The global automotive jack market is experiencing steady growth, driven by increasing vehicle production, rising demand for aftermarket tools, and a growing emphasis on vehicle safety and maintenance. According to a report by Mordor Intelligence, the automotive lifting equipment market—including pole jacks—is projected to grow at a CAGR of over 4.5% from 2023 to 2028. Additionally, Grand View Research estimates that the global car care products and equipment market, which encompasses vehicle lifting and support tools, was valued at over USD 7.5 billion in 2022 and is expected to expand significantly through 2030 due to increasing DIY automotive maintenance trends and the proliferation of electric vehicles requiring specialized service equipment. Amid this growth, pole jacks remain a critical component in both professional repair shops and home garages, prized for their durability, lifting capacity, and compact design. The following list highlights the top 9 pole jack manufacturers shaping the industry through innovation, reliability, and market reach.

Top 9 Pole Jack Automotive Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

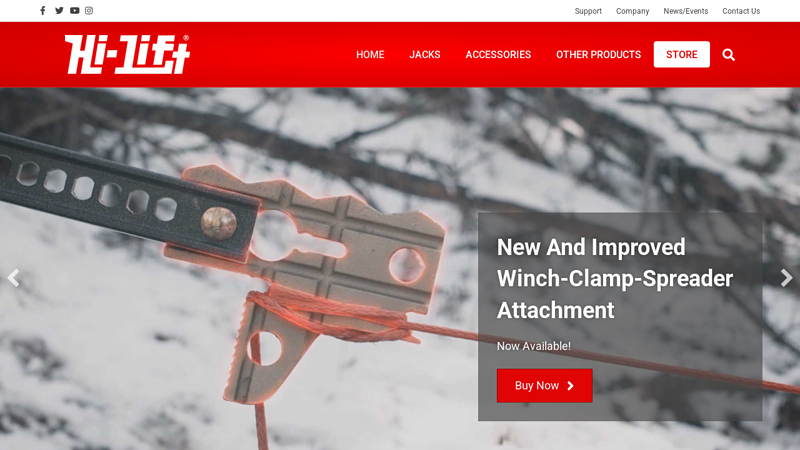

#1 Hi-Lift® Jack Co.

Domain Est. 1996

Website: hi-lift.com

Key Highlights: Manufacturer of “The Original Power Tool” Hi-Lift® Jack along with accessories and other recovery related equipment designed for off-road, farm, and rescue….

#2 4-Post Car Lifts

Domain Est. 1997

Website: bendpak.com

Key Highlights: Free deliveryBendPak four-post lifts use the best construction, material and technology. They also has the best safety features in the industry….

#3 Roush Performance

Domain Est. 2001

Website: roushperformance.com

Key Highlights: Roush Performance manufactures pre-titled vehicles and performance parts for enthusiasts worldwide—engineered for performance, precision, and style….

#4 Custom Hydraulic Jack & Lifting System Manufacturer in USA

Domain Est. 2020

Website: stillwellinc.com

Key Highlights: Discover Stillwell’s superior custom hydraulic lifting systems, tailored to your needs with optimal performance and reliability. Talk to an expert today….

#5 Enerpac

Domain Est. 1995

Website: enerpac.com

Key Highlights: We offer a wide selection of high-quality hydraulic equipment tailored to the specific needs of wind energy professionals….

#6 Pro Eagle Off Road Jacks

Domain Est. 1999

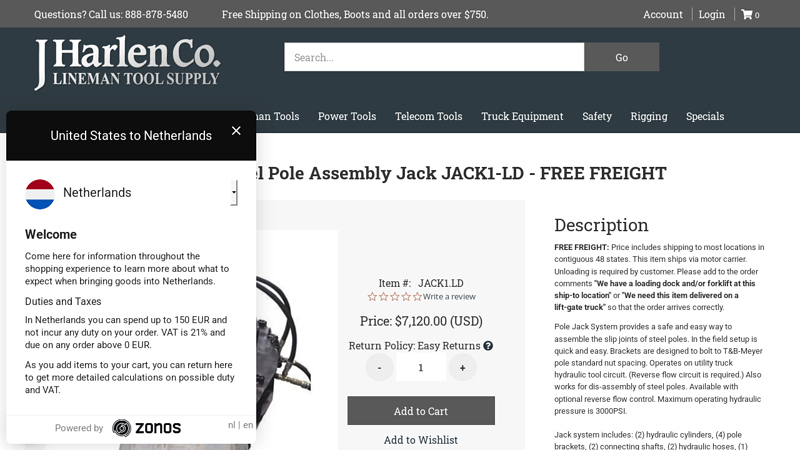

#7 Hydraulic Steel Pole Assembly Jack JACK1

Domain Est. 2000

Website: jharlen.com

Key Highlights: In stock Free deliveryPole Jack System provides a safe and easy way to assemble the slip joints of steel poles. In the field setup is quick and easy….

#8 Two-Post Car Lifts

Domain Est. 2009

Website: rotarysolutions.com

Key Highlights: Engineered for speed and reliability, Rotary 2-post car lifts help you service more customers daily with the world’s fastest lifting….

#9 Jacks

Domain Est. 2014

Website: amio.pl

Key Highlights: Our hydraulic pole lift is a reliable and robust tool, ideal for lifting vehicles, machinery and other loads….

Expert Sourcing Insights for Pole Jack Automotive

H2: 2026 Market Trends Forecast for Pole Jack Automotive

As we approach 2026, Pole Jack Automotive is positioned at a pivotal juncture shaped by evolving technological, regulatory, and consumer-driven market dynamics. The automotive industry is undergoing a transformative phase, and Pole Jack Automotive must align its strategy with key macroeconomic and sector-specific trends to maintain competitiveness and drive sustainable growth.

1. Electrification and Sustainable Mobility

By 2026, the global shift toward electric vehicles (EVs) will accelerate, driven by stricter emissions regulations in Europe, North America, and China. Pole Jack Automotive is expected to face increasing pressure to expand its portfolio of electric and hybrid models. Market analysts project that EVs will represent over 35% of new car sales globally by 2026, creating both opportunity and risk. Companies that fail to invest in battery technology, charging infrastructure partnerships, and sustainable supply chains may lose market share to more agile competitors.

For Pole Jack, this trend suggests a strategic imperative to:

– Launch at least two new EV platforms by 2026.

– Invest in battery R&D or secure long-term supply agreements with battery manufacturers.

– Develop a circular economy approach for battery recycling and end-of-life vehicle management.

2. Digitalization and Connected Vehicles

The integration of advanced connectivity, over-the-air (OTA) software updates, and AI-powered driver assistance systems is becoming standard. By 2026, consumers will expect seamless digital experiences comparable to smartphones. Pole Jack Automotive must enhance its infotainment systems, vehicle-to-everything (V2X) communication, and fleet telematics to remain competitive.

Key actions include:

– Partnering with tech firms to improve software capabilities.

– Building a robust data analytics platform to personalize customer experiences and optimize maintenance.

– Ensuring cybersecurity resilience across all connected vehicle systems.

3. Supply Chain Resilience and Localization

Geopolitical tensions and past disruptions have highlighted vulnerabilities in global supply chains. By 2026, automotive manufacturers are expected to adopt more regionalized production models, with nearshoring or onshoring of critical components such as semiconductors and battery cells.

Pole Jack should consider:

– Diversifying supplier networks and increasing inventory buffers for high-risk components.

– Establishing regional manufacturing hubs closer to key markets (e.g., North America, EU, Southeast Asia).

– Leveraging AI-driven demand forecasting to improve supply chain agility.

4. Shifting Consumer Preferences

Consumers in 2026 will prioritize sustainability, affordability, and digital convenience. While premium EVs will attract early adopters, there will be growing demand for affordable, reliable electrified vehicles—particularly in emerging markets. Subscription-based ownership, vehicle sharing, and mobility-as-a-service (MaaS) will continue to gain traction, especially among younger demographics.

Pole Jack can respond by:

– Introducing a competitive entry-level EV model by 2026.

– Exploring flexible ownership models, such as leasing or subscription plans.

– Enhancing direct-to-consumer (DTC) sales channels and digital showrooms.

5. Regulatory and Policy Landscape

Governments worldwide will enforce tougher emissions standards and introduce carbon pricing mechanisms by 2026. The European Union’s Euro 7 standards, U.S. Clean Air Act amendments, and China’s dual-credit policy will directly impact Pole Jack’s product planning and compliance costs.

Recommendations:

– Proactively engage with regulators to shape policy outcomes.

– Accelerate the phase-out of internal combustion engine (ICE) models in key markets.

– Invest in carbon offset programs and green manufacturing certifications.

Conclusion

The 2026 market landscape for Pole Jack Automotive will be defined by rapid technological change, sustainability imperatives, and evolving customer expectations. Success will depend on the company’s ability to innovate, adapt supply chains, and deliver value through smart, eco-conscious mobility solutions. Strategic investments in electrification, digital transformation, and customer-centric services will be critical to securing long-term market relevance and profitability.

Common Pitfalls Sourcing Pole Jack Automotive (Quality, IP)

Sourcing automotive components like pole jacks from manufacturers, particularly in competitive markets such as China, involves significant risks if not managed carefully. Two critical areas where companies often encounter problems are quality assurance and intellectual property (IP) protection. Overlooking these aspects can lead to production delays, safety issues, financial losses, and legal disputes.

Quality Inconsistencies and Lack of Oversight

One of the most frequent challenges in sourcing pole jacks is maintaining consistent product quality. Initial samples may meet specifications, but mass production units often exhibit deviations due to:

- Inadequate Quality Control Processes: Suppliers may lack standardized inspection protocols or fail to implement statistical process control (SPC), leading to variability in dimensions, material strength, and welding integrity.

- Use of Substandard Materials: To cut costs, some manufacturers substitute specified high-tensile steel or reinforced alloys with lower-grade alternatives that compromise the jack’s load-bearing capacity and durability.

- Poor Workmanship: Issues such as uneven welds, misaligned components, or improper surface treatment (e.g., insufficient rust protection) can reduce reliability and pose safety hazards.

- Insufficient Testing: Many suppliers do not perform rigorous load testing, fatigue testing, or compliance checks against automotive safety standards (e.g., ISO 3188), increasing the risk of field failures.

Without on-site audits, third-party inspections, and clearly defined quality benchmarks in contracts, buyers may receive batches that fail to meet automotive-grade requirements.

Intellectual Property (IP) Risks and Unauthorized Use

Sourcing pole jacks—especially custom-designed units—exposes companies to significant IP vulnerabilities:

- Design Replication and Reverse Engineering: Suppliers may copy proprietary designs, molds, or technical specifications and sell them to competitors or produce counterfeit versions under different brands.

- Weak Contractual Protections: Agreements that lack explicit clauses on IP ownership, confidentiality, and non-compete terms leave buyers with little recourse if their designs are misused.

- Lack of Legal Enforcement in Jurisdictions: In some regions, enforcing IP rights is challenging due to legal system limitations or inconsistent application of IP laws, making litigation costly and ineffective.

- Unauthorized Secondary Production: Suppliers may overproduce beyond the agreed order quantity and sell excess units on the gray market, diluting brand value and undercutting official distribution channels.

To mitigate these risks, companies must conduct thorough due diligence, establish ironclad legal agreements, and consider using trusted intermediaries or IP protection services when sourcing critical automotive components.

Logistics & Compliance Guide for Pole Jack Automotive

This comprehensive guide outlines the essential logistics and compliance procedures for Pole Jack Automotive to ensure efficient operations, regulatory adherence, and customer satisfaction.

Supply Chain Management

Pole Jack Automotive must establish reliable supply chain partnerships with verified suppliers of automotive parts and equipment. All suppliers must meet quality standards and provide documentation for traceability. Maintain an accurate inventory management system to track stock levels, prevent overstocking or shortages, and ensure timely reordering of critical components.

Transportation & Distribution

Coordinate with licensed and insured logistics providers for the safe and timely delivery of goods. Ensure all shipments are properly packaged, labeled, and secured to prevent damage during transit. Utilize GPS tracking for real-time shipment monitoring and maintain delivery logs for accountability. Optimize delivery routes to reduce fuel consumption and delivery times.

Import/Export Compliance

For international shipments, ensure compliance with all customs regulations, including accurate documentation (commercial invoices, packing lists, bills of lading). Classify products correctly under the Harmonized System (HS) codes and verify tariff rates. Obtain necessary import/export licenses and stay updated on trade restrictions, sanctions, and embargoes affecting automotive products.

Regulatory Compliance

Adhere to all local, national, and international regulations governing automotive parts, including safety standards (e.g., DOT, FMVSS in the U.S.), emissions requirements, and environmental directives (e.g., REACH, RoHS). Maintain records of product certifications and ensure all parts meet applicable performance and safety benchmarks.

Product Labeling & Documentation

All products must be clearly labeled with part numbers, manufacturer details, country of origin, and compliance markings. Provide customers with detailed product documentation, including installation guides, warranty information, and safety warnings. Ensure labeling is in the required language(s) for the destination market.

Warehouse Operations

Maintain clean, organized, and secure warehouse facilities with designated storage zones for different product categories. Implement fire safety measures, pest control, and climate controls as needed. Conduct regular audits and cycle counts to ensure inventory accuracy and prevent loss or damage.

Environmental & Safety Standards

Comply with OSHA (or equivalent) workplace safety regulations. Train staff on proper handling of automotive components, use of lifting equipment (e.g., pole jacks), and emergency procedures. Manage hazardous materials (e.g., batteries, fluids) according to EPA (or local) guidelines, including proper storage, labeling, and disposal.

Data Security & Recordkeeping

Protect customer and transaction data in accordance with data privacy laws (e.g., GDPR, CCPA). Maintain digital and physical records of all logistics and compliance activities for a minimum of seven years, including shipping manifests, customs filings, supplier agreements, and inspection reports.

Audits & Continuous Improvement

Conduct regular internal audits to assess compliance and logistics efficiency. Address non-conformities promptly and implement corrective actions. Stay informed on regulatory changes and industry best practices to continuously improve supply chain resilience and compliance posture.

In conclusion, sourcing pole jacks for the automotive industry requires careful consideration of quality, reliability, cost-efficiency, and supplier credibility. As essential tools in vehicle maintenance and repair, pole jacks must meet stringent safety and performance standards to ensure operational efficiency and user safety. Conducting thorough supplier evaluations, verifying compliance with industry regulations, and prioritizing durable, well-engineered products are critical steps in the procurement process. Establishing strong relationships with reputable manufacturers or distributors can lead to long-term benefits, including consistent supply, technical support, and competitive pricing. Ultimately, a strategic sourcing approach ensures that automotive businesses acquire pole jacks that enhance productivity, ensure workplace safety, and deliver value for money.