The global plastic electronic enclosures market is experiencing robust growth, driven by rising demand across industries such as consumer electronics, industrial automation, telecommunications, and healthcare. According to a report by Grand View Research, the global electronic enclosures market size was valued at USD 52.1 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030. This growth is fueled by the increasing adoption of compact, lightweight, and cost-effective plastic enclosures that offer superior electrical insulation, corrosion resistance, and design flexibility compared to metal alternatives. Additionally, Mordor Intelligence projects steady market expansion, citing advancements in smart manufacturing and the proliferation of IoT-enabled devices as key contributors to rising enclosure demand. As original equipment manufacturers (OEMs) prioritize modular designs and rapid prototyping, plastic enclosures have become integral to product development cycles. In this evolving landscape, a select group of manufacturers has emerged as leaders, combining material innovation, scalable production, and global distribution to meet the escalating needs of electronics industries worldwide.

Top 9 Plastic Electronic Enclosures Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 OKW Enclosures

Domain Est. 1999

Website: okwenclosures.com

Key Highlights: OKW manufacture plastic enclosures, aluminium enclosures and tuning knobs for OEM electronics industry; standard and with individual modifications More……

#2 Box Enclosures

Domain Est. 2003

Website: boxenclosures.com

Key Highlights: Box Enclosures, Inc. is a full service designer, manufacturer and supplier of injection molded plastic enclosures, handheld electronic enclosures etc….

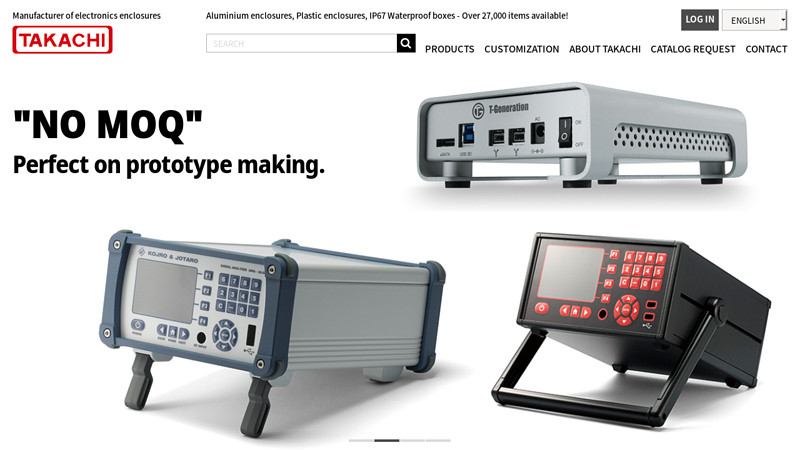

#3 TAKACHI

Domain Est. 2011

Website: takachi-enclosure.com

Key Highlights: TAKACHI is a manufacturer of electronics enclosures and industrial enclosures.We provide over 22000 items : Plastic enclosure, Handheld enclosure, ……

#4 Custom Plastic Enclosures

Domain Est. 2001

Website: envplastics.com

Key Highlights: The No Molds Required method allows us to design and fabricate your custom plastic enclosure without the need for expensive tooling or molds!…

#5 Plastic electronic enclosures & injection molding services by New …

Domain Est. 2003

Website: newageenclosures.com

Key Highlights: New Age Enclosures is a leading manufacturer of off-the-shelf plastic enclosures for electronics. We manufacture small plastic PCB enclosures….

#6 Bud Industries

Domain Est. 1996

Website: budind.com

Key Highlights: At Bud Industries, we have a wide selection of electronic enclosures to choose from. From diecast aluminum to plastic, click here to learn more!…

#7 US

Domain Est. 1996

Website: polycase.com

Key Highlights: 3-day deliveryEnclosures manufactured in the USA solve supply chain issues! Polycase’s Ohio-based manufacturing plant molds indoor & outdoor electrical enclosures….

#8 Enclosure and Cabinet Products

Domain Est. 1996

Website: fibox.com

Key Highlights: Fibox is the pioneer in manufacturing enclosures and cabinets. Our polycarbonate enclosures are potential competitors to aluminum, sheet steel, or stainless- ……

#9 Electronic enclosures in plastic and metal

Domain Est. 2001

Website: tekoenclosures.com

Key Highlights: Teko offers its customers a wide range of plastic and metal electronic enclosures, characterized by an extremely accurate and innovative design, ……

Expert Sourcing Insights for Plastic Electronic Enclosures

H2: 2026 Market Trends for Plastic Electronic Enclosures

The global market for plastic electronic enclosures is poised for significant transformation by 2026, driven by technological advancements, sustainability imperatives, and evolving industry demands. As electronics continue to permeate consumer, industrial, medical, and automotive sectors, the need for durable, lightweight, and cost-effective enclosures remains critical. Here are the key trends shaping the plastic electronic enclosure market in 2026:

-

Growing Demand for Lightweight and Compact Enclosures

With the proliferation of portable and wearable electronics—such as smartwatches, IoT devices, and compact medical instruments—manufacturers are prioritizing lightweight and miniaturized enclosures. Engineering plastics like polycarbonate (PC), acrylonitrile butadiene styrene (ABS), and polyamide (PA) dominate due to their strength-to-weight ratio and design flexibility, enabling sleek, ergonomic product designs. -

Sustainability and Eco-Friendly Materials

Environmental regulations and consumer pressure are accelerating the shift toward sustainable materials. By 2026, bio-based plastics, recycled polymers, and biodegradable compounds are expected to gain market share. Enclosure manufacturers are adopting circular economy principles, incorporating post-consumer recycled (PCR) content and designing for disassembly and recyclability. -

Advancements in Material Science and Additive Manufacturing

Innovations in high-performance thermoplastics, such as PEEK and PPS, are enabling enclosures that withstand extreme temperatures, UV exposure, and harsh chemicals—critical for automotive and industrial applications. Concurrently, 3D printing (additive manufacturing) is facilitating rapid prototyping and low-volume, customized enclosure production, reducing time-to-market. -

Integration of Smart Features and EMI Shielding

As electronics become more interconnected, plastic enclosures are being engineered with embedded functionalities. Conductive plastics and coatings that offer electromagnetic interference (EMI) shielding are increasingly used to protect sensitive components in 5G devices, automotive electronics, and industrial control systems. Some enclosures now include integrated sensors or RFID tags for asset tracking and diagnostics. -

Regional Market Expansion and Supply Chain Resilience

Asia-Pacific, particularly China and India, remains a manufacturing hub due to cost advantages and growing domestic electronics demand. However, geopolitical factors and supply chain disruptions are pushing companies to diversify production to Southeast Asia, Mexico, and Eastern Europe. Localized manufacturing is expected to rise, supported by automation and nearshoring trends. -

Regulatory Compliance and Safety Standards

Stringent safety and environmental regulations (e.g., RoHS, REACH, UL, and IEC standards) are shaping material selection and production processes. Flame-retardant (FR) plastics without halogen additives are gaining favor, especially in consumer electronics and public infrastructure applications.

Conclusion:

By 2026, the plastic electronic enclosure market will be characterized by innovation, sustainability, and smarter integration. Companies that invest in advanced materials, adopt eco-conscious manufacturing practices, and respond to regional and regulatory dynamics will be best positioned to lead in this evolving landscape.

Common Pitfalls When Sourcing Plastic Electronic Enclosures (Quality, IP)

Sourcing plastic electronic enclosures involves more than just selecting a shape and color. Overlooking critical quality and Ingress Protection (IP) factors can lead to product failure, safety risks, and increased costs. Here are key pitfalls to avoid:

Inadequate Material Selection

Choosing the wrong plastic resin—such as using ABS where UV-resistant polycarbonate is needed—can lead to premature degradation, brittleness, or discoloration in harsh environments. Always match material properties (UV stability, chemical resistance, flame rating) to the intended application.

Misunderstanding IP Ratings

Many buyers assume a higher IP number guarantees complete protection, but IP ratings are specific to certain conditions (e.g., IP65 protects against dust and low-pressure water jets, but not submersion). Misinterpreting or overstating IP claims from suppliers can result in enclosures failing in real-world conditions.

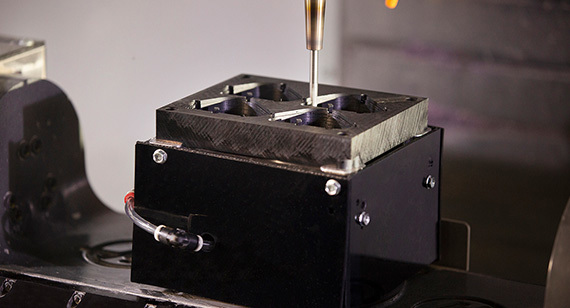

Poor Mold Quality and Tolerances

Low-cost molds often lead to inconsistent wall thickness, warping, or flashing, compromising structural integrity and IP performance. Poor dimensional tolerances can prevent proper sealing with gaskets or misalignment with internal components.

Inconsistent Sealing and Gasket Integration

Even with a high IP rating, poor design or inconsistent manufacturing of gaskets, O-rings, or sealing surfaces can create leak paths. Suppliers may overlook compression set, material compatibility, or long-term seal durability.

Lack of Certification and Testing Documentation

Some suppliers provide IP ratings without third-party verification. Always request test reports (e.g., IEC 60529 compliance) and ensure enclosures are certified for relevant safety standards (UL, CE) to avoid compliance issues.

Overlooking Long-Term Environmental Resistance

Enclosures may perform well initially but degrade under prolonged exposure to temperature cycles, humidity, or chemicals. Failing to test for long-term environmental resilience can lead to field failures.

Supply Chain and Quality Control Variability

Sourcing from multiple batches or suppliers without strict quality control can result in color variation, material substitution, or dimensional drift—jeopardizing both aesthetics and functionality.

Insufficient Attention to Mechanical Durability

Thin walls, weak mounting points, or poor snap-fit designs can lead to breakage during assembly or field use. Ensure drop tests and stress analysis are conducted, especially for portable or industrial applications.

Avoiding these pitfalls requires thorough supplier vetting, clear specifications, and independent validation of both quality and IP claims.

Logistics & Compliance Guide for Plastic Electronic Enclosures

This guide outlines key logistics considerations and regulatory compliance requirements for the manufacturing, transportation, and distribution of plastic electronic enclosures.

Material Sourcing & Supply Chain Management

Ensure all raw materials (e.g., ABS, polycarbonate, polypropylene) are sourced from certified suppliers adhering to environmental and quality standards. Maintain traceability records for resins and additives, including flame retardants. Conduct regular supplier audits to verify compliance with REACH, RoHS, and other relevant regulations.

Manufacturing & Quality Control

Implement strict quality control protocols to ensure dimensional accuracy, surface finish, and structural integrity. Monitor production processes for consistency and document all inspections. Validate tooling and molding parameters to prevent defects that could compromise electronic protection or regulatory compliance.

Regulatory Compliance

Plastic electronic enclosures must comply with multiple international and regional regulations. Key standards include:

– RoHS (Restriction of Hazardous Substances): Prohibits specific hazardous materials (e.g., lead, cadmium, mercury) in electrical equipment.

– REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals): Requires disclosure of Substances of Very High Concern (SVHCs) in plastic components.

– UL 94 Flammability Ratings: Classifies materials based on their ability to resist ignition and flame spread; enclosures must meet minimum ratings (e.g., V-0, V-2) depending on application.

– IEC 60529 (IP Ratings): Specifies ingress protection levels for dust and water resistance; design and test enclosures accordingly.

– WEEE (Waste Electrical and Electronic Equipment): Requires design for recyclability and proper labeling for end-of-life handling.

Packaging & Labeling

Use protective packaging to prevent scratches, deformation, or electrostatic damage during transit. Clearly label each unit or shipment with product identifiers, material type (e.g., “PC/ABS”), compliance marks (e.g., CE, UL), and handling instructions. Include RoHS and REACH compliance declarations in shipping documentation.

Transportation & Storage

Ship enclosures in climate-controlled environments when possible to prevent warping or moisture absorption. Stack pallets securely and avoid exposure to direct sunlight or extreme temperatures. Store materials in dry, ventilated areas away from combustibles, especially for flame-retardant plastics that may degrade under heat.

Import/Export Documentation

Prepare accurate customs documentation, including Harmonized System (HS) codes (typically under 3926.30 for plastic lids and enclosures), commercial invoices, and certificates of origin. Declare compliance with destination country regulations (e.g., FCC in the U.S., CCC in China) where applicable.

End-of-Life & Sustainability

Design enclosures with recyclability in mind—avoid mixed plastics and use standardized resins. Provide disassembly instructions and material markings (e.g., resin identification codes) to support recycling. Comply with local take-back and recycling programs under WEEE or equivalent legislation.

Audit & Continuous Improvement

Conduct regular compliance audits and update documentation as regulations evolve. Track non-conformances and implement corrective actions. Engage in industry certifications (e.g., ISO 14001, ISO 9001) to demonstrate ongoing commitment to quality and environmental responsibility.

Conclusion: Sourcing Plastic Electronic Enclosures

Sourcing plastic electronic enclosures requires a strategic balance between material performance, design flexibility, cost-efficiency, and supplier reliability. High-quality enclosures protect sensitive electronics from environmental factors such as moisture, dust, and impact, while also contributing to the overall aesthetics and usability of the end product. Materials like ABS, polycarbonate (PC), and polypropylene offer varying degrees of strength, chemical resistance, and thermal stability, allowing selection based on specific application needs.

When sourcing, it is essential to consider manufacturing processes such as injection molding or CNC machining, which influence scalability, lead times, and customization options. Working with experienced suppliers who adhere to industry standards (e.g., IP ratings, UL certifications) ensures compliance and product durability. Additionally, evaluating total cost—including tooling, volume discounts, and logistics—helps optimize the procurement process.

In conclusion, selecting the right plastic enclosures involves a thorough understanding of technical requirements, production volumes, and supply chain capabilities. By partnering with reliable manufacturers and focusing on quality, scalability, and regulatory compliance, companies can secure enclosures that enhance product performance and support long-term success in competitive markets.