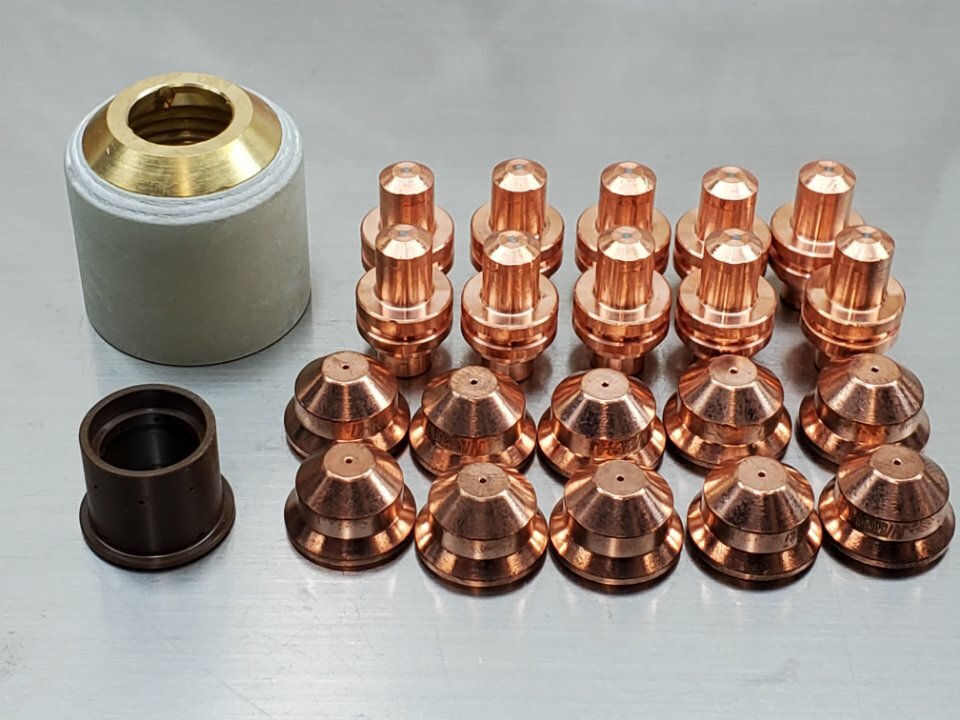

The global plasma cutting equipment market is experiencing robust growth, driven by rising demand for precision cutting solutions across heavy industries such as automotive, shipbuilding, and construction. According to Grand View Research, the global industrial cutting equipment market size was valued at USD 12.3 billion in 2022 and is projected to expand at a compound annual growth rate (CAGP) of 6.8% from 2023 to 2030, with plasma cutting technologies representing a significant share. As plasma cutter usage increases, so does the need for reliable replacement parts—including electrodes, nozzles, swirl rings, retaining caps, and shields—to maintain optimal performance and minimize downtime. This rising demand has spurred the growth of specialized manufacturers focused on high-quality, durable consumables. Based on market presence, product reliability, and technical innovation, the following nine manufacturers have emerged as leaders in supplying plasma cutter replacement parts globally.

Top 9 Plasma Cutter Replacement Parts Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Thermal Dynamics

Domain Est. 1996

Website: thermal-dynamics.com

Key Highlights: Thermal Dynamics is a leading US manufacturer of high-performance plasma cutters, CNC plasma tables, and automated cutting machines built to boost your bottom ……

#2 Laser, Plasma and Oxy Fuel Cutting Technology

Domain Est. 1998

Website: thermacut.com

Key Highlights: For more than 30 years THERMACUT® is successfully designing, producing and distributing HQ products for laser, plasma, and oxy fuel cutting….

#3 Genuine OEM Plasma Consumables

Domain Est. 2020

Website: lindedirect.com

Key Highlights: Genuine OEM consumables from Linde keep your plasma cutting system running at peak performance. Linde provides the highest quality consumables from the leading ……

#4 Service parts for your Hypertherm plasma cutter, laser cutting system

Domain Est. 1995

Website: hypertherm.com

Key Highlights: We offer a complete range of plasma cutter parts from relays and contactors to pumps and torches, ensuring you continue to get the same great performance as ……

#5 289 Plasma Cutting Accessories for sale from $7.44

Domain Est. 1998

Website: weldersupply.com

Key Highlights: Free delivery over $300 · 14-day returnsReplacement torches, electrodes, nozzles, and circle cutting guides for Hypertherm, Miller, & Thermal Dynamics. Free shipping over $300….

#6 Fine Plasma Parts and Consumables

Domain Est. 2000

Website: komatsupress.com

Key Highlights: For all your parts and consumables needs, our dedicated sales team is just an email or phone call away! Contact us at [email protected] or call 1-800-70- ……

#7 Repair and Replacement Parts

Domain Est. 2003

Website: weldfabulous.com

Key Highlights: Free delivery · 30-day returnsGet a great deal on name brand plasma cutting spare parts! Weldfabulous carries heavy duty plasma cutting spare parts at low prices!…

#8 Hypermax

Domain Est. 2011

#9 Replacement Parts for Welders & Plasma Cutters

Domain Est. 2014

Expert Sourcing Insights for Plasma Cutter Replacement Parts

H2: 2026 Market Trends for Plasma Cutter Replacement Parts

The global market for plasma cutter replacement parts is poised for steady growth by 2026, driven by increased industrial automation, advancements in cutting technology, and rising demand across manufacturing, automotive, and construction sectors. Key trends shaping the market include:

-

Increased Demand from Heavy Industries

The expanding use of plasma cutting in metal fabrication, shipbuilding, and infrastructure development is fueling demand for reliable replacement parts such as nozzles, electrodes, swirl rings, and shields. As industries prioritize precision and efficiency, regular maintenance and part replacement become essential, boosting aftermarket sales. -

Growth in Automation and CNC Integration

The integration of plasma cutting systems with computer numerical control (CNC) machines is accelerating, especially in high-volume production environments. This shift increases wear on consumable parts due to continuous operation, thereby driving recurring demand for replacements. Manufacturers are focusing on durable, high-performance components compatible with automated systems. -

Technological Advancements in Consumables

Innovations in material science—such as the use of hafnium electrodes and advanced copper alloys—are enhancing the lifespan and cutting efficiency of replacement parts. By 2026, smart consumables equipped with usage tracking or wear indicators may begin to enter the market, improving predictive maintenance and reducing downtime. -

Rise of E-Commerce and Aftermarket Channels

Online platforms are becoming preferred channels for purchasing replacement parts, offering convenience, competitive pricing, and faster delivery. Independent aftermarket suppliers are gaining traction by providing cost-effective alternatives to OEM parts, particularly in emerging economies. -

Sustainability and Recycling Initiatives

There is growing emphasis on recycling worn-out electrodes and nozzles, especially those containing precious metals like hafnium. By 2026, manufacturers may expand take-back programs and sustainable sourcing practices to meet environmental regulations and reduce material costs. -

Regional Market Expansion

Asia-Pacific, particularly China and India, is expected to lead market growth due to rapid industrialization and infrastructure investments. North America and Europe will maintain strong demand, supported by modernization of manufacturing facilities and adherence to high safety and efficiency standards. -

Impact of Supply Chain Resilience

Post-pandemic supply chain restructuring has prompted companies to localize production and maintain higher inventories of critical spare parts. This trend is likely to continue into 2026, enhancing market stability and reducing lead times for replacement components.

In summary, the 2026 plasma cutter replacement parts market will be shaped by technological innovation, industrial digitization, and geographic expansion. Stakeholders who invest in quality, sustainability, and supply chain agility are expected to gain a competitive edge.

Common Pitfalls When Sourcing Plasma Cutter Replacement Parts (Quality & IP)

Sourcing replacement parts for plasma cutters can significantly impact equipment performance, operational downtime, and overall costs. Two major pitfalls to watch for are compromised quality and intellectual property (IP) risks. Being aware of these issues helps ensure reliable, safe, and legally compliant procurement.

Poor Quality Parts Leading to Equipment Failure

One of the most frequent pitfalls is selecting replacement parts based solely on price, which often results in substandard components. Low-quality consumables—such as nozzles, electrodes, swirl rings, and shields—can degrade quickly, produce inconsistent cuts, and damage the plasma torch or power source. Inferior materials may not withstand high thermal and electrical stresses, leading to premature failure, increased downtime, and higher long-term costs. Additionally, mismatched tolerances or poor manufacturing precision can affect arc stability and cut quality, ultimately reducing productivity and increasing scrap rates.

Intellectual Property (IP) Infringement Risks

Another critical concern is inadvertently sourcing counterfeit or cloned parts that violate manufacturer IP rights. Many OEMs hold patents, trademarks, and design rights on their plasma cutter components. Third-party suppliers may produce near-identical copies that infringe on these protections, exposing buyers to legal risks, especially in regulated industries or international markets. Using counterfeit parts may also void equipment warranties and compromise safety certifications. Furthermore, IP-infringing parts often lack rigorous testing and quality control, compounding performance and reliability issues.

To mitigate these pitfalls, always verify supplier credibility, prioritize parts with traceable quality certifications, and confirm IP compliance—especially when considering non-OEM alternatives.

Logistics & Compliance Guide for Plasma Cutter Replacement Parts

Overview

This guide outlines the logistics procedures and compliance requirements for the procurement, handling, shipping, storage, and disposal of plasma cutter replacement parts. Adherence to these guidelines ensures operational efficiency, regulatory compliance, and safety across the supply chain.

Procurement & Supplier Management

Ensure all suppliers are vetted for quality assurance and regulatory compliance. Procurement must verify that replacement parts meet industry standards (e.g., ISO, ANSI, or OEM specifications) and are supplied with proper documentation, including Certificates of Conformance (CoC) and Material Safety Data Sheets (MSDS), where applicable.

Packaging & Labeling Requirements

All plasma cutter replacement parts must be packaged to prevent damage during transit. Use anti-static materials for sensitive electronic components (e.g., torch tips, swirl rings, retaining caps). Labels must include part number, manufacturer, date of packaging, and handling instructions (e.g., “Fragile,” “Do Not Stack”). Hazardous materials (if any) must be labeled per GHS standards.

Shipping & Transportation

Shipments must comply with domestic and international transportation regulations (e.g., IATA, IMDG, or 49 CFR for hazardous materials). Use carriers experienced in handling industrial components. Track all shipments in real-time using a logistics management system. For international shipments, ensure proper customs documentation, including commercial invoices, packing lists, and Harmonized System (HS) codes.

Import/Export Compliance

Verify export control classifications (ECCN) for applicable parts under the Export Administration Regulations (EAR). Obtain necessary export licenses if required. For imports, ensure compliance with destination country regulations, including CE marking (EU), UKCA (UK), or other regional certifications. Maintain records of all import/export documentation for a minimum of five years.

Storage & Inventory Management

Store replacement parts in a dry, temperature-controlled environment away from direct sunlight and sources of electromagnetic interference. Implement a first-in, first-out (FIFO) inventory system to minimize obsolescence. Segregate hazardous components (e.g., electrodes containing hafnium or zirconium) per local environmental regulations.

Quality Control & Traceability

Maintain full traceability of all parts through batch/lot numbers and supplier records. Conduct incoming inspections to verify part integrity and conformity. Document all quality checks and non-conformances in the quality management system (QMS).

Safety & Handling Procedures

Train personnel on safe handling practices. Use appropriate personal protective equipment (PPE) when handling sharp or contaminated components. Follow lockout/tagout (LOTO) procedures when installing parts to powered equipment.

Environmental & Disposal Compliance

Dispose of used or defective plasma cutter parts in accordance with local, state, and federal environmental regulations. Some components may contain regulated metals or hazardous substances and must be recycled or disposed of via certified e-waste or hazardous waste handlers. Maintain disposal records for audit purposes.

Regulatory Audits & Recordkeeping

Prepare for internal and external audits by maintaining up-to-date records of procurement, transportation, storage, inspections, and disposal activities. Records must be retained for a minimum of seven years or as required by jurisdiction.

Contact & Support

For compliance or logistics inquiries, contact the Supply Chain Compliance Officer at [email protected] or call +1 (555) 123-4567. Report any non-compliance incidents immediately through the company’s incident reporting system.

In conclusion, sourcing plasma cutter replacement parts requires careful consideration of compatibility, quality, supplier reliability, and cost-effectiveness. Ensuring that parts meet original equipment manufacturer (OEM) specifications or are from reputable aftermarket suppliers helps maintain optimal performance and extends the lifespan of the plasma cutting system. Establishing relationships with trusted suppliers, maintaining an inventory of commonly replaced components such as nozzles, electrodes, and swirl rings, and staying informed about part availability can minimize downtime and improve operational efficiency. Regular maintenance combined with timely replacement of worn parts ultimately supports consistent cut quality, productivity, and long-term savings in industrial cutting operations.