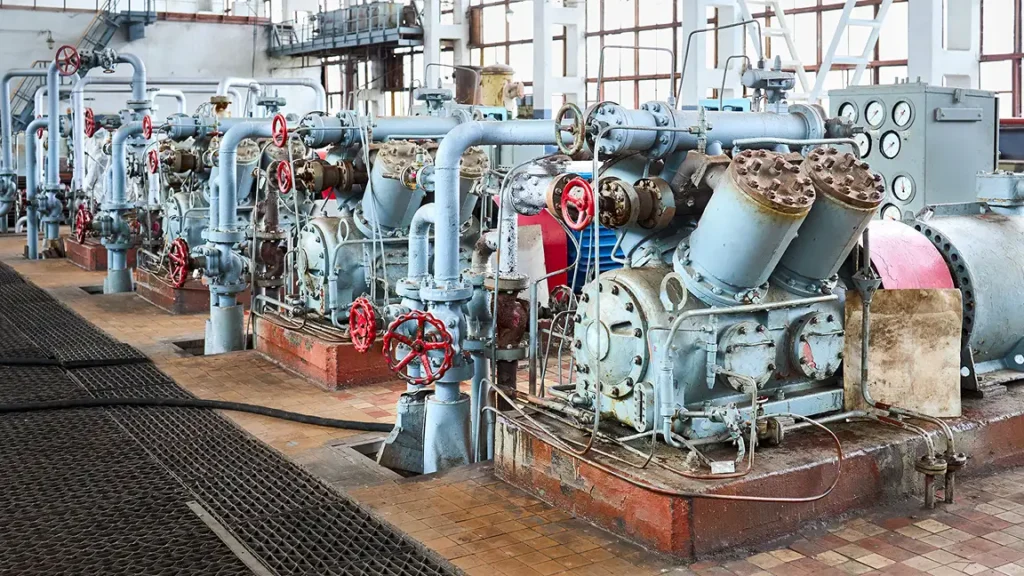

The global piston axial pump market is experiencing robust growth, driven by rising demand across industrial, mobile, and aerospace applications. According to Grand View Research, the global hydraulic pumps market—of which piston axial pumps are a key segment—was valued at USD 13.1 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. Mordor Intelligence further highlights that increasing automation in manufacturing, coupled with growing investments in construction and mining equipment, is accelerating the adoption of high-efficiency axial piston pumps. As performance, durability, and energy efficiency become critical selection criteria, leading manufacturers are innovating to meet stringent industry standards. This evolving landscape has positioned a select group of companies at the forefront of technology and market share. Below, we highlight the top 8 piston axial pump manufacturers shaping the industry through engineering excellence and global reach.

Top 8 Piston Axial Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 AXP Axial Piston Pump

Domain Est. 1990

Website: moog.com

Key Highlights: Perfect Balance. Zero Compromise. The new Moog AXP Axial Piston Pump Series delivers the ideal balance of performance, features, and cost‑efficiency….

#2 Variable displacement axial piston motors

Domain Est. 1995

Website: danfoss.com

Key Highlights: Our H1 bent axis motors are designed to complement the growing family of H1 axial piston pumps. Featuring proven 32 degree bent axis technology, zero degree ……

#3 Axial Piston Pumps AX

Domain Est. 1998

Website: bucherhydraulics.com

Key Highlights: AX is the innovative piston pump series, designed and industrialized to match newest requirements of electric machines with variable speed drives….

#4 Fixed & Variable Displacement Axial Piston Pumps

Domain Est. 1995

Website: oilgear.com

Key Highlights: Variable displacement piston pumps adjust fluid flow to match your system’s real-time demands, resulting in increased efficiency, reduced energy consumption, ……

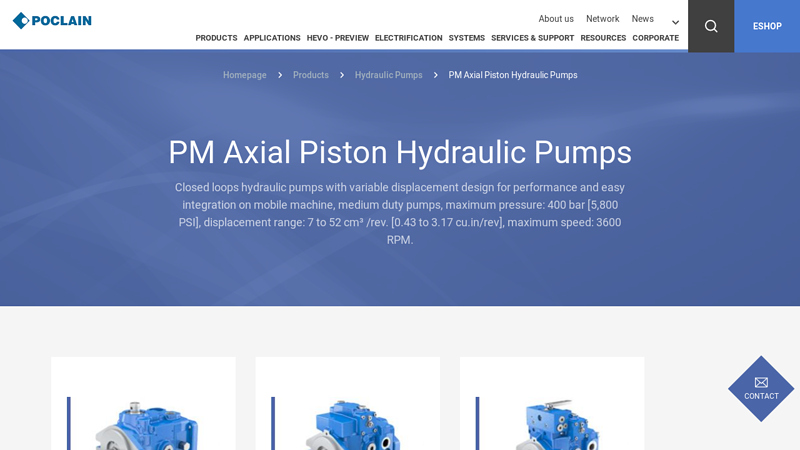

#5 PM Axial Piston Hydraulic Pumps

Domain Est. 1999

Website: poclain.com

Key Highlights: Closed loops hydraulic pumps with variable displacement design for performance and easy integration on mobile machine, medium duty pumps….

#6 Axial piston motors

Domain Est. 2000

Website: store.boschrexroth.com

Key Highlights: Axial piston motors are available in swash plate or bent axis design for medium and high-pressure applications. Our hydrostatic drives for mobile and ……

#7 Axial piston pumps

Domain Est. 2010

Website: hawe.com

Key Highlights: Axial piston pumps have several pistons that are arranged parallel to the drive shaft. · Radial piston pumps are a type of hydraulic pump. · Air driven hydraulic ……

#8 Axial Piston Pumps

Domain Est. 2019

Website: kawasakihydraulics.com

Key Highlights: Axial Piston Pumps. Kawasaki has been producing axial piston pumps for more than 50 years and leads the world in terms of pump efficiency and performance….

Expert Sourcing Insights for Piston Axial

H2: Market Trends for Piston Axial Technology in 2026

As we approach 2026, the piston axial technology market—particularly in hydraulic pumps and motors—is undergoing significant transformation driven by industrial automation, energy efficiency demands, and advancements in materials science and digital integration. This analysis outlines the key trends shaping the piston axial market in the second half (H2) of 2026.

-

Increased Demand in Mobile and Industrial Hydraulics

The adoption of axial piston pumps and motors continues to grow in construction, agriculture, and material handling equipment. OEMs are favoring compact, high-efficiency axial piston units due to their superior power density and controllability. In H2 2026, especially in emerging markets like Southeast Asia and India, infrastructure development is fueling demand for heavy machinery equipped with advanced hydraulic systems. -

Electrification and Hybrid Systems Integration

A defining trend in 2026 is the integration of axial piston units into hybrid and electric drivetrains. As industries move toward decarbonization, electro-hydraulic systems that combine electric motors with axial piston pumps are gaining traction. These systems offer precise control, reduced emissions, and improved energy recovery—particularly in off-highway vehicles and renewable energy applications like wind turbine pitch control. -

Smart Hydraulics and IoT Connectivity

Digitalization is a major driver. Axial piston units in 2026 increasingly feature embedded sensors and IoT connectivity, enabling predictive maintenance, real-time performance monitoring, and remote diagnostics. Manufacturers like Bosch Rexroth, Parker Hannifin, and Danfoss are launching “smart” axial piston pumps that interface with industrial IoT platforms, improving uptime and reducing lifecycle costs. -

Advancements in Materials and Efficiency

Material innovations—such as ceramic-coated pistons, high-performance composites, and advanced valve plates—are enhancing durability and reducing wear. In H2 2026, efficiency standards (e.g., ISO 13730 and regional energy regulations) are pushing manufacturers to develop variable-displacement axial piston pumps with >95% volumetric efficiency and lower noise emissions. -

Sustainability and Circular Economy Focus

End-of-life recyclability and reduced environmental impact are influencing design. Leading players are adopting modular designs and biodegradable hydraulic fluids compatible with axial piston systems. Regulatory pressure in the EU and North America is accelerating this shift, with extended producer responsibility (EPR) schemes affecting product lifecycle planning. -

Supply Chain Resilience and Regional Manufacturing

Ongoing geopolitical tensions and trade dynamics have prompted a reevaluation of supply chains. In H2 2026, there is a noticeable shift toward regionalization, with increased manufacturing of axial piston components in North America and Eastern Europe to mitigate risks and reduce lead times. -

Competitive Landscape and M&A Activity

The market remains consolidated among key players, but niche innovators focusing on compact, high-speed axial piston units for robotics and aerospace are attracting investment. Mergers and partnerships—such as those between hydraulic specialists and control system developers—are accelerating innovation in integrated fluid power solutions.

Conclusion:

By H2 2026, the piston axial market is characterized by technological convergence, sustainability imperatives, and digital integration. Companies that leverage smart hydraulics, support electrification trends, and ensure supply chain agility are best positioned to capture growth. The sector is moving beyond traditional performance metrics toward intelligent, adaptive, and eco-efficient systems, marking a pivotal shift in fluid power technology.

Common Pitfalls When Sourcing Piston Axial Pumps: Quality and Intellectual Property Risks

Sourcing piston axial pumps—commonly used in hydraulic systems across industrial, mobile, and aerospace applications—can be fraught with challenges, particularly concerning quality consistency and intellectual property (IP) protection. Failing to address these pitfalls can lead to equipment failure, legal disputes, and reputational damage. Below are key risks to watch for.

Inconsistent Quality and Reliability

One of the most frequent issues when sourcing piston axial pumps—especially from low-cost manufacturers or unfamiliar suppliers—is inconsistent product quality. Substandard materials, poor machining tolerances, and inadequate testing can result in:

- Premature wear and failure due to subpar piston seals or valve plates

- Reduced efficiency from internal leakage or imprecise swashplate alignment

- Unreliable performance under load, leading to system downtime

- Lack of traceability in component sourcing, making root-cause analysis difficult

To mitigate this, always require certified quality documentation (e.g., ISO 9001), conduct factory audits, and perform third-party performance testing on initial batches.

Intellectual Property Infringement Risks

Piston axial pump designs often incorporate proprietary engineering, including unique swashplate mechanisms, porting configurations, and control systems. Sourcing from unauthorized or copycat manufacturers can expose buyers to significant IP risks:

- Direct infringement of patented designs, potentially leading to legal action against both supplier and end-user

- Counterfeit or reverse-engineered products that mimic branded pumps but lack performance and safety validation

- Voided warranties and lack of technical support due to unauthorized reproduction

- Supply chain liability, especially in regulated industries like aerospace or medical equipment

Always verify that suppliers hold proper licensing for the designs they produce and conduct due diligence on the origin of the technology. Use non-disclosure agreements (NDAs) when sharing specifications and consider working only with authorized distributors or OEMs.

Additional Sourcing Challenges

Beyond quality and IP, buyers should also be cautious of:

- Misrepresented performance data (e.g., exaggerated pressure or flow ratings)

- Lack of after-sales support and spare parts availability

- Inadequate documentation, including missing CAD files or compliance certificates

Proactively addressing these pitfalls through rigorous supplier vetting, contractual safeguards, and technical validation can ensure reliable, legally compliant sourcing of piston axial pumps.

Logistics & Compliance Guide for Piston Axial

This guide outlines the essential logistics and compliance considerations for the handling, transportation, storage, and regulatory adherence related to Piston Axial components or products. Adherence to these guidelines ensures operational efficiency, legal compliance, and product integrity.

Product Classification and Regulatory Requirements

Piston Axial units may be subject to industrial, mechanical, and export control regulations depending on their application and technical specifications. Ensure proper classification under relevant international and national frameworks, such as the Harmonized System (HS) codes, Export Control Classification Numbers (ECCN), or dual-use regulations (e.g., EU Dual-Use Regulation, U.S. EAR). Conduct regular reviews to confirm classification accuracy and compliance with trade sanctions.

Packaging and Handling Standards

Use packaging that protects Piston Axial components from shock, vibration, moisture, and corrosion during transit. Follow industry best practices such as ISTA 3A for transportation testing where applicable. Clearly label all packages with handling instructions (e.g., “Fragile,” “This Side Up”) and include product identification, batch numbers, and safety warnings as required.

Transportation and Shipping Protocols

Utilize certified carriers experienced in handling precision mechanical components. Maintain temperature and humidity controls if specified by technical documentation. For international shipments, ensure all required documentation is complete, including commercial invoices, packing lists, certificates of origin, and export licenses when necessary. Comply with IATA, IMDG (if hazardous materials are involved), and local transport regulations.

Import and Export Compliance

Verify that all exports and imports of Piston Axial products comply with destination country requirements. Conduct end-use and end-user screening to prevent violations of trade restrictions. Maintain records of licenses, authorizations, and compliance audits for a minimum of five years, or as required by jurisdiction.

Storage and Inventory Management

Store Piston Axial components in a clean, dry, and temperature-controlled environment to prevent corrosion and degradation. Implement a first-in, first-out (FIFO) inventory system and conduct periodic inspections to ensure product quality. Segregate non-conforming or quarantined items to avoid unintended use.

Environmental, Health, and Safety (EHS) Compliance

Adhere to OSHA, REACH, RoHS, and other applicable EHS regulations. Ensure safe handling procedures are in place for any lubricants, coatings, or materials used in Piston Axial units. Provide appropriate personal protective equipment (PPE) and training for personnel involved in logistics operations.

Documentation and Traceability

Maintain complete and accurate records for full traceability of each Piston Axial unit, including manufacturing date, serial number, inspection reports, and shipping details. Digital tracking systems (e.g., ERP or WMS) are recommended to streamline compliance and support audits.

Audit and Continuous Improvement

Conduct regular internal logistics and compliance audits to identify gaps and implement corrective actions. Stay updated on regulatory changes and industry standards. Engage in training programs to ensure staff competency in compliance procedures and emerging logistics technologies.

Conclusion for Sourcing Piston Axial Pumps

In conclusion, sourcing piston axial pumps requires a strategic approach that balances performance requirements, cost-efficiency, reliability, and supplier credibility. These pumps are critical components in high-pressure hydraulic systems, offering advantages such as high efficiency, variable flow control, and durability under demanding operating conditions. When selecting a supplier, key considerations include product quality, compliance with industry standards (e.g., ISO, SAE), technical support, delivery timelines, and total cost of ownership.

Evaluating both domestic and international suppliers reveals a trade-off between upfront cost savings and long-term reliability. While some global manufacturers offer competitive pricing, partnering with reputable suppliers—whether local or overseas—ensures consistent quality, access to engineering expertise, and timely after-sales service. Additionally, factors such as customization capability, energy efficiency, and compatibility with existing systems play a vital role in the selection process.

Ultimately, a successful sourcing strategy for axial piston pumps involves thorough supplier vetting, lifecycle cost analysis, and integration with broader supply chain objectives. By prioritizing quality and partnership over short-term savings, organizations can enhance system performance, reduce downtime, and achieve long-term operational efficiency.