The global Plaster of Paris (POP) market is witnessing steady expansion, driven by rising construction activities and growing demand for decorative interior finishes. According to Mordor Intelligence, the global plaster market is projected to grow at a CAGR of over 5.2% from 2023 to 2028, with Plaster of Paris maintaining a significant share due to its lightweight properties, fire resistance, and versatility in design. Increasing urbanization and the trend toward aesthetic ceiling designs in residential and commercial spaces are particularly boosting demand across emerging economies in Asia-Pacific and the Middle East. As the industry expands, a select group of manufacturers are leading innovation in product quality, durability, and design customization. Below is a data-informed look at the top 8 Plaster of Paris ceiling manufacturers shaping the market landscape.

Top 8 Plaster Of Paris Ceiling Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Gypsum Plaster Manufacturers In India

Domain Est. 2009

Website: trimurtiproducts.com

Key Highlights: Trimurti Products is the no.1 gypsum plaster manufacturer and supplier in India. We provide high-quality POP plaster and gypsum powder at affordable prices….

#2 Plaster Of Paris Pop Manufacturer from Jaipur

Domain Est. 2023

Website: amrstrongceiling.com

Key Highlights: Plaster Of Paris Pop · Use: Ceiling and walls · Material: Plaster of paris · Usage: Residense · Color: White · Country of Origin: Made in India. Use: Ceiling ……

#3 DAP Plaster of Paris for Wall & Ceiling Repairs

Domain Est. 1995

Website: dap.com

Key Highlights: Plaster of Paris is a versatile solution for wall and ceiling repairs that offers both speed and durability. Its easy-to-mix formula sets quickly to create ……

#4 GYPSUM BRANDS

Domain Est. 1995

Website: saint-gobain.com

Key Highlights: We design, manufacture and supply plaster, dry lining and ceilings innovative products and systems that improve wellbeing in living spaces. OUR MULTI-MATERIAL ……

#5 Knauf

Domain Est. 1997

Website: knauf.com

Key Highlights: United Arab Emirates. Global. Knauf Group · Knauf Gruppe · Legal NoticePrivacy PolicyCookie Policy Cookies Settings. ©2026 Knauf Digital GmbH….

#6 Gyproc

Domain Est. 2011

Website: gyproc.in

Key Highlights: Gyproc is a market leader in gypsum-based building solutions. Explore innovative drywall, ceilings, and plaster products for sustainable and safe ……

#7 DAP Plaster of Paris for Wall & Ceiling Repairs

Domain Est. 2012

Website: dap.ca

Key Highlights: Plaster of Paris is your all-in-one solution for repairs, crafts, and DIY projects. This easy-to-mix powder combines with water to form a workable compound ……

#8 Projects Fibrous plaster

Domain Est. 2019

Website: rouveure-marquez.com

Key Highlights: Contemporary or classic fibrous plaster, cornices and mouldings, acoustic or suspended ceilings, and more, for a variety of sectors throughout France….

Expert Sourcing Insights for Plaster Of Paris Ceiling

2026 Market Trends for Plaster of Paris Ceiling

The Plaster of Paris (POP) ceiling market is poised for transformation by 2026, driven by evolving consumer preferences, technological advancements, and sustainability demands. While facing competition from alternative materials, POP remains a dominant choice in both residential and commercial construction, particularly in emerging economies. Key trends shaping the market include:

1. Growing Demand for Customization and Aesthetic Versatility

By 2026, consumers and designers will increasingly seek personalized interiors, fueling demand for intricate POP ceiling designs. Advances in mold-making and casting techniques will enable highly detailed patterns, 3D textures, and seamless integration with lighting (cove lighting, hidden LEDs). POP’s adaptability to modern, minimalist, and traditional styles ensures its relevance in luxury homes, boutique hotels, and retail spaces.

2. Rising Popularity in Emerging Markets

Regions like South Asia, Southeast Asia, and the Middle East will drive market growth due to rapid urbanization and expanding middle-class populations. Countries such as India, Indonesia, and the UAE are witnessing a construction boom, with POP ceilings favored for cost-effective elegance in residential apartments and commercial developments.

3. Integration with Smart Home Technology

POP ceilings will increasingly incorporate smart features. Designers will embed recessed speakers, smart lighting controls, and climate sensors into POP structures. By 2026, compatibility with home automation systems will become a differentiator, enhancing both functionality and aesthetic appeal.

4. Shift Toward Sustainable and Eco-Friendly Solutions

Environmental concerns will push manufacturers and contractors to adopt greener practices. Trends include using recycled gypsum, low-VOC (volatile organic compound) additives, and energy-efficient production methods. Certifications like LEED or GREEN Building standards will influence material selection, promoting eco-conscious POP variants.

5. Competition from Alternative Materials

Despite its popularity, POP will face intensified competition from lightweight alternatives such as mineral fiber, metal panels, and PVC ceilings—especially in humid or high-maintenance environments. However, POP’s superior acoustic properties, fire resistance, and design flexibility will help maintain its stronghold in premium applications.

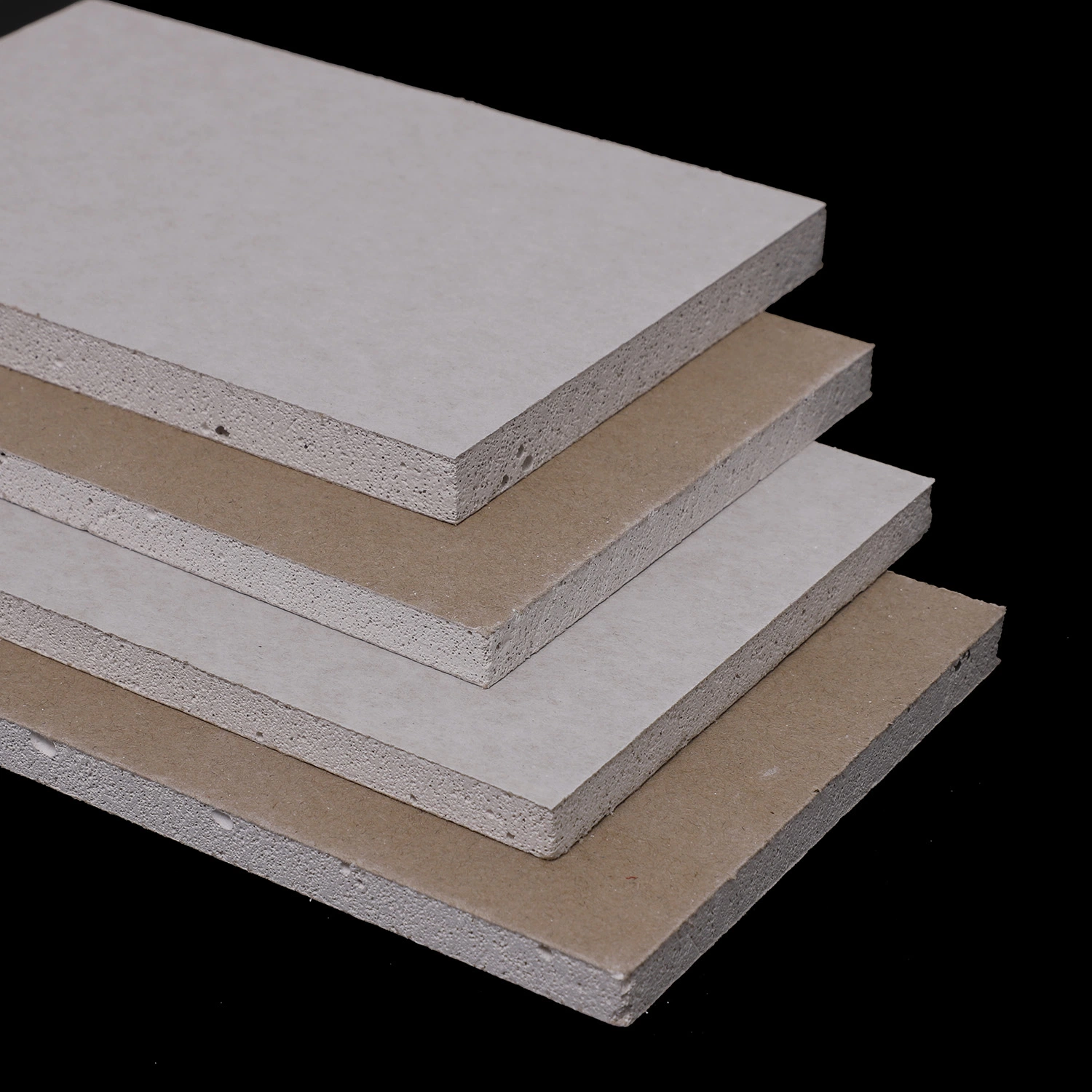

6. Advancements in Pre-Fabricated and Modular POP Systems

To reduce on-site labor and construction time, pre-fabricated POP panels will gain traction. These modular systems offer consistent quality, faster installation, and reduced waste. By 2026, such innovations will appeal to developers focused on efficiency and cost control in large-scale projects.

7. Labor Skill Shortages and the Need for Training

The craftsmanship required for high-quality POP installation is becoming scarce. This will prompt industry stakeholders to invest in vocational training and promote standardized installation protocols to maintain quality and ensure market growth.

In conclusion, the Plaster of Paris ceiling market in 2026 will be characterized by innovation, sustainability, and design excellence. While challenges exist, strategic adaptation to consumer and environmental demands will secure POP’s position as a preferred ceiling solution in the global construction landscape.

Common Pitfalls When Sourcing Plaster of Paris Ceiling Products (Quality and Intellectual Property)

Sourcing Plaster of Paris (POP) ceiling products—especially decorative elements like moldings, panels, and custom designs—can be fraught with challenges related to both material quality and intellectual property (IP) rights. Being aware of these pitfalls helps ensure you receive durable, safe, and legally compliant products.

Poor Material Quality and Composition

One of the most frequent issues is receiving substandard Plaster of Paris that fails to meet structural or aesthetic requirements. Low-grade POP may contain excessive impurities, incorrect gypsum calcination, or added fillers that reduce strength and durability. This can lead to cracking, chipping, or even collapse over time, especially in humid environments.

Inconsistent Workmanship and Finishing

Even with high-quality raw material, poor craftsmanship during casting, drying, and finishing can compromise the final product. Inconsistencies in surface smoothness, dimensional accuracy, or joint alignment are common when sourcing from unqualified or under-resourced manufacturers, affecting the visual appeal and installation process.

Lack of Standardization and Certification

Many suppliers, particularly smaller or informal ones, do not adhere to national or international standards (such as IS 2631 in India or ASTM C26 in the US). Without certification, there is no guarantee of fire resistance, moisture tolerance, or load-bearing capacity—critical factors for ceiling applications.

Inadequate Moisture and Fire Resistance

Standard POP is highly susceptible to moisture and fire. Sourcing products without proper additives or protective coatings can result in mold growth, deterioration, or safety hazards. Always verify that the supplier incorporates moisture-resistant compounds or recommends appropriate sealing methods.

Intellectual Property Infringement

A significant but often overlooked risk is the unauthorized replication of copyrighted or patented ceiling designs. Many ornate POP patterns are protected under design patents or artistic copyrights. Sourcing from manufacturers who copy high-end or branded designs without licensing exposes the buyer to legal liability, product seizure, or reputational damage.

Use of Counterfeit or Unlicensed Designs

Suppliers may offer “inspired by” versions of popular designer ceiling motifs, but these often cross the line into infringement. Without proper due diligence, buyers may unknowingly purchase counterfeit products that mimic protected intellectual property, leading to legal disputes or project delays.

Lack of Design Ownership and Customization Rights

When commissioning custom POP ceilings, it’s essential to clarify who owns the design rights. Some suppliers retain IP rights over custom molds or patterns, limiting your ability to reproduce or modify the design in the future. Always secure written agreements transferring IP ownership if needed.

Insufficient Documentation for IP Compliance

Reputable suppliers should provide documentation confirming that their designs are either original, licensed, or in the public domain. The absence of such records increases the risk of unintentional IP violations, particularly in commercial or public projects where legal scrutiny is higher.

Hidden Costs from Rework and Replacement

Poor quality or IP-related issues often result in costly rework, delayed timelines, and replacement expenses. Investing in verified, high-quality POP products from reputable suppliers with clear IP policies ultimately saves money and mitigates legal and structural risks.

Logistics & Compliance Guide for Plaster Of Paris Ceiling Installations

Overview and Scope

This guide outlines the logistical considerations and compliance requirements for the supply, transportation, installation, and finishing of Plaster of Paris (POP) ceiling systems in construction and renovation projects. It applies to contractors, suppliers, architects, and site managers involved in POP ceiling projects.

Material Procurement and Supply Chain

- Source Plaster of Paris from certified suppliers adhering to national and international standards (e.g., ASTM C25 or ISO 6707-3).

- Ensure batch consistency and quality certification (e.g., COA – Certificate of Analysis) for each delivery.

- Maintain a minimum lead time of 7–10 days for material orders to account for processing and shipping.

- Verify packaging integrity: POP must be sealed in moisture-resistant bags to prevent premature hydration.

Transportation and Handling

- Transport POP in dry, covered vehicles with climate control if necessary to avoid exposure to rain or high humidity.

- Handle bags carefully; do not drop or puncture to prevent powder spillage and contamination.

- Store materials off the ground on pallets in a dry, well-ventilated warehouse with relative humidity below 60%.

- Implement a first-in, first-out (FIFO) inventory system to prevent material aging (shelf life typically 6 months).

On-Site Storage and Inventory Management

- Designate a dry storage area near the work zone, protected from moisture, direct sunlight, and temperature extremes.

- Limit on-site POP stock to 3–5 days’ usage to reduce exposure risks.

- Use sealed containers for mixed or partially used batches; discard any damp or lumpy material.

Installation Compliance and Safety Standards

- Ensure installers are trained and certified in POP application techniques and safety protocols.

- Follow manufacturer’s mixing instructions: use clean water and approved additives only.

- Install in stages with adequate curing time (minimum 24–48 hours between layers) before sanding or painting.

- Comply with local building codes regarding fire resistance, ceiling load limits, and structural anchoring.

Health, Safety, and Environmental (HSE) Compliance

- Provide PPE (gloves, masks, goggles) to all personnel handling POP due to dust and irritation risks.

- Use dust extraction systems or wet sanding methods to minimize airborne particles (OSHA or local dust exposure limits apply).

- Dispose of waste POP and packaging in accordance with local environmental regulations—do not dump in waterways or open land.

- Ensure proper ventilation in enclosed workspaces during and after installation.

Quality Control and Inspection

- Conduct pre-installation substrate checks: ensure ceiling framework (suspended grid or wooden battens) is level and secure.

- Perform trial mixes and sample panels for client and architect approval before full-scale work.

- Implement daily site inspections to check for cracks, delamination, or uneven finishes.

- Document each phase with photos and inspection reports for compliance audits.

Regulatory and Documentation Requirements

- Retain all material safety data sheets (MSDS/SDS) for POP and additives on site.

- Submit compliance certificates, work permits, and inspection records to project authorities as required.

- Adhere to fire safety regulations, especially in commercial or high-occupancy buildings (e.g., flame spread index <25 per ASTM E84).

- Ensure work complies with accessibility standards if applicable (e.g., ceiling height clearances in public buildings).

Post-Installation and Warranty Compliance

- Provide clients with a care and maintenance manual detailing cleaning methods and damage prevention.

- Offer a standard warranty (typically 1–2 years) covering structural integrity and workmanship defects.

- Schedule follow-up inspections at 30, 90, and 180 days post-installation to identify and rectify issues early.

Conclusion

Proper logistics planning and strict adherence to compliance standards are critical for successful Plaster of Paris ceiling installations. By following this guide, stakeholders can ensure quality outcomes, regulatory conformity, and long-term durability of ceiling systems.

Conclusion for Sourcing Plaster of Paris Ceiling:

Sourcing Plaster of Paris (POP) for ceiling applications requires careful consideration of material quality, supplier reliability, cost-effectiveness, and adherence to design and structural requirements. High-quality POP ensures durable, smooth, and aesthetically pleasing ceiling finishes that resist cracks and offer excellent workability for intricate designs. It is essential to partner with reputable suppliers who provide consistent product standards, timely delivery, and technical support. Additionally, evaluating factors such as lead times, transportation logistics, and local availability can significantly impact project timelines and costs. By conducting thorough market research, comparing quotations, and verifying material certifications, contractors and builders can make informed sourcing decisions that enhance the overall quality and longevity of POP ceiling installations. Ultimately, strategic sourcing not only supports project efficiency but also ensures a premium finish that meets both functional and decorative expectations.