The global pipette market is experiencing steady growth, driven by rising demand for precision liquid handling in pharmaceutical, biotechnology, and clinical research laboratories. According to Grand View Research, the global laboratory pipette market was valued at USD 2.7 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.3% from 2023 to 2030. Similarly, Mordor Intelligence projects a CAGR of approximately 6.1% over the forecast period (2023–2028), underpinned by increased R&D investments and the adoption of automated liquid handling systems. As reliability and accuracy remain critical in laboratory workflows, the demand for high-quality pipette components—such as plungers, seals, tips, and piston assemblies—has surged. This growth has spurred a competitive manufacturing landscape, with leading suppliers focusing on durable materials, tight tolerances, and compliance with international standards. In this evolving environment, identifying the top pipette parts manufacturers is essential for OEMs and service providers aiming to maintain performance, reduce downtime, and meet stringent regulatory requirements.

Top 10 Pipette Parts Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 PIPETTE / DISPENSER / CUSTOM MADE & OEM NICHIRYO

Website: nichiryo.co.jp

Key Highlights: Nichipet Air. New evolution for world-class light weight, accuracy and precision. Nichipet EX Plus Ⅱ. Chemical Resistant Model of Nichipet Series….

#2 Liquid Handling

Domain Est. 1993

Website: mt.com

Key Highlights: Pipetting 360+ reflects our commitment to providing the very finest pipettes, pipette tips, service, and support….

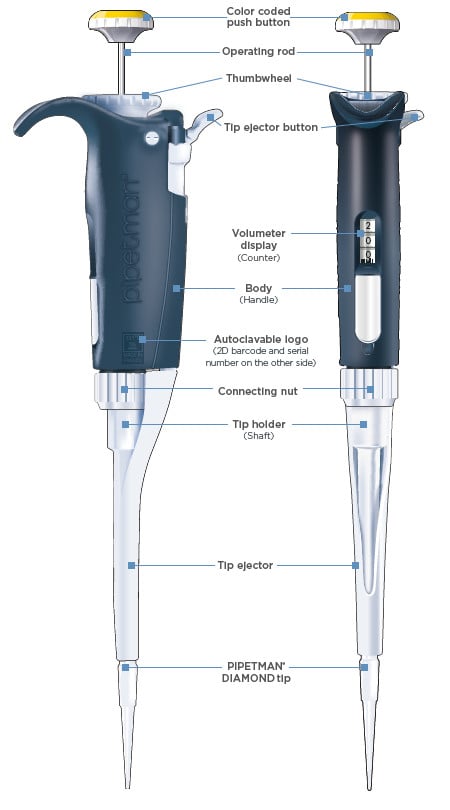

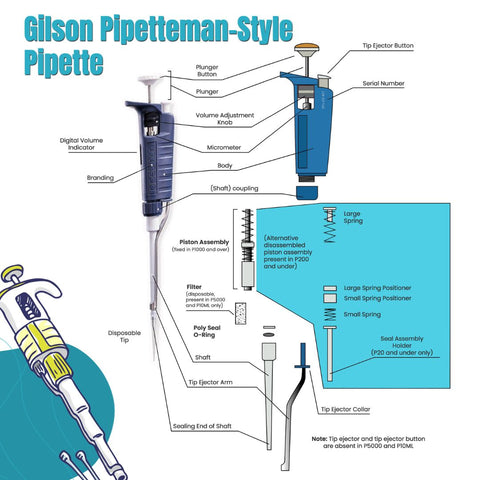

#3 PIPETMAN Service Kits

Domain Est. 1995

#4 Pipetting

Domain Est. 1996

Website: sartorius.com

Key Highlights: Our ergonomic pipettes make pipetting easy, accurate and comfortable. See our full range of mechanical and electronic pipettes as well as pipette tips and ……

#5 Your Reliable Partner For Productive Pipettes

Domain Est. 1997

Website: integra-biosciences.com

Key Highlights: Would you like to improve your pipetting efficiency? We provide you with cutting-edge pipettes, facilitating whatever pipetting task you might have….

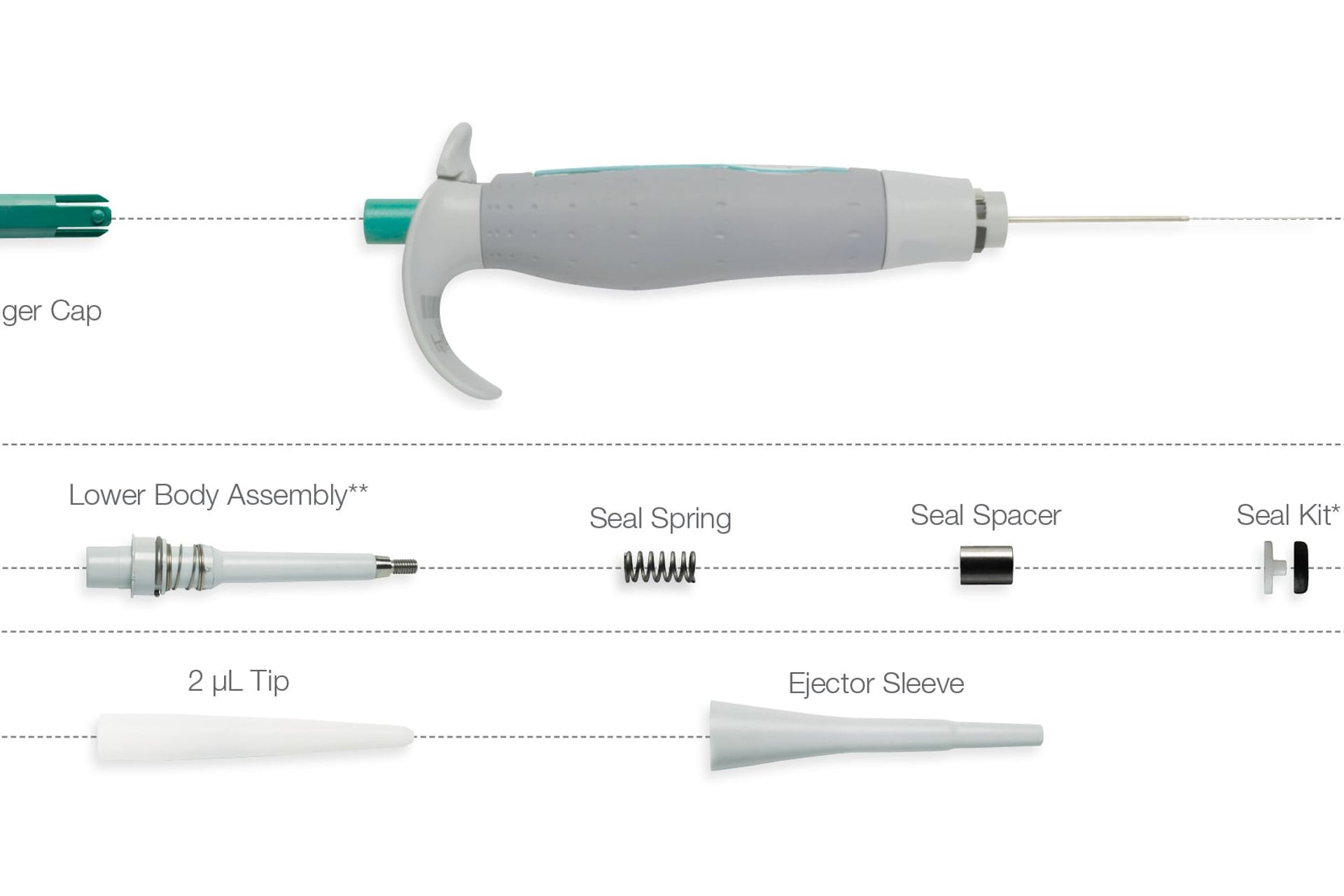

#6 SoftGrip Pipette Replacement Parts

Domain Est. 1998

Website: hamiltoncompany.com

Key Highlights: $10 deliveryDiscover Hamilton’s range of pipette replacement parts designed to keep your Softgrip pipettes operating at peak performance….

#7 Pipette Parts & Accessories

Domain Est. 1999

Website: nelsonjameson.com

Key Highlights: 30-day returnsPipette Parts & Accessories · Controller 9 · Pump 8 · Bulb 8 · Helper w/ Filter 3 · Grommet 1 · Battery 4 · Filter 8 · Grease 2….

#8 Adjustable Ergonomic Ovation Pipettes

Domain Est. 1999

Website: vistalab.com

Key Highlights: The adjustable ergonomic ovation pipettes offer Superior performance, ideal ergonomics and innovative features in one unique, patented design….

#9 Pipette Supplies

Domain Est. 2002

Website: pipettesupplies.com

Key Highlights: $9.85 deliveryYour One Stop Pipette Shop. Dedicated to our customers, we provide fast, affordable, hassle-free product delivery. Shop pipettes and parts….

#10 AHN Biotechnologie

Domain Est. 2009

Website: ahn-bio.com

Key Highlights: With over 25 years of experience, we manufacture a wide range of products, including pipettes, tips, tubes, cryo vials, spin columns and more….

Expert Sourcing Insights for Pipette Parts

H2: 2026 Market Trends for Pipette Parts

The global market for pipette parts is poised for steady growth and transformation by 2026, driven by advancements in laboratory automation, rising demand in life sciences and pharmaceutical research, and increased emphasis on precision and reproducibility in liquid handling. Below is an analysis of key trends shaping the pipette parts market in 2026:

-

Increased Demand for High-Precision Components

As research protocols become more sensitive—especially in genomics, proteomics, and drug discovery—there is growing demand for pipette parts that ensure high accuracy and low variability. Manufacturers are focusing on producing wear-resistant, chemically inert components such as ceramic plungers, fluoropolymer seals, and corrosion-proof pistons to meet these requirements. -

Rise of Electronic and Automated Pipetting Systems

The adoption of electronic pipettes and robotic liquid handling platforms is accelerating. This shift is increasing demand for compatible electronic components such as micro-motors, sensors, circuit boards, and rechargeable battery modules. Pipette parts that support programmable multi-channel dispensing, touchless operation, and integration with Laboratory Information Management Systems (LIMS) are expected to see strong market traction. -

Focus on Sustainability and Reusability

Environmental concerns are influencing the design and sourcing of pipette parts. By 2026, there is a noticeable shift toward reusable, autoclavable, and recyclable components. Leading suppliers are offering modular designs that allow for easy replacement of worn parts—extending the lifespan of pipettes and reducing plastic waste. Biodegradable or bio-based materials are also under exploration for non-critical components. -

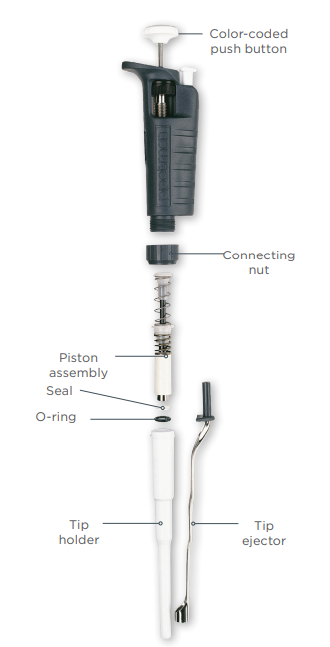

Growth in Aftermarket and Replacement Parts

With cost-efficiency becoming a priority for research institutions and diagnostic labs, the aftermarket for replacement pipette parts (e.g., tips, seals, O-rings, ejector mechanisms) is expanding. Third-party suppliers are gaining market share by offering high-quality, compatible parts at lower prices than original equipment manufacturers (OEMs), supported by certification standards like ISO 8655. -

Geographic Expansion and Emerging Markets

While North America and Europe remain dominant due to advanced R&D infrastructure, the Asia-Pacific region—particularly China, India, and South Korea—is witnessing rapid growth. Increased investment in biotechnology, government funding for healthcare, and the expansion of contract research organizations (CROs) are fueling demand for pipette parts in these regions. -

Technological Integration and Smart Components

The integration of IoT and data connectivity in pipettes is leading to the development of “smart” parts capable of tracking usage, wear, and calibration status. By 2026, intelligent pipette components with embedded RFID tags or sensors for real-time performance monitoring are gaining adoption, enhancing traceability and compliance in regulated environments. -

Impact of Regulatory Standards and Quality Assurance

Stricter regulatory requirements, especially in clinical diagnostics and pharmaceutical manufacturing, are raising the bar for pipette part quality. Compliance with ISO, GLP, and FDA guidelines is becoming a competitive advantage. Manufacturers are investing in precision manufacturing and rigorous testing to ensure batch-to-batch consistency and traceability.

Conclusion

The 2026 market for pipette parts reflects a convergence of technological innovation, sustainability, and global expansion. As laboratories demand higher performance, efficiency, and compliance, the pipette parts industry is adapting through advanced materials, smart technology, and flexible supply models. Stakeholders who prioritize innovation, quality, and environmental responsibility are likely to lead the market in this evolving landscape.

Common Pitfalls Sourcing Pipette Parts: Quality and Intellectual Property Risks

Sourcing replacement or consumable parts for laboratory pipettes—especially from third-party or aftermarket suppliers—can introduce significant risks related to both part quality and intellectual property (IP) infringement. Being aware of these pitfalls is essential for maintaining instrument performance, data integrity, and legal compliance.

Poor Part Quality Leading to Performance Issues

One of the most prevalent risks when sourcing pipette parts is receiving components that do not meet the original equipment manufacturer’s (OEM) specifications. Low-quality seals, plungers, or tips may seem cost-effective initially but can lead to:

- Inaccurate volume delivery due to improper fit or material deformation.

- Increased contamination risk from substandard materials that leach chemicals or degrade over time.

- Premature wear and instrument damage, shortening the lifespan of expensive pipetting equipment.

- Inconsistent results across users or labs, undermining reproducibility and data integrity.

These issues are often exacerbated when suppliers lack rigorous quality control processes or use inferior raw materials to cut costs.

Intellectual Property Infringement

Many pipette designs and component geometries are protected by patents, trademarks, or design rights. Sourcing counterfeit or cloned parts from unauthorized manufacturers can expose laboratories and procurement departments to legal liability. Common IP-related pitfalls include:

- Patent infringement on proprietary designs (e.g., tip ejection mechanisms or internal sealing systems).

- Trademark violations when third-party parts are labeled or marketed using OEM brand names or logos.

- Voided warranties if the use of non-OEM parts is detected, potentially leaving the lab responsible for costly repairs.

Unwittingly purchasing infringing parts—especially through online marketplaces or obscure suppliers—can result in enforcement actions, product recalls, or reputational damage.

Mitigation Strategies

To avoid these pitfalls, organizations should:

- Source parts only from authorized distributors or reputable suppliers with verifiable quality certifications (e.g., ISO 13485).

- Request material specifications and performance validation data for critical components.

- Conduct supplier audits and verify IP compliance, particularly for high-volume or mission-critical applications.

- Train procurement staff to recognize red flags such as unusually low prices or vague product descriptions.

By prioritizing quality and IP compliance, labs can ensure reliable pipetting performance while avoiding legal and operational risks.

Logistics & Compliance Guide for Pipette Parts

This guide outlines the essential logistics and compliance considerations for the handling, transportation, storage, and regulatory adherence related to pipette parts used in laboratory and manufacturing environments. Proper management ensures product integrity, user safety, and compliance with international and local regulations.

Shipping & Transportation

Pipette parts, particularly those made from precision plastics, glass, or metal components, require careful packaging to prevent damage during transit. Use anti-static, crush-resistant packaging with padding to protect delicate parts such as plungers, seals, and tip cones. Shipments should comply with IATA, IMDG, or other relevant transport regulations if hazardous materials (e.g., lubricants with chemical content) are present. Temperature-sensitive components should be shipped with thermal packaging and monitored via data loggers when required.

Storage Conditions

Store pipette parts in a clean, dry, temperature-controlled environment (typically 15–25°C with <60% relative humidity) to prevent degradation, warping, or contamination. Keep parts in original sealed packaging until use to minimize exposure to dust, moisture, and biological contaminants. Segregate sterile parts from non-sterile items and clearly label storage areas to prevent cross-contamination. Implement a first-in, first-out (FIFO) inventory system to reduce the risk of using outdated components.

Regulatory Compliance

Ensure all pipette parts meet applicable regulatory standards, including but not limited to:

- ISO 8655: International standard for piston-operated volumetric apparatus, covering design, performance, and testing of pipettes and their components.

- REACH & RoHS: Compliance with EU regulations on the restriction of hazardous substances in electrical and electronic equipment and chemical safety.

- FDA 21 CFR Part 820 (if applicable): For components used in medical device manufacturing, adherence to Quality System Regulations may be required.

- CE Marking: Required for parts sold in the European Economic Area, indicating conformity with health, safety, and environmental protection standards.

Maintain documentation such as Certificates of Conformance (CoC), material declarations, and traceability records for audit readiness.

Import/Export Requirements

When shipping pipette parts across international borders, ensure compliance with customs regulations, including proper classification under the Harmonized System (HS) codes (e.g., 9026.20 for laboratory instruments parts). Complete required documentation such as commercial invoices, packing lists, and export declarations. Be aware of import restrictions or licensing requirements in destination countries, particularly for items with potential dual-use applications.

Environmental & Safety Considerations

Dispose of defective or end-of-life pipette parts in accordance with local environmental regulations. Recycle materials such as plastics and metals where possible. For parts containing lubricants or other chemical substances, follow hazardous waste disposal protocols. Provide Safety Data Sheets (SDS) for components that contain regulated substances, even in small quantities.

Quality Control & Traceability

Implement a quality control process for incoming and outgoing pipette parts, including visual inspection, dimensional checks, and functional testing where applicable. Maintain batch-level traceability through labeling and inventory management systems to support recalls or investigations. Regularly audit suppliers to ensure consistent compliance with quality and regulatory standards.

By adhering to this logistics and compliance framework, organizations can ensure the reliable performance of pipette systems, maintain regulatory compliance, and support operational efficiency in laboratory and production settings.

Conclusion for Sourcing Pipette Parts:

In conclusion, sourcing pipette parts requires a strategic approach that balances quality, cost, reliability, and compliance with industry standards. Selecting suppliers with a proven track record in producing precision laboratory components ensures the performance, accuracy, and longevity of pipettes. It is essential to evaluate suppliers based on certifications (such as ISO 13485), material traceability, and adherence to regulatory requirements, especially when serving diagnostic or pharmaceutical sectors. Additionally, establishing long-term partnerships with responsive and technically capable vendors supports supply chain resilience and facilitates quick resolution of any quality or delivery issues. By prioritizing quality assurance, technical compatibility, and supplier reliability, organizations can maintain high standards in laboratory operations and ensure the consistent performance of their liquid handling instrumentation.