The global plastic holders market is experiencing steady growth, driven by rising demand across industries such as automotive, electronics, consumer goods, and healthcare. According to Grand View Research, the global plastic components market was valued at USD 677.3 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 4.9% from 2023 to 2030. This growth is fueled by the increasing adoption of lightweight, durable, and cost-effective plastic solutions in manufacturing and packaging applications. As industries prioritize efficiency and sustainability, leading plastic holder manufacturers are investing in advanced molding technologies and recyclable materials to meet evolving regulatory and consumer demands. In this competitive landscape, the top eight plastic holder manufacturers stand out for their innovation, production scale, and global reach—shaping the future of plastic component manufacturing.

Top 8 Plastic Holder Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

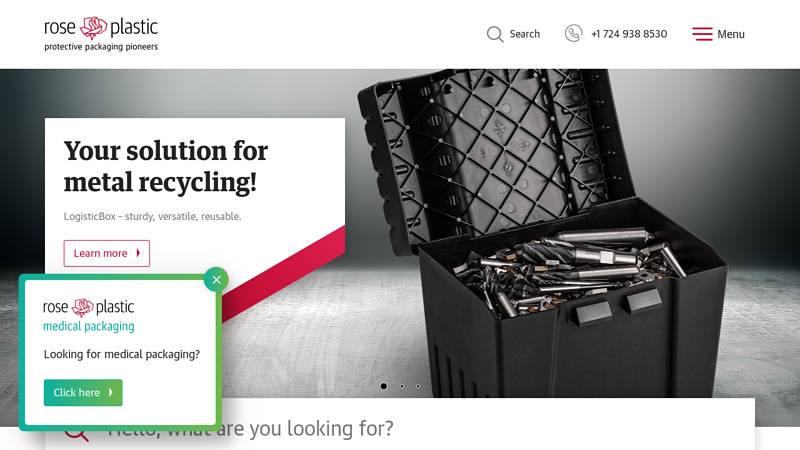

#1 rose plastic

Domain Est. 2002

Website: rose-plastic.us

Key Highlights: rose plastic is one of the world’s leading manufacturers of plastic packaging for cutting tools, industrial components, tools and other products….

#2 Utz Group

Domain Est. 2008

Website: utzgroup.com

Key Highlights: We are a global Plastic Packaging Manufacturer, providing containers, trays, and pallets. Specializing in Transport Packaging for industries like ……

#3 Capital Plastics

Domain Est. 1996 | Founded: 1952

Website: capitalplastics.com

Key Highlights: Discover premium acrylic coin and currency holders from Capital Plastics. Made in the U.S.A. since 1952 for collectors who demand lasting protection….

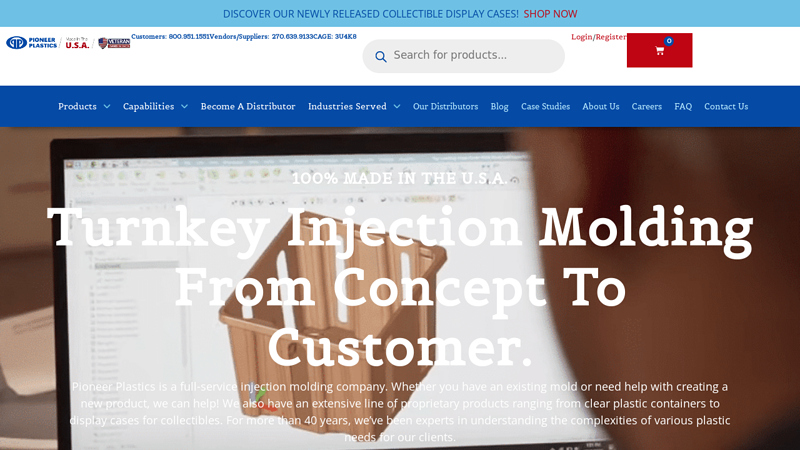

#4 Pioneer Plastics

Domain Est. 1997

Website: pioneerplastics.com

Key Highlights: Pioneer Plastics creates crystal clear diecast display cases perfect for presenting and protecting memorabilia, heirlooms, and collectibles!…

#5 Custom Plastic Envelopes and Document Holders

Domain Est. 1999

Website: printglobe.com

Key Highlights: 10–17 day delivery · 30-day returnsStore your documents in style with our plastic document holders and plastic envelopes with your printed logo! Add your company logo to outfit yo…

#6 Plastic Products Mfg.

Domain Est. 2001

Website: plasticproductsmfg.com

Key Highlights: Discover expert measurement tips and explore our complete range of high-quality cubicle solutions and products to optimize your workspace today. Shop Now….

#7 Plastic Sign Holders & Custom Made Acrylic Displays by Plastics Plus

Domain Est. 2005

Website: signholdersusa.com

Key Highlights: Plastics Plus manufactures a variety of Plastic Brochure Holders; suitable for both indoor and outdoor use. We carry wall mount magazine holders, as well as ……

#8 Sign Holders

Domain Est. 2010

Website: plasticbyall.com

Key Highlights: Plastic by All is an award-winning plastic fabrication company that specializes in sign holders, countertop displays, brochure holders, and more!…

Expert Sourcing Insights for Plastic Holder

H2: 2026 Market Trends for Plastic Holders

The global plastic holders market is poised for continued evolution in 2026, driven by shifting consumer demands, regulatory pressures, technological advancements, and sustainability imperatives. While growth will persist in certain segments, the landscape will be increasingly defined by the transition towards eco-conscious solutions and functional innovation. Key trends shaping the market include:

-

Accelerated Shift Towards Sustainability & Circularity:

- Regulatory Pressure: Stricter global regulations (e.g., extended producer responsibility – EPR, plastic taxes, bans on specific single-use items) will force manufacturers to prioritize recyclability and reduced virgin plastic use. Compliance will be non-negotiable.

- Material Innovation: Significant growth in holders made from recycled plastics (rPET, rPP, rHDPE) and bio-based plastics (PLA, PHA). Expect improved performance and cost-effectiveness of these materials.

- Design for Recycling: Simpler designs using mono-materials, avoiding problematic additives (like dark colors or complex laminates), and clear labeling (e.g., How2Recycle) will become standard to enhance end-of-life recyclability.

- Circular Economy Models: Increased exploration of take-back schemes, refill systems (especially in consumer goods), and design for durability/reusability in specific applications (e.g., high-end electronics, premium packaging).

-

Continued Material Substitution & Blending:

- Lightweighting: Ongoing efforts to reduce plastic usage per unit through optimized design and advanced resins without compromising strength, driven by cost and environmental goals.

- Performance Polymers: Increased use of engineering plastics (e.g., PEEK, PPS, high-performance nylons) in demanding applications (automotive, electronics, medical) where heat resistance, strength, or chemical resistance are critical, replacing metals or standard plastics.

- Hybrid Materials: Growth in composites combining plastics with natural fibers (wood, bamboo, flax) or minerals to enhance stiffness, reduce weight, and improve biodegradability in specific compostable applications.

-

Functional Integration & Smart Features:

- Multi-functionality: Holders will increasingly integrate additional features – built-in stands, cable management, tool-less assembly, or even simple electronics (e.g., NFC tags for product info or authentication in retail displays).

- Smart Packaging Integration: In consumer goods, holders may incorporate simple sensors (temperature, freshness indicators) or connectivity elements, moving towards “smart” packaging solutions, though cost remains a barrier for mass adoption.

- Customization & Branding: Demand for highly customized shapes, textures, and integrated branding elements (beyond simple printing) will grow, driven by e-commerce and direct-to-consumer models.

-

Supply Chain Resilience & Regionalization:

- Nearshoring/Reshoring: Ongoing geopolitical tensions and supply chain disruptions will push some manufacturers to regionalize production, particularly for high-volume or strategically important holders (e.g., in automotive or medical sectors), impacting global trade flows.

- Cost Volatility Management: Companies will focus on long-term contracts, material hedging, and design flexibility to mitigate the impact of fluctuating fossil fuel and resin prices.

-

Sector-Specific Dynamics:

- Electronics & Automotive: Remain strong growth drivers due to miniaturization, increased electronic content in vehicles, and demand for protective, lightweight, and EMI-shielding holders. Sustainability demands are high here too.

- Healthcare & Medical: High demand for sterile, chemically resistant, and precise holders (e.g., for diagnostics, devices). Regulatory compliance (ISO, USP Class VI) is paramount. Single-use dominates, but reusable options in non-critical areas are emerging.

- Consumer Goods & Retail: Facing the most intense pressure to eliminate unnecessary plastic. Focus shifts to essential protective holders made from recycled/content, or complete redesigns (e.g., molded fiber, paperboard). E-commerce demands robust, protective (but sustainable) solutions.

- Industrial & Logistics: Focus on durability, reusability, and standardization (e.g., for bins, totes, pallets). Sustainability driven by operational cost savings (reduced waste, lower transport costs via lightweighting).

Conclusion for 2026:

The plastic holders market in 2026 will be characterized by a dual trajectory. While volume growth continues in essential applications (electronics, automotive, medical), the overall narrative is dominated by sustainability transformation. Success will depend on a manufacturer’s ability to innovate with eco-friendly materials and designs, navigate complex regulations, ensure supply chain agility, and meet the increasingly sophisticated functional demands of end-users. Companies slow to adapt to the circular economy imperative will face significant challenges, while those leading in sustainable innovation and functional integration will capture market share. The “plastic holder” of 2026 will increasingly be defined by its environmental profile and integrated functionality, not just its basic holding capability.

Common Pitfalls Sourcing Plastic Holders (Quality, IP)

Sourcing plastic holders—especially for industries like electronics, medical devices, or automotive—can be deceptively complex. While they may appear simple components, overlooking key factors can lead to significant quality issues, intellectual property (IP) risks, and supply chain disruptions. Below are common pitfalls to watch for:

Quality Inconsistencies Due to Material Selection

One of the most frequent issues is inconsistent material quality. Suppliers may substitute lower-grade resins (e.g., using recycled or off-spec polymers) to cut costs, leading to dimensional instability, reduced strength, or poor thermal/chemical resistance. Ensure material specifications (e.g., UL certifications, FDA compliance, or RoHS) are clearly defined and validated through material test reports (MTRs) and batch sampling.

Poor Tooling and Mold Maintenance

Plastic holders are typically injection-molded, and mold quality directly affects part consistency. Low-cost suppliers may use inferior mold steel or skip regular maintenance, causing flash, warping, or short shots over time. Poor venting or cooling design can also introduce internal stresses. Always audit tooling capabilities and request mold flow analysis or first-article inspection reports (FAIRs).

Lack of Dimensional Accuracy and Tolerance Control

Many plastic holders interface with precision components (e.g., circuit boards, sensors), making tight tolerances critical. Inadequate process control or lack of statistical process control (SPC) at the supplier can result in out-of-spec parts. Confirm the supplier’s measurement systems (e.g., CMM availability) and insist on process capability (Cp/Cpk) data.

Inadequate Surface Finish and Aesthetics

Surface defects—such as flow lines, sink marks, or ejector pin marks—can affect both function and appearance. If the holder is visible or mates with sensitive components, surface quality is crucial. Define acceptable finish standards (e.g., SPI, VDI) and include visual inspection criteria in quality agreements.

Intellectual Property (IP) Risks in Design and Tooling

A major hidden risk is IP leakage. When providing custom designs or CAD files, suppliers—especially overseas—may replicate the holder for other clients or sell tooling to competitors. Ensure robust Non-Disclosure Agreements (NDAs) and clearly define IP ownership in contracts. Consider using third-party tooling custodians or retaining physical possession of molds.

Unauthorized Subcontracting

Suppliers may subcontract production without notice, especially to lower-tier factories with weaker quality systems. This increases variability and reduces traceability. Audit the full production chain and include clauses prohibiting subcontracting without prior approval.

Incomplete or Missing Documentation

Missing compliance documentation—such as material certifications, mold specifications, or quality test results—can delay product launches or fail regulatory audits. Require full documentation packages as part of procurement agreements and verify authenticity.

Overlooking Long-Term Supply and Obsolescence

Plastic holders may become obsolete if the mold wears out or the supplier discontinues the resin grade. Ensure long-term supply agreements include mold life expectations, spare part availability, and end-of-life planning to avoid production halts.

By proactively addressing these quality and IP pitfalls during the sourcing process, companies can secure reliable, compliant, and legally protected supply chains for their plastic holder components.

Logistics & Compliance Guide for Plastic Holder

This guide outlines the essential logistics and compliance considerations for the safe, efficient, and legally compliant handling, transportation, and use of plastic holders.

Product Identification and Classification

Clearly define the type of plastic holder (e.g., display holder, electronic component holder, medical device holder) and its composition (e.g., PP, PET, ABS). Accurate material identification is critical for regulatory compliance, recycling, and waste management.

Regulatory Compliance

Ensure adherence to all applicable regional and international regulations, including:

– REACH (EU): Registration, Evaluation, Authorization, and Restriction of Chemicals. Verify that plastic materials and additives are registered and do not contain substances of very high concern (SVHC).

– RoHS (EU): Restriction of Hazardous Substances in electrical and electronic equipment, if applicable.

– FDA Regulations (USA): For plastic holders used in food contact or medical applications, ensure compliance with 21 CFR requirements.

– Proposition 65 (California, USA): Provide warnings if the product contains chemicals known to cause cancer or reproductive harm.

– Packaging Waste Directives: Comply with producer responsibility schemes (e.g., PROs in Europe) for packaging and end-of-life management.

Labeling and Marking Requirements

All plastic holders must be correctly labeled with:

– Material identification (e.g., resin code ♳ for PP)

– Manufacturer name and contact information

– Country of origin

– Compliance marks (e.g., CE marking if applicable)

– Recycling symbols and disposal instructions

Packaging and Transportation

Use sustainable and protective packaging to prevent damage during shipping. Ensure packaging complies with:

– ISTA or ASTM standards for drop and vibration testing

– Requirements for hazardous materials, if any additives are regulated

– Dimensional weight and load optimization to reduce shipping costs and carbon footprint

Import/Export Documentation

Prepare accurate documentation for international shipments, including:

– Commercial invoice

– Packing list

– Certificate of Conformity (if required)

– Material Safety Data Sheet (MSDS/SDS), if applicable

– Harmonized System (HS) code for correct customs classification (e.g., 3923.50 for plastic articles of table or kitchen use)

Environmental and Sustainability Considerations

Prioritize recyclable or bio-based plastics where feasible. Implement take-back programs or support circular economy initiatives. Document carbon footprint and environmental impact for ESG reporting.

Storage and Handling

Store plastic holders in a dry, temperature-controlled environment away from direct sunlight to prevent deformation or degradation. Follow first-in, first-out (FIFO) inventory practices to ensure product integrity.

End-of-Life Management

Provide clear guidance for end users on proper disposal, recycling, or return options. Design for disassembly and recyclability to support compliance with extended producer responsibility (EPR) laws.

Audit and Recordkeeping

Maintain records of supplier certifications, compliance test reports, and shipment documentation for a minimum of five years. Conduct regular internal audits to ensure ongoing compliance with all relevant standards and regulations.

Conclusion for Sourcing Plastic Holders:

In conclusion, sourcing plastic holders requires a strategic approach that balances cost, quality, material suitability, supplier reliability, and sustainability considerations. After evaluating various suppliers, materials (such as ABS, polycarbonate, or recycled plastics), and manufacturing methods (like injection molding), it is essential to select a partner that aligns with both technical requirements and corporate social responsibility goals. Prioritizing vendors with certifications, consistent quality control, and the capacity for scalability ensures long-term reliability and product performance. Additionally, incorporating eco-friendly materials and recyclable design principles supports environmental sustainability and meets growing market demands. Ultimately, a well-executed sourcing strategy for plastic holders enhances product functionality, reduces total cost of ownership, and strengthens supply chain resilience.