The global plastic media blasting market is experiencing steady growth, driven by increasing demand for non-abrasive surface finishing solutions across aerospace, automotive, and industrial maintenance sectors. According to a 2023 report by Mordor Intelligence, the abrasive blasting market—of which plastic media is a rapidly expanding segment—is projected to grow at a CAGR of over 4.5% from 2023 to 2028. This growth is fueled by the rising preference for environmentally sustainable and substrate-safe cleaning methods, with plastic media emerging as a preferred alternative to silica sand and other aggressive abrasives. Grand View Research further underscores this trend, noting that advancements in polymer-based blasting materials are enhancing efficiency and reducing secondary damage during surface preparation and paint stripping. As industries prioritize precision, reusability, and compliance with environmental regulations, the need for high-performance plastic media has intensified. In this competitive landscape, a select group of manufacturers have distinguished themselves through innovation, scalability, and product consistency—making them key players in shaping the future of non-destructive surface treatment technologies.

Top 10 Plastic Media Blasting Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 SurfacePrep

Domain Est. 1995

Website: surfaceprep.com

Key Highlights: SurfacePrep is the largest network of distributors of blasting and vibratory media, specialty abrasives, and industrial blasting equipment….

#2 Plastic Blast Media

Domain Est. 1996

Website: compomat.com

Key Highlights: Manufacturer of Plastic Media Abrasives for economical paint removal and blast cleaning. Excellent results on cars, trucks, airplanes, steel and aluminum….

#3 OPTI

Domain Est. 1997

Website: products.kleenblast.com

Key Highlights: To ensure consistent quality, we manufacture ALL of our plastic blast media. We are the ONLY true manufacturer of plastic abrasives as many competitors do ……

#4 Plastic Blast Media

Domain Est. 1999

Website: optiblast.com

Key Highlights: Opti-Blast manufactures and supplies quality, mil-spec approved plastic blast media to MROs, military, and industries worldwide. Contact us….

#5 Blast Media

Domain Est. 1996

Website: maxiblast.com

Key Highlights: US-made plastic blast media for mold cleaning, paint removal, deflashing. Granulated plastic, engineered thermoplastic & abrasive media options….

#6 Sand, Abrasive, Wet and Vapor Blaster Cabinets

Domain Est. 1996

Website: mediablast.com

Key Highlights: Media Blast & Abrasives is the go-to source for top-quality sandblasting cabinets, abrasive blasting cabinets, and wet vapor blasting solutions made in the USA….

#7 Clemco Industries

Domain Est. 1999

Website: clemcoindustries.com

Key Highlights: Clemco is a global leader in abrasive blasting, cleaning, shot peening, and surface preparation solutions, serving industries from aerospace and energy to ……

#8 Abrasive Blasting Media

Domain Est. 2001

Website: kramerindustriesonline.com

Key Highlights: Shop abrasive blasting media from Kramer Industries—trusted media blasting suppliers for surface prep, cleaning, and finishing across industries….

#9 MEDIA BLASTING FAQS

Domain Est. 2011

Website: dustlessblasting.com

Key Highlights: Get answers to the most common questions about media blasting, including what it is, how it works, and the different types of blasting….

#10 Plastic blast media from the Fischer GmbH

Website: fischer-jetplast.de

Key Highlights: A brilliant product. FISCHER JETplast® has a gentle impact to surfaces without penetrating them – a big advantage compared to standard abrasive blasting media….

Expert Sourcing Insights for Plastic Media Blasting

H2: 2026 Market Trends for Plastic Media Blasting

By 2026, the plastic media blasting market is poised for continued evolution driven by environmental regulations, technological advancements, and shifting industrial demands. Key trends shaping the landscape include:

1. Accelerated Shift Toward Eco-Friendly and Biodegradable Media:

Environmental regulations, particularly in North America and Europe, are increasingly restricting the use of non-recyclable and hazardous blasting materials. This is driving significant innovation and adoption of biodegradable plastic media derived from plant-based polymers (e.g., polylactic acid – PLA) or recycled content. By 2026, suppliers offering sustainable, low-impact media with verifiable end-of-life pathways will gain a competitive edge, especially in regulated industries like aerospace and automotive.

2. Growth in Reusable and Recyclable Media Systems:

Cost-efficiency and sustainability goals are pushing the market toward closed-loop systems where plastic media can be effectively recycled and reused. Advanced separator technologies and automated reclamation systems will become more common, reducing operational costs and waste output. Manufacturers investing in durable, high-recyclability media grades will benefit from rising demand in cost-sensitive sectors such as general manufacturing and restoration.

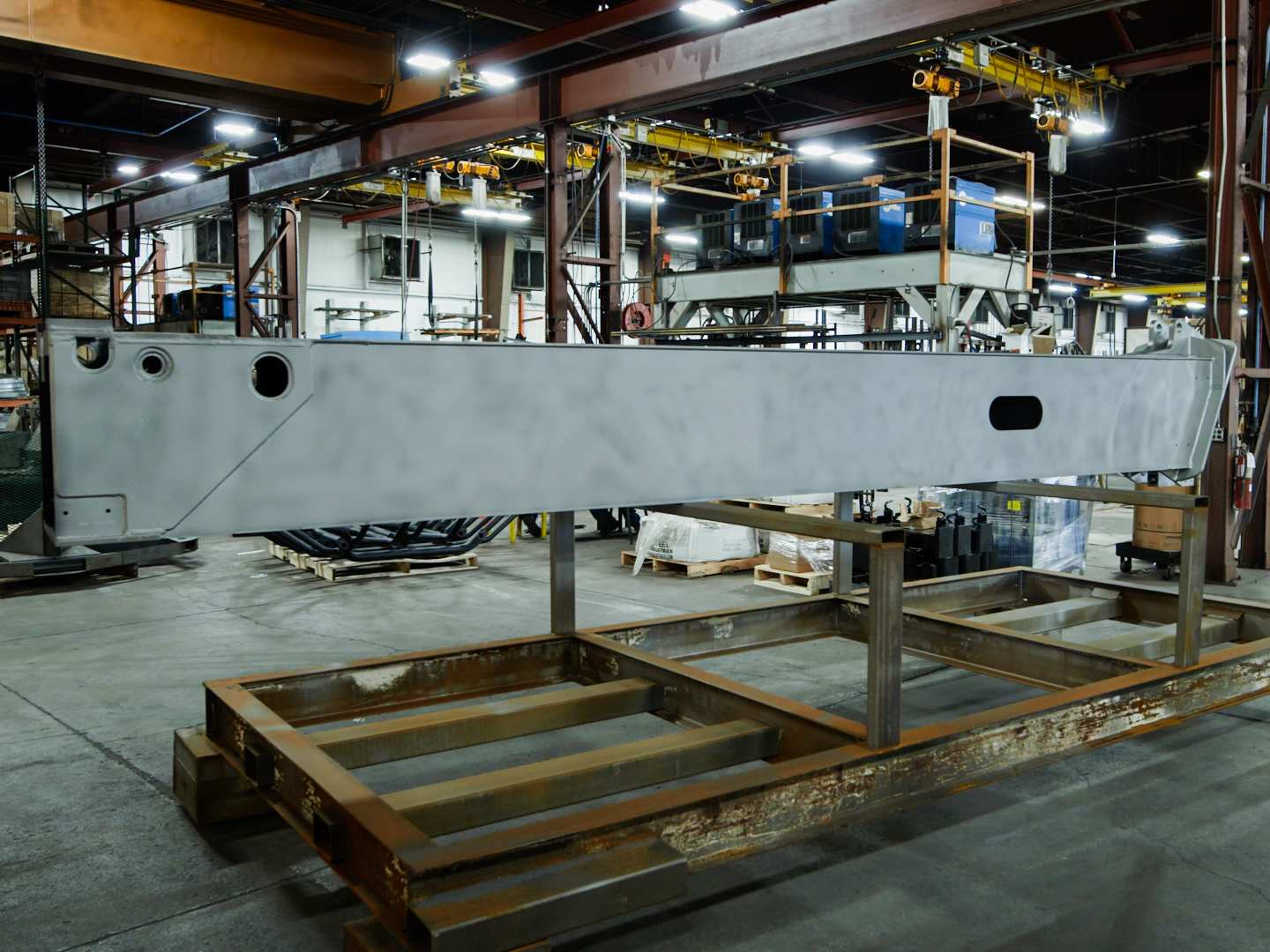

3. Expansion in Aerospace and Automotive Maintenance, Repair, and Overhaul (MRO):

Plastic media blasting remains a preferred non-destructive method for paint stripping and surface preparation in aerospace composites and sensitive aircraft components. With increasing global air traffic and aging fleets, the MRO sector will drive demand. Similarly, in the automotive industry, plastic media is used for refurbishing wheels, engine parts, and molds. Electric vehicle (EV) production growth will also create new applications for cleaning battery enclosures and lightweight composite parts.

4. Integration with Automation and Robotics:

To improve precision, consistency, and worker safety, plastic media blasting systems are increasingly being integrated into robotic cells and automated production lines. By 2026, smart blasting systems with real-time monitoring, adjustable pressure controls, and data analytics will gain traction, especially in high-volume manufacturing environments seeking repeatability and reduced human exposure to dust.

5. Regional Market Diversification and Supply Chain Resilience:

While North America and Europe remain dominant due to strict environmental standards and mature industrial bases, emerging markets in Asia-Pacific (notably India and Southeast Asia) will see faster growth due to expanding manufacturing and infrastructure development. Companies will focus on regionalizing supply chains to mitigate disruptions and meet localized regulatory requirements.

6. Competitive Pressure and Innovation in Media Formulations:

The market will experience consolidation and heightened competition, pushing suppliers to innovate in media hardness, particle shape, and dust suppression properties. Customized media blends tailored for specific substrates (e.g., composites, aluminum, or delicate alloys) will become more prevalent, allowing end-users to achieve optimal surface profiles without substrate damage.

In summary, the 2026 plastic media blasting market will be defined by sustainability, automation, and precision. Companies that prioritize environmental compliance, invest in recyclable technologies, and adapt to evolving industrial needs will be best positioned for growth.

Common Pitfalls Sourcing Plastic Media Blasting (Quality, IP)

Sourcing Plastic Media Blasting (PMB) services involves more than selecting a vendor—it requires careful attention to both material quality and intellectual property (IP) considerations. Overlooking these aspects can lead to project delays, compromised results, and legal risks. Below are key pitfalls to avoid:

Poor Media Quality and Inconsistent Blasting Performance

One of the most frequent issues is receiving substandard or inconsistent plastic media. Low-quality media may contain impurities, inconsistent particle sizes, or improper hardness, leading to uneven surface finishes, substrate damage, or incomplete coating removal. This compromises the effectiveness of the blasting process, particularly in precision applications like aerospace or automotive restoration. Always verify the media’s specifications (e.g., particle size distribution, chemical composition, hardness) and request batch testing data to ensure consistency and suitability for your specific application.

Lack of Media Traceability and Certification

Without proper traceability, it becomes difficult to verify the origin and compliance of the plastic media used. Reputable suppliers should provide material certifications (e.g., RoHS, REACH compliance) and batch-specific documentation. In regulated industries, such as defense or medical device manufacturing, using non-certified media can result in rejected components or compliance violations. Always confirm that your supplier maintains a documented chain of custody and can provide full traceability.

Inadequate Control Over Intellectual Property (IP)

When outsourcing PMB, especially for proprietary components or molds, there is a risk of unauthorized duplication or exposure of sensitive designs. Vendors without robust IP protection policies may fail to safeguard your designs during handling, storage, or processing. Ensure contracts include clear IP ownership clauses, non-disclosure agreements (NDAs), and restrictions on third-party subcontracting. Audit the supplier’s security protocols for digital and physical handling of components to mitigate IP theft risks.

Insufficient Process Documentation and Reproducibility

A common oversight is assuming that blasting results will be consistent across batches without standardized procedures. Without detailed process documentation—such as pressure settings, nozzle type, dwell time, and media type—reproducing results becomes challenging. This lack of standardization can affect quality control, especially in high-volume or repeat production runs. Demand documented work instructions and process validation reports from your supplier to ensure repeatability and quality assurance.

Failure to Address Environmental and Disposal Compliance

Plastic media blasting generates waste that may contain hazardous materials, especially when stripping coatings containing heavy metals or other regulated substances. Sourcing from vendors unaware of or non-compliant with environmental regulations (e.g., EPA, local waste disposal laws) can expose your organization to liability. Confirm that the supplier has proper waste handling procedures, recycling practices, and compliance certifications to manage blasting byproducts responsibly.

By proactively addressing these pitfalls—prioritizing media quality, traceability, IP protection, process control, and regulatory compliance—you can ensure a reliable and secure Plastic Media Blasting supply chain.

Logistics & Compliance Guide for Plastic Media Blasting

Plastic media blasting (PMB) is a non-abrasive surface cleaning and paint stripping method commonly used in aerospace, automotive, and precision manufacturing. Proper logistics and compliance management are critical to ensure environmental protection, worker safety, and regulatory adherence.

Regulatory Framework and Permits

Plastic media blasting operations are subject to federal, state, and local regulations. Key regulatory areas include air quality, waste management, and worker safety. Operators must comply with the Environmental Protection Agency (EPA) standards under the Clean Air Act, particularly National Emission Standards for Hazardous Air Pollutants (NESHAP) for aerospace and industrial coatings. Additionally, OSHA (Occupational Safety and Health Administration) regulations mandate safe handling of materials and worker exposure limits. Facilities may require air permits and waste discharge authorizations depending on location and volume of operations.

Waste Handling and Disposal

Spent plastic media and removed coating debris constitute hazardous or non-hazardous waste, depending on substrate coatings (e.g., lead-based or chrome-containing paints). Waste must be properly segregated, labeled, and stored in containment areas to prevent environmental contamination. A waste profile analysis should be conducted to determine disposal classification. Certified hazardous waste haulers must transport waste to approved Treatment, Storage, and Disposal Facilities (TSDFs). Recycling of uncontaminated media may be possible through specialized reclamation services, reducing disposal costs and environmental impact.

Environmental Controls and Containment

Effective containment systems are essential during blasting operations to prevent media and particulate release. Use of blast rooms, enclosures, or portable containment with negative air pressure and HEPA filtration helps capture airborne particles. Secondary containment (e.g., berms or liners) should be used outdoors to prevent soil and water contamination. Stormwater discharge must be monitored and permitted under the National Pollutant Discharge Elimination System (NPDES) if runoff is possible.

Worker Safety and Personal Protective Equipment (PPE)

Employees must be trained in hazard communication (HazCom), respiratory protection, and proper use of PPE. Required PPE includes:

– Full-face respirators with P100 filters or supplied-air systems

– Flame-resistant coveralls

– Safety goggles or face shields

– Hearing protection

– Gloves and steel-toed boots

Medical evaluations and fit testing for respirators are mandatory under OSHA 29 CFR 1910.134. Regular monitoring of air quality in the work zone ensures acceptable exposure levels.

Transportation of Materials

Virgin and spent plastic media must be transported in sealed, labeled containers to prevent spillage and exposure. Transporters of hazardous waste must be licensed under the Department of Transportation (DOT) Hazardous Materials Regulations (49 CFR). Proper shipping manifests (e.g., Uniform Hazardous Waste Manifest) are required for off-site disposal. Documentation must be retained for at least three years.

Recordkeeping and Reporting

Facilities must maintain comprehensive records, including:

– Waste manifests and disposal receipts

– Air permit compliance reports

– Employee training logs and medical surveillance records

– Spill response plans and incident reports

– Inspection logs for containment and filtration systems

Regulatory agencies may request these documents during audits. Non-compliance can result in fines, operational shutdowns, or legal action.

Best Practices for Compliance

- Conduct regular internal audits and compliance checks

- Implement a Spill Prevention, Control, and Countermeasure (SPCC) plan if storing oils or solvents

- Use recyclable or biodegradable media when feasible

- Provide ongoing employee training on safety and environmental procedures

- Stay updated on regulatory changes through industry associations and state environmental agencies

Adhering to this guide ensures safe, efficient, and legally compliant plastic media blasting operations.

In conclusion, sourcing plastic media blasting (PMB) involves a careful evaluation of material specifications, supplier reliability, cost-efficiency, and environmental considerations. Plastic media offers a non-destructive, reusable solution ideal for precision cleaning and surface preparation of softer materials such as aluminum, composites, and delicate castings. When selecting a supplier, it is crucial to ensure consistent media quality, appropriate particle size and hardness, and compliance with environmental and safety standards. Establishing long-term relationships with reputable vendors can lead to improved supply chain stability, technical support, and cost savings over time. Additionally, considering sustainability factors—such as recyclability and waste management—can further enhance the environmental profile of the blasting process. Overall, a strategic sourcing approach to plastic media blasting supports operational efficiency, part integrity, and compliance with industry requirements.