The global polyethylene (PE) gas pipe market is experiencing steady growth, driven by increasing demand for durable, corrosion-resistant, and cost-effective piping solutions in natural gas distribution networks. According to a report by Mordor Intelligence, the global PE pipe market was valued at USD 31.5 billion in 2023 and is projected to grow at a CAGR of 5.8% from 2024 to 2029. This expansion is fueled by ongoing infrastructure development, rising natural gas consumption, and the replacement of aging metal pipelines with high-density polyethylene (HDPE) alternatives. Grand View Research further supports this outlook, highlighting that the versatility of PE pipes in trenchless installation methods and their compliance with international safety standards are accelerating adoption across both developed and emerging economies. As the energy sector continues to prioritize leak prevention and long-term reliability, manufacturers specializing in PE gas piping are playing a critical role in shaping modern utility infrastructure. The following list highlights the top 10 polyethylene gas pipe manufacturers leading innovation, quality, and market reach in this evolving landscape.

Top 10 Polyethylene Gas Pipe Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Gas Distribution

Domain Est. 2000

Website: cpchem.com

Key Highlights: Chevron Phillips Chemical is a leading manufacturer of polyethylene piping and fittings for municipal, industrial, and oilfield applications….

#2 HDPE Pipe Solutions

Domain Est. 1995

Website: isco-pipe.com

Key Highlights: ISCO is the leading HDPE pipe & fusion equipment supplier in North America, providing expert solutions for municipal, industrial & oil/gas HDPE piping ……

#3 WL Plastics

Domain Est. 2000

Website: wlplastics.com

Key Highlights: WL Plastics is a trusted industry leader in manufacturing high-density polyethylene (HDPE) pipe for municipal, industrial, and energy applications….

#4 JM Eagle™

Domain Est. 2007

Website: jmeagle.com

Key Highlights: JM Eagle · Delivering life’s essentials through the most eco-friendly plastic pipe products on the market. · Express Service Trucks (ESTs) Deliver within 24 hours ……

#5 to PolyPipe USA

Domain Est. 2021

Website: polypipeusa.com

Key Highlights: PolyPipe is one of the largest manufacturers of polyethylene pipe for gas distribution and the only nation-wide manufacturer of bimodal PE2708 PolyTough1….

#6 Your Source for Quality Polyethylene Pipe

Domain Est. 2000

Website: centennialplastics.com

Key Highlights: We are committed to making the very best polyethylene pipe products on the market and providing customer service that is second to none….

#7 Gas Industry

Domain Est. 2001

Website: gfps.com

Key Highlights: Georg Fischer Central Plastics is North America’s largest single source supplier of piping systems for the natural gas industry….

#8 Radius Systems: Pipeline Solutions – Power, Water, Gas

Domain Est. 2002 | Founded: 1969

Website: radius-systems.com

Key Highlights: Leading pipelines since 1969. Experts in PE pipeline solutions setting standards in safety, quality, and innovation. Your trusted choice for PE pipes….

#9 United Poly Systems

Domain Est. 2011

Website: unitedpolysystems.com

Key Highlights: We manufacture custom HDPE pipe in the USA for the water and sewer, power & communications and oil & gas markets. Contact us for a quote now!…

#10 Oil Creek Plastics

Domain Est. 2012

Website: oilcreekplastics.com

Key Highlights: Choose Oil Creek Plastics for high-quality polyethylene piping solutions that exceed expectations with superior quality, exceptional service, and integrity….

Expert Sourcing Insights for Polyethylene Gas Pipe

H2: 2026 Market Trends for Polyethylene Gas Pipe

The global polyethylene (PE) gas pipe market is poised for steady growth by 2026, driven by increasing demand for safe, durable, and cost-effective solutions in natural gas distribution infrastructure. Key market trends shaping the industry in 2026 include technological advancements, regulatory support, energy transition initiatives, and regional infrastructure development.

1. Rising Demand for Energy Infrastructure Modernization

A primary driver of the polyethylene gas pipe market in 2026 is the ongoing modernization of aging gas distribution networks, particularly in North America and Europe. Governments and utility companies are replacing corroded metal pipes with corrosion-resistant PE pipes to reduce gas leaks, improve safety, and comply with stricter environmental regulations. The U.S. Infrastructure Investment and Jobs Act continues to fund pipeline replacement programs, significantly boosting demand for PE-100 and PE-100 RC (resistant to crack) materials.

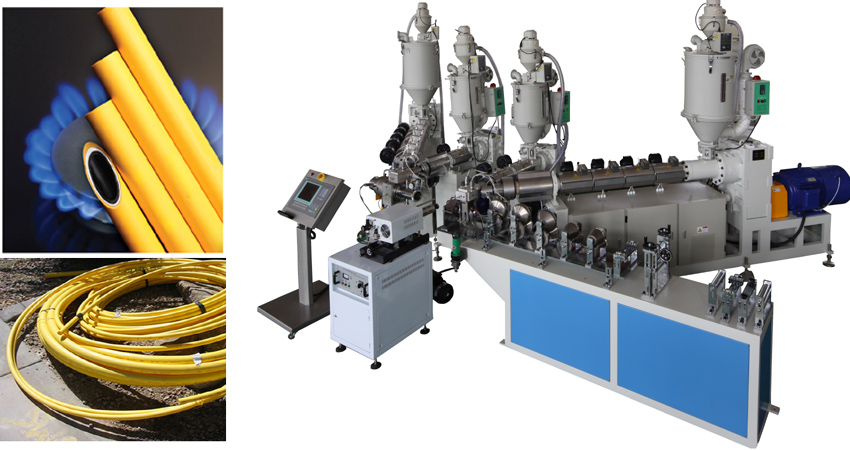

2. Adoption of High-Performance PE Materials

By 2026, there is a growing shift toward advanced polyethylene grades such as PE-100 and PE-100 RC. These materials offer superior strength, slow crack growth resistance, and longer service life (up to 100 years), making them ideal for high-pressure gas transmission applications. The adoption of bimodal and multilayer PE pipes enhances performance in challenging environments, further supporting market expansion.

3. Urbanization and Gas Grid Expansion in Emerging Economies

In regions such as Asia-Pacific, Latin America, and the Middle East, rapid urbanization and expanding access to natural gas are fueling infrastructure investments. Countries like India, China, and Indonesia are extending gas pipeline networks to industrial and residential areas, favoring PE pipes due to their flexibility, ease of installation, and lower maintenance costs compared to steel or concrete alternatives.

4. Sustainability and Environmental Regulations

Environmental concerns and emissions reduction targets are influencing utility choices. PE gas pipes contribute to lower methane emissions due to their leak-proof joints and durability. In 2026, stricter regulations under frameworks like the EU Methane Strategy and U.S. EPA guidelines are accelerating the replacement of outdated pipelines with PE systems. Additionally, the industry is exploring recycled polyethylene content and improved recyclability to meet circular economy goals.

5. Technological Integration and Smart Pipelines

Innovations in pipeline monitoring are integrating PE gas pipes with smart technologies. By 2026, an increasing number of installations include embedded sensors and IoT-enabled systems for real-time leak detection, pressure monitoring, and predictive maintenance. These advancements enhance operational efficiency and safety, making PE pipelines more attractive to utilities.

6. Competitive Landscape and Supply Chain Dynamics

The market remains competitive, with key players such as Uponor, Georg Fischer, Wienerberger, and NOVATEC investing in R&D and production capacity. Regional supply chains are adapting to fluctuating feedstock prices (e.g., ethylene) and geopolitical factors. Localization of manufacturing is rising to reduce logistics costs and improve supply resilience, particularly in high-growth markets.

7. Challenges and Restraints

Despite positive trends, the market faces challenges including price volatility of raw materials, competition from alternative energy sources (e.g., hydrogen and electrification), and regulatory uncertainty around the future of natural gas. However, the transitional role of natural gas in the energy mix supports continued investment in PE infrastructure through 2026.

Conclusion

The polyethylene gas pipe market in 2026 reflects a confluence of infrastructure renewal, material innovation, and sustainability imperatives. Driven by safety, performance, and regulatory factors, PE pipes are set to maintain dominance in gas distribution systems globally, with sustained growth expected in both developed and emerging markets.

H2: Common Pitfalls in Sourcing Polyethylene Gas Pipe (Quality and Intellectual Property)

Sourcing polyethylene (PE) gas pipe—especially for critical applications such as natural gas distribution—requires careful attention to material quality, compliance standards, and intellectual property (IP) considerations. Failing to address these aspects can lead to safety hazards, regulatory non-compliance, financial loss, or legal disputes. Below are the most common pitfalls in these areas:

1. Substandard Material Quality

-

Use of Non-Compliant Resins: Some suppliers may use recycled or off-spec polyethylene resins that do not meet required standards (e.g., PE80 or PE100 per ISO 4437 or ASTM D2513). This compromises pipe strength, slow crack growth resistance, and long-term performance.

-

Inconsistent Manufacturing Processes: Poor extrusion control, inadequate cooling, or improper stabilization (e.g., insufficient carbon black dispersion or antioxidant packages) can result in premature pipe failure.

-

Lack of Certification: Pipes may be sold without valid certification from accredited bodies (e.g., NSF, DVGW, KIWA, or TSE). This increases the risk of using non-compliant products in regulated markets.

-

Counterfeit or Misrepresented Products: Some suppliers may label inferior pipes as PE100 when they fail to meet the required MRS (Minimum Required Strength) or other performance metrics.

2. Non-Compliance with Regional Standards

-

Misalignment with Local Codes: Gas pipe requirements vary by country. For example, European markets require EN 1555 compliance with SDR (Standard Dimension Ratio) and MOP (Maximum Operating Pressure) ratings, while North America follows ASTM and CSA standards. Sourcing pipes that do not meet local regulations can result in project delays or rejection.

-

Inadequate Testing and Documentation: Reputable suppliers provide test reports for hydrostatic strength, resistance to rapid crack propagation (RCP), and electrofusion compatibility. Omitting these documents is a red flag.

3. Intellectual Property (IP) Infringement Risks

-

Unauthorized Use of Proprietary Technologies: Leading manufacturers (e.g., Borealis, SABIC, LyondellBasell) hold patents on specific PE100-RC (resistant to crack) and bimodal resins. Sourcing pipes made with such materials without proper licensing may expose buyers to IP litigation.

-

“Copycat” Pipe Designs: Some manufacturers replicate patented pipe wall structures, jointing systems, or stabilization formulations. Even if the pipe functions adequately, using such products may violate IP rights held by innovators.

-

Lack of Transparency in Supply Chain: If the resin source or manufacturing process is not disclosed, buyers risk unknowingly procuring infringing products. This is particularly common in complex global supply chains.

4. Poor Supplier Due Diligence

-

Unverified Suppliers: Engaging with new or unproven suppliers without auditing their production facilities or reviewing third-party certifications increases the risk of receiving subpar or non-compliant products.

-

OEM vs. Genuine Manufacturer Confusion: Some suppliers rebrand pipes from unknown manufacturers without proper quality control. Buyers may assume they are purchasing from a reputable brand, only to receive inferior alternatives.

5. Inadequate Traceability and Marking

-

Missing or Falsified Markings: Legitimate PE gas pipes must be continuously marked with resin type, standard, size, manufacturer, and production date. Absence or inconsistency in markings often indicates poor quality control or deliberate misrepresentation.

-

Lack of Batch Traceability: In the event of a defect or recall, absence of batch-level traceability makes it difficult to identify and replace affected pipe segments.

Best Practices to Avoid Pitfalls

- Verify Certifications: Require up-to-date certificates from independent bodies (e.g., DVGW, Kiwa, CSA, or NSF).

- Conduct Factory Audits: Visit or audit the manufacturer’s facility to assess quality systems and resin sourcing.

- Demand Full Documentation: Request material test reports, resin data sheets, and compliance declarations.

- Protect Against IP Risks: Ensure suppliers warrant that their products do not infringe on third-party IP, especially for advanced resin types.

- Use Reputable Suppliers: Partner with established manufacturers or distributors with proven track records in gas pipe supply.

By proactively addressing quality and IP concerns, organizations can ensure the safety, reliability, and legal compliance of their polyethylene gas pipe sourcing.

H2: Logistics & Compliance Guide for Polyethylene (PE) Gas Pipe

Proper logistics and compliance protocols are essential for the safe, efficient, and legally compliant handling, transportation, storage, and installation of Polyethylene (PE) Gas Pipe. This guide outlines key considerations to ensure operational integrity and regulatory adherence throughout the supply chain.

- Regulatory Compliance

1.1 International and National Standards

– ISO 4437 / ISO 4437-2: Specifies requirements for PE pipes and fittings used in gas supply systems.

– EN 1555 Series (Europe): Covers materials, dimensions, performance, and testing for PE gas piping systems.

– ASTM D2513 (USA): Standard specification for PE gas pressure pipe, tubing, and fittings.

– AS/NZS 4130 (Australia/New Zealand): Specifies requirements for polyethylene piping systems for gas supply.

1.2 Material Certification

– Ensure all PE gas pipes are certified to relevant standards and supplied with material test reports (MTRs).

– Traceability: Each pipe must be marked with manufacturer name, material designation (e.g., PE100, PE100-RC), standard, diameter, SDR (Standard Dimension Ratio), and production date.

1.3 Pressure and Safety Regulations

– Compliance with local gas safety regulations (e.g., U.S. DOT 49 CFR Part 192, UK Gas Safety (Installation and Use) Regulations).

– Only pressure-rated PE pipes suitable for natural gas or other specified gaseous fuels may be used.

- Transportation

2.1 Handling Precautions

– Use appropriate lifting equipment (e.g., cradles, slings) to avoid stress on pipe bundles.

– Never drag or drop pipes—use rollers or forklifts with protective attachments.

– Protect ends from damage to prevent intrusion of debris or moisture.

2.2 Vehicle Requirements

– Flatbed or enclosed trailers with side rails to prevent shifting.

– Secure loads with straps or chains; avoid over-tightening to prevent deformation.

– Protect from direct sunlight and extreme temperatures during transit.

2.3 Labeling and Documentation

– Clearly label shipments as “Gas Pipe – Polyethylene – Handle with Care.”

– Include shipping manifest, compliance certificates, and safety data sheets (SDS), if required.

- Storage

3.1 Environmental Conditions

– Store indoors or under UV-protective cover; avoid prolonged exposure to sunlight (UV degrades PE).

– Keep pipes away from heat sources, chemicals, and flammable materials.

– Ideal storage temperature: -20°C to +40°C.

3.2 Stacking and Placement

– Store pipes horizontally on flat, level surfaces with adequate support.

– Avoid stacking more than 1.5 meters (5 ft) high to prevent deformation.

– Use wooden pallets or racks to prevent ground contact and moisture absorption.

3.3 Segregation

– Separate by size, grade (e.g., PE80 vs. PE100), and SDR to prevent mix-ups.

– Keep fittings and valves in original packaging until use.

- On-Site Handling & Installation Compliance

4.1 Pre-Installation Inspection

– Inspect for cracks, dents, scratches, or UV degradation before installation.

– Reject damaged or non-compliant materials.

4.2 Joining Procedures

– Fusion welding (butt, socket, or electrofusion) must follow manufacturer and standard guidelines.

– Qualified personnel only—certification per EN 13067 or equivalent required.

– Record all jointing operations, including date, operator ID, and pressure/temperature data.

4.3 Pressure Testing & Commissioning

– Perform leak testing and pressure testing in accordance with local codes (e.g., hydrostatic or pneumatic test).

– Document all tests and obtain regulatory sign-off before commissioning.

- Environmental & Safety Compliance

5.1 Waste Management

– Recycle off-cuts and scrap PE where possible; follow local environmental regulations.

– Do not burn PE pipes—combustion releases hazardous fumes.

5.2 Worker Safety

– Provide PPE (gloves, eye protection, face shields) during handling and fusion.

– Train personnel on safe handling, emergency response, and gas system hazards.

-

Documentation & Traceability

-

Maintain full traceability from manufacturer to installation site (batch numbers, test results).

- Keep records of certifications, inspection reports, joint logs, and test results for audit purposes.

Conclusion

Adhering to logistics and compliance best practices ensures the integrity, safety, and longevity of PE gas pipe systems. Regular training, audits, and alignment with evolving standards are critical for sustained regulatory compliance and operational excellence.

In conclusion, sourcing polyethylene (PE) gas pipe requires a comprehensive evaluation of material quality, compliance with international standards (such as ISO 4437 and ASTM D2513), supplier reliability, and long-term performance considerations. High-density polyethylene (HDPE) pipes are preferred for gas distribution due to their excellent chemical resistance, flexibility, durability, and leak-free jointing through fusion welding. When selecting a supplier, factors such as certification, manufacturing consistency, technical support, and delivery capabilities are critical to ensuring project success and regulatory compliance. Additionally, life-cycle cost analysis—factoring in installation ease, maintenance, and service life—demonstrates that HDPE offers a cost-effective and sustainable solution for modern gas infrastructure. Therefore, a strategic sourcing approach that prioritizes quality, compliance, and supplier partnership is essential for safe and efficient gas pipeline systems.