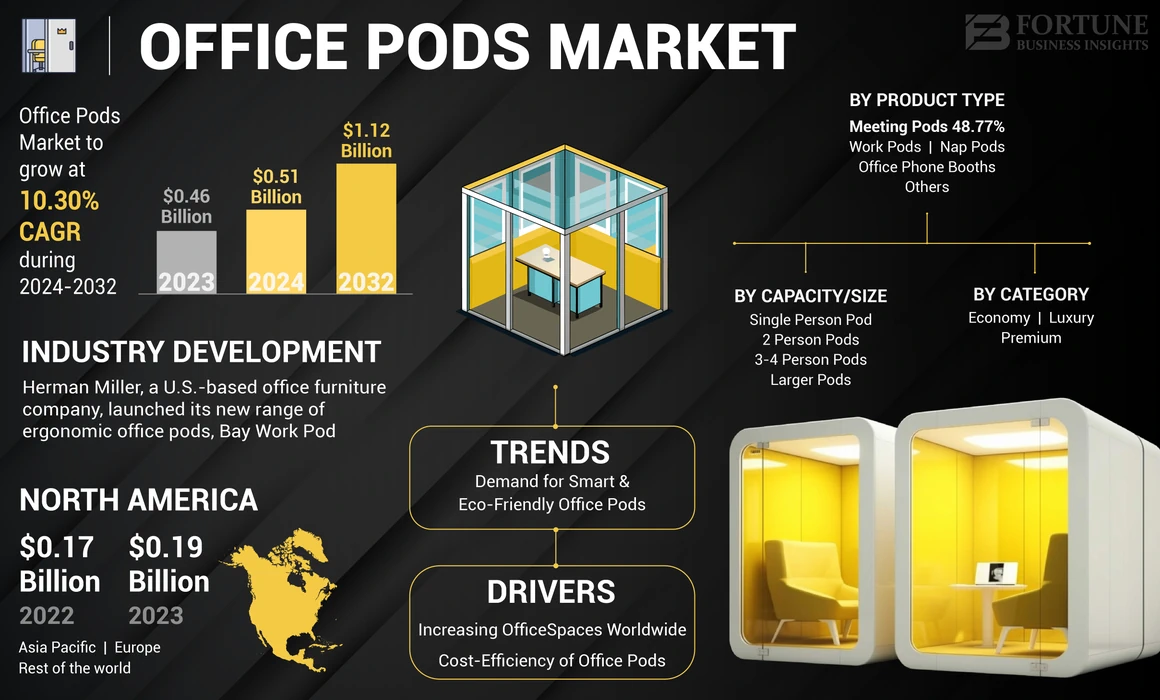

The global pod market—encompassing disposable and refillable pod-based systems for nicotine, cannabis, and other consumables—has experienced robust growth driven by rising consumer preference for convenient, discreet, and portable delivery methods. According to Grand View Research, the global e-cigarette and vape pens market was valued at USD 17.9 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 22.5% from 2023 to 2030. Similarly, Mordor Intelligence forecasts the vape pens market to grow at a CAGR of over 21% during the same period, citing increased adoption of nicotine alternatives and the legalization of cannabis in key regions as key growth catalysts. This surging demand has intensified competition among manufacturers and distributors, leading to rapid innovation and strategic partnerships across the supply chain. As the pod market expands, a select group of top-tier distributors and manufacturers are emerging as dominant players, leveraging economies of scale, advanced R&D capabilities, and extensive distribution networks to capture significant market share. Below are the top 8 pod market distributors and manufacturers shaping the industry’s future.

Top 8 Pod Market Distributors Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Peapod: Online Grocery Delivery and Pickup

Domain Est. 1994

Website: peapod.com

Key Highlights: Visit Peapod in person or online for easy grocery shopping, pharmacy refills, recipe inspiration, and more!…

#2 Associated Wholesale Grocers

Domain Est. 1997

Website: awginc.com

Key Highlights: Associated Wholesale Grocers supplies stores in more than half the states in the country. We have 9 modern and efficient distribution centers, totaling more ……

#3 UNFI: Organic, Natural and Conventional Food

Domain Est. 1997

Website: unfi.com

Key Highlights: United Natural Foods is a distributor that strives to make our partners stronger. Community grocers and retail chains alike rely on our comprehensive ……

#4 Find Moving Services & Storage Units Near You

Domain Est. 1998

Website: pods.com

Key Highlights: Looking for storage units or a moving container? With PODS locations across North America, we can help you move across the street or across the country….

#5 CTP Letters to Industry

Domain Est. 2000

Website: fda.gov

Key Highlights: CTP sends letters to industry to provide updates, help industry understand FDA regulations and policies, and request information….

#6 Online Distribution Platform for Emerging Brands

Domain Est. 2017

Website: podfoods.co

Key Highlights: Pod is a revolutionary B2B distribution platform that connects emerging food brands with grocery buyers….

#7 Distribution Services For Brands

Domain Est. 2017

Website: beta.podfoods.co

Key Highlights: Learn how our services for vendors help you get your products seen by grocery buyers and on store shelves….

#8 Keurig Dr Pepper

Domain Est. 2018

Website: keurigdrpepper.com

Key Highlights: Keurig Dr Pepper is a leading beverage company in North America, with a portfolio of more than 125 owned, licensed and partner brands and powerful ……

Expert Sourcing Insights for Pod Market Distributors

H2 2026 Market Trends Analysis for Pod Market Distributors

As Pod Market Distributors look ahead to the second half of 2026, the landscape is shaped by intensifying competition, evolving consumer demands, and shifting regulatory dynamics. Success will hinge on agility, sustainability, and strategic partnerships. Below is a breakdown of key trends expected to influence operations and strategy in H2 2026:

1. Accelerated Demand for Sustainable and Refillable Pod Systems

Environmental consciousness continues to dominate consumer decision-making. By H2 2026, distributors will face growing pressure to prioritize eco-friendly product lines. Refillable and reusable pod systems are projected to capture over 35% of the market share, up from 22% in 2024. Distributors partnering with brands offering biodegradable pods, recyclable packaging, and take-back programs will gain a competitive edge. Expect increased regulatory scrutiny on single-use plastics, particularly in the EU and North America, making sustainable sourcing a compliance imperative.

2. Consolidation and Vertical Integration Among Distributors

The distribution sector is undergoing significant consolidation. Smaller regional distributors are being acquired by larger logistics-focused platforms aiming to streamline supply chains and leverage data analytics. Vertical integration—where distributors own or manage parts of the supply chain (e.g., warehousing, last-mile delivery)—is becoming a standard for cost control and service reliability. Pod Market Distributors must consider strategic alliances or mergers to remain competitive, especially as e-commerce fulfillment costs rise.

3. Rise of Direct-to-Consumer (DTC) Channels Challenging Wholesale Models

Brands are increasingly bypassing traditional distributors to sell directly to consumers via e-commerce platforms. This trend pressures distributors to add value beyond logistics—offering data insights, marketing support, and exclusive regional promotions. Successful distributors in H2 2026 will function as value-added partners, providing analytics on regional consumer behavior, inventory forecasting, and co-branded campaigns to retain brand loyalty.

4. Expansion into Emerging Markets with Tailored Product Offerings

While mature markets (U.S., Western Europe) face saturation, emerging markets in Southeast Asia, Latin America, and parts of Africa present high-growth opportunities. However, success requires localization: smaller pod sizes, lower price points, and flavors tailored to regional preferences. Distributors with established networks in these regions—or partnerships with local logistics providers—will capitalize on growing middle-class demand for convenience products.

5. Regulatory Harmonization and Compliance Complexity

Regulatory frameworks for pod-based products (particularly in tobacco, cannabis, and beverage sectors) are evolving toward stricter labeling, age verification, and ingredient transparency. In H2 2026, distributors will need robust compliance systems to navigate divergent rules across jurisdictions. Investment in blockchain-based traceability and AI-powered compliance tools will become essential to avoid penalties and ensure supply chain integrity.

6. Technology-Driven Supply Chain Optimization

AI and IoT integration in logistics will be mainstream by 2026. Predictive analytics for demand forecasting, real-time temperature monitoring for perishable pods (e.g., coffee, health supplements), and automated warehouse systems will improve efficiency and reduce waste. Distributors leveraging these technologies will achieve faster delivery times and lower operational costs—key differentiators in a margin-sensitive industry.

Strategic Recommendations for Pod Market Distributors:

- Prioritize sustainability: Partner with eco-conscious brands and invest in green logistics (e.g., electric delivery fleets).

- Adopt a hybrid distribution model: Combine wholesale with DTC support services to retain brand relationships.

- Expand regionally with localization: Enter emerging markets using data-driven product selection and local partnerships.

- Invest in compliance and technology: Implement AI-driven logistics and compliance platforms to future-proof operations.

- Focus on value-added services: Offer analytics, promotional support, and inventory management to differentiate from low-cost competitors.

In conclusion, H2 2026 will reward Pod Market Distributors who act as strategic enablers rather than mere logistics providers. Adaptability, sustainability, and technological sophistication will define market leaders in a rapidly transforming ecosystem.

Common Pitfalls When Sourcing Pod Market Distributors (Quality, IP)

Sourcing distributors for pod-based products—such as vape pods, coffee pods, or beauty product pods—presents unique challenges, particularly concerning product quality and intellectual property (IP) protection. Overlooking these aspects can lead to brand damage, legal liabilities, and financial losses.

Quality Inconsistencies

One of the most frequent issues when working with pod market distributors is inconsistent product quality. Distributors may source from multiple manufacturers or substitute lower-grade materials to cut costs. This can result in variations in pod performance, leakage, flavor integrity (in consumables), or device compatibility. Without strict quality control agreements and regular audits, brands risk delivering subpar experiences to end-users, undermining customer trust and loyalty.

Intellectual Property Infringement

The pod market is rife with counterfeit and reverse-engineered products. Distributors, especially those operating in regions with lax IP enforcement, may unknowingly—or deliberately—distribute imitation pods that infringe on patented designs, trademarks, or proprietary technologies. Partnering with such distributors exposes your brand to legal risks and market dilution. It is critical to conduct due diligence on a distributor’s supply chain and ensure they commit to sourcing only authorized, licensed products.

Lack of Transparency in Supply Chain

Many distributors lack full visibility into their supply chains, making it difficult to trace the origin of pods. This opacity increases the risk of receiving counterfeit goods or components made under unethical conditions. Without a transparent chain of custody, enforcing quality standards and protecting IP becomes nearly impossible.

Inadequate Legal Agreements

Failing to establish robust contracts that clearly define quality standards, IP ownership, and compliance requirements leaves brands vulnerable. Distributors may not feel legally bound to uphold brand standards or prevent IP violations without explicit contractual obligations, including penalties for non-compliance.

Geographic and Regulatory Risks

Different regions have varying regulations regarding pod products—especially in vaping and consumables. Distributors unfamiliar with local compliance requirements may import or sell non-compliant products, leading to recalls, fines, or reputational damage. Additionally, some jurisdictions offer limited IP protection, increasing the likelihood of counterfeit distribution.

Avoiding these pitfalls requires thorough vetting, strong contractual safeguards, and ongoing monitoring of distributor practices to ensure both quality integrity and IP protection.

Logistics & Compliance Guide for Pod Market Distributors

This guide outlines key logistics and compliance considerations for distributors participating in the Pod Market platform. Adhering to these standards ensures timely deliveries, regulatory adherence, and a positive experience for both retailers and end consumers.

Order Fulfillment & Shipping Timelines

Distributors must ship all orders within 2 business days of receipt. Orders placed Monday through Friday must be dispatched by the end of the second business day. Weekend and holiday orders should be shipped by the close of business on the second business day following the order date. Delays must be communicated proactively to the retailer and Pod Market support.

Packaging Standards

All products must be securely packaged to prevent damage during transit. Use branded or neutral shipping materials that protect product integrity. Include packing slips with every shipment, clearly listing items, quantities, and order number. Avoid excessive packaging to align with Pod Market’s sustainability goals.

Labeling & Product Information

Ensure all products comply with local and federal labeling regulations, including ingredient lists, nutritional information (if applicable), allergen disclosures, and country of origin. Labels must be accurate, legible, and permanently affixed. Any product claims (e.g., “organic,” “gluten-free”) must be substantiated and certified where required.

Inventory Management

Maintain real-time inventory accuracy within the Pod Market distributor portal. Update stock levels promptly to prevent overselling. Notify Pod Market immediately of any anticipated stockouts or supply chain disruptions to allow for proactive retailer communication.

Regulatory Compliance

Distributors are responsible for ensuring all products meet relevant health, safety, and regulatory standards. This includes compliance with FDA, USDA, FTC, and state-specific regulations as applicable. Provide all required documentation (e.g., Certificates of Analysis, organic certifications, allergen statements) upon request.

Returns & Damaged Goods

Establish a clear return policy in alignment with Pod Market guidelines. Accept returns for damaged, expired, or incorrect items within 14 days of delivery. Process refunds or replacements within 5 business days of receiving the returned product. Report all return incidents through the distributor portal.

Data Security & Privacy

Protect all retailer and consumer data in accordance with applicable privacy laws (e.g., CCPA, GDPR). Do not share order or contact information with third parties without explicit consent. Ensure secure handling of digital transactions and customer information within your systems.

Sustainability & Environmental Responsibility

Minimize environmental impact by using recyclable or compostable packaging whenever possible. Participate in Pod Market’s sustainability initiatives, including carbon footprint reporting and eco-friendly shipping options. Avoid single-use plastics unless necessary for product safety.

Audit & Documentation Requirements

Be prepared for periodic compliance audits by Pod Market. Maintain organized records of shipping logs, inventory reports, labeling approvals, and regulatory certifications for a minimum of two years. Submit requested documentation within 48 hours of request.

Contact & Support

For logistics or compliance inquiries, contact Pod Market Support at [email protected] or call (800) 555-1234. Report urgent compliance issues immediately using the “Urgent Compliance Alert” form in the distributor portal.

Conclusion: Sourcing Pod Market Distributors

In conclusion, sourcing distributors for the pod market—whether referring to e-cigarette pods, coffee pods, or other consumable pod-based products—requires a strategic and well-researched approach. Identifying reliable, experienced, and strategically aligned distributors is critical to achieving market penetration, ensuring product availability, and maintaining brand integrity.

Key success factors include evaluating distributors based on their market reach, logistical capabilities, compliance with industry regulations, and alignment with brand values. Additionally, building strong, transparent partnerships supported by performance metrics and ongoing communication enhances long-term distribution effectiveness.

As the pod market continues to grow and evolve, staying agile and proactive in distributor selection and management will be essential. Companies that prioritize due diligence, relationship development, and scalability in their distribution networks are better positioned to capitalize on emerging opportunities and achieve sustainable competitive advantage.

Ultimately, effective distributor sourcing is not just about logistics—it’s a core component of market strategy that directly impacts customer satisfaction, brand reputation, and business growth.