The global polymer molding market is experiencing robust growth, driven by rising demand across industries such as automotive, healthcare, consumer goods, and electronics. According to a 2023 report by Mordor Intelligence, the market was valued at USD 346.7 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 4.8% from 2024 to 2029. This expansion is fueled by advancements in material science, increased adoption of lightweight plastics in vehicle manufacturing, and the surge in single-use medical devices. Meanwhile, Grand View Research highlights the Asia Pacific region as a key growth engine, attributing its dominance to rapid industrialization and expanding manufacturing capabilities in countries like China and India. As competition intensifies and innovation accelerates, identifying leading polymer molding manufacturers has become critical for businesses seeking high-quality, scalable production partners. Below are the top six companies shaping the industry through technological expertise, global reach, and consistent performance.

Top 6 Polymer Molding Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Polymer Molding, Inc

Domain Est. 2000

Website: dipmoldedplastics.com

Key Highlights: Polymer Molding Inc. (PMI) is a leading manufacturer of dip molded plastic components with over 40 years of experience in the industry. Based in Ohio, PMI….

#2 Plastic Molding Technology

Domain Est. 2002

Website: plasticmolding.com

Key Highlights: PMT specializes in heavy-gauge thermoforming for durable, highly cosmetic, close-tolerance large plastic parts. Vacuum Forming. PMT offers custom vacuum forming ……

#3 Polymer Molding Inc.

Domain Est. 2005

Website: polymermolding.com

Key Highlights: Polymer Molding Inc. provides premium pipe caps, plugs, tubing inserts, and custom injection molded parts made with plastic, rubber, vinyl, and silicone….

#4 Plastic Injection Molding

Domain Est. 2004

Website: precisionmoldedplastics.com

Key Highlights: Precision is a vertically integrated, plastic injection molding company that builds custom molds and tooling, manufactures parts and products, and performs a ……

#5 Plastic Molding Manufacturing

Domain Est. 2008

Website: plasticmoldingmfg.com

Key Highlights: Plastic Molding Manufacturing is a U.S.-based custom plastic injection molding company, providing full-service, single-source solutions for custom molded ……

#6 Springboard Manufacturing

Domain Est. 2019

Website: springboardmfg.com

Key Highlights: We offer state-of-the-art medical injection molding and assembly services for numerous types of medical device applications in a wide range of sizes….

Expert Sourcing Insights for Polymer Molding

H2: 2026 Market Trends for Polymer Molding

As we approach 2026, the global polymer molding industry is undergoing significant transformation, driven by technological innovation, sustainability imperatives, evolving end-market demands, and geopolitical shifts. Key trends shaping the landscape include:

1. Accelerated Adoption of Sustainable Materials & Practices:

Environmental regulations (e.g., EU Green Deal, extended producer responsibility) and consumer pressure are pushing the industry toward circularity. By 2026, expect:

* Increased Use of Bio-based Polymers: PLA, PHA, and bio-PP/PE adoption will grow, especially in packaging, consumer goods, and automotive interiors.

* Rise of Recycled Content: Mechanical recycling advancements will boost the use of post-consumer recycled (PCR) plastics like rPET, rPP, and rHDPE in non-critical applications. Chemical recycling (depolymerization) will scale, enabling higher-quality recycled feedstocks.

* Design for Recycling/Disassembly: Molders will prioritize mono-material designs and easier separation techniques to facilitate end-of-life processing.

* Biodegradable Solutions: Limited but growing niche applications in short-life products (e.g., agricultural films, specific packaging).

2. Integration of Advanced Manufacturing & Industry 4.0:

Digitalization is optimizing efficiency, quality, and customization:

* AI & Machine Learning: Widespread use for predictive maintenance, real-time process optimization (reducing scrap), and quality control (automated defect detection via computer vision).

* Digital Twins & Simulation: Enhanced virtual prototyping and process simulation (mold flow, warpage) will shorten development cycles and reduce physical trials.

* Additive Manufacturing (AM) for Molds: Increased use of metal AM (e.g., conformal cooling channels) to create complex, high-performance molds, improving cycle times and part quality.

* IoT & Smart Factories: Connected machines and sensors enabling real-time monitoring, data-driven decision-making, and seamless integration across supply chains.

3. Material Innovation & High-Performance Polymers:

Demand for lighter, stronger, and more functional parts drives material development:

* Engineering Thermoplastics Growth: Continued expansion of PEEK, PEI, PPS, and high-temperature nylons in automotive (under-hood, e-mobility), electronics, and medical devices.

* Multi-Material & Overmolding: Increased complexity in parts combining rigid/soft materials (e.g., soft-touch grips, seals) or different polymers for integrated functionality.

* Nanocomposites & Functional Additives: Enhanced properties (barrier, conductivity, flame retardancy) via nanofillers or smart additives (e.g., antimicrobials, self-healing).

4. Reshoring & Supply Chain Resilience:

Geopolitical instability and pandemic disruptions emphasize localized production:

* Nearshoring/Reshoring: Particularly in North America and Europe, companies will invest in domestic molding capacity for critical components (e.g., medical, defense, automotive), reducing reliance on long Asian supply chains.

* Vertical Integration: Larger players may acquire upstream (resin) or downstream (assembly) capabilities for greater control.

* Diversified Sourcing: Molders will actively diversify resin suppliers and geographic footprint to mitigate risks.

5. Shifting End-Market Dynamics:

Key sectors will influence demand:

* E-Mobility Boom: High demand for lightweight, insulated, and durable components (battery housings, connectors, charging parts) using engineering polymers.

* Medical Device Expansion: Growth in minimally invasive devices, diagnostics, and home healthcare drives demand for precision molding with biocompatible, sterilizable materials (e.g., PEEK, PSU).

* Sustainable Packaging: Pressure to reduce plastic waste fuels innovation in recyclable mono-material packaging and reusable systems, impacting injection and thermoforming.

* Consumer Electronics: Miniaturization and integration require high-precision micro-molding and advanced materials for thermal management and EMI shielding.

6. Labor & Skill Gaps:

Automation mitigates but doesn’t eliminate the need for skilled workers:

* Focus on Digital Skills: Demand will rise for technicians and engineers proficient in data analytics, AI, robotics, and advanced process control.

* Automation & Robotics: Wider adoption of collaborative robots (cobots) for part handling, inspection, and assembly to address labor shortages and improve consistency.

Conclusion:

The 2026 polymer molding market will be characterized by sustainability as a core driver, deep digital integration, material sophistication, and strategic supply chain reconfiguration. Success will depend on molders’ ability to innovate in materials and processes, embrace digital tools, secure resilient supply chains, and meet the stringent demands of high-growth sectors like e-mobility and medical devices, all while navigating the imperative for a circular economy.

Common Pitfalls in Sourcing Polymer Molding: Quality and Intellectual Property Risks

Sourcing polymer molding—whether through injection molding, blow molding, or other processes—can present significant challenges, particularly concerning product quality and intellectual property (IP) protection. Failing to address these areas can lead to costly delays, legal disputes, and reputational damage. Below are key pitfalls to avoid in both domains.

Quality-Related Pitfalls

1. Inadequate Supplier Qualification

Selecting a molding partner without thoroughly vetting their capabilities, certifications (e.g., ISO 9001), and track record often results in inconsistent part quality. Suppliers may lack the process control, metrology tools, or material expertise required for precision molding.

2. Poor Mold Design and Tooling Quality

Substandard mold design or tooling made from inferior materials can lead to short mold life, part defects (e.g., warping, sink marks, flash), and frequent rework. Rushing the tooling phase or skipping design for manufacturability (DFM) reviews increases this risk.

3. Inconsistent Material Sourcing and Handling

Polymer properties are highly sensitive to moisture, temperature, and contamination. Suppliers that do not follow proper material drying protocols or use off-spec resins can produce non-conforming parts, especially in high-performance applications.

4. Lack of Process Validation and Control

Without robust process validation—including Design of Experiments (DOE), process capability (Cp/Cpk) studies, and Statistical Process Control (SPC)—molded parts may vary significantly between production runs, leading to assembly issues or failures in the field.

5. Insufficient Quality Assurance and Testing

Relying solely on visual inspections or spot checks without comprehensive dimensional, mechanical, and environmental testing increases the likelihood of undetected defects. First Article Inspection (FAI) and ongoing quality audits are essential.

Intellectual Property-Related Pitfalls

1. Inadequate IP Protection in Contracts

Failing to include clear IP clauses in supplier agreements can result in disputes over ownership of molds, designs, and process innovations. Without explicit terms, suppliers may claim rights or reuse tooling for competing clients.

2. Unsecured Mold Ownership and Storage

Molds are valuable assets. If molds are left with the supplier without a formal custody agreement, the buyer risks loss, unauthorized use, or difficulty retrieving them. Suppliers may also leverage mold ownership in pricing negotiations.

3. Exposure of Sensitive Design Data

Sharing CAD files or detailed specifications without non-disclosure agreements (NDAs) or data security measures exposes proprietary designs to theft or reverse engineering, especially in high-risk regions.

4. Weak Enforcement of Confidentiality

Even with NDAs, weak enforcement mechanisms or lack of audit rights can allow suppliers to share design information with third parties or competitors, particularly in regions with lax IP enforcement.

5. Unintended IP Leakage Through Sub-Tier Suppliers

Many molding suppliers outsource secondary operations (e.g., plating, assembly). Without controlling the flow of IP through the supply chain, sensitive information may be exposed to unauthorized parties.

Mitigation Strategies

To avoid these pitfalls, sourcing teams should:

– Conduct rigorous supplier audits and require quality certifications.

– Own the molds and specify storage, maintenance, and retrieval terms.

– Use comprehensive contracts with clear IP ownership and confidentiality clauses.

– Implement secure data-sharing protocols (e.g., encrypted file transfers, limited access).

– Validate processes and conduct regular quality inspections.

– Monitor sub-tier suppliers and require flow-down IP protections.

Proactively addressing quality and IP concerns during the sourcing process ensures reliable production and safeguards critical innovations.

Logistics & Compliance Guide for Polymer Molding

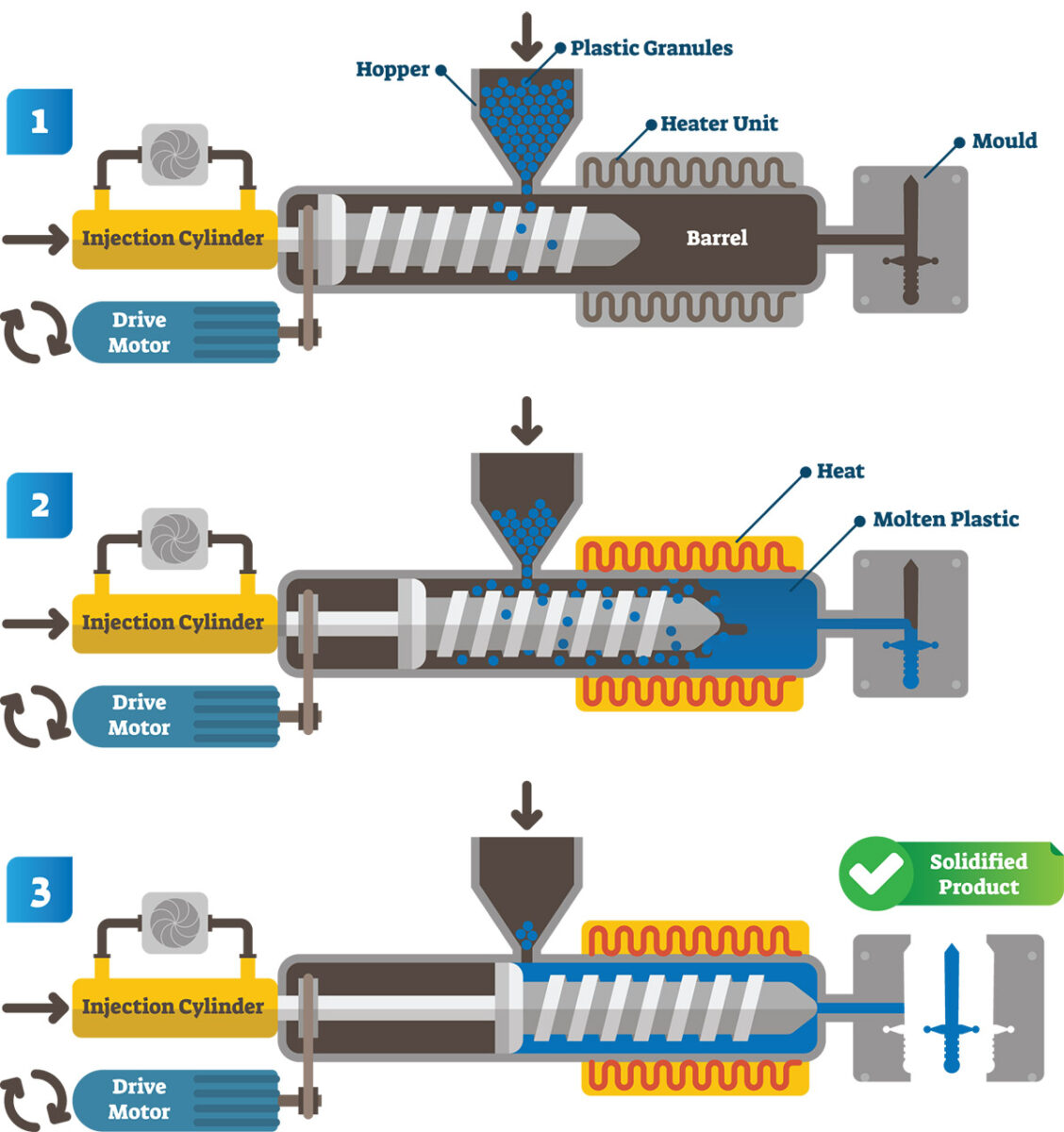

Overview of Polymer Molding Processes

Polymer molding encompasses various manufacturing techniques—such as injection molding, blow molding, compression molding, and extrusion—used to shape thermoplastic and thermosetting polymers into finished products. Ensuring efficient logistics and compliance throughout the supply chain is critical for operational success, regulatory adherence, and environmental responsibility.

Raw Material Sourcing and Handling

Proper sourcing of polymer resins (e.g., polyethylene, polypropylene, ABS) requires vetting suppliers for quality certifications (e.g., ISO 9001) and material traceability. Resins are typically shipped in pellet form via bulk containers, supersacks, or Gaylords. Storage conditions must maintain dry, temperature-controlled environments to prevent moisture absorption, which can degrade material quality. First-In, First-Out (FIFO) inventory practices help prevent resin aging.

Transportation and Supply Chain Logistics

Transportation of raw materials and finished goods must consider polymer sensitivity to heat, humidity, and mechanical stress. Use of climate-controlled trucks or containers is recommended for long-haul shipments. Finished molded parts should be packaged in anti-static or protective materials to prevent scratching, deformation, or electrostatic damage. Route optimization and reliable freight partners minimize delivery delays and reduce carbon footprint.

Regulatory Compliance Requirements

Polymer molding operations must comply with regional and international regulations, including:

– REACH (EU): Registration, Evaluation, Authorization, and Restriction of Chemicals; requires declaration of Substances of Very High Concern (SVHC).

– RoHS (EU): Restriction of Hazardous Substances in electrical and electronic equipment.

– FDA (USA): Required for food-contact and medical-grade polymers; mandates compliance with 21 CFR regulations.

– Proposition 65 (California): Requires warnings for products containing listed carcinogens or reproductive toxins.

Documentation such as Safety Data Sheets (SDS), Certificates of Compliance (CoC), and material declarations must be maintained.

Environmental and Waste Management

Polymer molding generates sprues, runners, and reject parts. Recycling in-house regrind (when uncontaminated) reduces material waste and costs. Proper disposal of non-recyclable waste must follow local environmental regulations (e.g., EPA in the U.S.). Volatile organic compound (VOC) emissions from processing may require air quality permits and abatement systems (e.g., carbon filters, thermal oxidizers).

Quality Control and Traceability

Implementing quality management systems (e.g., ISO 9001, IATF 16949 for automotive) ensures product consistency. Batch tracking using barcodes or RFID tags enables full traceability from raw material lot to finished product. Regular audits and inspection protocols (dimensional checks, material testing) support compliance and defect prevention.

International Trade and Customs Considerations

Exporting molded polymer products requires accurate Harmonized System (HS) code classification (e.g., 3926 for articles of plastics). Proper labeling, country-of-origin marking, and adherence to import regulations (e.g., CE marking in Europe) are essential. Free Trade Agreements (FTAs) may offer tariff reductions if rules of origin are met.

Worker Safety and Facility Compliance

Compliance with OSHA (U.S.) or equivalent workplace safety standards is mandatory. Personnel must be trained in handling hot molds, operating heavy machinery, and responding to resin dust or fume exposure. Machine guarding, lockout/tagout (LOTO) procedures, and personal protective equipment (PPE) are required to maintain a safe working environment.

Sustainability and Circular Economy Practices

Adopting sustainable practices such as using bio-based or recycled resins, reducing energy consumption via efficient machinery, and designing for disassembly supports environmental goals. Participating in Extended Producer Responsibility (EPR) programs may be required in certain jurisdictions for plastic waste management.

Conclusion

Effective logistics and compliance in polymer molding demand a proactive approach to material management, regulatory adherence, environmental stewardship, and supply chain coordination. By integrating robust systems and staying current with evolving standards, manufacturers can ensure operational efficiency, legal compliance, and market competitiveness.

Conclusion for Sourcing Polymer Molding:

Sourcing polymer molding requires a strategic approach that balances material selection, manufacturing capabilities, cost-efficiency, and supplier reliability. By understanding the specific requirements of the application—such as mechanical properties, environmental resistance, and volume demands—companies can identify the most suitable polymer materials and molding processes, including injection molding, blow molding, or extrusion. Partnering with experienced and certified suppliers ensures consistent quality, regulatory compliance, and timely delivery. Additionally, considering factors such as tooling costs, lead times, and scalability supports long-term production success. In a competitive and evolving market, effective sourcing of polymer molding not only reduces overall costs but also enhances product performance and time-to-market, making it a critical component of successful product development and manufacturing.