The global plastic bag printing market continues to expand, driven by rising demand for branding, retail packaging, and customized solutions across industries. According to Grand View Research, the global plastic packaging market was valued at USD 238.5 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.6% from 2023 to 2030. A significant portion of this growth is attributed to printed plastic bags, which are widely used in supermarkets, e-commerce, and promotional campaigns due to their cost-effectiveness and branding potential. Additionally, Mordor Intelligence projects that increasing urbanization, coupled with consumer preference for branded shopping experiences, will further accelerate demand for customized plastic bag printing solutions—particularly in emerging economies. As sustainability concerns rise, leading manufacturers are also adapting by offering recyclable materials and eco-friendly inks, balancing compliance with evolving regulations and market needs. In this dynamic landscape, the top 10 plastic bag printing manufacturers stand out through innovation, scalability, and environmental stewardship, shaping the future of flexible packaging.

Top 10 Plastic Bag Printing Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Primary Packaging Inc.: Heavy

Domain Est. 2001

Website: primarypackaging.com

Key Highlights: Primary Packaging Inc. is a Heavy-Duty Plastic Bags & Film Manufacturer delivering custom, durable packaging solutions for industrial and commercial needs….

#2 Custom Poly Bags Manufacturer & Poly Film Manufacturer in NJ

Domain Est. 1996

Website: rutanpoly.com

Key Highlights: Rutan Poly manufactures custom poly bags and film in New Jersey. Made in the USA for commercial and industrial use. Reliable, fast, and built to spec….

#3 Paper and Plastic Bag Manufacturers

Domain Est. 1996

Website: bulldogbag.com

Key Highlights: Printing. Elevate your packaging with our advanced colour printing services, capable of bringing any design to life in up to ten colours….

#4 M Plastics Inc

Domain Est. 2011

Website: mplasticsinc.com

Key Highlights: A family-owned manufacturer that offers comprehensive all-in-one services. From extrusion and printing to bag making, we handle every step of the process with ……

#5 Flexible Packaging

Domain Est. 1997

Website: flexpack.com

Key Highlights: Custom printed plastic bags is one of our specialties. Print your company name, logo or special message on your plastic bags in 1 to 6 COLORS!…

#6 Custom Plastic Bags

Domain Est. 1998

Website: 4imprint.com

Key Highlights: 1-day deliveryPersonalized plastic bags get your logo and message out there, including at trade shows, community events, holiday parties and around ……

#7 Packaging Solutions: Clear Plastic, Paper and Eco

Domain Est. 1999

Website: clearbags.com

Key Highlights: ClearBags provides clear plastic bags, shipping boxes, zipper pouches, and packaging supplies at wholesale prices. Custom and Eco-Friendly options ……

#8 Universal Plastic Bag Manufacturing Co

Domain Est. 1999

Website: universalplastic.com

Key Highlights: 6-day delivery 30-day returnsUniversal Plastic has been in business for over twenty years, catering to the packaging industry.We manufacture Plastic Bags, Reclosable Bags, Gusseted…

#9 Custom Plastic Shopping Bags

Domain Est. 1999

Website: aplasticbag.com

Key Highlights: 5–8 day delivery 30-day returnsCustom printed plastic bags, poly bags, plastic shopping bags, high clarity bags, stand up pouches, vinyl bags, paper bags….

#10 American Plastic Mfg.

Domain Est. 2008

Website: apmbags.com

Key Highlights: For over 30 years, American Plastic has been manufacturing custom made plastic bags in a wide variety of sizes and colors….

Expert Sourcing Insights for Plastic Bag Printing

2026 Market Trends for Plastic Bag Printing

Sustainability and Regulatory Pressures Driving Transformation

By 2026, the plastic bag printing industry will be fundamentally reshaped by intense environmental scrutiny and tightening global regulations. Bans and levies on single-use plastics, now widespread across the EU, North America, and parts of Asia, will force printers to pivot towards compliant materials. Demand for oxo-degradable and conventional plastic bags will plummet, replaced by biodegradable polymers (like PLA), compostable films, and increased use of recycled content (rLDPE, rPP). Printers investing in R&D for water-based and UV-curable inks compatible with these new substrates will gain a competitive edge. Transparency in material sourcing and end-of-life pathways will become a critical selling point, with printed messaging increasingly highlighting certifications (e.g., TÜV OK Compost) and recycling instructions.

Demand for Premiumization and Brand Elevation in Resilient Segments

Despite overall volume declines in traditional retail bags, niche and high-value segments will drive growth in printed plastic bags by 2026. Luxury goods, high-end fashion, premium cosmetics, and specialty food retailers will continue to utilize custom-printed bags as essential brand touchpoints. Expect sophisticated printing techniques—metallic inks, soft-touch coatings, embossing, and intricate multi-color designs—to become standard in these markets. Printers offering integrated design services, rapid prototyping, and small-batch flexibility will capture this premium demand, where functionality and aesthetic appeal outweigh cost sensitivity.

Technological Advancements Enhancing Efficiency and Customization

Digital printing technology will mature significantly by 2026, enabling short-run, highly customized bag production with minimal setup waste. This shift will allow brands to launch limited editions, regional campaigns, or personalized bags cost-effectively. Automation in pre-press, inline quality control, and finishing (like automated bag making and packing) will boost throughput and reduce labor costs for larger converters. Furthermore, investments in AI-driven color matching and predictive maintenance will optimize press performance and ensure consistent print quality across diverse, often challenging, sustainable substrates.

E-commerce Packaging as a Key Growth Driver

The relentless growth of online shopping will solidify e-commerce packaging as a major application for printed plastic films by 2026. Printed poly mailers, waterproof shipping bags, and branded outer wraps offer prime real estate for marketing and unboxing experiences. Durability, tamper evidence, and clear branding remain paramount. Printers specializing in robust, printable films with high-opacity inks and offering value-added services like integrated labels or QR codes for tracking/engagement will be well-positioned. Sustainability remains a concern here too, driving demand for lighter-weight, recyclable, or compostable mailer solutions with effective branding.

Consolidation and Strategic Partnerships in a Competitive Landscape

The dual pressures of regulatory compliance and technological investment will accelerate consolidation within the plastic bag printing sector by 2026. Smaller converters lacking resources for R&D or digital printing upgrades may exit or be acquired. Larger players will form strategic partnerships with material suppliers (developing new printable substrates) and brand owners (offering end-to-end packaging solutions). Success will depend on agility, innovation, and the ability to provide not just printing, but comprehensive sustainability consulting and design expertise to navigate the complex market.

Common Pitfalls in Sourcing Plastic Bag Printing (Quality, IP)

Sourcing plastic bag printing, particularly from overseas suppliers, presents several risks that can impact both product quality and intellectual property (IP) protection. Being aware of these common pitfalls is essential for mitigating risks and ensuring a successful partnership.

Poor Print Quality and Color Inconsistency

One of the most frequent issues is inconsistent or subpar print quality. Suppliers may use low-resolution artwork, mismatch Pantone colors, or apply uneven ink coverage, leading to blurry logos, faded designs, or off-brand color representation. This often stems from outdated equipment, untrained operators, or lax quality control processes. Always request physical print proofs and conduct pre-production sample approvals.

Material and Durability Deficiencies

Suppliers may substitute lower-grade plastic materials (e.g., using recycled polyethylene instead of virgin LDPE) to cut costs, resulting in bags that tear easily, have inconsistent thickness, or lack the required strength. Misrepresentation of material specifications—such as gauge (microns) or load capacity—can undermine brand reliability and lead to customer complaints.

Lack of Intellectual Property Protection

When sharing custom designs, logos, or proprietary artwork with suppliers, there’s a significant risk of IP theft or unauthorized reproduction. Without proper legal agreements (e.g., Non-Disclosure Agreements and IP assignment clauses), suppliers may replicate your designs for other clients or sell them independently. This is especially critical in regions with weaker IP enforcement.

Inadequate Compliance and Certification

Printed plastic bags may need to meet regulatory standards for food safety (e.g., FDA, EU compliance), recyclability, or ink toxicity (e.g., EN 71-3 for toys). Suppliers might claim compliance without proper documentation or testing. Using non-compliant inks or materials can lead to product recalls, legal liability, or market access denial.

Hidden Costs and Minimum Order Quantity (MOQ) Traps

Initial quotes may exclude costs for cylinder engraving, setup fees, or shipping, leading to unexpected expenses. Additionally, suppliers often impose high MOQs that strain inventory budgets, particularly for startups or small businesses. Always clarify all cost components and negotiate MOQ terms upfront.

Communication and Language Barriers

Misunderstandings due to language differences or time zone challenges can result in incorrect specifications, delayed timelines, or overlooked details. Poor communication may also hinder issue resolution when quality problems arise.

Limited Supply Chain Transparency

Some suppliers outsource production to subcontractors without disclosure, reducing oversight and increasing quality variability. Without visibility into the full production chain, it becomes difficult to ensure ethical practices, consistent standards, or timely delivery.

Failure to Conduct On-Site Audits or Third-Party Inspections

Relying solely on digital communication increases the risk of receiving non-conforming goods. Skipping pre-shipment inspections or factory audits can result in undetected defects reaching the end customer. Third-party quality control services can help verify production standards before shipment.

To avoid these pitfalls, establish clear specifications, insist on sample approvals, use legally binding contracts with IP protections, and consider working with sourcing agents or inspection companies familiar with packaging manufacturing standards.

Logistics & Compliance Guide for Plastic Bag Printing

Overview of Plastic Bag Printing Logistics

Managing the logistics of plastic bag printing involves coordinating raw material sourcing, manufacturing, quality control, packaging, warehousing, and shipping. Efficient logistics ensure timely delivery, cost-effectiveness, and product integrity. Key considerations include supplier reliability, production lead times, transportation methods, and inventory management.

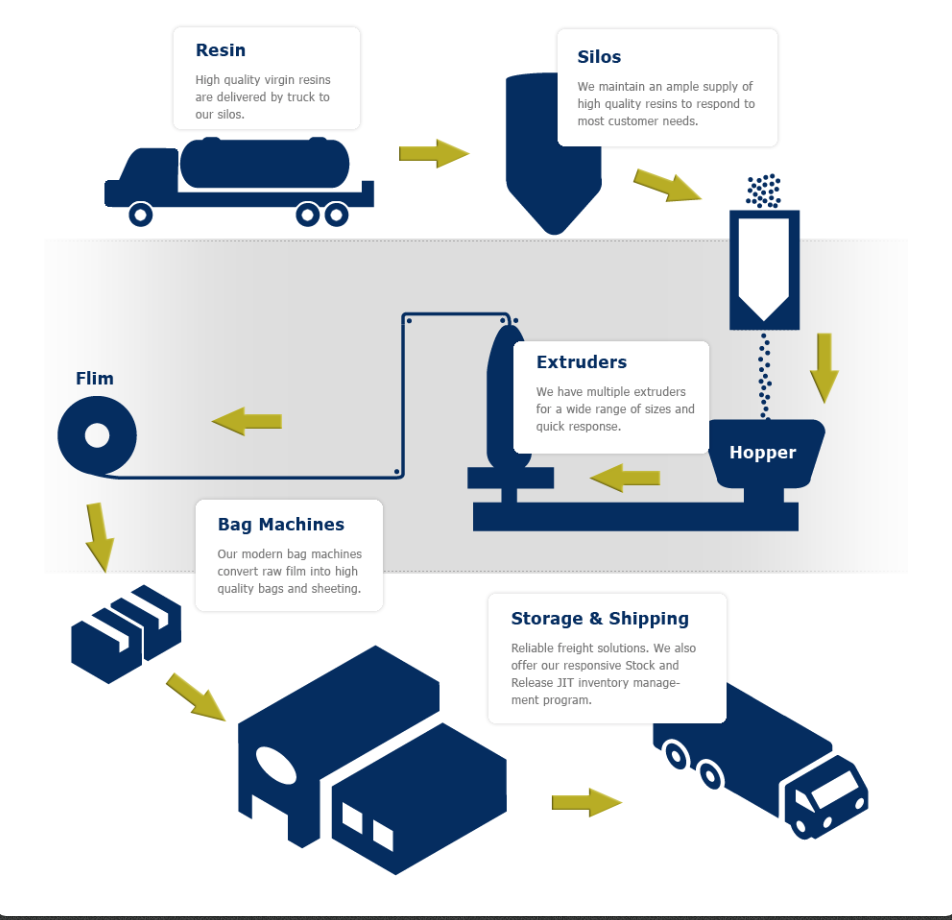

Raw Material Sourcing and Compliance

Plastic bags are typically made from LDPE (Low-Density Polyethylene), HDPE (High-Density Polyethylene), or recycled materials. Ensure suppliers provide certification of material quality and compliance with relevant standards (e.g., FDA for food-grade bags, REACH for chemical safety in the EU). Track resin sources to meet sustainability and regulatory requirements.

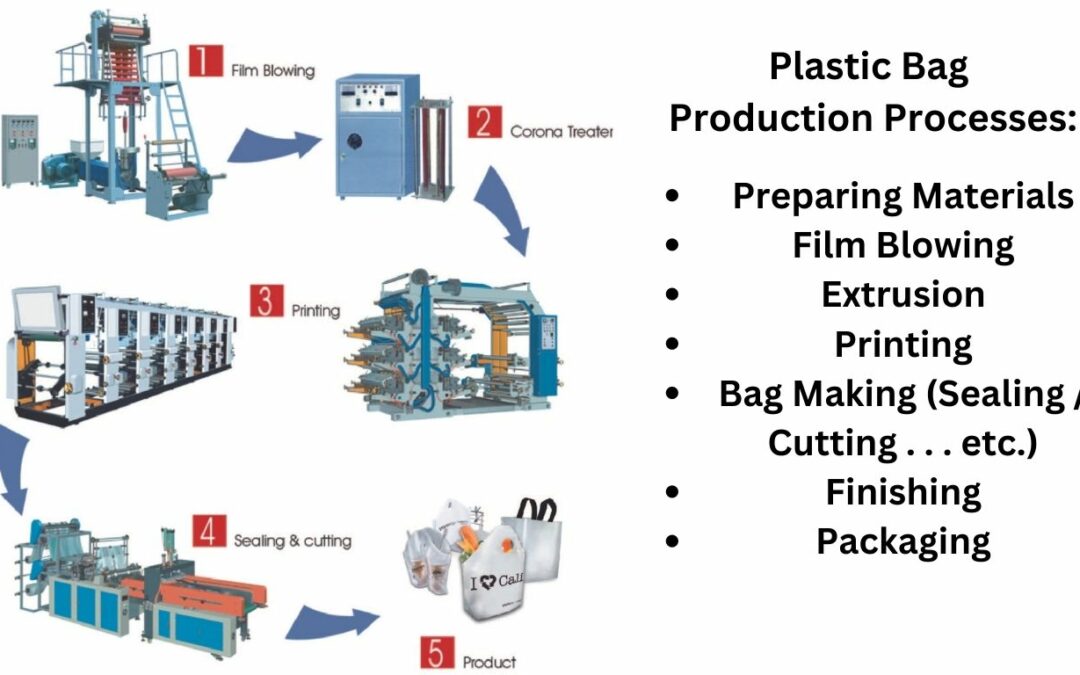

Manufacturing Process and Quality Control

The printing process includes extrusion, printing (flexographic or rotogravure), cutting, and sealing. Implement strict quality control protocols to monitor print accuracy, bag dimensions, seal strength, and thickness consistency. Regular audits of production facilities help maintain compliance with industry standards such as ISO 9001.

Regulatory Compliance by Region

Different regions have specific regulations governing plastic bags:

- United States: Comply with FDA regulations for food-contact bags; state-level laws (e.g., California’s Proposition 65) may require warnings for certain chemicals.

- European Union: Follow REACH and the Packaging and Packaging Waste Directive. Single-use plastic bans apply to certain lightweight plastic bags.

- Canada: Adhere to the Canadian Environmental Protection Act (CEPA) and provincial regulations on recyclability and labeling.

- Australia and New Zealand: Comply with the Australian Packaging Covenant and mandatory recycling labeling.

Environmental and Sustainability Requirements

Many jurisdictions mandate the use of recyclable materials, recycled content, or biodegradable alternatives. Ensure printed bags meet compostability standards (e.g., EN 13432 for industrial compostability) if marketed as such. Avoid misleading environmental claims (greenwashing) by substantiating all eco-labels with third-party certifications.

Labeling and Marking Standards

Printed bags must include required labeling such as:

– Recyclability symbols (e.g., Mobius loop)

– Resin identification codes (e.g., #2 for HDPE)

– Manufacturer information

– Warning labels (if applicable)

Ensure inks and additives are non-toxic and comply with local safety standards.

Shipping and Distribution Logistics

Optimize packaging to prevent damage during transit. Use pallets and stretch wrap appropriately. Choose carriers with reliable cold-chain or climate-controlled options if needed. Provide accurate documentation for customs when exporting, including commercial invoices, material safety data sheets (MSDS), and certificates of origin.

Waste Management and Extended Producer Responsibility (EPR)

Many countries enforce EPR schemes requiring producers to contribute to the collection and recycling of plastic waste. Register with relevant EPR programs and report annual plastic usage. Design bags for recyclability to reduce environmental impact and comply with future regulations.

Recordkeeping and Documentation

Maintain detailed records of:

– Material safety data sheets (MSDS/SDS)

– Certifications (FDA, REACH, ISO)

– Quality control test results

– Supplier compliance documents

– EPR registration and reporting

These records are essential for audits, regulatory inspections, and supply chain transparency.

Best Practices for Compliance and Efficiency

- Conduct regular compliance training for staff.

- Partner with certified and audited printing facilities.

- Use digital tracking systems for inventory and shipments.

- Stay updated on changing legislation via industry associations.

- Invest in sustainable alternatives to reduce regulatory risk.

By integrating robust logistics with strict compliance measures, businesses can ensure the safe, legal, and efficient production and distribution of printed plastic bags.

In conclusion, sourcing plastic bag printing requires a careful evaluation of suppliers based on quality, customization capabilities, cost-efficiency, compliance with environmental and safety standards, and production capacity. While plastic bags remain a widely used packaging solution due to their durability and low cost, it is increasingly important to consider sustainable alternatives, such as biodegradable or recyclable materials, in response to environmental concerns and evolving regulations. Building strong relationships with reliable manufacturers, negotiating favorable terms, and ensuring consistency in branding and print quality are essential for long-term success. Ultimately, a strategic sourcing approach that balances functionality, cost, and sustainability will help businesses meet their packaging needs effectively while supporting environmental responsibility.