The global pneumatic vacuum pump market is on a robust growth trajectory, driven by rising demand across industries such as packaging, pharmaceuticals, automotive, and food & beverage. According to a 2023 report by Mordor Intelligence, the vacuum pump market is projected to grow at a CAGR of over 5.8% from 2023 to 2028, with pneumatic solutions gaining traction due to their reliability, energy efficiency, and low maintenance requirements. Similarly, Grand View Research estimates that the global vacuum pump market size was valued at USD 4.5 billion in 2022 and is expected to expand at a CAGR of 5.6% through 2030, fueled by advancements in industrial automation and process optimization. Amid this growth, key manufacturers are innovating to meet stringent industry standards and evolving application needs. In this landscape, identifying the top pneumatic vacuum pump manufacturers becomes crucial for businesses seeking performance, durability, and technical support. Here’s a data-driven look at the leading 10 companies shaping the future of vacuum technology.

Top 10 Pneumatic Vacuum Pump Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 OEM Vacuum Pumps and Compressors Technologies

Domain Est. 1995

Website: thomaspumps.com

Key Highlights: Thomas is a leading manufacturer of systems, compressors, vacuum, and liquid pumps for Original Equipment Manufacturers (OEMs)…

#2 VAC

Domain Est. 1996

Website: vac-u-max.com

Key Highlights: VAC-U-MAX is a premier manufacturer of custom pneumatic systems and support equipment for conveying, batching, and weighing materials….

#3 Piab vacuum technology

Domain Est. 1996

Website: piab.com

Key Highlights: Compact and configurable vacuum pump powered by Piab’s multistage COAX® technology — delivering reliable performance, easy maintenance, and energy-efficient ……

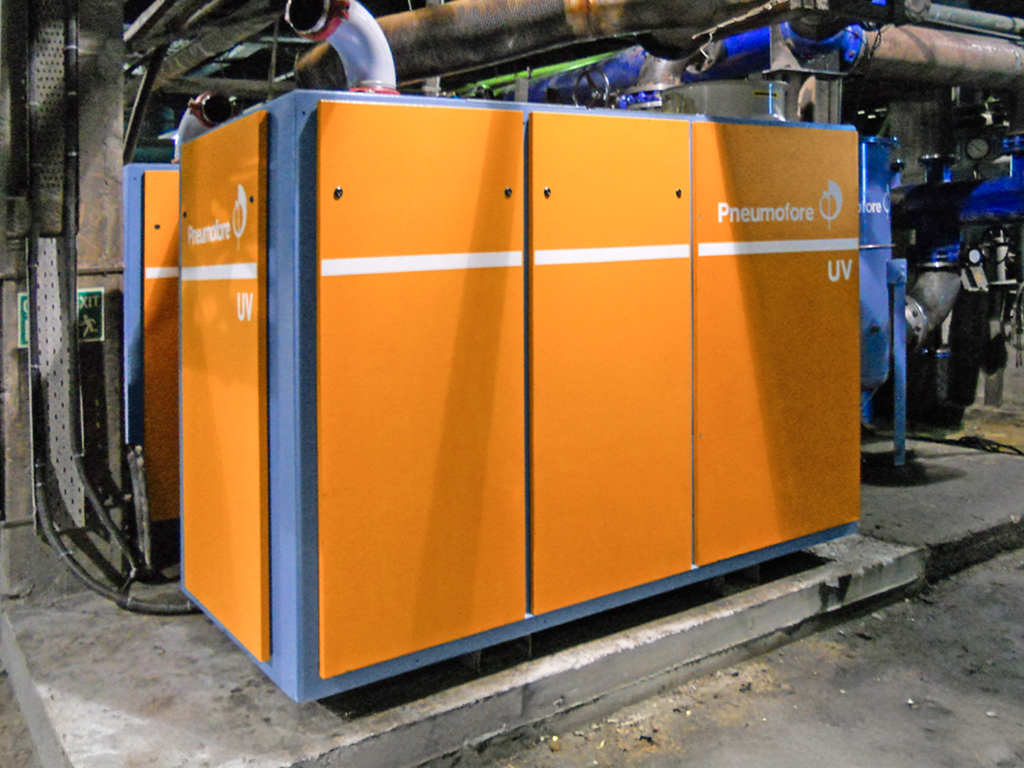

#4 Pneumofore

Domain Est. 1997 | Founded: 1923

Website: pneumofore.com

Key Highlights: Since 1923, Pneumofore is a leading supplier of vacuum pumps and compressed air and gas systems for industrial applications worldwide….

#5 Custom Blower & Vacuum Pump Engineering Manufacturer

Domain Est. 1998

Website: airtechusa.com

Key Highlights: Airtech Vacuum is a custom blower & vacuum pump engineering company. Their solutions are made to fit your specific needs. Learn how AirtechUSA can help you….

#6 Manufacturers of Blower and Vacuum pumps

Domain Est. 2006

Website: elmorietschle.com

Key Highlights: Welcome to Elmo Rietschle. Our range of Blower and Vacuum pumps will support all your demands and requests for vacuum and pressure….

#7 Industrial Vacuum Pumps

Domain Est. 2015

Website: republic-mfg.com

Key Highlights: Republic Manufacturing provides a extensive range of high-quality vacuum pumps designed to address the unique needs of diverse industrial applications….

#8 Becker Pumps

Domain Est. 1996

Website: beckerpumps.com

Key Highlights: Becker offers a wide range of vacuum pumps, compressors, vacuum/pressure combined pumps, regenerative blowers, and central vacuum systems….

#9 Ideal Vacuum

Domain Est. 2008

Website: idealvac.com

Key Highlights: Buy vacuum pumps, vacuum chambers, vacuum systems, products, fittings & flanges. Ideal Vacuum provides Vacuum Pump Repair and Rebuilding Services….

#10 M

Domain Est. 2021

Website: md-kinney.com

Key Highlights: Explore our catalog of vacuum boosters, liquid ring vacuum pumps, rotary vane, rotary piston vacuum pumps, and a wide selection of dry vacuum pumps….

Expert Sourcing Insights for Pneumatic Vacuum Pump

H2: 2026 Market Trends for Pneumatic Vacuum Pumps

The global pneumatic vacuum pump market is poised for significant transformation by 2026, shaped by technological innovation, evolving industrial automation, and shifting regional demand dynamics. As industries increasingly prioritize energy efficiency, reliability, and compact design, pneumatic vacuum pumps—particularly ejector-based systems—are gaining traction across manufacturing, packaging, automotive, and life sciences sectors.

-

Growth Driven by Industrial Automation

By 2026, the expansion of smart manufacturing and Industry 4.0 initiatives will continue to fuel demand for pneumatic vacuum solutions. These pumps are integral to robotic handling systems, pick-and-place operations, and automated assembly lines due to their maintenance-free operation, fast response times, and compatibility with clean environments. The integration of IoT-enabled sensors in vacuum systems will allow for predictive maintenance and real-time performance monitoring, enhancing operational efficiency. -

Energy Efficiency and Sustainability Focus

Environmental regulations and corporate sustainability goals are pushing manufacturers toward energy-optimized components. Pneumatic vacuum pumps, especially those with adjustable suction and low compressed air consumption, will be favored. Innovations such as zero-air-consumption nozzles and regenerative ejectors are expected to gain market share, reducing operational costs and carbon footprints in compressed air-dependent facilities. -

Adoption in Emerging Markets

Asia-Pacific, led by China, India, and Southeast Asia, will remain a key growth region by 2026. Rising investments in automotive production, electronics manufacturing, and food packaging are increasing the demand for reliable vacuum handling solutions. Localized production and cost-effective alternatives from regional manufacturers will further accelerate market penetration. -

Competition from Electric Vacuum Pumps

Despite growth, pneumatic vacuum pumps face increasing competition from electrically driven alternatives, especially in applications where energy efficiency and noise reduction are paramount. However, pneumatic systems retain advantages in environments requiring explosion-proof operation, resistance to harsh conditions, and simplicity of design—ensuring continued relevance in specific industrial niches. -

Miniaturization and Customization Trends

Equipment designers are demanding smaller, modular vacuum solutions to fit compact machinery. By 2026, suppliers will focus on developing miniaturized ejectors and customizable manifold systems that integrate seamlessly into advanced automation platforms. 3D printing and advanced materials will enable rapid prototyping and tailored performance characteristics. -

Supply Chain and Material Innovations

Ongoing advancements in composite materials and additive manufacturing are improving the durability and weight efficiency of pneumatic vacuum components. These innovations reduce wear and corrosion, particularly in wet or chemically aggressive environments, extending product lifecycle and lowering total cost of ownership.

In conclusion, the 2026 market for pneumatic vacuum pumps will be defined by smart integration, energy optimization, and regional industrial growth. While facing competition from electric systems, pneumatic solutions will maintain a robust position in applications valuing reliability, safety, and simplicity—especially within automated and high-speed production environments.

Common Pitfalls When Sourcing Pneumatic Vacuum Pumps (Quality & IP)

Sourcing pneumatic vacuum pumps involves more than just matching technical specifications. Overlooking critical quality and intellectual property (IP) aspects can lead to performance issues, safety risks, supply chain disruptions, and legal exposure. Here are key pitfalls to avoid:

Poor Quality Control and Inconsistent Performance

Many suppliers, especially low-cost manufacturers, lack robust quality management systems. This results in inconsistent materials, imprecise machining, and variable performance across units. Buyers may receive pumps that fail to meet stated vacuum levels, have shorter lifespans, or exhibit erratic operation. Always verify certifications (e.g., ISO 9001) and request performance test data from independent batches.

Use of Substandard Materials and Components

Inferior seals, diaphragms, and valve components degrade quickly under continuous operation, especially in demanding environments. Low-grade aluminum or plastic housings may crack or deform. These shortcuts reduce reliability and increase maintenance costs. Insist on material specifications (e.g., FKM seals, anodized aluminum) and conduct sample testing under real operating conditions.

Misrepresentation of Technical Specifications

Some suppliers exaggerate flow rates, vacuum levels, or air consumption to win bids. Published curves may not reflect real-world performance. Always request actual test reports from accredited labs and compare data under standardized conditions (e.g., ISO 21774 for vacuum pumps).

Lack of IP Protection and Risk of Infringement

Sourcing from manufacturers that replicate patented designs poses serious IP risks. Using such pumps may expose your company to legal action, product recalls, or customs seizures. Verify the supplier’s ownership of design rights or legitimate licensing agreements. Avoid “copycat” products that closely mimic established brands without authorization.

Inadequate Documentation and Traceability

Poor labeling, missing serial numbers, and incomplete technical documentation hinder maintenance, compliance, and traceability. This is critical in regulated industries (e.g., medical, food & beverage). Ensure suppliers provide full documentation, including CE/UKCA marks, DoC (Declaration of Conformity), and material traceability.

Hidden Costs from Poor Reliability

While initial purchase price may be low, unreliable pumps increase total cost of ownership through downtime, energy waste, and frequent replacements. A slightly more expensive, high-quality pump with proven durability often delivers better long-term value.

Supply Chain Vulnerability

Over-reliance on a single low-cost supplier with weak IP or quality processes creates risk. If legal issues arise or quality drops, switching suppliers can disrupt production. Diversify sources and conduct due diligence on supplier stability and IP compliance.

Avoiding these pitfalls requires thorough vetting, independent testing, and clear contractual terms around quality standards and IP warranties. Prioritize suppliers with transparent processes, verifiable certifications, and a commitment to innovation and compliance.

Logistics & Compliance Guide for Pneumatic Vacuum Pump

Overview

This guide provides essential information for the safe, efficient, and compliant handling, transportation, storage, and regulatory compliance of Pneumatic Vacuum Pumps. Adherence to these guidelines ensures product integrity, regulatory compliance, and personnel safety throughout the supply chain.

Packaging Requirements

Pneumatic Vacuum Pumps must be packaged in robust, protective materials to prevent damage during transit. Use double-walled corrugated cardboard boxes with internal foam or molded inserts to secure the pump and prevent movement. Include desiccant packs to minimize moisture exposure, especially for long-term storage or maritime transport. Ensure all ports are capped or sealed to prevent contamination.

Labeling and Marking

All packages must display clear, durable labels including:

– Product name and model number

– Manufacturer name and contact information

– Gross and net weight

– “Fragile” and “This Side Up” handling indicators

– Hazard symbols (if applicable, e.g., for compressed components)

– Country of origin

Ensure labels comply with international shipping standards (e.g., ISO 780, ISTA).

Transportation

- Mode of Transport: Suitable for road, air, and sea freight. Confirm compliance with IATA (air), IMDG (sea), and ADR (road) regulations if applicable.

- Environmental Conditions: Avoid exposure to extreme temperatures (below -10°C or above 50°C), humidity above 85%, and direct sunlight during transit.

- Securement: Pumps must be secured within transport vehicles to prevent shifting. Use pallets and stretch-wrapping for multi-unit shipments.

Storage Conditions

Store in a clean, dry, temperature-controlled environment (5°C to 40°C recommended). Keep away from corrosive substances, dust, and vibration sources. Pumps should be stored upright on stable surfaces with adequate ventilation. Maximum stack height should not exceed manufacturer recommendations (typically 2–3 layers).

Import/Export Compliance

- HS Code: 8414.80 (Pumps having a displacement, whether or not equipped with a measuring device) – confirm with local customs authority.

- Export Controls: Verify if the pump contains components subject to export control regulations (e.g., EAR in the U.S., EU Dual-Use Regulation). Most general-purpose pneumatic vacuum pumps are not controlled, but verify based on technical specifications.

- Documentation: Include commercial invoice, packing list, bill of lading/air waybill, and certificate of origin. A conformity declaration may be required depending on destination.

Regulatory Compliance

- CE Marking (EU): Ensure compliance with Machinery Directive 2006/42/EC and relevant harmonized standards (e.g., EN ISO 12100). Technical file and EU Declaration of Conformity must be maintained.

- UKCA Marking (UK): Required for pumps placed on the UK market. Follow UK regulations post-Brexit.

- RoHS Compliance (EU/UK): Confirm that electrical components (if any) comply with RoHS 2 (2011/65/EU) restricting hazardous substances.

- REACH (EU): Ensure no substances of very high concern (SVHC) are present above threshold levels.

- OSHA (USA): Comply with workplace safety standards regarding noise and compressed air use.

- Pressure Equipment Directive (PED 2014/68/EU): Most pneumatic vacuum pumps fall outside the scope of PED as they operate at low pressure; verify based on operating parameters.

Safety and Handling

- Personnel must use appropriate PPE (gloves, safety glasses) during handling.

- Do not operate the pump without proper mounting and connection to clean, dry compressed air supply.

- Follow lockout/tagout (LOTO) procedures during maintenance or inspection.

Disposal and Environmental Considerations

Dispose of pumps in accordance with local waste electrical and electronic equipment (WEEE) regulations. Recycle metal and plastic components where possible. Do not incinerate. Refer to manufacturer’s end-of-life guidance.

Documentation and Recordkeeping

Maintain records of:

– Certificates of Conformity (CE, UKCA, etc.)

– Technical specifications and test reports

– Shipping and customs documentation

– Safety data sheets (SDS) for any associated materials

Retention period: Minimum 10 years, or as required by local regulations.

Contact Information

For compliance inquiries, technical support, or documentation requests, contact:

[Manufacturer Name]

Compliance Department

Email: [email protected]

Phone: +1-XXX-XXX-XXXX

Website: www.manufacturer.com/compliance

Note: Regulations vary by country and may change; always consult local authorities and legal counsel for up-to-date compliance requirements.

Conclusion for Sourcing Pneumatic Vacuum Pump

After a thorough evaluation of technical specifications, performance requirements, cost considerations, and supplier capabilities, sourcing a pneumatic vacuum pump is a strategic decision that offers reliability, energy efficiency, and operational simplicity—especially in environments where electrical hazards must be avoided or compressed air is readily available. Pneumatic vacuum pumps provide strong suction performance, require minimal maintenance, and are well-suited for applications in automation, packaging, material handling, and laboratory settings.

Key factors in the final sourcing decision include compatibility with existing systems, durability under intended operating conditions, availability of spare parts and technical support, and total cost of ownership. Suppliers offering certified products with proven track records in quality and after-sales service have been prioritized to ensure long-term operational efficiency.

In conclusion, selecting the right pneumatic vacuum pump from a reputable supplier ensures enhanced productivity, reduced downtime, and improved safety. Ongoing supplier relationships will be maintained to support future needs and potential scalability, reinforcing operational excellence across relevant processes.