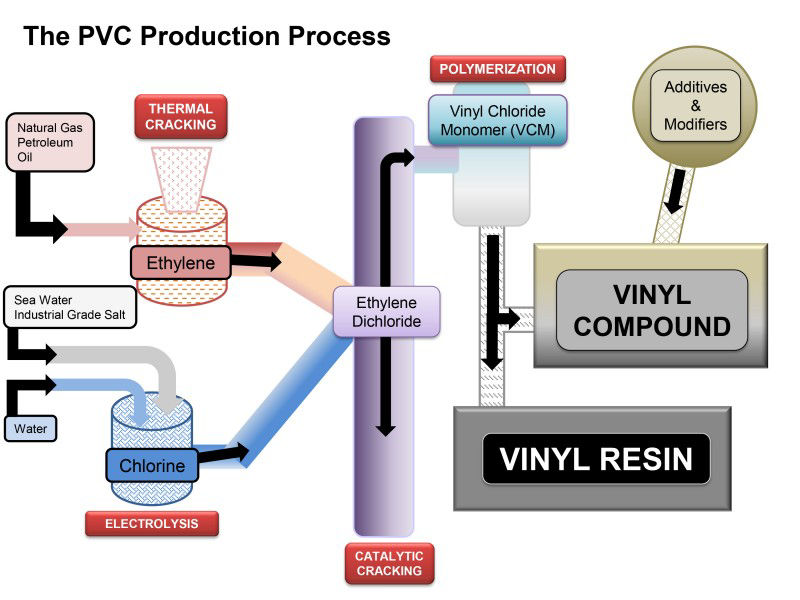

The global engineered wood products market, including plywood and PVC composites, is experiencing robust growth, driven by rising demand in construction, furniture, and interior design sectors. According to a 2023 report by Grand View Research, the global plywood market was valued at USD 40.8 billion and is expected to expand at a CAGR of 6.1% from 2023 to 2030, fueled by urbanization and increasing residential and commercial infrastructure development. Concurrently, PVC-based panel solutions are gaining traction due to their moisture resistance, durability, and low maintenance—qualities that make them ideal for humid climates and high-traffic environments. Mordor Intelligence projects that the PVC foam board market will grow at a CAGR of over 5.8% during the 2024–2029 forecast period, underpinned by innovation in lightweight, eco-friendly materials and expanded applications in modular construction and retail fit-outs. As demand surges, a select group of manufacturers has emerged as industry leaders, combining advanced production technologies, consistency in quality, and scalable output. Here’s a data-informed look at the top 9 plywood and PVC panel manufacturers shaping the future of modern construction and design.

Top 9 Plywood Pvc Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Amal Plywood

Domain Est. 2018

Website: amalplywood.com

Key Highlights: Amal Plywood is a leading ISO 9001-2008 accredited plywood importer, manufacturer, exporter, trader, and wholesaler in South India, delivering MDF, Particle ……

#2 Buy Plywood Wholesale Direct from Manufacturer

Domain Est. 2018

Website: plyterra.com

Key Highlights: Plyterra is a trusted plywood manufacturer with over 20 years of expertise. Offering a wide range of plywood grades and types for wholesale buyers….

#3 K Board Ply – Plywood Particle Board

Domain Est. 2019

Website: kboardply.com

Key Highlights: K-Board provides a range of highly quality 100% Gurjan wood core plywoods. Our Plywoods are available in BWP grade, BWR grade Marine Plywood, Film Coated ……

#4 Atlantic Plywood Corporation

Domain Est. 1999

Website: atlanticplywood.com

Key Highlights: Wholesale Supplier of Hardwood Plywood, Panel Product and More! Since our inception in 1974, Atlantic Plywood Corporation has prided itself on delivering the ……

#5 Madar PP

Domain Est. 2001

Website: madar.com

Key Highlights: Durable green PVC plywood by Madar with high bending strength, ideal for concrete shuttering in tough site conditions. In stock. Please select location….

#6 Dhabriya Polywood Limited

Domain Est. 2003

Website: polywood.org

Key Highlights: The company was incorporated in the year 1992 with the brand name POLYWOOD manufacturing PVC profiles. With continuous growth and innovation….

#7 Products

Domain Est. 2006

Website: nashvilleplywood.com

Key Highlights: Find your building solutions with our premium wood products, including domestic and imported plywood, lumber, and innovative cabinetry at Nashville Plywood….

#8 Apple Plywoods

Domain Est. 2008

Website: appleplywoods.com

Key Highlights: Apple Plywoods is India’s best manufacturers of allied wood products including Plywood, HDHMR, Veneers and Particle board over 35 years….

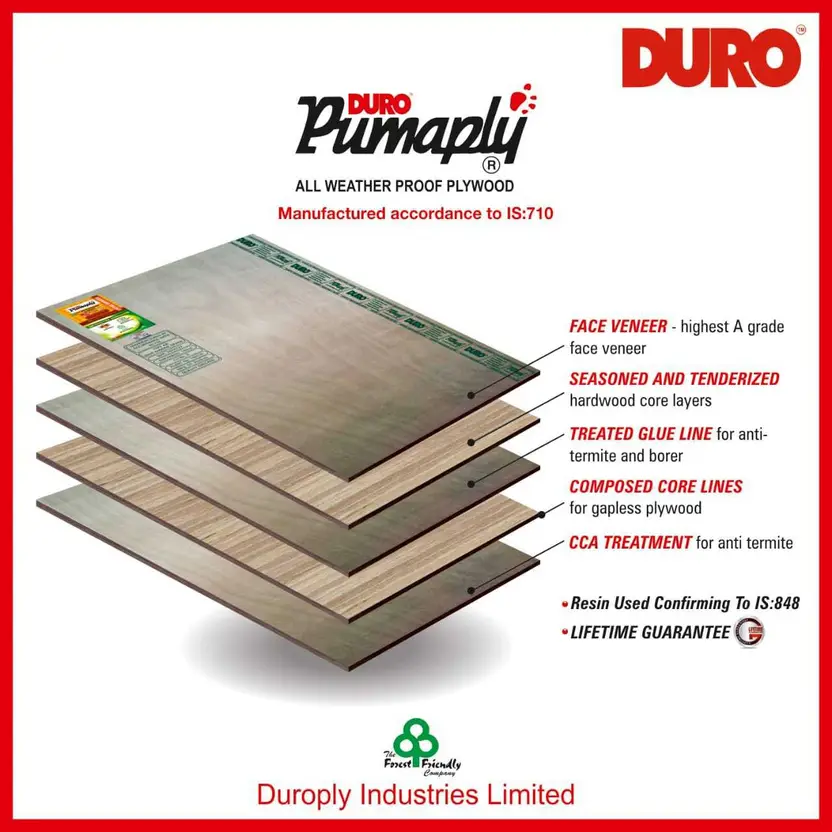

#9 Duroply

Domain Est. 2018

Website: duroply.in

Key Highlights: Duroply offers the high quality industry standard plywoods in India. Get the Plywood, Blockboard, Veneers, Doors, PVC boards & doors at best prices….

Expert Sourcing Insights for Plywood Pvc

H2 2026 Market Trends for Plywood PVC

The Plywood PVC (Polyvinyl Chloride) market, particularly referring to PVC-coated or PVC-laminated plywood and rigid PVC foam boards often used interchangeably in construction and design, is projected for significant evolution in H2 2026. Driven by sustainability mandates, technological innovation, and shifting construction dynamics, key trends will shape the industry landscape:

1. Accelerated Demand for Sustainable & Recyclable Solutions:

Environmental regulations (e.g., EU Green Deal, tightening VOC standards globally) will intensify pressure on manufacturers. H2 2026 will see a surge in demand for:

* Bio-based & Recycled PVC Content: Development and commercialization of plywood with PVC layers incorporating higher percentages of recycled PVC (rPVC) and bio-derived plasticizers will gain traction, reducing carbon footprint.

* Improved Recyclability: Enhanced design-for-recycling strategies, such as easily separable layers or mono-material composites, will be prioritized to meet Extended Producer Responsibility (EPR) schemes.

* Low-VOC & Non-Toxic Formulations: Market preference will heavily favor PVC coatings/laminates certified for ultra-low emissions (e.g., Greenguard Gold, Blue Angel), crucial for indoor air quality in residential and healthcare applications.

2. Dominance of High-Performance & Multifunctional Materials:

Basic PVC-laminated plywood will face competition from advanced composites. Key trends include:

* Enhanced Durability & Weather Resistance: Demand for products with superior UV stability (reduced fading/chalking), impact resistance, and moisture barrier properties (critical for façades, outdoor furniture, wet areas) will grow, driven by climate resilience needs.

* Integrated Functionality: Surfaces incorporating antimicrobial, self-cleaning, or fire-retardant (low-smoke, zero-halogen) properties within the PVC layer will become standard in healthcare, hospitality, and public infrastructure projects.

* Aesthetic Sophistication: High-definition printing, textured finishes (wood grain, stone, metallic), and customizable colors will be essential to compete with solid wood and HPL, especially in retail and high-end residential interiors.

3. Growth in Prefabrication & Modular Construction:

The push for faster, more efficient building methods will boost demand for:

* Standardized, Dimensionally Stable Panels: PVC-laminated plywood’s consistency and moisture resistance make it ideal for off-site manufacturing of wall panels, cabinets, and modular units. H2 2026 will see increased adoption in modular housing and commercial fit-outs.

* Ease of Installation: Products designed for quick assembly (e.g., tongue-and-groove, integrated edge banding) will be favored by contractors.

4. Geographic Shifts & Supply Chain Resilience:

Asia-Pacific Leadership: China and India will remain dominant manufacturing hubs and key growth markets, driven by urbanization and infrastructure development. However, focus will shift towards higher-value, sustainable products.

* Nearshoring & Regionalization: Geopolitical tensions and supply chain vulnerabilities will encourage manufacturers in North America and Europe to source more regionally or invest in local production, impacting global trade flows.

* Raw Material Volatility Management:* Fluctuations in PVC resin and plasticizer prices will persist. Leading players will focus on long-term contracts, vertical integration, and alternative plasticizer development to mitigate risk.

5. Digitalization & Smart Manufacturing:

Adoption of Industry 4.0 technologies will increase:

* Precision Coating/Lamination: AI-driven process control for consistent quality and reduced waste.

* Digital Inventory & Traceability: Blockchain or RFID for tracking sustainable material origin and product lifecycle data, enhancing transparency for ESG reporting.

* Customization at Scale: Digital printing enabling cost-effective small-batch, customized panel production.

6. Competitive Intensification & Consolidation:

The market will see:

* Blurring Lines: Competition from advanced alternatives like PETG laminates, aluminum composites, and improved wood products will pressure innovation.

* M&A Activity: Larger players may acquire innovative SMEs specializing in sustainable formulations or digital printing to capture market share.

* Price Pressure vs. Value Premium: A clear divide will emerge between low-cost commodity products and premium, high-performance, certified sustainable offerings commanding significant price premiums.

Conclusion for H2 2026:

The Plywood PVC market in H2 2026 will be defined by a strategic pivot towards sustainability, performance, and digital integration. Success will depend on manufacturers’ ability to innovate with eco-friendly materials, deliver advanced functionalities, adapt to modular construction demands, ensure supply chain resilience, and leverage digital tools for efficiency and customization. The market will increasingly bifurcate, rewarding leaders in sustainable innovation while commoditizing basic products.

Common Pitfalls Sourcing Plywood PVC (Quality, IP)

Sourcing Plywood PVC—whether referring to PVC-coated plywood or a composite material—requires attention to both material quality and intellectual property (IP) considerations. Overlooking these aspects can lead to substandard products, legal risks, and supply chain disruptions.

Poor Material Quality and Inconsistent Specifications

One of the most prevalent issues in sourcing Plywood PVC is receiving materials that fail to meet required quality standards. This includes inconsistent thickness, poor adhesion of the PVC layer, warping, delamination, or surface defects such as bubbles and scratches. Suppliers, especially those in low-cost regions, may cut corners by using inferior adhesives or subpar wood cores. Without proper quality control protocols and third-party inspections, buyers risk project delays or product failures.

Lack of Standardized Testing and Certifications

Many suppliers do not provide verifiable test reports or certifications (e.g., for moisture resistance, fire retardancy, or formaldehyde emissions). This absence makes it difficult to confirm compliance with international standards such as EN, ASTM, or CARB. Relying solely on supplier claims without third-party validation increases the risk of non-compliance, particularly in regulated markets like construction or furniture manufacturing.

Inadequate Intellectual Property Verification

When sourcing innovative or branded Plywood PVC products, there’s a risk of inadvertently purchasing counterfeit or IP-infringing materials. Some suppliers may falsely claim proprietary technology, patented manufacturing processes, or brand affiliations. Without due diligence—such as verifying trademarks, patents, or licensing agreements—buyers may face legal liability, shipment seizures, or reputational damage.

Unreliable Supply Chain Transparency

Opaque supply chains make it difficult to trace raw material origins or manufacturing processes. This lack of transparency can hide unethical practices (e.g., illegal logging) or environmental non-compliance. It also complicates efforts to ensure consistent quality across batches, especially when subcontractors are involved without the buyer’s knowledge.

Miscommunication on Customization and Tolerances

Custom orders for specific dimensions, colors, or performance attributes often suffer from miscommunication. Differences in interpretation of technical drawings, color standards (e.g., Pantone vs. RAL), or tolerance levels can result in delivered goods that don’t fit the intended application. Clear documentation and sample approvals are essential but frequently overlooked.

Failure to Audit Suppliers Proactively

Many buyers rely on initial supplier assessments but fail to conduct regular audits or factory inspections. Over time, supplier practices can degrade, especially under cost pressure. Without ongoing oversight, quality and IP compliance can deteriorate between orders, leading to unexpected failures or legal exposure.

Logistics & Compliance Guide for Plywood PVC

Product Overview and Classification

Plywood PVC, also known as PVC-coated plywood or plastic-coated plywood, is a composite material made of a wooden core (typically plywood) with a protective layer of polyvinyl chloride (PVC) laminated onto one or both sides. This product is widely used in construction, transportation, and packaging due to its moisture resistance, durability, and ease of cleaning. Correct classification is essential for logistics and compliance, as it determines applicable regulations for transport, import/export, and environmental safety.

International Shipping and Packaging Requirements

When shipping Plywood PVC internationally, ensure the product is securely packed to prevent damage during transit. Use moisture-resistant wrapping and durable wooden or metal crating where necessary. Stacking must follow weight distribution guidelines to avoid deformation. For sea freight, comply with the International Maritime Dangerous Goods (IMDG) Code if applicable—though standard Plywood PVC is typically non-hazardous, verify based on adhesive or coating additives. Air freight must adhere to IATA regulations, focusing on weight, dimensions, and proper labeling.

Customs Documentation and Tariff Classification

Accurate customs documentation is crucial for smooth clearance. Required documents typically include a commercial invoice, packing list, bill of lading or air waybill, and certificate of origin. Classify Plywood PVC correctly using the Harmonized System (HS) Code. Common classifications fall under heading 4412 (Plywood, veneered panels, and similar laminated wood), with potential subheadings depending on thickness, composition, and surface treatment. Consult the importing country’s tariff schedule, as PVC lamination may affect duty rates or trigger anti-dumping measures.

Phytosanitary and ISPM 15 Compliance

Although Plywood PVC is often exempt from phytosanitary requirements due to manufacturing processes (heat and pressure during lamination), some countries may still require documentation. If wooden components originate from raw timber, compliance with ISPM 15 (International Standards for Phytosanitary Measures No. 15) may apply. Confirm whether the plywood core is made from raw lumber requiring heat treatment and marking. When in doubt, provide a phytosanitary certificate to avoid delays.

Environmental and Chemical Regulations

Plywood PVC may be subject to chemical and environmental regulations due to PVC content and adhesives. In the European Union, compliance with REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) and RoHS (Restriction of Hazardous Substances) may be required, particularly concerning plasticizers like phthalates. Ensure suppliers provide Substance of Very High Concern (SVHC) declarations. Additionally, verify compliance with local waste and recycling laws, as PVC disposal is regulated in many jurisdictions.

Import/Export Restrictions and Trade Compliance

Some countries impose restrictions on wood-based products to prevent illegal logging or protect native forests. Verify compliance with initiatives such as the Lacey Act (USA), which prohibits trade in illegally sourced wood. Maintain chain-of-custody documentation from raw material sourcing to finished product. Additionally, check for anti-dumping or countervailing duties on plywood imports, especially from regions like Southeast Asia, where such measures are commonly enforced.

Labeling and Marking Standards

Proper labeling ensures regulatory compliance and efficient handling. Export packages must include: product description, HS code, country of origin, net/gross weight, handling symbols (e.g., “Do Not Stack,” “Protect from Moisture”), and supplier/exporter information. If treated with flame-retardant chemicals, include safety data sheets (SDS) and appropriate hazard labels per GHS (Globally Harmonized System). For consumer or construction applications, ensure compliance with local building material labeling requirements.

Storage and Handling Best Practices

During storage, keep Plywood PVC in a dry, ventilated area off the ground to prevent moisture absorption and warping. Avoid exposure to direct sunlight or extreme temperatures, which can degrade the PVC layer. Use forklifts or pallet jacks for handling; never drag panels. Segregate from corrosive or reactive materials. Implement a first-in, first-out (FIFO) inventory system to minimize long-term storage risks.

Certifications and Supplier Verification

Work with suppliers who provide valid certifications, such as FSC or PEFC (for sustainable wood sourcing), ISO 9001 (quality management), and test reports for mechanical and fire performance. Request documentation proving compliance with destination country standards (e.g., CE marking in the EU, CARB in the USA). Conduct periodic audits to ensure ongoing regulatory adherence and supply chain transparency.

Conclusion

Successfully managing the logistics and compliance of Plywood PVC requires attention to material classification, international regulations, documentation, and environmental standards. Proactive planning, accurate labeling, and supplier due diligence minimize risks of shipment delays, customs penalties, or product rejection. Stay informed about evolving regulations in target markets to ensure continuous compliance and operational efficiency.

Conclusion for Sourcing Plywood and PVC:

Sourcing plywood and PVC requires a strategic approach that balances quality, cost, sustainability, and supply chain reliability. Both materials serve critical roles in construction, manufacturing, and design, and selecting the right suppliers ensures project durability and efficiency. It is essential to partner with reputable suppliers who comply with industry standards and environmental regulations, especially given growing concerns about deforestation and plastic waste. Evaluating factors such as material grade, certifications (e.g., FSC for plywood, REACH for PVC), lead times, and logistical capabilities will contribute to a successful procurement process. Additionally, considering alternative or composite materials may offer long-term benefits in terms of sustainability and performance. Ultimately, a well-informed sourcing strategy for plywood and PVC supports not only project success but also environmental responsibility and operational resilience.