The global synthetic fibers market, driven by rising demand for performance textiles in apparel, sportswear, and technical applications, is experiencing steady growth. According to a report by Grand View Research, the global synthetic fibers market was valued at USD 107.6 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. A significant portion of this growth is attributed to blends of polyamide (nylon) and elastane (spandex), which offer durability, stretch, and resilience—key attributes for activewear, swimwear, and intimate apparel. Mordor Intelligence projects that increasing consumer preference for functional and form-fitting garments, coupled with advancements in sustainable fiber production, will continue to drive demand for high-performance polyamide-elastane fabrics. As brands prioritize flexibility, comfort, and longevity in textile selection, a select group of manufacturers has emerged at the forefront of innovation, scalability, and quality. Here are the top 9 polyamide and elastane fabric manufacturers shaping the future of technical and fashion textiles.

Top 9 Polyamide And Elastane Fabric Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Fulgar S.p.A.

Domain Est. 1999

Website: fulgar.com

Key Highlights: Fulgar is a leading Italian yarn manufacturer producing polyamide 6.6 and covered yarns for textile and industrial applications. Find out more!…

#2 Hyosung TNC

Domain Est. 1999

Website: hyosungtextile.com

Key Highlights: Hyosung TNC is the world’s largest manufacturer of spandex supplying the broadest range of stretch … CREORATM Spandex/Elastane, Nylon and Polyester. View ……

#3 INVISTA

Domain Est. 1999

Website: invista.com

Key Highlights: INVISTA is a global manufacturer of ingredients in the nylon 6,6 and polypropylene value chains, helping bring many of life’s essential products to market….

#4 The LYCRA Company

Domain Est. 2018

Website: thelycracompany.com

Key Highlights: The LYCRA Company produces innovative fiber and technology solutions for the global textile, apparel, and personal care industries. Our products add comfort ……

#5 CORDURA®

Domain Est. 1997

Website: cordura.com

Key Highlights: As an INVISTA brand, CORDURA Advanced Fabrics utilize more than a dozen different technologies to deliver unmatched durability and reliability.Missing: polyamide elastane…

#6 Polyamide, high performance polymers, advanced textile solutions

Domain Est. 1997

Website: radicigroup.com

Key Highlights: RadiciGroup is a leading player in the production and sale of polyamide, chemical intermediates, high performance polymers, advanced textile solutions….

#7 LYCRA®

Domain Est. 1999 | Founded: 1958

Website: lycra.com

Key Highlights: Since 1958, LYCRA® brand spandex (elastane) fiber has transformed the global textile industry to meet your need for comfort, fit and movement….

#8 Brookwood® Companies

Domain Est. 2008

Website: brookwoodcompanies.com

Key Highlights: Brookwood@ is a vertically integrated textile company. We make and stock fabrics. Finishing and Laminating in USA. Fabric rolls sold online.Missing: polyamide elastane…

#9 Primeflex – SPORTS FABRICS

Website: sportstextiles.toray

Key Highlights: Bicomponent structured nylon fiber delivers high stretchability as well as smooth feel. This versatile fabric suits athletic wear to casual wear and even ……

Expert Sourcing Insights for Polyamide And Elastane Fabric

H2: 2026 Market Trends for Polyamide and Elastane Fabric

The global market for polyamide and elastane fabric is poised for significant evolution by 2026, driven by shifting consumer preferences, technological advancements, and sustainability imperatives. As a high-performance textile combination, polyamide (commonly known as nylon) and elastane (spandex or Lycra) are widely used in activewear, intimate apparel, swimwear, sportswear, and technical textiles due to their durability, elasticity, and moisture-wicking properties. The following key trends are expected to shape the market landscape in 2026:

-

Rising Demand in Activewear and Athleisure

The continued growth of the athleisure trend is a primary driver for polyamide-elastane fabric consumption. Consumers increasingly favor comfortable, functional, and stylish clothing for both fitness and everyday wear. By 2026, the global activewear market is projected to expand at a CAGR of over 6%, directly boosting demand for high-stretch, durable fabric blends. Brands are investing in innovative fabric technologies that enhance performance, such as improved breathability and UV protection, further increasing reliance on polyamide-elastane composites. -

Sustainability and Circular Economy Initiatives

Environmental concerns are reshaping production and sourcing strategies. By 2026, there will be a marked shift toward bio-based polyamides and recycled elastane. Major textile manufacturers—including Lycra Company and Aquafil—are advancing closed-loop recycling systems and developing eco-friendly alternatives like ECONYL® (regenerated nylon). Consumers and regulatory bodies are pushing for transparency in supply chains, leading to increased adoption of certified sustainable fabrics and digital product passports. -

Technological Innovations in Fabric Performance

Innovation in fiber engineering is enhancing the functionality of polyamide-elastane blends. Developments such as antimicrobial treatments, temperature regulation, and improved recovery after stretching are making these fabrics more desirable. Smart textiles incorporating sensors or phase-change materials may begin to enter niche markets by 2026, particularly in premium sportswear and healthcare applications. -

Regional Manufacturing Shifts and Supply Chain Resilience

Geopolitical factors and post-pandemic supply chain recalibrations are prompting brands to diversify sourcing. While Asia remains a dominant producer—particularly China, India, and Vietnam—nearshoring trends in Turkey, Eastern Europe, and the Americas are gaining traction. This shift supports faster time-to-market and reduces logistics-related carbon emissions, aligning with sustainability goals. -

Regulatory Pressures and Chemical Management

Stricter regulations on microplastic shedding and chemical usage (e.g., REACH in the EU, ZDHC in global supply chains) will influence fabric development. By 2026, manufacturers will need to ensure compliance with restrictions on hazardous substances and demonstrate responsible end-of-life management for synthetic textiles. Innovations in biodegradable elastane and fabric coatings that reduce microfiber release are expected to gain momentum. -

Growth in E-Commerce and Direct-to-Consumer Models

The expansion of online retail continues to impact fabric demand patterns. Fast fashion and DTC brands rely on agile production of polyamide-elastane blends to meet rapidly changing trends. By 2026, data-driven design and on-demand manufacturing could reduce overproduction and waste, while increasing customization options for consumers.

In conclusion, the 2026 market for polyamide and elastane fabric will be defined by a balance between performance innovation and environmental responsibility. Companies that invest in sustainable sourcing, circular technologies, and digital integration are likely to gain a competitive edge in this dynamic and evolving sector.

Common Pitfalls When Sourcing Polyamide and Elastane Fabric: Quality and Intellectual Property Concerns

Logistics & Compliance Guide for Polyamide and Elastane Fabric

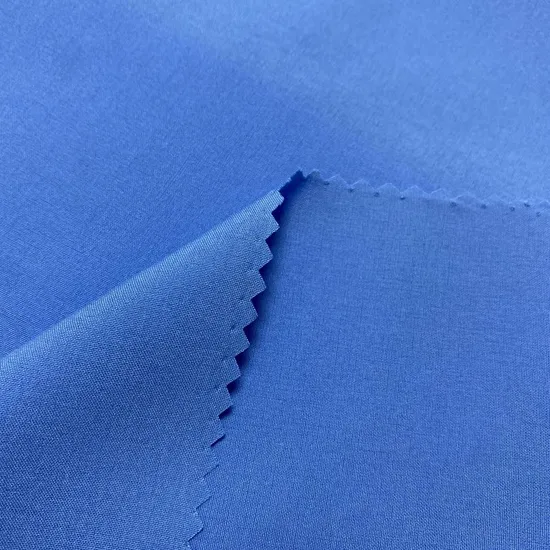

Overview of Polyamide and Elastane Fabric

Polyamide (commonly known as nylon) and elastane (also known as spandex or Lycra®) are synthetic fibers widely used in textiles for their strength, durability, and elasticity. Fabrics blending these materials are commonly used in sportswear, swimwear, lingerie, and performance apparel. Due to their chemical composition and production processes, specific logistics and compliance considerations must be addressed when importing, exporting, or distributing these fabrics globally.

International Trade Regulations

Classification Under HS Codes

Polyamide and elastane fabrics are classified under the Harmonized System (HS) for international trade. Common HS codes include:

– 5407.42: Woven fabrics of synthetic filament yarn, of nylon or other polyamides, elastic yarn included.

– 5516.41: Woven fabrics of artificial staple fibers, containing elastomeric yarn (e.g., spandex).

– 6006.31: Knitted or crocheted fabrics containing elastomeric yarn.

Accurate classification is critical for determining duty rates, import quotas, and regulatory compliance. Misclassification can lead to customs delays, fines, or shipment rejection.

Import and Export Documentation

Required documentation typically includes:

– Commercial invoice

– Packing list

– Bill of lading or air waybill

– Certificate of origin (especially if claiming preferential tariffs under trade agreements)

– Textile declaration (specifying fiber content)

Some countries may require additional documentation, such as a conformity certificate or import license.

Chemical and Safety Compliance

REACH (EU Regulation)

Under the EU’s Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH), manufacturers and importers must ensure that polyamide and elastane fabrics do not contain restricted or hazardous substances above permissible levels. Key concerns include:

– Restricted substances: Certain phthalates, azo dyes, and heavy metals (e.g., cadmium, lead).

– Substances of Very High Concern (SVHC): Regularly updated list; suppliers must notify if SVHCs exceed 0.1% weight by weight.

Compliance requires supply chain transparency and chemical testing.

OEKO-TEX® Standard 100

While voluntary, OEKO-TEX® certification is widely recognized and indicates that the fabric has been tested for harmful substances. Many brands require fabrics to meet Class II (products with skin contact) or Class I (baby articles) standards.

U.S. Consumer Product Safety Improvement Act (CPSIA)

For products entering the U.S., especially children’s apparel, compliance with CPSIA is mandatory. This includes limits on lead content and phthalates in accessible parts.

Environmental and Sustainability Standards

EU Ecodesign Regulation for Sustainable Products (ESP)

Upcoming regulations will require textiles to meet durability, recyclability, and recycled content standards. Polyamide and elastane blends pose challenges due to difficulty in recycling, so long-term compliance strategies may include using bio-based polyamides or mechanical recycling systems.

ZDHC (Zero Discharge of Hazardous Chemicals)

Apparel brands increasingly require suppliers to comply with ZDHC’s Manufacturing Restricted Substances List (MRSL), which governs chemical inputs in textile production. Factories producing polyamide and elastane fabrics should implement ZDHC-conformant wastewater treatment and chemical management systems.

Labeling and Fiber Content Requirements

Textile Fiber Products Identification Act (U.S.)

The U.S. Federal Trade Commission (FTC) requires accurate labeling of fiber content. For blends:

– Polyamide and elastane content must be listed in descending order by weight.

– Generic names (e.g., “nylon” or “spandex”) must be used.

– Labels must be durable and permanent.

EU Textile Regulation (EU) No 1007/2011

Mandates precise labeling of fiber composition using legally defined names (e.g., “polyamide” not “nylon”). Labels must be:

– Clear, legible, and accessible.

– Present in all languages of the destination country.

– Accompanied by care instructions in certain member states.

Logistics and Handling

Packaging and Storage

- Fabrics should be packed in moisture-resistant, UV-protected materials to prevent degradation.

- Rolls should be stored vertically to avoid deformation.

- Climate-controlled environments are recommended to prevent static buildup and fiber damage.

Transportation

- Sea freight is most common for bulk shipments; ensure containers are dry and well-ventilated.

- Air freight may be used for time-sensitive orders but increases costs.

- Use anti-static packaging where applicable to reduce fiber cling and production issues.

Customs Clearance Delays

Common causes include:

– Incomplete or incorrect documentation.

– Missing chemical compliance certificates.

– Discrepancies in declared vs. actual fiber content.

Proactive verification of documents and pre-shipment audits can reduce delays.

Country-Specific Requirements

United States

- Customs and Border Protection (CBP) may inspect shipments for fiber content accuracy.

- Customs often verifies country of origin claims, especially if duty preferences are claimed.

European Union

- Importers must comply with EU customs regulations and provide a Customs Representative if outside the EU.

- EU market surveillance authorities may conduct random checks on chemical compliance.

China

- China Compulsory Certification (CCC) does not typically apply to raw fabrics, but fiber content and labeling must conform to GB standards.

- Exporters must provide detailed technical specifications.

Recommendations for Compliance

- Engage certified testing laboratories for REACH, CPSIA, and OEKO-TEX® verification.

- Maintain full traceability of raw materials and chemical inputs.

- Train staff on international labeling and documentation requirements.

- Work with customs brokers experienced in textile imports/exports.

- Monitor regulatory updates from EU, U.S. EPA, and other regional authorities.

Conclusion

Polyamide and elastane fabrics offer excellent performance characteristics but require careful management of chemical, labeling, and customs compliance across international markets. A proactive approach to documentation, testing, and supply chain transparency will ensure smooth logistics and regulatory adherence.

Conclusion for Sourcing Polyamide and Elastane Fabric:

Sourcing polyamide (nylon) and elastane (spandex/Lycra) fabric requires a strategic approach that balances quality, cost, sustainability, and supply chain reliability. These high-performance synthetic fibers are essential for applications requiring durability, stretch, and resilience—common in activewear, swimwear, lingerie, and sportswear. When sourcing, it is crucial to partner with reputable suppliers who adhere to consistent quality standards, offer certification for eco-friendly production (such as bluesign® or Oeko-Tex), and provide transparency in their manufacturing processes.

Key considerations include evaluating the fabric’s denier, stretch recovery, dyeing capabilities, and environmental impact, especially as the industry shifts toward sustainable practices. Blending polyamide with elastane enhances comfort and fit, but optimal performance depends on precise fiber ratios and textile construction. Additionally, monitoring global market trends, regional production capabilities (e.g., in China, Italy, or Turkey), and logistics costs ensures supply chain efficiency and timely delivery.

In conclusion, successful sourcing of polyamide and elastane fabric hinges on building strong supplier relationships, prioritizing sustainability without compromising performance, and staying informed about technological advancements in textile innovation. A well-structured sourcing strategy will support product quality, brand integrity, and long-term competitiveness in the global apparel market.