mixed-material laminates unless recyclable). In regions with Extended Producer Responsibility (EPR) laws, producers may be required to report packaging volumes and contribute to recycling schemes.

International Shipping Considerations

When exporting polyolefin shrink wrap, ensure compliance with destination country import regulations. While the material itself rarely requires special permits, accurate Harmonized System (HS) codes (e.g., 3920.10 for non-cellular plastic film) must be used for customs declarations. Be aware of specific packaging regulations in markets such as the EU (packaging and packaging waste directive) or Japan (JIS standards). Language-specific labeling may be required, and documentation should include certificates of compliance if requested by the importer.

Quality Control and Traceability

Maintain a robust quality control process that includes incoming inspection of shipments and tracking of lot numbers throughout the supply chain. Use serialized labeling for traceability in case of recalls or compliance audits. Regularly verify film thickness, tensile strength, and shrink performance according to agreed specifications (e.g., ASTM D2732 for shrinkage). Partner with certified suppliers who adhere to ISO 9001 or equivalent quality management systems.

Emergency Response and Spill Management

In the event of a damaged shipment or uncontrolled roll deployment, secure the area to prevent tripping hazards. While polyolefin is non-toxic, loose film can pose entanglement or suffocation risks—especially in large quantities. Clean up promptly using cutters and proper disposal methods. No special spill kits are required, but standard industrial cleanup procedures should be followed. Train staff on safe handling and emergency roll control techniques.

Documentation and Recordkeeping

Retain all relevant compliance documentation, including SDS, certificates of analysis (COA), REACH/RoHS compliance statements, and shipping records. Maintain logs of storage conditions, handling incidents, and quality checks. These records support regulatory audits and ensure continuity in compliance across the supply chain. Digital recordkeeping systems are recommended for easy access and traceability.

Conclusion

Effective logistics and compliance management for polyolefin shrink wrap involves proper storage, careful handling, adherence to transportation standards, and compliance with environmental and international regulations. By following this guide, businesses can ensure product quality, regulatory conformity, and operational safety throughout the supply chain. Always consult with manufacturers and regulatory experts to stay updated on evolving requirements.

Conclusion for Sourcing Polyolefin Shrink Wrap

In conclusion, sourcing polyolefin shrink wrap requires a strategic approach that balances quality, cost, sustainability, and supplier reliability. As a versatile and eco-friendlier alternative to traditional PVC shrink films, polyolefin offers excellent clarity, durability, and shrink performance, making it ideal for a wide range of packaging applications across industries. When selecting a supplier, factors such as film thickness, shrink ratio, environmental certifications, and recyclability should align with your specific packaging needs and sustainability goals.

Additionally, building strong relationships with reputable manufacturers or distributors—preferably those with proven track records in consistent supply and technical support—can ensure long-term operational efficiency. Conducting thorough market research, requesting samples, and evaluating total cost of ownership (including shipping, storage, and waste management) are essential steps in making an informed decision.

Ultimately, sourcing the right polyolefin shrink wrap not only enhances product presentation and protection but also supports environmental responsibility and cost-effective packaging operations. By prioritizing these factors, businesses can optimize their packaging solutions while remaining competitive and sustainable in today’s market.