The global metal finishing and surface treatment industry is experiencing robust growth, driven by rising demand for corrosion resistance, enhanced aesthetics, and improved functionality across the automotive, electronics, aerospace, and consumer goods sectors. According to a 2023 report by Mordor Intelligence, the global electroplating market was valued at USD 15.8 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.4% from 2023 to 2028. This expansion is fueled by advancements in plating technologies—such as electroless nickel plating, PVD (physical vapor deposition), and eco-friendly alternatives—as well as increasing regulatory focus on durability and sustainability in manufacturing. Additionally, Grand View Research highlights the growing integration of automation and digital monitoring systems in plating processes, enhancing precision and consistency for high-performance applications. As industries continue to prioritize quality and longevity, selecting a reliable plating partner has become critical. Below is a data-informed overview of the top 10 plating companies and manufacturers leading innovation, scalability, and technical excellence in this evolving landscape.

Top 10 Plating Companies Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Lincoln Industries

Domain Est. 2002

Website: lincolnindustries.com

Key Highlights: Lincoln Industries is a leader in advanced manufacturing, plating, and finishing solutions, serving top OEMs in trucking, powersports, and industrial ……

#2 The Armoloy Corporation

Domain Est. 1997

Website: armoloy.com

Key Highlights: Armoloy is a plating company with over 65 years of expertise in metal plating services and surface treatments for high-performance manufacturers worldwide….

#3 Industrial Plating Company

Domain Est. 2001

Website: sharrettsplating.com

Key Highlights: Sharretts Plating is a leader in industrial plating & metal finishing services in the U.S. Visit our site today for more info & contact us for a free quote!…

#4 Plating International, Inc.

Domain Est. 2009

Website: platinginternational.com

Key Highlights: Plating International is your one-stop shop for functional plating chemicals, equipment, and plating lines in North America….

#5 Durable Industrial Finishing Company

Website: difco.us.com

Key Highlights: We are a metal finishing company providing fast turn-around and excellent service! High-capacity metal plating lines ensure jobs are delivered on time….

#6 BFG Manufacturing

Domain Est. 1996

Website: zincplating.com

Key Highlights: A leader in the plating and coating industry for more than 75 years, BFG Manufacturing Services is known for innovative solutions and high-quality workmanship….

#7 Pioneer Metal Finishing

Domain Est. 1997

Website: pioneermetal.com

Key Highlights: Pioneer Metal Finisher processes for gold plating, chrome plating and more! Request a quote, find your finish, or explore quality finishing services….

#8 Advanced Plating

Domain Est. 1997

Website: advancedplating.com

Key Highlights: We are proud to have worked with some of the most talented builders and collectors on the most stunning machines in the world….

#9 Metal Plating Services

Domain Est. 1999

Website: arlingtonplating.com

Key Highlights: We pride ourselves on producing flawless, high performance finishes on aluminum, magnesium, steel and stainless steel, as well as copper alloys and zinc die ……

#10 Eastern Plating Company

Domain Est. 2007

Website: easternplatingcompany.com

Key Highlights: Eastern Plating Company provides metal anodizing and plating services to the defense, medical, aerospace & commercial industries….

Expert Sourcing Insights for Plating Companies

H2: 2026 Market Trends for Plating Companies

The global plating industry in 2026 is poised for significant transformation, driven by technological advancements, evolving regulatory landscapes, and shifting end-market demands. Here’s an analysis of key trends shaping the sector:

1. Sustainability and Regulatory Compliance Accelerate

Environmental regulations will be a dominant force in 2026. Stricter global standards—such as the EU’s REACH and RoHS expansions, U.S. EPA wastewater discharge limits, and China’s dual carbon goals—will compel plating companies to:

– Phase out hexavalent chromium, cyanide-based baths, and other hazardous chemistries.

– Invest in closed-loop water recycling, zero-liquid discharge (ZLD) systems, and advanced filtration.

– Adopt trivalent chromium, ionic liquids, and bio-based plating solutions.

– Increase transparency in chemical sourcing and waste management to meet ESG reporting requirements.

Companies unable to comply will face operational restrictions or closure, while leaders will leverage green certifications as competitive advantages.

2. Rise of Advanced and Functional Coatings

Demand for high-performance plating will grow, especially in aerospace, medical devices, and electric vehicles (EVs). Trends include:

– Wear and corrosion-resistant coatings: Nanocomposite coatings (e.g., Ni-P-PTFE, Ni-SiC) and PVD/DLC (diamond-like carbon) for extreme environments.

– Conductive and low-friction finishes: Essential for EV battery connectors, sensors, and high-efficiency motors.

– Antimicrobial plating: Increased adoption in healthcare and consumer products post-pandemic.

– Smart coatings: Incorporating sensors or self-healing properties via nanotechnology.

These value-added services will allow plating firms to move beyond commodity pricing into specialized, high-margin niches.

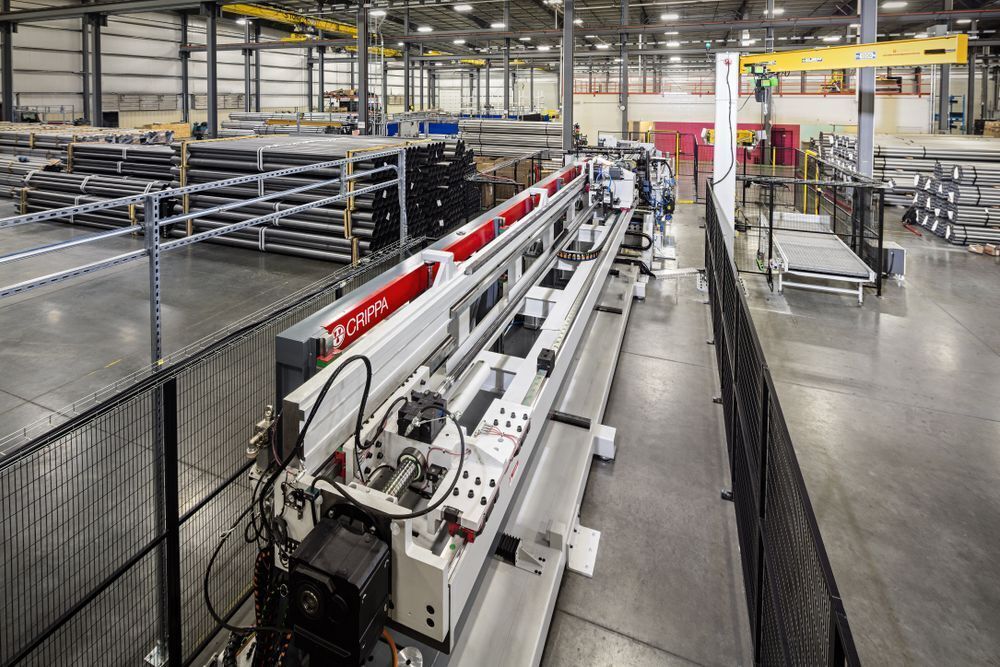

3. Automation and Digitalization Reshape Operations

By 2026, Industry 4.0 integration will be critical for competitiveness:

– Automated plating lines: Robotic handling, real-time bath monitoring, and AI-driven process optimization will improve consistency and reduce labor costs.

– Predictive maintenance: IoT sensors on rectifiers, filtration systems, and hoists will minimize downtime.

– Digital twins and simulation software: Used to model plating processes, reduce trial-and-error, and accelerate R&D.

– Blockchain for traceability: Ensuring material provenance and compliance across complex supply chains, especially in aerospace and defense.

Early adopters will gain efficiency gains of 15–25%, while laggards risk margin compression.

4. Supply Chain Resilience and Onshoring Pressures

Geopolitical instability and trade tensions will continue pushing manufacturers toward regionalization:

– Nearshoring and friend-shoring of plating services, particularly in North America and Europe.

– Increased demand for local plating capacity to support automotive, defense, and semiconductor industries.

– Strategic partnerships between platers and OEMs to ensure supply continuity.

Plating companies with agile, localized operations will benefit from shorter lead times and reduced logistics risk.

5. EV and Renewable Energy Drive Demand

The electrification megatrend will significantly boost plating volumes:

– EVs: Require extensive plating for battery terminals (nickel, tin, silver), motor components (copper, zinc-nickel), and connectors (gold, palladium).

– Solar and wind infrastructure: Corrosion-resistant coatings for offshore turbines and solar panel frames.

– Energy storage systems: Plated contacts and busbars in battery packs.

The EV sector alone could account for over 30% of new plating demand growth by 2026, particularly in fast-growing markets like Southeast Asia and India.

6. Talent Shortage and Workforce Transformation

The industry faces a growing skills gap:

– Aging workforce and lack of interest in industrial trades.

– Need for technicians skilled in automation, data analytics, and green chemistry.

Forward-thinking companies will invest in apprenticeship programs, partnerships with technical schools, and upskilling to retain talent.

Conclusion

By 2026, successful plating companies will be those that embrace sustainability, adopt digital technologies, and pivot toward high-value, application-specific services. Firms that innovate in eco-friendly processes, automate operations, and align with growth sectors like EVs and renewables will capture market share. Conversely, those reliant on outdated technologies and non-compliant processes risk obsolescence. The plating industry is evolving from a traditional finishing service to a strategic, technology-driven partner in advanced manufacturing.

Common Pitfalls When Sourcing Plating Companies (Quality, IP)

Sourcing plating services is a critical decision that impacts product performance, reliability, and compliance. While cost and lead time are often primary considerations, overlooking key risks—particularly in quality assurance and intellectual property (IP) protection—can lead to significant downstream problems. Below are common pitfalls to avoid:

Inadequate Quality Control Processes

Many plating companies lack robust, documented quality management systems. Without certifications like ISO 9001 or industry-specific standards (e.g., AS9100 for aerospace), there is no guarantee of consistent process control. Hidden issues such as inconsistent coating thickness, poor adhesion, or contamination may not surface until after parts are in use, leading to field failures and costly recalls.

Lack of Process Documentation and Traceability

A major red flag is when a supplier cannot provide detailed process sheets, material certifications, or lot traceability. Without clear documentation, it becomes nearly impossible to troubleshoot defects or verify compliance with specifications. In regulated industries (medical, automotive, defense), missing traceability can result in non-compliance and audit failures.

Poor Communication and Technical Misalignment

Some plating vendors may lack the technical expertise to fully understand your application requirements. Miscommunication about substrate materials, environmental exposure, or functional specifications (e.g., conductivity, solderability) can result in unsuitable plating finishes. Always ensure the supplier engages in technical dialogue and offers process validation (e.g., salt spray testing, adhesion tests).

Insufficient Capacity or Scalability

Choosing a plating partner based solely on low pricing may lead to issues when scaling production. Smaller shops may lack the equipment capacity, skilled labor, or process stability to maintain quality at higher volumes, resulting in inconsistent output and delivery delays.

Weak Intellectual Property Protections

Plating often involves proprietary designs, material specifications, or custom chemistries. A common pitfall is working with suppliers who do not sign non-disclosure agreements (NDAs) or have weak IP policies. Without legal safeguards, your designs or formulations could be exposed or misused, especially if the vendor serves competing clients.

Subcontracting Without Disclosure

Some plating companies subcontract work to third parties without informing the customer. This lack of transparency can compromise quality control and IP security, as you lose visibility into who is actually handling your parts and processes.

Regulatory and Environmental Non-Compliance

Plating processes involve hazardous chemicals and are subject to strict environmental regulations (e.g., RoHS, REACH, ELV). Sourcing from a company with poor environmental controls not only poses compliance risks but may also affect your own product’s marketability and corporate responsibility goals.

Failure to Validate with Sample Batches

Skipping pilot runs or first-article inspections is a frequent oversight. Always require sample plating under real production conditions and conduct thorough testing before full-scale rollout. This step uncovers compatibility issues and ensures the finish meets performance expectations.

Avoiding these pitfalls requires due diligence: audit potential suppliers, request certifications, enforce NDAs, and establish clear quality and IP agreements upfront. A well-vetted plating partner is an extension of your manufacturing process—choose accordingly.

Logistics & Compliance Guide for Plating Companies

This guide outlines essential logistics and regulatory compliance considerations for plating companies to ensure safe, efficient operations and adherence to environmental, health, and safety standards.

Regulatory Compliance Framework

Plating operations are subject to stringent federal, state, and local regulations due to the use of hazardous chemicals and generation of regulated waste. Key regulatory areas include:

- Environmental Protection Agency (EPA) Regulations: Compliance with the Clean Water Act (CWA), Clean Air Act (CAA), and Resource Conservation and Recovery Act (RCRA) is mandatory. This includes controlling wastewater discharges, managing air emissions, and properly handling hazardous waste.

- Occupational Safety and Health Administration (OSHA): Adherence to OSHA standards such as the Hazard Communication Standard (HazCom), Permissible Exposure Limits (PELs) for metals and chemicals, and requirements for personal protective equipment (PPE) and ventilation systems.

- State and Local Environmental Agencies: Many states have additional permitting and reporting requirements for plating facilities, including wastewater discharge permits (e.g., NPDES) and air quality permits.

- TSCA and Chemical Safety: Compliance with the Toxic Substances Control Act, particularly regarding the use and reporting of certain chemical substances.

Wastewater Management and Treatment

Proper handling and treatment of wastewater are critical to avoid environmental contamination and regulatory penalties.

- On-Site Treatment Systems: Install and maintain chemical precipitation, filtration, or ion exchange systems to remove heavy metals (e.g., chromium, nickel, cadmium) before discharge.

- pH Adjustment and Neutralization: Regularly monitor and adjust pH levels to meet discharge limits and prevent corrosion in piping systems.

- Sludge Handling: Classify and manage treatment sludge as hazardous or non-hazardous waste; ensure proper storage, labeling, and disposal via licensed hazardous waste contractors.

- Discharge Monitoring and Reporting: Conduct routine sampling and maintain detailed records of effluent quality. Submit Discharge Monitoring Reports (DMRs) as required by permit.

Hazardous Materials Handling and Storage

Safe handling and storage of plating chemicals minimize risks to workers and the environment.

- Chemical Inventory Management: Maintain a complete, up-to-date inventory of all chemicals, including Safety Data Sheets (SDS) readily accessible to employees.

- Segregation and Labeling: Store incompatible chemicals (e.g., acids and cyanides) separately in approved, labeled containers and cabinets.

- Spill Prevention and Control: Implement secondary containment (e.g., spill berms, trays) and maintain spill kits. Train staff on emergency response procedures.

- Ventilation Systems: Ensure functional fume hoods and local exhaust ventilation in plating and chemical handling areas to control airborne contaminants.

Waste Management and Disposal

Effective waste management ensures compliance and reduces liability.

- Waste Characterization: Test waste streams to determine if they are hazardous under RCRA (e.g., toxicity characteristic leaching procedure – TCLP).

- Accumulation Areas: Designate and label hazardous waste accumulation areas with time limits (90/180 days depending on generator status).

- Manifest System: Use EPA hazardous waste manifests for off-site shipment and retain records for at least three years.

- Recycling and Recovery: Explore metal recovery systems (e.g., drag-out rinses, electrowinning) to reduce waste volume and reclaim valuable materials.

Transportation and Logistics

Safe and compliant transportation of raw materials and waste is essential.

- DOT Regulations: Classify and package hazardous materials according to Department of Transportation (DOT) rules for shipping. Ensure proper labeling, marking, and documentation.

- Carrier Qualifications: Use only licensed and trained hazardous materials carriers for chemical and waste transport.

- Manifest Tracking: Monitor waste shipments from cradle-to-grave using tracking systems to ensure proper final disposal.

- Incoming Material Verification: Inspect chemical deliveries for damaged containers, proper labeling, and correct quantities.

Employee Training and Safety Programs

A well-trained workforce is key to compliance and operational safety.

- Initial and Refresher Training: Provide comprehensive training on chemical hazards, PPE use, emergency procedures, and regulatory requirements upon hire and annually.

- Emergency Response Plan: Develop and practice spill response, fire evacuation, and medical emergency procedures. Maintain contact lists for emergency responders.

- PPE Program: Supply appropriate PPE (e.g., gloves, aprons, face shields, respirators) and ensure proper use, maintenance, and replacement.

- Medical Surveillance: Implement medical monitoring programs where required (e.g., hexavalent chromium exposure).

Recordkeeping and Auditing

Robust documentation supports compliance and continuous improvement.

- Permit and Compliance Records: Maintain copies of all environmental permits, inspection reports, and regulatory correspondence.

- Training Logs: Document employee training dates, topics, and attendees.

- Monitoring and Maintenance Records: Keep logs of wastewater testing, air emissions, equipment maintenance, and spill incidents.

- Internal Audits: Conduct regular compliance audits to identify gaps and implement corrective actions proactively.

Sustainability and Continuous Improvement

Adopting sustainable practices enhances compliance and corporate responsibility.

- Pollution Prevention (P2): Implement process improvements such as drag-out reduction, water recycling, and chemical substitution to minimize waste.

- Energy Efficiency: Optimize tank heaters, rectifiers, and ventilation systems to reduce energy use.

- Supplier Collaboration: Work with chemical suppliers to reduce packaging waste and improve material safety.

- Certifications: Pursue industry certifications such as ISO 14001 (Environmental Management) to demonstrate commitment to compliance and sustainability.

By adhering to this guide, plating companies can ensure regulatory compliance, protect worker health and the environment, and maintain efficient, responsible operations.

Conclusion: Sourcing Plating Companies

In conclusion, sourcing the right plating company is a critical decision that directly impacts product quality, durability, compliance, and overall manufacturing success. A thorough evaluation process should consider key factors such as technical capabilities, quality certifications (e.g., ISO, NADCAP), material and plating method expertise (e.g., electroplating, electroless nickel, zinc, chrome), environmental and regulatory compliance, capacity, scalability, and customer service.

Prioritizing suppliers with a proven track record, robust quality control systems, and transparent communication ensures reliable performance and long-term partnership success. Additionally, conducting on-site audits or requesting samples can provide valuable insights into a vendor’s operational excellence.

Ultimately, selecting a plating partner that aligns with your technical, regulatory, and strategic requirements not only enhances product performance but also supports cost-efficiency and supply chain resilience. Investing time in due diligence during the sourcing process paves the way for a successful and sustainable supplier relationship.