The global packaging industry is witnessing robust expansion, driven by increasing e-commerce activity, rising food delivery services, and growing consumer demand for sustainable and durable packaging solutions. According to a report by Mordor Intelligence, the global food packaging market was valued at USD 352.4 billion in 2023 and is projected to grow at a CAGR of 5.2% from 2024 to 2029. Plate boxes, a critical component in foodservice and takeaway packaging, are benefiting significantly from this trend. With heightened emphasis on hygiene, convenience, and eco-friendly materials, manufacturers are innovating to meet stringent regulatory standards and evolving customer preferences. As demand surges across restaurants, catering services, and retail sectors, a competitive landscape of plate box producers has emerged—spanning from established industry leaders to agile regional suppliers. This list highlights the top 10 plate box manufacturers demonstrating excellence in product quality, scalability, sustainability practices, and market reach, based on production capacity, material innovation, and global distribution networks.

Top 10 Plate Box Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

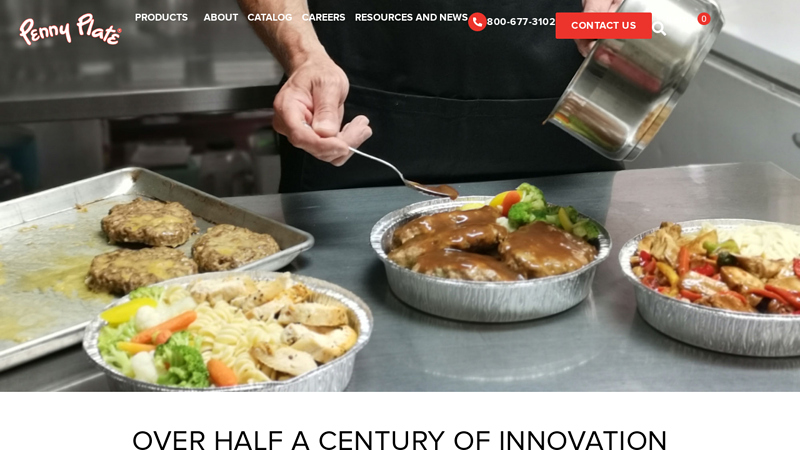

#1 Penny Plate

Domain Est. 1997

Website: pennyplate.com

Key Highlights: Penny Plate has established its position as an industry leader and the largest independently owned manufacturer of aluminum food containers….

#2 Printing Plate Manufacturer

Domain Est. 1997

Website: platecrafters.com

Key Highlights: PlateCrafters specializes in flexographic, offset, photopolymer & foil stamping plates. Custom dies, UV coating plates & pre-press services….

#3

Domain Est. 1998

Website: ajmpack.com

Key Highlights: Over the last 65 years, AJM has grown into a leading manufacturer of high-quality branded and private label paper products including paper plates, bowls, cups,…

#4 Bollant Industries

Domain Est. 2014

Website: bollant.com

Key Highlights: BOLLANT produces eco-friendly disposable products and packaging solutions for manufacturers out of the natural leaf and recycled paper….

#5 Beverage & Food Packaging

Domain Est. 1995

Website: dartcontainer.com

Key Highlights: From to-go containers and dinnerware to tamper-evident food packaging, our products have been keeping people on the go and having fun for 60+ years….

#6 Paper Plates

Domain Est. 1997

Website: graphicpkg.com

Key Highlights: Our plates are an ideal alternative to plastic and foam for individual portions. Designed with strength, stability, and with a grease-resistant barrier….

#7 Dixie® Cups, Paper Products & Disposable Tableware

Domain Est. 1998

Website: dixie.com

Key Highlights: Dixie® paper products make every meal more memorable. Explore a wide variety of premium, disposable paper plates, bowls, cups and more with Dixie®….

#8 ECO3

Domain Est. 2002

Website: eco3.com

Key Highlights: ECO3 is a leading global supplier of prepress and printing solutions to the graphic arts industry. CTP systems are a key part of our offering….

#9 World Centric

Domain Est. 2004

Website: worldcentric.com

Key Highlights: We manufacture compostable and reusable foodservice and packaging products and give 25% of our profits to social and environmental organizations….

#10 Disposable Eco Friendly Dinnerware

Domain Est. 2007

Website: verterra.com

Key Highlights: Explore VerTerra’s eco-friendly dinnerware collection. Shop now for sustainable, stylish, and biodegradable plates, bowls, and utensils….

Expert Sourcing Insights for Plate Box

H2 2026 Market Trends Analysis for Plate Box

As we approach the second half of 2026, the market for plate boxes—packaging solutions designed to protect and transport ceramic, glass, and other fragile dishware—is undergoing significant transformation. Driven by evolving consumer preferences, sustainability mandates, and technological advancements, key trends are reshaping demand, design, and competitive dynamics.

1. Sustainability as a Core Competitive Differentiator

By H2 2026, sustainability is no longer optional—it’s a primary purchasing criterion. Consumers and retailers demand eco-friendly packaging, pushing plate box manufacturers toward:

– Widespread Adoption of Recycled and Recyclable Materials: Boxboard made from 100% post-consumer recycled (PCR) fiber dominates the market. Virgin fiber use is minimized and only FSC-certified.

– Biodegradable and Compostable Alternatives: Innovations in molded fiber and bio-based plastics (e.g., PLA blends) are replacing traditional EPS foam inserts. These materials offer comparable protection while decomposing in industrial composting facilities.

– Plastic-Free Designs: Elimination of plastic windows, laminates, and sealing tapes accelerates. Paper-based coatings and water-based adhesives are now standard.

– Extended Producer Responsibility (EPR) Compliance: Brands investing in take-back programs and circular packaging models gain regulatory and reputational advantages.

2. E-Commerce Optimization Drives Design Innovation

With online sales of tableware continuing to grow, plate boxes are engineered for:

– Enhanced Drop and Crush Resistance: Reinforced corners, double-wall construction, and optimized internal cushioning (e.g., die-cut paper partitions) reduce damage rates in last-mile delivery.

– Right-Sized Packaging: AI-powered design tools enable custom-fit boxes that minimize void fill and dimensional weight, reducing shipping costs and carbon footprint.

– Unboxing Experience: Brands leverage the box as a touchpoint—featuring premium finishes, minimal branding, and seamless opening mechanisms to enhance perceived value.

3. Smart Packaging Integration Gains Traction

While still emerging, smart features are being piloted by leading brands:

– QR Codes and NFC Tags: Embedded in box flaps for instant access to care instructions, product origin, recycling guidance, and loyalty programs.

– Tamper-Evident Seals: Increasingly used to assure authenticity and safety, especially in premium and gift segments.

– Track-and-Trace Capabilities: Integrated with logistics platforms to improve supply chain visibility and reduce loss.

4. Customization and Niche Market Expansion

Mass customization enables:

– Bespoke Designs for DTC Brands: Small-batch, on-demand plate box production allows artisanal ceramicists and independent designers to compete with established players.

– Subscription and Gift Packaging: Seasonal or themed boxes with personalized messaging see rising demand, particularly in the gifting segment.

– Regional and Cultural Adaptation: Packaging tailored to local aesthetics and gifting traditions (e.g., minimalist designs in Scandinavia, vibrant patterns in Southeast Asia) gains importance.

5. Supply Chain Resilience and Regionalization

Geopolitical instability and logistics volatility prompt:

– Nearshoring of Production: Brands shift from offshore to regional manufacturing hubs to reduce lead times and exposure to trade disruptions.

– Strategic Inventory Buffering: Just-in-time models are balanced with safety stock for critical packaging components.

– Supplier Diversification: Companies actively reduce dependency on single material sources, especially for specialty papers and adhesives.

Strategic Implications for Plate Box Manufacturers

To thrive in H2 2026, stakeholders must:

– Invest in R&D for Sustainable Materials: Prioritize innovations that maintain performance while meeting circular economy goals.

– Leverage Digital Design Tools: Offer rapid prototyping and customization services to meet agile market demands.

– Strengthen End-of-Life Infrastructure Partnerships: Collaborate with recyclers and municipalities to ensure packaging is effectively recovered.

– Focus on Total Cost of Ownership (TCO): Demonstrate value through reduced damage rates, lower shipping costs, and brand equity enhancement—not just unit price.

In conclusion, the H2 2026 plate box market is defined by sustainability, e-commerce adaptation, and smart integration. Winners will be those who combine environmental responsibility with functional innovation and supply chain agility.

Common Pitfalls Sourcing Plate Box (Quality, IP)

When sourcing plate boxes—particularly in industries such as oil and gas, power generation, or heavy manufacturing—overlooking quality and intellectual property (IP) considerations can lead to significant operational, legal, and financial risks. Below are key pitfalls to avoid:

Poor Material and Manufacturing Quality

Sourcing plate boxes from suppliers without stringent quality controls can result in substandard materials or workmanship. Common issues include improper welding, incorrect thickness, or use of non-compliant alloys, which compromise structural integrity and safety. Always verify certifications (e.g., ISO, ASME, or EN standards) and conduct third-party inspections when possible.

Lack of Traceability and Documentation

Many low-cost suppliers fail to provide full material traceability (e.g., mill test certificates) or fabrication records. This absence makes it difficult to verify compliance with project specifications and can create problems during audits or regulatory inspections.

Inadequate Testing and Certification

Some suppliers may claim compliance but skip essential non-destructive testing (NDT) like ultrasonic or radiographic testing. Always confirm that the plate box undergoes required quality checks and comes with a full test package.

Intellectual Property (IP) Infringement Risks

Using designs or technical specifications without proper licensing can expose your organization to IP violations. This is especially relevant when sourcing from regions with weak IP enforcement. Ensure that the supplier has the right to manufacture the design and that your use of the equipment doesn’t infringe on patented technologies.

Reverse Engineering Without Authorization

Some suppliers replicate OEM plate boxes without permission, leading to counterfeit or imitation products. While these may appear cost-effective, they often lack performance validation and expose buyers to legal liability and warranty issues.

Ambiguous Ownership of Custom Designs

If you provide custom engineering drawings or specifications to a supplier, failing to establish IP ownership in the contract may allow the supplier to reuse or resell your design. Always include IP clauses that clearly assign rights to your organization.

Supply Chain Transparency Gaps

Hidden subcontractors or unverified supply chains increase the risk of receiving non-compliant components. Insist on transparency in the manufacturing process and audit rights when sourcing mission-critical equipment.

Avoiding these pitfalls requires due diligence, clear contractual terms, and working with reputable suppliers who prioritize quality assurance and IP compliance.

Logistics & Compliance Guide for Plate Box

This guide outlines the essential logistics and compliance considerations for handling, transporting, and managing Plate Box shipments. Adhering to these guidelines ensures operational efficiency, regulatory compliance, and product integrity.

Packaging and Handling Requirements

Plate Boxes must be properly packaged to prevent damage during transit. Use sturdy, corrugated cardboard boxes that are specifically designed for flat, rigid items. Each plate should be separated with protective interleaf paper or foam inserts to avoid scratching. Seal boxes securely with reinforced tape and label them clearly with handling instructions such as “Fragile” and “This Side Up.” Avoid over-packing to prevent structural failure of the box.

Transportation and Shipping Protocols

Ship Plate Boxes via carriers experienced in handling fragile or high-value goods. Ensure boxes are palletized when shipping in bulk, secured with stretch wrap, and protected with edge boards. Maintain a controlled supply chain to minimize handling touchpoints. Use temperature-controlled vehicles if environmental exposure (e.g., extreme heat or moisture) could compromise packaging or contents. Always choose shipping methods with tracking and delivery confirmation.

Regulatory Compliance

Ensure all Plate Box shipments comply with local, national, and international regulations. For cross-border shipments, complete accurate customs documentation, including commercial invoices, packing lists, and certificates of origin. Verify compliance with import/export restrictions, especially when transporting goods containing materials subject to environmental or trade regulations (e.g., certain wood-based packaging materials under ISPM 15). Where applicable, adhere to REACH, RoHS, or other relevant product safety standards.

Storage Conditions

Store Plate Boxes in a dry, climate-controlled environment with stable temperatures between 15°C and 25°C (59°F to 77°F) and relative humidity below 60%. Stack boxes no higher than three layers unless on pallets and using industrial racking. Avoid direct sunlight and contact with water or chemicals. Implement a first-in, first-out (FIFO) inventory system to prevent prolonged storage and potential degradation.

Documentation and Traceability

Maintain complete and accurate records for each Plate Box shipment, including batch numbers, production dates, destination, and carrier details. Use barcodes or RFID tags for real-time inventory tracking. Retain documentation for a minimum of five years to support audits, recalls, or compliance verification. Digital logs should be backed up regularly and secured against unauthorized access.

Sustainability and Disposal

Follow environmental regulations for packaging waste. Use recyclable or biodegradable materials wherever possible. Clearly label recyclable components and provide disposal instructions to customers. Comply with Extended Producer Responsibility (EPR) schemes where applicable. Partner with logistics providers committed to carbon reduction and sustainable practices to align with corporate environmental goals.

Incident Reporting and Corrective Actions

Establish a protocol for reporting and addressing logistics-related incidents such as damaged shipments, delivery delays, or compliance violations. Document all incidents, conduct root cause analyses, and implement corrective actions promptly. Communicate with affected parties and update standard operating procedures to prevent recurrence.

Conclusion for Sourcing Plate Box:

After a comprehensive evaluation of potential suppliers, cost structures, material quality, and logistical considerations, the sourcing of plate boxes has been strategically aligned with suppliers who offer a balance of durability, cost-efficiency, and reliable delivery. Selecting suppliers with certified materials and sustainable manufacturing practices ensures product integrity and supports environmental responsibility. Additionally, establishing long-term partnerships with vendors offering scalability and consistent quality will enhance supply chain resilience. In conclusion, the chosen sourcing strategy for plate boxes meets current operational demands while allowing flexibility for future growth and market changes.