The global plastic cutting equipment market is experiencing steady growth, driven by rising demand across packaging, automotive, and consumer goods industries. According to Mordor Intelligence, the plastic processing machinery market is projected to grow at a CAGR of over 5.2% from 2023 to 2028, with increasing automation and precision manufacturing accelerating the adoption of advanced cutting solutions. Additionally, Grand View Research reports that the global plastics market size—closely tied to processing equipment demand—is expected to expand at a CAGR of 4.5% from 2023 to 2030, fueled by innovations in polymer materials and sustainable production practices. As operational efficiency and material waste reduction become critical priorities, manufacturers are turning to high-performance plastic cutters to meet tight tolerances and high-volume output. In this evolving landscape, a select group of manufacturers has emerged as leaders, combining engineering excellence with scalable solutions. Below are the top 9 plastic cutter manufacturers shaping the industry through innovation, reliability, and global reach.

Top 9 Plastic Cutter Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Plastic packaging for cutting tools, plastic injection molding services

Domain Est. 2012

Website: plaselplastic.com

Key Highlights: Precision injection molding and advanced technology manufacturers of customized and eco-friendly plastic packaging for cutting tools….

#2 Industrial Cutting Machines

Domain Est. 1996

Website: atom.it

Key Highlights: For over 70 years, ATOM has been designing, developing and manufacturing cutting systems for flexible and semi-rigid materials….

#3 Single Stroke Cutters

Domain Est. 1995

Website: ridgid.com

Key Highlights: Rating 3.7 (6) RIDGID’s Single Stroke Cutters are perfect for plastic (PVC, PP, PEX, PE) and multilayer tubing. Shop now….

#4 Reed Manufacturing

Domain Est. 1997

Website: reedmfgco.com

Key Highlights: Reed Universal Pipe Cutter (UPC) makes the in-ditch cut for a municipal water project. The UPC handles tough cuts in the trench, underwater or aboveground….

#5 Gate Cutters and Nippers

Domain Est. 1997

Website: pcs-company.com

Key Highlights: 30-day returnsPCS Company features numerous grades of manual gate cutters, heated gate cutters as well as air powered gate cutters and accessories….

#6 Plastic Cutters

Domain Est. 1998

Website: abbeon.com

Key Highlights: Plastic Cutters | Hot knife cutter | Electric cutter | Saw blades for Plastic | AZTC-20 and Zetz-24 Thermocutter | Hot wire cutter | AZ Formen German made ……

#7

Domain Est. 2001

Website: appletonmfg.com

Key Highlights: For over 75 years Appleton Mfg. has been providing a variety of core cutters and core cutting solutions to the converting industry….

#8 USCutter Sign Making and Custom Apparel Equipment and Supplies

Domain Est. 2006

Website: uscutter.com

Key Highlights: Free delivery over $200 · 30-day returnsUSCutter is the leading supplier of low cost, high quality sign making and customer apparel equipment and suppliers. Vinyl cutters, heat pr…

#9 Single Stroke Cutters

Website: ridgid.eu

Key Highlights: Rating 3.7 (6) RIDGID’s Single Stroke Cutters are perfect for plastic (PVC, PP, PEX, PE) and multilayer tubing. Shop now….

Expert Sourcing Insights for Plastic Cutter

H2: 2026 Market Trends for Plastic Cutters

The global plastic cutter market is poised for significant transformation by 2026, driven by technological innovation, sustainability demands, and evolving industrial applications. Key trends shaping the market include automation integration, increased demand from packaging and recycling sectors, regional shifts in manufacturing, and a growing emphasis on precision and energy efficiency.

-

Rise of Automation and Smart Cutting Systems

By 2026, the integration of automation and Industry 4.0 technologies is expected to redefine plastic cutter capabilities. Manufacturers are increasingly adopting CNC (Computer Numerical Control) and IoT-enabled cutters that allow for remote monitoring, predictive maintenance, and real-time performance analytics. These smart systems enhance cutting precision, reduce waste, and improve overall operational efficiency, particularly in high-volume production environments. -

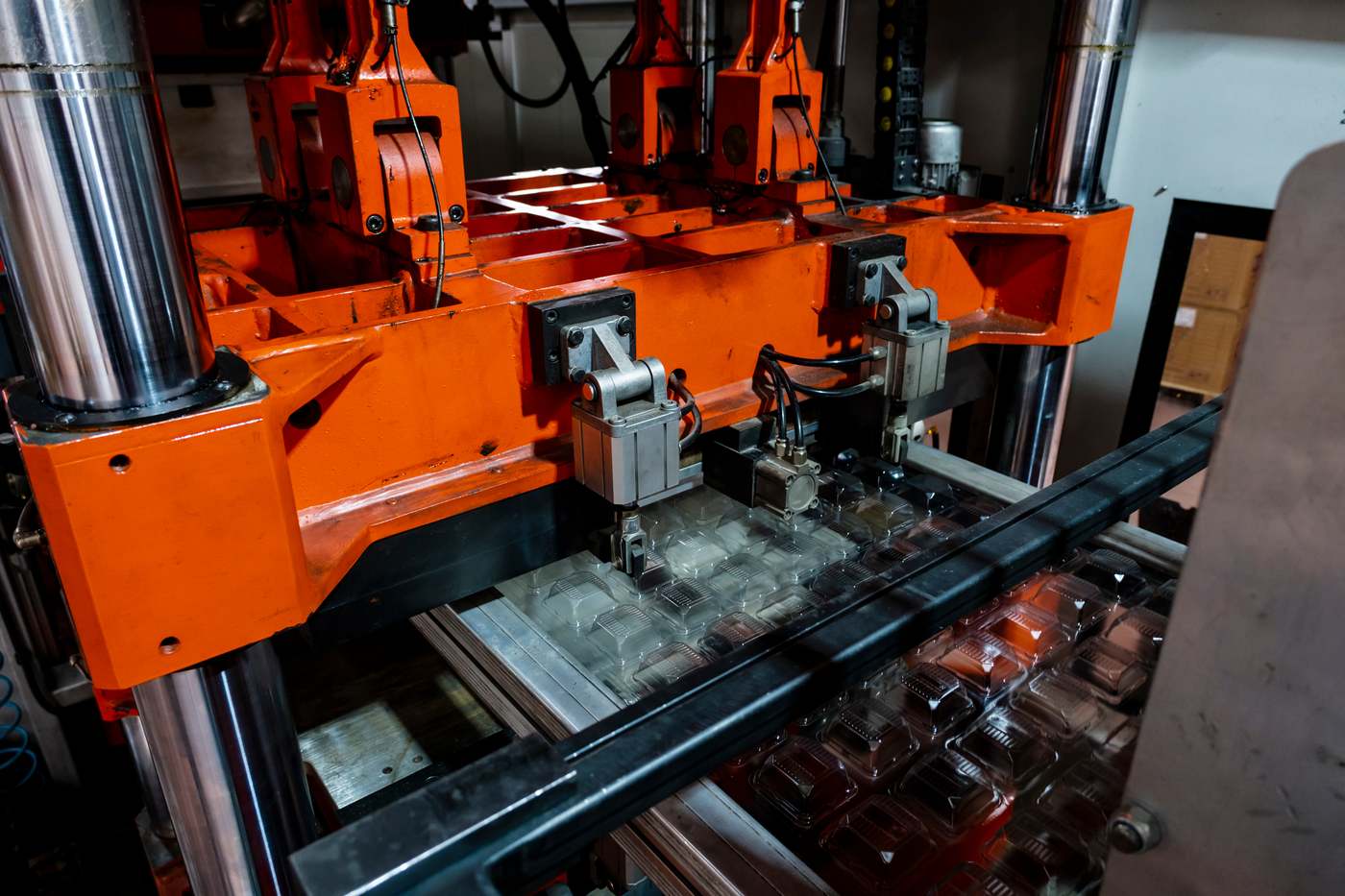

Growth in Packaging and E-Commerce Sectors

The surge in e-commerce and demand for customized packaging solutions will drive the need for versatile and high-speed plastic cutters. Flexible plastic films, blister packs, and thermoformed containers require precise cutting equipment capable of handling diverse materials and thicknesses. As brands prioritize unique packaging designs, plastic cutters with modular configurations and quick-change tooling will gain market preference. -

Sustainability and Recycling-Driven Demand

With global focus on circular economy models, the recycling of plastic waste is becoming a major growth driver. Plastic cutters used in recycling plants—such as granulators, shredders, and size-reduction machines—are seeing increased investment. Innovations in cutter design that improve material recovery rates and reduce contamination are expected to dominate the market, especially in regions with stringent environmental regulations. -

Shift Toward Energy-Efficient and Low-Maintenance Designs

Manufacturers are prioritizing energy efficiency and durability to reduce total cost of ownership. By 2026, plastic cutters featuring advanced blade materials (e.g., tungsten carbide), optimized motor systems, and reduced noise emissions will be in higher demand. These improvements not only extend equipment lifespan but also align with corporate sustainability goals. -

Regional Market Dynamics

Asia-Pacific, particularly China and India, will remain the largest market due to booming manufacturing, packaging, and construction industries. North America and Europe will focus on high-precision and automated cutters, driven by advanced manufacturing and strict environmental standards. Meanwhile, Latin America and Africa are expected to witness gradual market expansion, supported by industrialization and infrastructure development. -

Material Diversity and Customization Needs

As new bioplastics, composites, and multi-layer materials enter the market, plastic cutters must adapt to varying hardness, stickiness, and thermal properties. Cutter manufacturers are responding with customizable blade configurations and temperature-controlled systems to maintain clean cuts across material types.

In summary, the 2026 plastic cutter market will be characterized by intelligent automation, sustainability integration, and regional diversification. Companies that innovate in precision, efficiency, and environmental performance will be best positioned to capture emerging opportunities across packaging, recycling, and advanced manufacturing sectors.

Common Pitfalls When Sourcing Plastic Cutters: Quality and Intellectual Property Issues

Logistics & Compliance Guide for Plastic Cutter

Product Classification and HS Code

Determine the correct Harmonized System (HS) code for the plastic cutter based on its specifications (e.g., manual vs. electric, industrial vs. consumer use). Typical HS codes may fall under 8203 (hand tools) or 8479 (machines with specific functions). Accurate classification ensures correct duty rates and compliance with import/export regulations.

Import/Export Regulations

Verify country-specific import/export requirements. Some regions may impose restrictions on machinery based on safety, environmental, or energy efficiency standards. Ensure all necessary permits, licenses, or certifications are obtained before shipping.

Packaging and Labeling Requirements

Package the plastic cutter securely to prevent damage during transit. Include required labeling per destination country: product identification, voltage ratings (if electric), safety warnings, manufacturer details, and compliance marks (e.g., CE, FCC, RoHS). Bilingual labeling may be required in certain markets.

Safety and Environmental Compliance

Ensure the plastic cutter meets relevant safety standards (e.g., UL, CSA, or EN standards). Confirm compliance with environmental regulations such as RoHS (Restriction of Hazardous Substances) and REACH (chemical safety) for materials used in construction.

Shipping and Transportation

Choose appropriate freight mode (air, sea, or land) based on urgency, volume, and cost. Declare the goods accurately to customs, including value, weight, and dimensions. Use Incoterms (e.g., FOB, CIF) to clarify responsibilities between buyer and seller.

Customs Documentation

Prepare complete documentation, including commercial invoice, packing list, bill of lading/air waybill, and any applicable certificates of origin or conformity. Missing or incorrect paperwork may result in delays or penalties.

Duty and Tax Considerations

Calculate applicable import duties, VAT, or GST based on the destination country and HS code. Leverage free trade agreements if eligible to reduce tariff burdens. Maintain records for audit and compliance purposes.

End-of-Life and Recycling Compliance

Adhere to WEEE (Waste Electrical and Electronic Equipment) directives if applicable, particularly in the EU. Provide information on proper disposal and recycling to customers or distributors.

Recordkeeping and Audit Readiness

Maintain comprehensive records of compliance certifications, shipping documents, and communication with regulatory bodies for at least five years. Regular internal audits help ensure ongoing adherence to logistics and compliance standards.

In conclusion, sourcing a plastic cutter requires careful consideration of various factors such as the type of plastic material, cutting precision, production volume, budget, and desired automation level. Whether opting for manual, pneumatic, hydraulic, or CNC-driven models, it is essential to select a machine that aligns with your specific operational needs and quality requirements. Evaluating suppliers based on reputation, after-sales support, and machine durability will ensure long-term reliability and efficiency. Additionally, considering safety features and compliance with industry standards contributes to a safer working environment. By conducting thorough research and performing a cost-benefit analysis, businesses can make an informed decision that enhances productivity, reduces waste, and supports sustainable manufacturing practices.