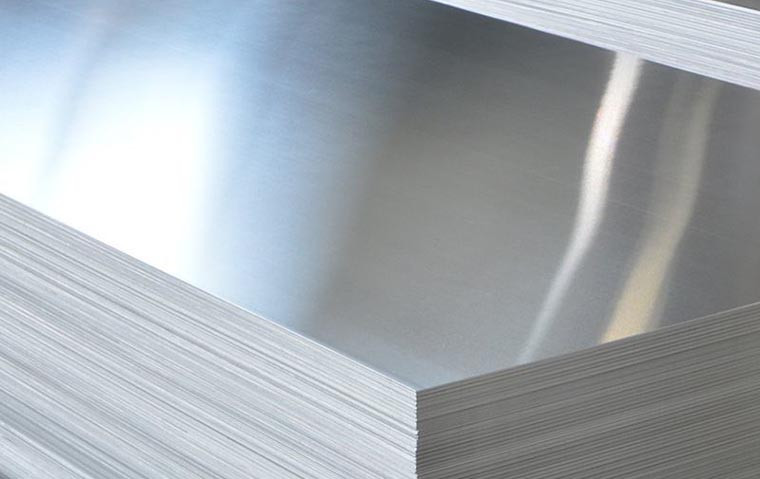

The global aluminum sheets market is experiencing robust expansion, driven by rising demand across aerospace, automotive, and architectural sectors. According to Mordor Intelligence, the aluminum sheets market was valued at USD 54.3 billion in 2023 and is projected to grow at a CAGR of over 5.2% from 2024 to 2029. A significant contributor to this growth is the increasing preference for polished aluminum sheets, which offer enhanced aesthetic appeal, superior corrosion resistance, and excellent reflectivity. Lightweight and recyclable, these sheets are increasingly specified in high-performance and design-critical applications. With global production shifting toward high-quality, value-added products, manufacturers specializing in polished aluminum sheets are gaining strategic importance. This report identifies the top nine manufacturers leading innovation, scalability, and precision in the polished aluminum sheet segment, based on production capacity, geographic reach, technological capabilities, and market reputation.

Top 9 Polished Aluminum Sheet Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 TW Metals: Specialty Metals Suppliers

Domain Est. 1997

Website: twmetals.com

Key Highlights: TW Metals stocks and processes Tube, Pipe, Bar, Extrusions, Sheet, and Plate in stainless, aluminum, nickel, titanium, and carbon alloy….

#2 Industrial Metal Supply Co.

Domain Est. 1999

Website: industrialmetalsupply.com

Key Highlights: Our premium aluminum sheet and plate products are available in several alloys, including 6061, 5052, and 3003, to meet your exact project specifications….

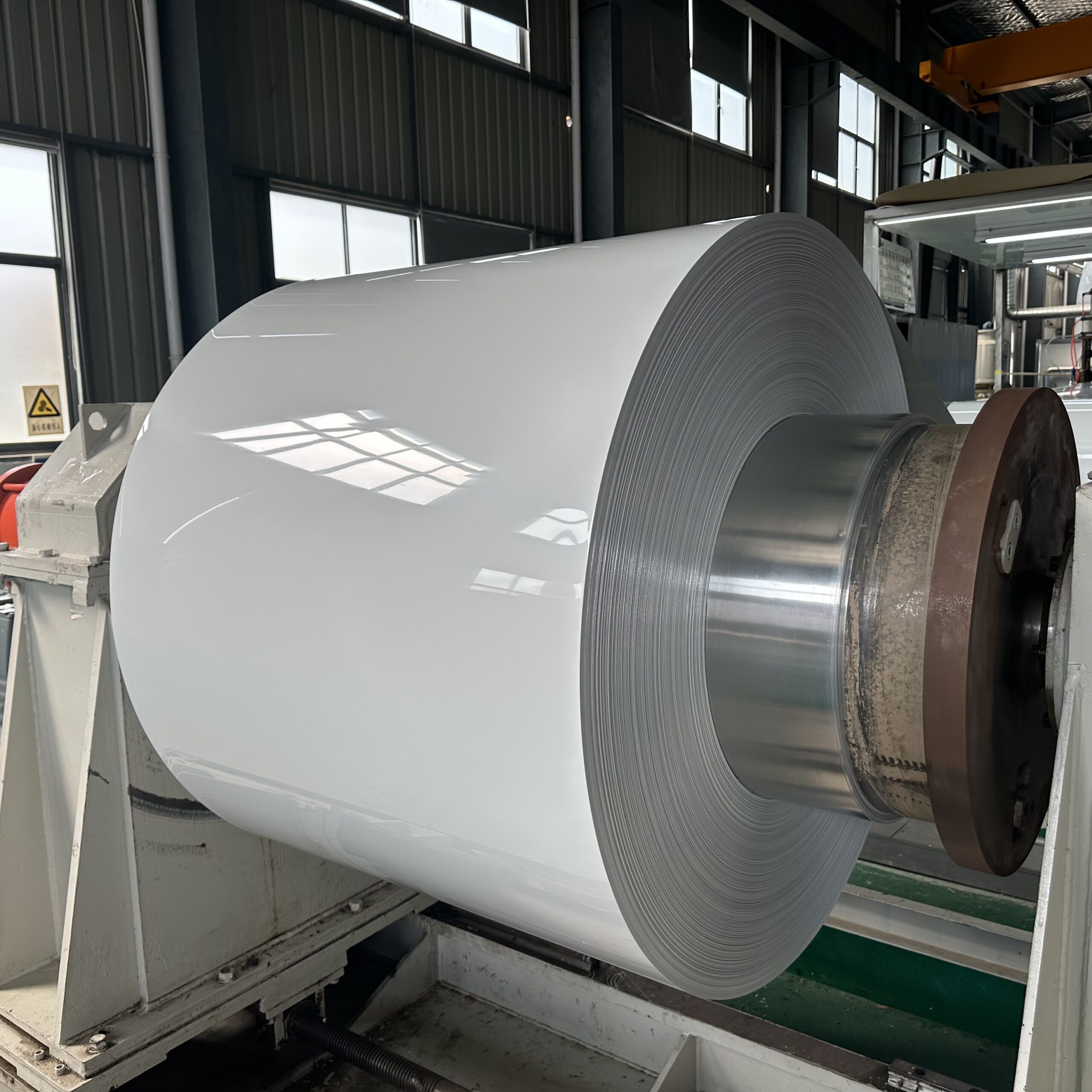

#3 Polished aluminum mirror sheet

Domain Est. 2012

Website: polishing-aluminum-sheet.com

Key Highlights: Haomei Aluminum is located in famous aluminum capital of Zhengzhou, Henan province. We are professional manufacturer of Polished Aluminum sheet for many ……

#4 Industrial Polished Aluminum Sheet & Plate & Circles

Domain Est. 2017

Website: hdmetalm.com

Key Highlights: HDM specializes in premium commercial-grade polished aluminum finishes for rolled materials—sheets, plates, circles, and checker plates….

#5 Polished Aluminum

Domain Est. 1994

Website: mcmaster.com

Key Highlights: Choose from our selection of polished aluminum, including over 6100 products in a wide range of styles and sizes. Same and Next Day Delivery….

#6 Polished Aluminum Finishes

Domain Est. 1998

Website: polishedmetals.com

Key Highlights: Polished aluminum finishes are most often used for exterior building panels, roof systems, and storefronts. Learn more about our offerings….

#7 Polished Aluminum Sheet

Domain Est. 2009

Website: cnchangsong.com

Key Highlights: Polished aluminum sheet features a sleek, mirror-like surface with high reflectivity, showcasing a bright silver hue. Lightweight yet durable….

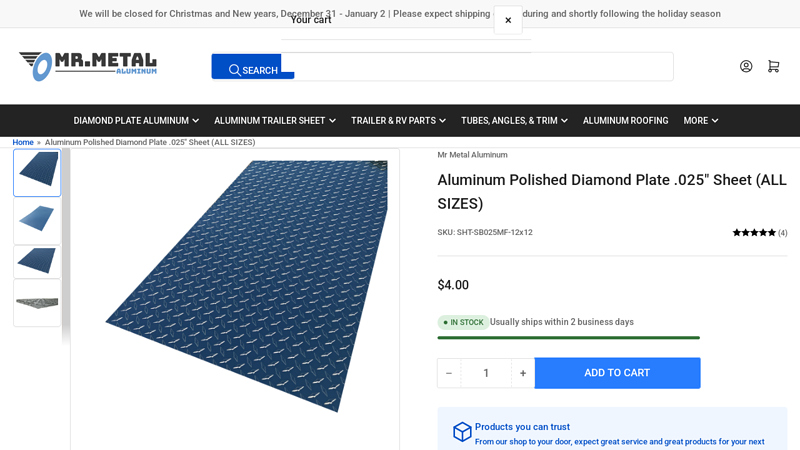

#8 Aluminum Polished Diamond Plate .025″ Sheet (ALL SIZES)

Domain Est. 2021

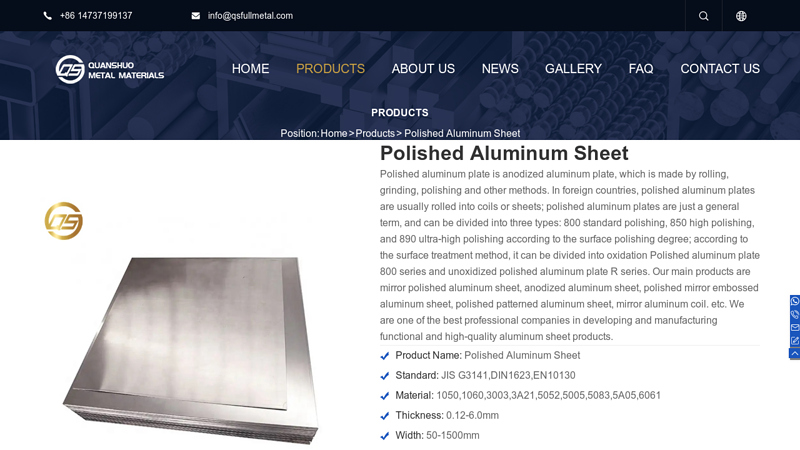

#9 Polished Aluminum Sheet

Domain Est. 2023

Website: qsfullmetal.com

Key Highlights: Our main products are mirror polished aluminum sheet, anodized aluminum sheet, polished mirror embossed aluminum sheet, polished patterned aluminum sheet, ……

Expert Sourcing Insights for Polished Aluminum Sheet

H2: 2026 Market Trends for Polished Aluminum Sheet

The global market for polished aluminum sheet is poised for steady growth and transformation by 2026, driven by evolving end-user demands, technological advancements, and sustainability imperatives. Key trends shaping the market include:

1. Accelerated Demand from Lightweighting in Transportation: The automotive and aerospace sectors will remain dominant drivers. Stringent global fuel efficiency and emissions regulations (e.g., CAFE standards, EU fleet targets) will intensify the push for vehicle lightweighting. Polished aluminum sheets, offering a high strength-to-weight ratio, excellent formability, and superior aesthetics, will see increased adoption in structural components, body panels, trim, and interior applications, particularly in electric vehicles (EVs) where weight reduction directly extends battery range.

2. Surge in Architectural and Design Applications: The construction sector will witness significant growth, fueled by the demand for modern, sustainable, and low-maintenance building facades, curtain walls, and interior design elements. Polished aluminum’s reflective properties, durability, recyclability, and ability to create striking visual effects align perfectly with green building certifications (LEED, BREEAM) and contemporary architectural trends emphasizing light, space, and energy efficiency (reflective surfaces reducing cooling loads).

3. Expansion in Consumer Electronics and High-End Appliances: Demand will grow for premium finishes in consumer goods. Polished aluminum’s sleek, modern, and premium aesthetic makes it ideal for smartphone casings, laptops, tablets, high-end kitchen appliances (refrigerators, ovens), and luxury electronics. Manufacturers will leverage its scratch resistance (with protective coatings) and thermal conductivity properties.

4. Sustainability and Circularity as Core Market Drivers: Environmental regulations and corporate sustainability goals will profoundly impact the market. Key trends include:

* Increased Use of Recycled Content: Pressure to reduce carbon footprint will drive demand for polished sheets made with higher percentages of recycled aluminum (secondary aluminum), significantly lowering embodied energy compared to primary production.

* Focus on End-of-Life Recycling: The inherent recyclability of aluminum (infinite without quality loss) will be a major selling point. Closed-loop recycling systems within industries like automotive will become more prevalent.

* Transparency in Supply Chain: Buyers will demand greater transparency regarding the sourcing of raw materials and energy consumption in production.

5. Technological Advancements in Finishing and Processing:

* Improved Surface Quality and Consistency: Advancements in rolling, grinding, and polishing technologies will deliver consistently higher surface finishes (e.g., enhanced mirror finishes) with fewer defects, meeting exacting standards for premium applications.

* Advanced Protective Coatings: Development and application of more durable, scratch-resistant, and self-healing clear coats (e.g., advanced anodizing, specialized lacquers) will be crucial to protect the polished surface during fabrication, transportation, and in-service, especially in harsh environments.

* Digitalization and Automation: Increased adoption of automation in polishing lines and process control will improve efficiency, consistency, yield, and reduce labor costs.

6. Geopolitical and Supply Chain Dynamics: Market growth will be influenced by regional factors:

* Asia-Pacific Dominance: China, India, Japan, and Southeast Asia will remain the largest production and consumption hubs, driven by massive infrastructure projects, booming automotive/EV markets, and electronics manufacturing.

* Supply Chain Resilience: Companies will focus on diversifying sourcing and nearshoring/reshoring to mitigate risks from geopolitical tensions and logistical disruptions, potentially boosting regional production capacity in North America and Europe.

* Raw Material Price Volatility: Fluctuations in bauxite/alumina prices and energy costs (critical for smelting) will continue to impact production costs and pricing strategies.

7. Niche Applications and Innovation: Exploration into new uses will continue, such as in solar reflectors for concentrated solar power (CSP), specialized lighting fixtures, high-end furniture, and artistic installations, where the unique optical properties of polished surfaces are paramount.

In conclusion, the 2026 polished aluminum sheet market will be characterized by robust demand from core sectors like transportation and construction, propelled by lightweighting and sustainability mandates. Success will depend on manufacturers’ ability to deliver high-quality, consistent finishes, integrate recycled content, implement advanced protective technologies, ensure supply chain resilience, and meet the growing demand for environmentally responsible products.

Common Pitfalls Sourcing Polished Aluminum Sheet (Quality, IP)

Sourcing polished aluminum sheet involves navigating several critical quality and intellectual property (IP) challenges. Overlooking these pitfalls can lead to product defects, project delays, legal disputes, or reputational damage. Here are the most common issues to avoid:

Inadequate Surface Quality Specifications

Buyers often fail to define precise surface finish requirements, leading to inconsistent or substandard deliveries. Polished aluminum is graded by finish type (e.g., #4, #6, #8), Ra (roughness average) values, reflectivity, and absence of defects like scratches, pits, or orange peel. Without clear specifications in procurement documents, suppliers may deliver sheets that visually appear polished but do not meet functional or aesthetic needs.

Lack of Consistent Batch-to-Batch Uniformity

Polished aluminum sheets, particularly mirror finishes (#8), can vary significantly between production batches due to differences in polishing techniques, equipment calibration, or operator skill. Relying on visual inspection alone without standardized quality control protocols increases the risk of receiving non-uniform material, especially in large or repeat orders.

Misunderstanding Alloy and Temper Suitability

Not all aluminum alloys are ideal for high-polish finishes. While 5052, 6061, and 3003 are commonly used, their machinability and polishability differ. Selecting an inappropriate alloy or temper (e.g., overly soft or hard) can result in surface imperfections, poor reflectivity, or reduced durability. Buyers must match alloy properties to the application’s mechanical and aesthetic demands.

Overlooking Protective Coatings and Handling Damage

Polished aluminum is highly susceptible to scratches, fingerprints, and oxidation during transit and handling. Suppliers may skimp on protective films or packaging, or use low-quality peelable coatings that leave residue. Failing to specify protective requirements can result in surface degradation before the material reaches the production floor.

Ignoring Intellectual Property (IP) in Finish Processes

Some specialized polishing techniques—such as proprietary buffing sequences, chemical treatments, or hybrid mechanical-chemical processes—may be protected by patents or trade secrets. Sourcing from suppliers using such IP without proper licensing or due diligence exposes buyers to infringement risks, especially in regulated industries or export markets.

Supplier Certification and Traceability Gaps

Reputable suppliers provide material test reports (MTRs), alloy certification (e.g., mill test certificates), and traceability documentation. Sourcing from uncertified or unqualified vendors increases the risk of receiving counterfeit, mislabeled, or substandard material. Lack of traceability also complicates quality investigations and compliance audits.

Insufficient On-Site or Pre-Shipment Inspections

Relying solely on supplier claims without third-party or in-person inspections can miss hidden defects. Conducting pre-shipment inspections using standardized checklists—covering surface quality, dimensions, flatness, and protective layers—is essential to verify compliance before accepting delivery.

Avoiding these pitfalls requires clear technical specifications, supplier vetting, robust quality agreements, and attention to both material standards and IP considerations.

Logistics & Compliance Guide for Polished Aluminum Sheet

Overview

Polished aluminum sheets are widely used in architectural, automotive, aerospace, and consumer goods industries due to their aesthetic appeal, corrosion resistance, and lightweight properties. Proper logistics planning and regulatory compliance are essential to ensure safe, efficient, and legal transportation and handling of these materials across domestic and international supply chains.

Packaging and Handling Requirements

Polished aluminum sheets are highly susceptible to surface damage, oxidation, and contamination. Appropriate packaging and handling procedures are critical to maintaining product quality.

– Surface Protection: Use protective films, paper interleaving, or plastic wraps to prevent scratching, marring, and chemical exposure.

– Palletization: Secure sheets on wooden or plastic pallets using edge protectors and strapping. Ensure even weight distribution to avoid deformation.

– Stacking Limits: Adhere to manufacturer-recommended stack heights to prevent bottom sheet damage.

– Handling Equipment: Use non-abrasive slings, vacuum lifters, or padded forklift attachments to avoid surface contact with metal parts.

– Environmental Controls: Store and transport in dry, climate-controlled environments to prevent moisture-related oxidation or staining.

Transportation Modes and Considerations

The choice of transport mode depends on volume, distance, destination, and delivery timelines.

– Trucking (Domestic): Ideal for regional distribution. Use enclosed trailers to protect against weather and debris. Ensure proper load securing per FMCSA regulations.

– Rail: Cost-effective for large-volume shipments over long distances. Requires compatible loading/unloading infrastructure.

– Maritime (International): Most common for cross-border trade. Use dry containers with desiccants to control humidity. Secure cargo to prevent shifting during transit.

– Air Freight: Reserved for urgent, high-value shipments due to cost. Limited by weight and dimensional constraints.

– Incoterms: Clearly define responsibilities (e.g., FOB, CIF, DDP) in contracts to allocate risks and costs between buyer and seller.

Regulatory Compliance

Adherence to international, national, and regional regulations is mandatory to avoid delays, fines, or shipment rejection.

– Customs Documentation: Provide accurate commercial invoices, packing lists, and bills of lading. Include detailed product descriptions, HS codes, and country of origin.

– HS Code Classification: Polished aluminum sheets typically fall under 7606.12.xx (flat-rolled products of aluminum, of thickness > 0.2 mm, not coated or plated). Confirm exact subheading based on thickness and alloy composition.

– Export Controls: Check for dual-use or strategic trade restrictions (e.g., EAR in the U.S.). Most polished aluminum sheets are not controlled, but verification is essential for military or aerospace grades.

– REACH & RoHS (EU): Ensure compliance with chemical substance regulations. Aluminum itself is exempt, but verify coatings or surface treatments for restricted substances.

– TSCA (U.S.): Confirm compliance with Toxic Substances Control Act, particularly for imported materials.

– Country-Specific Standards: Some markets require certifications (e.g., CE marking in Europe, INMETRO in Brazil). Verify local requirements prior to shipment.

Safety and Hazard Regulations

Polished aluminum sheets are generally non-hazardous but must be handled in accordance with safety standards.

– GHS/SDS: While not classified as hazardous, maintain Safety Data Sheets (SDS) per OSHA HazCom standards for workplace safety.

– Fire Safety: Aluminum is non-combustible but can react exothermically when powdered or in fine shavings. Avoid accumulation of machining debris during processing.

– Load Safety: Comply with DOT (U.S.) or ADR (Europe) load securement rules to prevent accidents during transit.

Import and Duty Considerations

Import duties and trade policies can significantly impact landed costs.

– Tariff Rates: Vary by destination country. Check current rates via official customs databases (e.g., USITC, EU TARIC).

– Trade Agreements: Leverage preferential tariffs under agreements like USMCA, CETA, or RCEP if applicable. Provide valid Certificates of Origin.

– Anti-Dumping/Countervailing Duties: Monitor for ongoing investigations or measures on aluminum products from specific countries (e.g., China, Russia).

– Customs Valuation: Declare accurate transaction values. Support with invoices and related-party agreements if required.

Environmental and Sustainability Compliance

Increasing regulatory and customer focus on sustainability requires due diligence.

– Recyclability: Highlight aluminum’s high recyclability (up to 95% energy savings) in marketing and reporting.

– Carbon Footprint: Track and report emissions across the supply chain, especially for ESG reporting or carbon border adjustments (e.g., EU CBAM).

– Waste Management: Ensure proper disposal of packaging materials in compliance with local environmental laws.

Best Practices for Supply Chain Efficiency

- Supplier Qualification: Audit suppliers for compliance with ISO 9001, ISO 14001, and responsible sourcing standards.

- Traceability: Implement lot tracking to manage quality issues and recalls.

- Insurance: Secure cargo insurance covering damage, theft, and delay. Specify coverage for cosmetic defects.

- Technology Integration: Use RFID or barcode systems for real-time inventory and shipment tracking.

Conclusion

Effective logistics and compliance management for polished aluminum sheets involves coordinated efforts across packaging, transportation, regulatory adherence, and sustainability. By following this guide, businesses can minimize risks, reduce costs, and ensure timely delivery of high-quality products to global markets. Regular updates on trade policies and continuous improvement in supply chain practices are recommended to maintain compliance and competitiveness.

In conclusion, sourcing polished aluminum sheets requires careful consideration of several key factors to ensure quality, cost-effectiveness, and timely delivery. It is essential to evaluate suppliers based on their material specifications, finishing processes, certifications, and reputation in the industry. Factors such as alloy type (e.g., 5052, 6061), temper, thickness tolerance, and surface finish quality play a significant role in meeting project requirements. Additionally, comparing pricing, minimum order quantities, lead times, and logistical capabilities helps in selecting the most reliable and efficient supplier.

Establishing strong communication with potential suppliers and requesting samples prior to bulk ordering can prevent discrepancies and ensure consistency in the final product. Whether sourcing locally or internationally, due diligence in vetting suppliers and understanding market trends contributes to a successful procurement strategy. Ultimately, a well-informed sourcing decision supports superior performance and aesthetics in applications ranging from architectural design to industrial manufacturing.