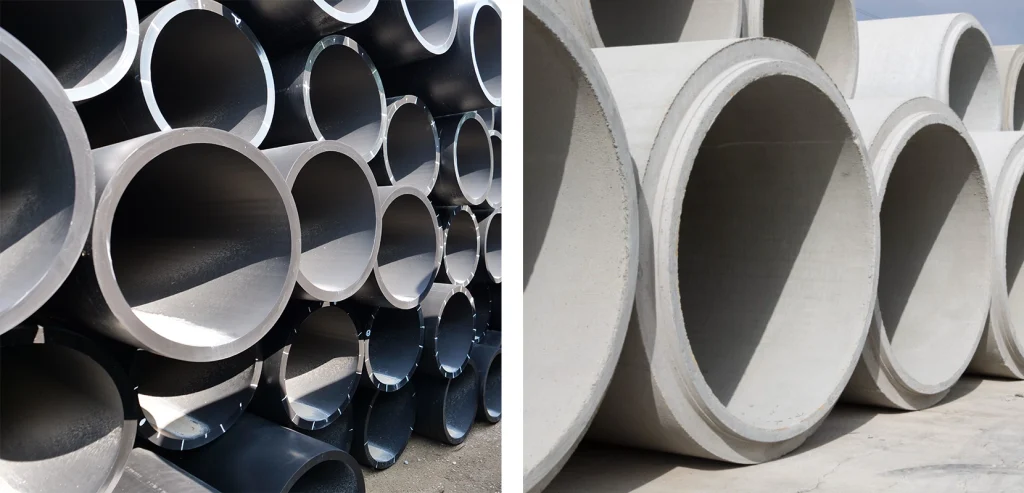

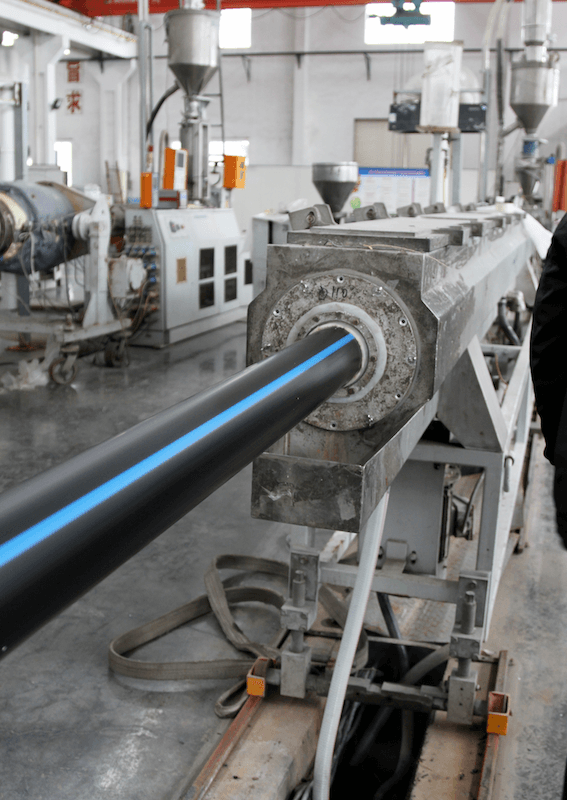

The global polyethylene (PE) pipework market is experiencing robust growth, driven by rising demand in water supply, gas distribution, and industrial applications. According to Grand View Research, the market was valued at USD 21.3 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 5.8% from 2024 to 2030. This growth is fueled by increasing infrastructure investments, especially in emerging economies, and a shift toward durable, corrosion-resistant piping solutions. Polyethylene’s flexibility, leak-free jointing capabilities, and long service life make it a preferred choice across municipal and industrial sectors. As sustainability and pipeline efficiency gain prominence, leading manufacturers are innovating with advanced PE grades such as PE100 and PE100-RC to meet stringent performance standards. In this evolving landscape, nine key players have emerged at the forefront, combining technological leadership, global reach, and scalable production to shape the future of fluid transport infrastructure.

Top 9 Polyethylene Pipework Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 HDPE Pipe Solutions

Domain Est. 1995

Website: isco-pipe.com

Key Highlights: ISCO is the leading HDPE pipe & fusion equipment supplier in North America, providing expert solutions for municipal, industrial & oil/gas HDPE piping ……

#2 PPI

Domain Est. 1996

Website: plasticpipe.org

Key Highlights: PPI is the major North American manufacturers trade association of advocacy and education for plastics use in pipe, conduit and infrastructure solutions….

#3 Cresline Plastic Pipe Co.

Domain Est. 1998

Website: cresline.com

Key Highlights: As one of the largest full-line pipe manufacturers, Cresline’s family of companies offers industry leading coast-to-coast service….

#4 WL Plastics

Domain Est. 2000

Website: wlplastics.com

Key Highlights: WL Plastics is a trusted industry leader in manufacturing high-density polyethylene (HDPE) pipe for municipal, industrial, and energy applications….

#5 JM Eagle™

Domain Est. 2007

Website: jmeagle.com

Key Highlights: JM Eagle · Delivering life’s essentials through the most eco-friendly plastic pipe products on the market. · Express Service Trucks (ESTs) Deliver within 24 hours ……

#6 to PolyPipe USA

Domain Est. 2021

Website: polypipeusa.com

Key Highlights: PolyPipe is one of the largest manufacturers of polyethylene pipe for gas distribution and the only nation-wide manufacturer of bimodal PE2708 PolyTough1….

#7 Your Source for Quality Polyethylene Pipe

Domain Est. 2000

Website: centennialplastics.com

Key Highlights: We are committed to making the very best polyethylene pipe products on the market and providing customer service that is second to none….

#8 Aquatherm: The Leader in Polypropylene Piping

Domain Est. 2002

Website: aquatherm.com

Key Highlights: The original polypropylene piping systems. Faster to install. Corrosion-free. Lasts for decades. These are just a few of the many benefits of aquatherm’s PP- ……

#9 United Poly Systems

Domain Est. 2011

Website: unitedpolysystems.com

Key Highlights: We manufacture custom HDPE pipe in the USA for the water and sewer, power & communications and oil & gas markets. Contact us for a quote now!…

Expert Sourcing Insights for Polyethylene Pipework

H2: 2026 Market Trends for Polyethylene Pipework

The global polyethylene (PE) pipework market is poised for sustained growth by 2026, driven by infrastructure development, environmental regulations, and material performance advantages. Key trends shaping the market include:

-

Rising Demand in Water and Wastewater Infrastructure

Governments worldwide are investing heavily in upgrading aging water and sewage systems, particularly in North America, Europe, and emerging economies. Polyethylene pipework—especially HDPE (High-Density Polyethylene)—is preferred due to its corrosion resistance, leak-free joints, and long service life. By 2026, water transmission projects are expected to account for over 40% of PE pipework demand. -

Growth in Gas Distribution Networks

Natural gas remains a transitional fuel in the global energy mix. PE pipes are increasingly used in gas distribution due to their flexibility, safety, and resistance to cracking. Regulatory approvals for higher-pressure PE100-RC (Resistant to Crack) materials are accelerating adoption in Europe and Asia-Pacific, supporting market expansion through 2026. -

Sustainability and Circular Economy Initiatives

The industry is responding to environmental concerns with increased use of recycled PE in non-critical applications. By 2026, leading manufacturers aim to incorporate 20–30% recycled content in pipework, driven by EU Green Deal policies and extended producer responsibility (EPR) schemes. Additionally, PE pipes contribute to water conservation through reduced leakage compared to traditional materials. -

Technological Advancements in Material Grades

Innovations such as PE100-RC and PE100+ offer enhanced durability, faster installation, and suitability for trenchless technologies like horizontal directional drilling (HDD). These high-performance materials are expected to gain over 25% market share in new installations by 2026, especially in challenging terrains and seismic zones. -

Expansion in Asia-Pacific and Africa

Rapid urbanization and industrialization in countries like India, Indonesia, and Nigeria are fueling demand for PE pipework. China continues to lead in production and consumption, supported by Belt and Road Initiative (BRI) infrastructure projects. The Asia-Pacific region is projected to register the highest CAGR of over 6.5% through 2026. -

Supply Chain and Raw Material Volatility

Fluctuations in crude oil prices and ethylene feedstock costs may impact PE pipe pricing. However, regional production capacity expansions—especially in the Middle East and North America—help stabilize supply. Localized manufacturing is becoming a strategic priority to reduce logistics costs and carbon footprints. -

Adoption of Digitalization and Smart Monitoring

Integration of IoT-enabled sensors within PE pipeline systems for real-time leak detection and condition monitoring is emerging. While still in early stages, smart pipework solutions are expected to see increased investment by utilities and municipalities by 2026.

In conclusion, the polyethylene pipework market is set for robust growth by 2026, supported by infrastructural needs, material innovation, and sustainability trends. Stakeholders should focus on high-performance materials, recycling technologies, and regional market diversification to capitalize on evolving opportunities.

Common Pitfalls Sourcing Polyethylene Pipework (Quality, IP)

When sourcing polyethylene (PE) pipework, overlooking critical quality and intellectual property (IP) considerations can lead to significant project risks, safety hazards, and financial losses. Below are key pitfalls to avoid:

Poor Material Quality and Non-Compliance

One of the most prevalent pitfalls is procuring PE pipes that fail to meet required material standards. Suppliers may offer pipes made from substandard or recycled resins, which compromise mechanical properties such as slow crack growth resistance, impact strength, and long-term hydrostatic strength. Always verify compliance with recognized international standards (e.g., ISO 4427, ASTM D3035, or EN 12201) and confirm material designation (e.g., PE100, PE100-RC) through certified test reports. Failure to do so can result in premature pipe failure, leaks, or bursts under pressure.

Counterfeit or Non-Certified Products

The market includes counterfeit PE pipes falsely labeled with reputable brand names or certifications. These may lack proper certification marks (e.g., WRAS, KIWA, DVGW) or traceability codes (e.g., batch numbers, production dates). Sourcing from unauthorized distributors increases the risk of receiving such products. Always purchase from authorized dealers and demand full traceability documentation, including material test reports and third-party certification.

Inadequate Pressure Rating and SDR Mismatch

Selecting pipes with incorrect Standard Dimension Ratio (SDR) or pressure rating for the intended application is a frequent error. Using pipes with insufficient pressure resistance in high-stress environments can lead to catastrophic failure. Ensure the SDR and pressure class (e.g., PN10, PN16) align with the system’s operating conditions, accounting for surge pressures and environmental factors.

Lack of UV and Oxidation Resistance

PE pipes exposed to sunlight during storage or in above-ground installations require UV stabilization. Pipes without adequate carbon black content (typically 2–3%) or antioxidants degrade rapidly, leading to embrittlement and failure. Verify that the material formulation includes proper stabilizers suitable for the installation environment.

Intellectual Property Infringement

Sourcing PE pipes from manufacturers that use patented resin formulations (e.g., PE100-RC for crack-resistant pipes) without proper licensing poses legal and performance risks. IP violations not only expose procurement teams to legal liability but also suggest the product may not deliver the claimed performance benefits. Confirm that the resin technology used (e.g., Borealis, LyondellBasell innovations) is legitimately licensed and documented.

Inconsistent Welding Compatibility

PE pipes and fittings must be compatible for fusion welding (butt or electrofusion). Mixing components from different manufacturers or grades without verifying compatibility can result in weak joints and leaks. Insist on full system compatibility and request welding procedure specifications (WPS) and qualification records from the supplier.

Inadequate Documentation and Traceability

Lack of proper documentation—such as mill test certificates, installation guidelines, and warranty information—hampers quality assurance and accountability. Ensure every delivery includes traceable batch information and compliance documentation to support audits and future maintenance.

Avoiding these pitfalls requires due diligence, supplier vetting, and adherence to technical standards. Prioritizing quality and IP integrity ensures the long-term reliability and safety of polyethylene pipework systems.

Logistics & Compliance Guide for Polyethylene Pipework

Storage and Handling

Proper storage and handling of polyethylene (PE) pipework are essential to maintain material integrity and ensure long-term performance. Follow these guidelines:

- Storage Environment: Store pipes in a cool, dry, and well-ventilated area, away from direct sunlight and sources of heat. UV exposure can degrade PE material over time.

- Stacking: Stack pipes horizontally on flat, level supports to prevent deformation. Use cradles or racks designed for pipe storage. Limit stack height based on pipe diameter and wall thickness to avoid bottom pipes being crushed.

- Protection from Contaminants: Keep pipes covered or wrapped to prevent dirt, moisture, grease, or chemical contamination.

- Handling: Use appropriate lifting equipment such as slings, cradles, or forklifts with soft pads. Avoid dragging pipes across surfaces, which can cause scratches or gouges that compromise structural integrity.

- Temperature Considerations: Do not handle or install PE pipes at temperatures below 0°C (32°F) without manufacturer consultation, as cold PE becomes brittle and prone to cracking.

Transport Requirements

Safe and compliant transportation of polyethylene pipework reduces damage risk and ensures regulatory adherence.

- Securing Loads: Use straps, chains, or nets to secure pipes firmly on transport vehicles. Protect pipe ends with caps or covers to prevent damage during transit.

- Avoid Abrasion: Place protective padding (e.g., rubber or foam) between pipes and securing devices to prevent abrasion or crushing.

- Vehicle Compatibility: Use flatbed trucks or trailers with adequate support and side rails. Tunnels or enclosed trailers are recommended for long-distance transport to shield from UV and weather.

- Documentation: Ensure transport manifests include material specifications, batch numbers, and safety data sheets (SDS) for compliance with carrier and regulatory requirements.

Regulatory Compliance

Polyethylene pipework must comply with national and international standards depending on application (e.g., water, gas, industrial).

- Standards and Certifications:

- ISO 4427: For polyethylene pipes and fittings for water supply.

- ISO 4437: For polyethylene pipes for gas supply.

- ASTM D3350: Standard specification for polyethylene plastics pipe and fitting materials.

- EN 12201: European standard for water supply systems using PE pipes.

- EN 1555: For gas distribution systems.

- Pressure Ratings: Ensure pipes are marked with PN (Nominal Pressure) or SDR (Standard Dimension Ratio) ratings appropriate for the intended service.

- Traceability: Maintain batch/lot traceability throughout the supply chain. Each pipe should bear permanent markings including manufacturer, material designation (e.g., PE100), standard, diameter, wall thickness, and production date.

- Hazardous Locations: For gas or flammable fluid applications, verify compliance with ATEX (Europe) or other regional explosion protection directives.

Installation Compliance

Installation must follow manufacturer guidelines and engineering standards to ensure system safety and performance.

- Fusion Procedures: Butt fusion, electrofusion, or mechanical jointing must be performed by certified personnel using calibrated equipment. Maintain records of fusion parameters (temperature, pressure, time).

- Bending Radius: Respect minimum bending radius (typically 25–30 times the pipe diameter) to avoid kinking or wall thinning.

- Backfilling and Bedding: Use appropriate granular bedding and backfill materials to support the pipe and prevent stress points. Follow local codes for trench preparation.

- Leak Testing: Conduct hydrostatic or pneumatic pressure testing as per applicable standards (e.g., ISO 11413 for gas, ISO 1452 for water) before commissioning.

Environmental and Safety Regulations

- Waste Management: Recycle PE pipe offcuts or packaging where possible. Follow local regulations for disposal of non-recyclable PE waste.

- Worker Safety: Provide PPE (gloves, eye protection) during handling and fusion. Ensure proper ventilation when fusion welding indoors.

- Spill Prevention: Avoid storing pipes near water sources or environmentally sensitive areas to prevent contamination in case of accidental release.

Documentation and Recordkeeping

Maintain comprehensive records for audit and compliance purposes:

- Material test reports (MTRs)

- Fusion logs and inspection records

- As-built drawings and pipeline alignment sheets

- Certificates of compliance with relevant standards

- SDS for PE materials and fusion accessories

Adherence to this logistics and compliance guide ensures the integrity, safety, and regulatory acceptance of polyethylene pipework systems across all project phases.

Conclusion:

Sourcing polyethylene (PE) pipework requires a strategic approach that balances quality, cost, compliance, and long-term performance. Polyethylene pipes offer significant advantages, including excellent chemical resistance, flexibility, durability, and resistance to corrosion, making them ideal for applications in water supply, gas distribution, and industrial fluid transfer. When sourcing, it is essential to select reputable suppliers who adhere to international standards such as ISO 4427, ASTM D3350, or EN 12201 to ensure material consistency and performance under varying environmental conditions.

Key considerations include the required pipe grade (e.g., PE80 or PE100), proper certification, pressure ratings, and UV resistance for outdoor applications. Additionally, logistical factors such as lead times, delivery capabilities, and technical support should be evaluated to ensure project continuity. Environmental sustainability and recyclability of PE materials further enhance their appeal in modern infrastructure projects.

In conclusion, a well-informed sourcing strategy for polyethylene pipework—prioritizing quality assurance, regulatory compliance, and supplier reliability—will result in long-term operational efficiency, reduced maintenance costs, and improved system reliability across diverse applications.