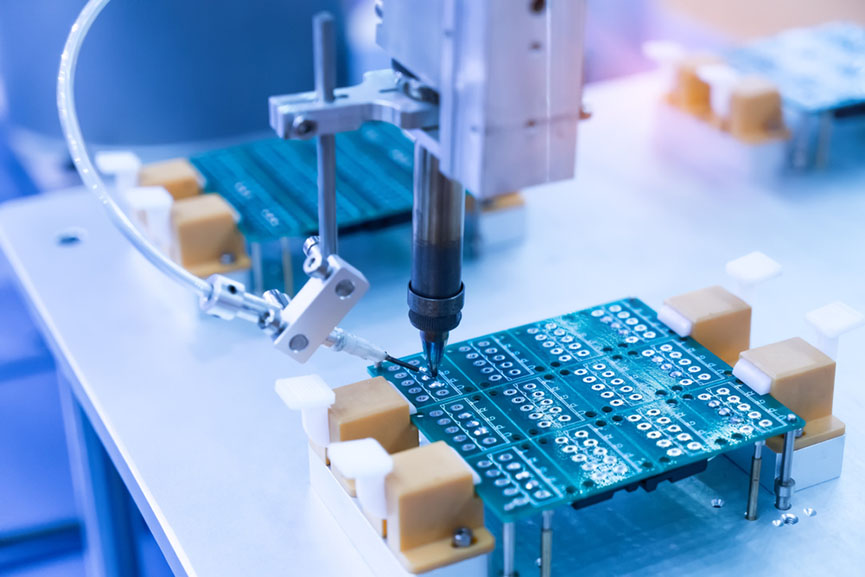

The global plastic standoffs market is experiencing steady expansion, driven by rising demand in electronics, telecommunications, and automotive industries for reliable, lightweight, and corrosion-resistant hardware. According to Grand View Research, the global plastic fasteners market—of which standoffs are a key segment—was valued at USD 86.5 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. This growth is fueled by the increasing adoption of plastic components in place of metal counterparts due to their electrical insulation properties, reduced weight, and resistance to environmental degradation. As manufacturers seek high-performance, cost-effective solutions, plastic standoffs have become critical in PCB assembly, enclosures, and modular designs. In this evolving landscape, a select group of manufacturers have emerged as leaders, combining innovation, scalability, and material expertise to meet stringent industry standards. Based on market presence, product range, and technical capabilities, here are the top 9 plastic standoffs manufacturers shaping the future of industrial and electronic hardware.

Top 9 Plastic Standoffs Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Plastic Spacers – Standoffs – Dowel Pins

Domain Est. 1997

Website: bulte.com

Key Highlights: At Bülte you will find a complete range of spacers, dowel pins and plastic standoffs with more than 4,500 dimensions for all applications and industrial sectors ……

#2 Standoffs & Spacers

Domain Est. 1995

Website: mouser.com

Key Highlights: $4.99 deliveryMouser is an authorized distributor for many standoff & spacer manufacturers including Essentra, Harwin, Keystone Electronics, PEM, RAF Electronic Hardware, ……

#3 Products

Domain Est. 1996

Website: pemnet.com

Key Highlights: Standoffs are a versatile family of fasteners designed to hold a fixed gap between two panels via some static attachment….

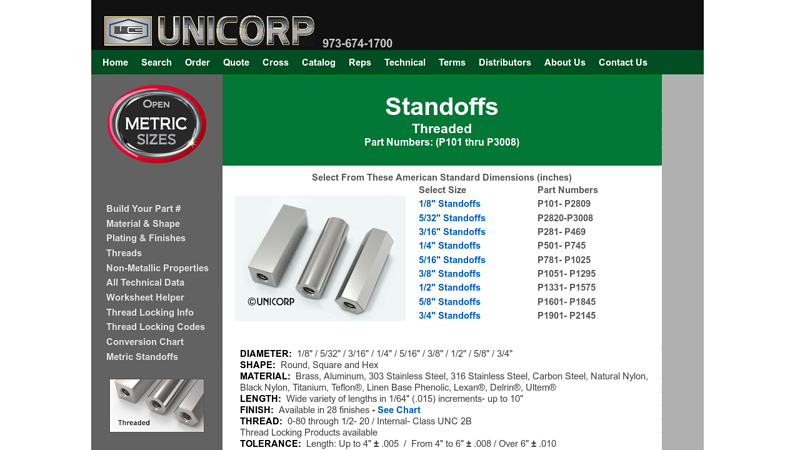

#4 Standoffs by UNICORP Standard/Metric

Domain Est. 1996

Website: unicorpinc.com

Key Highlights: Unicorp Standoffs round-square-hex, 28 finishes, available in brass, aluminum, stainless steel, carbon steel, nylon, Teflon, Phenolic, Lexan, Delrin, Ultem….

#5 Standoffs

Domain Est. 1996

Website: dbroberts.com

Key Highlights: Composed of materials like metal or plastic, standoffs provide structural support while preventing electrical contact between components. They are crucial ……

#6 Hex Hybrid Standoffs

Domain Est. 1998

Website: daviesmolding.com

Key Highlights: Upgrade your project with Davies Molding’s Hex Hybrid Standoffs. Durable and customizable, our standoffs are ideal for a range of applications….

#7 Hex PCB Standoffs

Domain Est. 2012

Website: essentracomponents.com

Key Highlights: Hex PCB standoffs and pillars for your PCB applications at Essentra Components US. Download 3D CADs, get free samples & quotes online!…

#8 Wholesale Nylon Standoffs

Domain Est. 2015

Website: rcfastener.com

Key Highlights: Nylon standoffs & spacers create space in printed circuit boards, preventing unwanted contact between components. Available in metric & standard sizing….

#9 Standoffs and long nuts

Website: ettinger.de

Key Highlights: Order high-quality standoffs made of steel, stainless steel, brass, aluminum, and other materials for electronic circuit boards from ETTINGER GmbH….

Expert Sourcing Insights for Plastic Standoffs

H2: 2026 Market Trends for Plastic Standoffs

The global market for plastic standoffs is poised for steady growth through 2026, driven by increasing demand across electronics, telecommunications, automotive, and industrial sectors. As miniaturization, lightweighting, and cost-efficiency remain key priorities, plastic standoffs are gaining traction over their metal counterparts in many applications. Below are the key trends shaping the plastic standoff market in 2026:

1. Rising Adoption in Consumer Electronics

The proliferation of compact consumer electronics—such as smartphones, tablets, wearables, and IoT devices—is fueling demand for lightweight and non-conductive fastening solutions. Plastic standoffs offer excellent electrical insulation, corrosion resistance, and design flexibility, making them ideal for densely packed PCB assemblies. In 2026, this segment continues to dominate consumption, particularly in Asia-Pacific manufacturing hubs.

2. Shift Toward High-Performance Plastics

Material innovation is a critical trend, with growing use of engineering thermoplastics like nylon (PA6, PA66), PEEK, and polycarbonate. These materials offer enhanced mechanical strength, temperature resistance, and flame retardancy, enabling plastic standoffs to perform reliably in challenging environments. Manufacturers are increasingly customizing formulations to meet industry-specific standards, such as UL 94 V-0 for flammability.

3. Sustainability and Circular Economy Pressures

Environmental regulations and corporate sustainability goals are pushing demand for recyclable and bio-based plastics. In 2026, leading suppliers are introducing standoffs made from recycled polymers or bioplastics to reduce carbon footprints. Product life cycle assessments (LCAs) are becoming standard in procurement decisions, especially in European and North American markets.

4. Growth in Electric Vehicles (EVs) and Advanced Automotive Systems

The automotive sector is emerging as a high-growth application area. Plastic standoffs are increasingly used in EV battery packs, power electronics, and ADAS modules due to their lightweight nature and electrical insulation properties. As vehicle electrification accelerates globally, demand for plastic standoffs in under-the-hood and interior electronics is expected to rise significantly by 2026.

5. Regional Manufacturing Shifts and Supply Chain Resilience

Geopolitical factors and trade dynamics are prompting companies to diversify production. In 2026, there is a notable shift toward localized manufacturing in North America and Southeast Asia to mitigate supply chain risks. This trend is encouraging regional suppliers to expand capacity and improve just-in-time delivery models for plastic standoff components.

6. Automation and Precision Engineering

Advancements in automated assembly lines and surface-mount technology (SMT) are driving demand for standoffs with tight tolerances and consistent quality. In 2026, manufacturers are investing in precision molding and quality control systems to meet the demands of high-speed electronics production.

Conclusion

By 2026, the plastic standoff market is expected to grow at a CAGR of approximately 4.5–5.2%, reaching a market value of over USD 650 million. Innovation in materials, sustainability, and application-specific design will be key differentiators. Companies that align with electrification trends, environmental standards, and regional supply chain needs are likely to capture the largest market share in this evolving landscape.

Common Pitfalls Sourcing Plastic Standoffs (Quality, IP)

Sourcing plastic standoffs involves navigating several potential quality and intellectual property (IP) challenges that can impact product performance, compliance, and legal standing. Overlooking these pitfalls can lead to supply chain disruptions, increased costs, or even product recalls.

Poor Material Quality and Inconsistent Specifications

One of the most frequent issues when sourcing plastic standoffs is receiving components made from substandard or inconsistent materials. Suppliers, particularly those offering low-cost options, may use recycled plastics, incorrect resin types (e.g., using ABS instead of UL-rated polycarbonate), or fail to adhere to dimensional tolerances. This compromises mechanical strength, heat resistance, and electrical insulation properties—critical factors in applications involving electronics or harsh environments.

Lack of Compliance with Industry Standards

Many plastic standoffs are expected to meet specific standards such as UL 94 flammability ratings, RoHS, or REACH compliance. However, some suppliers provide false or uncertified claims about compliance. Without proper documentation or third-party testing, sourced standoffs may fail safety certifications, risking non-compliance during audits or product certification processes.

Inadequate IP Due Diligence and Risk of Counterfeit Designs

Sourcing from generic or unauthorized manufacturers increases the risk of inadvertently using standoffs that infringe on patented designs or trademarks. Some suppliers replicate proprietary standoff geometries or branding without licensing, exposing the buyer to legal liability. Additionally, custom-designed standoffs may lack proper IP assignment agreements, leaving ownership unclear and potentially jeopardizing product differentiation.

Insufficient Supplier Qualification and Traceability

Working with suppliers who lack robust quality management systems (e.g., ISO 9001) or traceability practices can result in batch inconsistencies and difficulty in root-cause analysis during failures. Without lot traceability or material certifications, it becomes challenging to verify the origin of components or respond effectively to quality issues in the field.

Misrepresentation of IP Ratings (Ingress Protection)

For standoffs used in outdoor or harsh environments, false claims about IP ratings are a significant concern. Some suppliers label products as “IP67-rated” without undergoing proper testing. Since plastic standoffs themselves don’t typically carry an IP rating—rather, they contribute to an assembly’s overall enclosure rating—misunderstanding or misrepresenting their role can lead to design flaws and field failures in dust or moisture resistance.

Conclusion

To mitigate these risks, buyers should conduct thorough supplier audits, demand material certifications, validate compliance claims through independent testing, and ensure clear IP agreements—especially for custom designs. Engaging reputable manufacturers and avoiding the lowest-cost options without due diligence is key to ensuring reliable, compliant, and legally sound sourcing of plastic standoffs.

Logistics & Compliance Guide for Plastic Standoffs

Overview

Plastic standoffs are non-conductive spacers used in electronics, manufacturing, and assembly applications to separate components, provide mechanical support, and ensure proper alignment. Due to their widespread use across industries, proper logistics handling and regulatory compliance are essential for safe and efficient distribution.

Material Classification & Handling

Plastic standoffs are typically made from materials such as nylon, acetal (POM), polyethylene (PE), or polypropylene (PP). These materials are generally non-hazardous, but proper classification under international shipping standards (e.g., IATA, IMDG, ADR) must be confirmed based on additives or flame-retardant treatments.

- Non-Hazardous Classification: Most standard plastic standoffs are classified as non-dangerous goods.

- Flame-Retardant Additives: If standoffs contain halogenated flame retardants or other regulated substances, they may fall under hazardous material regulations.

- Static Sensitivity: Plastic components can generate static electricity; anti-static packaging may be required for sensitive electronic applications.

Packaging Requirements

Proper packaging ensures product integrity and compliance during transit.

- Inner Packaging: Use moisture-resistant bags (e.g., polyethylene) to prevent contamination and static buildup.

- Outer Packaging: Sturdy corrugated cardboard boxes designed to withstand stacking and handling.

- Labeling: Include product part number, quantity, material type, RoHS/REACH compliance status, and handling symbols (e.g., “Fragile,” “Do Not Stack”).

- ESD Protection: For use in electronics, consider static-dissipative or conductive packaging per ANSI/ESD S20.20 standards.

Transportation & Shipping

Plastic standoffs are generally suitable for all standard transportation modes (air, sea, road, rail), but documentation and labeling must comply with regional regulations.

- Air Freight (IATA): Confirm non-hazardous status; include UN3481 (if applicable for lithium battery equipment) only if standoffs are shipped with such devices.

- Ocean Freight (IMDG): No special requirements for non-treated plastics; ensure moisture protection for containerized shipping.

- Ground Transport (ADR/RID): Applicable only if flame-retardant or chemical-treated; otherwise, standard cargo rules apply.

Regulatory Compliance

Ensure adherence to global and regional regulations based on destination markets.

RoHS (Restriction of Hazardous Substances)

- Applicable to electrical and electronic equipment in the EU and other regions.

- Verify that plastic standoffs do not contain restricted substances (e.g., lead, cadmium, hexavalent chromium, PBB, PBDE, DEHP, BBP, DBP, DIBP).

- Provide RoHS compliance documentation upon request.

REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals)

- Requires disclosure of Substances of Very High Concern (SVHC) above 0.1% weight by weight.

- Confirm that raw materials used in plastic standoffs are registered under REACH.

- Maintain a compliance dossier for EU shipments.

Proposition 65 (California, USA)

- If standoffs contain listed chemicals (e.g., certain phthalates or flame retardants), a warning label may be required.

- Conduct material analysis if used in consumer products sold in California.

UL/CSA Certification

- If standoffs are used in safety-critical or electrical applications, certification to UL 94 (flammability ratings) may be required.

- Common ratings: UL 94 V-0, V-1, or V-2 for flammability resistance.

Customs Documentation

Accurate documentation ensures smooth customs clearance.

- Commercial Invoice: Include HS Code (e.g., 3917.39 for plastic tubes, pipes, and hoses fittings – may vary based on form and use), country of origin, material composition, and value.

- Packing List: Detailed breakdown of contents per package.

- Certificate of Origin: Required for preferential tariff treatment under trade agreements.

- Compliance Statements: Attach RoHS, REACH, or other relevant compliance certificates as needed.

Storage Conditions

Proper warehousing preserves product quality.

- Environment: Store in dry, temperature-controlled areas (15–25°C recommended).

- Humidity: Keep below 60% RH to prevent moisture absorption (especially for nylon).

- Shelf Life: Most plastic standoffs have no expiration, but prolonged UV exposure or extreme temperatures may degrade performance.

End-of-Life & Environmental Considerations

Support sustainability and regulatory compliance through responsible disposal.

- Recyclability: Most thermoplastics (nylon, acetal, PE, PP) are recyclable; provide guidance to customers.

- WEEE Compliance: If used in electronic devices, ensure standoffs do not hinder recyclability of end-of-life equipment.

- Waste Disposal: Follow local regulations; avoid incineration of halogen-containing plastics due to dioxin risk.

Summary

Plastic standoffs are low-risk components from a logistics and compliance standpoint, but attention to material content, packaging, regulatory standards, and documentation is essential—especially for international distribution. Proactively verifying compliance with RoHS, REACH, UL, and regional requirements ensures market access and customer confidence.

Conclusion for Sourcing Plastic Standoffs

After evaluating various suppliers, materials, specifications, and cost considerations, it is evident that sourcing plastic standoffs requires a balanced approach that prioritizes quality, durability, compatibility, and cost-efficiency. Plastic standoffs offer advantageous properties such as electrical insulation, corrosion resistance, lightweight design, and versatility in applications across electronics, industrial equipment, and consumer devices.

The optimal sourcing strategy involves selecting suppliers that provide consistent product quality, compliance with industry standards (e.g., RoHS, UL), and the ability to customize sizes, materials (e.g., nylon, PEEK, acetal), and mounting configurations to meet specific design requirements. Additionally, considering lead times, minimum order quantities, and long-term supply reliability is essential to ensure seamless integration into manufacturing or assembly processes.

In conclusion, by partnering with reputable suppliers and maintaining clear specifications, organizations can secure high-performance plastic standoffs that enhance product reliability and longevity while controlling costs and supporting efficient production workflows. Regular evaluation of supplier performance and emerging material technologies will further ensure continued competitiveness and quality in future procurement cycles.