The global pipeline strainers market is experiencing steady expansion, driven by increasing demand for efficient fluid filtration across industries such as oil & gas, chemical processing, power generation, and water treatment. According to Grand View Research, the global industrial filters market—which includes pipeline strainers—was valued at USD 63.5 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 6.2% from 2023 to 2030. Similarly, Mordor Intelligence forecasts robust growth in industrial filtration equipment, citing rising infrastructure investments and stricter regulatory standards for fluid purity as key drivers. With the Asia Pacific region emerging as a major growth hub due to rapid industrialization and expanding energy sectors, the demand for high-performance pipeline strainers is intensifying. As reliability and system uptime become critical, leading manufacturers are focusing on innovation, material durability, and compliance with international standards. In this evolving landscape, the following eight companies stand out for their technological expertise, global footprint, and strong market presence.

Top 8 Pipeline Strainers Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Industrial Strainer Manufacturer

Domain Est. 2002

Website: islipflowcontrols.com

Key Highlights: Islip Flow Controls is a leading industrial strainer manufacturer of Pipeline Strainers, Valves, and Accessories. We pride ourselves on exacting professional ……

#2 Pipeline Strainers

Domain Est. 1998

Website: keckley.com

Key Highlights: Keckley’s industrial and commercial steel pipeline strainers are designed for a wide variety of applications where protection from foreign matter in a pipeline ……

#3 Eaton Strainers

Domain Est. 2011

Website: strainersales.com

Key Highlights: Eaton Strainers are used by industrial users to protect their process equipment and machinery by removing debris from the liquid that flows through pipelines….

#4 Pipeline Basket Strainer, Duplex & Simplex Industry …

Domain Est. 2016

Website: filsonfilters.com

Key Highlights: Filson offers a wide variety of standard pipeline basket strainers as well as the custom-made strainer to effectively remove debris from industrial pipeline ……

#5 Strainers

Domain Est. 1995

Website: watts.com

Key Highlights: Strainers are designed to protect water and steam piping system components from dirt, rust, and other damaging debris in residential, commercial, and ……

#6 Weamco: Fabricated Strainers

Domain Est. 1997

Website: weamco.com

Key Highlights: Weamco, based in Sapulpa, OK, provides strainers, pipeline products, & accessories nationwide – including meter provers, MagTek switches, ……

#7 Strainers

Domain Est. 2000

Website: spiraxsarco.com

Key Highlights: Strainers arrest pipeline debris such as scale, rust, jointing compound and weld metal in pipelines, protecting equipment and processes….

#8 Products

Domain Est. 2012

Website: titanfci.co

Key Highlights: Basket Strainers remove unwanted debris from the pipeline flow. Basket Strainers are ideal for applications where debris loading is high. Duplex Strainers….

Expert Sourcing Insights for Pipeline Strainers

H2: 2026 Market Trends for Pipeline Strainers

The global pipeline strainers market is poised for steady growth through 2026, driven by increasing industrialization, infrastructure development, and a growing emphasis on system efficiency and reliability across key sectors such as oil & gas, power generation, water treatment, and chemical processing. This analysis outlines the primary market trends expected to shape the pipeline strainers industry by 2026.

-

Rising Demand from Energy and Utilities Sectors

The oil & gas industry remains a major end-user of pipeline strainers, particularly in upstream and midstream operations where protecting pumps, valves, and compressors from particulate contamination is critical. As global energy demand continues to rise—especially in emerging economies—new pipeline infrastructure and maintenance upgrades will drive strainer demand. Additionally, the expansion of LNG (liquefied natural gas) facilities and offshore drilling projects will further boost the need for high-performance strainers. In the power sector, both conventional and renewable energy plants (e.g., geothermal and biomass) require strainers for cooling water and fuel systems, contributing to market growth. -

Growth in Water and Wastewater Treatment Infrastructure

With increasing urbanization and stricter environmental regulations, governments worldwide are investing heavily in modernizing water and wastewater treatment systems. Pipeline strainers play a vital role in protecting pumps and filtration systems from debris. By 2026, this trend will be especially prominent in regions like Asia-Pacific and Africa, where rapid urban development is placing pressure on aging infrastructure. -

Technological Advancements and Smart Monitoring Integration

Manufacturers are increasingly adopting smart technologies, including IoT-enabled sensors and predictive maintenance systems, into pipeline strainers. By 2026, smart strainers equipped with pressure differential monitoring and automated cleaning functions are expected to gain traction, particularly in industries where downtime is costly. These innovations enhance operational efficiency, reduce maintenance costs, and support Industry 4.0 initiatives. -

Emphasis on Sustainability and Material Innovation

Environmental concerns are pushing manufacturers toward sustainable materials and energy-efficient designs. Strainer housings made from corrosion-resistant alloys and recyclable materials are gaining popularity. Additionally, improved designs that minimize pressure drop contribute to energy savings in pumping systems, aligning with global sustainability goals. -

Regional Market Dynamics

Asia-Pacific is expected to dominate the market by 2026, led by China, India, and Southeast Asian nations due to large-scale industrial and infrastructure projects. North America and Europe will maintain steady growth, supported by aging infrastructure upgrades and stringent regulatory standards for fluid system integrity. The Middle East remains a key market due to ongoing oil & gas investments. -

Supply Chain Resilience and Localization

Post-pandemic supply chain disruptions have prompted companies to diversify sourcing and increase local manufacturing. By 2026, regional production hubs for strainers are expected to expand, reducing lead times and improving responsiveness to customer needs.

In conclusion, the 2026 pipeline strainers market will be characterized by technological innovation, sustainability integration, and strong demand from energy, water, and industrial sectors. Companies that invest in smart solutions, durable materials, and regional supply chains are likely to gain a competitive edge in this evolving landscape.

Common Pitfalls When Sourcing Pipeline Strainers (Quality and Intellectual Property)

Sourcing pipeline strainers—critical components for protecting downstream equipment by removing debris from fluid systems—can present several challenges, particularly concerning quality assurance and intellectual property (IP) risks. Failing to address these pitfalls can lead to system failures, safety hazards, and legal complications. Below are key issues to watch for:

1. Compromised Material Quality

One of the most frequent quality pitfalls is the use of substandard materials. Suppliers, especially low-cost offshore manufacturers, may substitute specified alloys (e.g., stainless steel 316) with inferior grades to reduce costs. This can result in premature corrosion, reduced lifespan, and failure under pressure or high-temperature conditions.

Mitigation: Require material test reports (MTRs), conduct third-party inspections, and specify compliance with standards such as ASTM, ASME, or ISO.

2. Inadequate Manufacturing Tolerances

Poor dimensional accuracy and inconsistent screen mesh sizes can impair strainer performance. Off-spec perforations or misaligned flanges may lead to leaks, flow restriction, or ineffective filtration.

Mitigation: Enforce adherence to engineering drawings and applicable standards (e.g., MSS SP-71), and perform pre-shipment inspections.

3. Lack of Certification and Traceability

Reputable pipeline strainers must meet industry certifications (e.g., API, PED, CE). Sourcing from suppliers without proper documentation risks non-compliance with safety and regulatory requirements.

Mitigation: Verify certification validity and demand full traceability, including heat numbers and batch records.

4. Counterfeit or Reverse-Engineered Designs (IP Violations)

Some suppliers may offer strainers that mimic patented designs from leading manufacturers without licensing. These “copycat” products infringe on intellectual property rights and often lack performance validation.

Mitigation: Perform due diligence on supplier legitimacy, check for original design documentation, and avoid unusually low-priced offerings that may indicate IP infringement.

5. Incomplete or Misleading Documentation

Suppliers may provide incomplete operation manuals, falsified test data, or inaccurate performance specifications. This creates risks during installation, commissioning, and maintenance.

Mitigation: Insist on comprehensive technical submittals and validate claims through independent testing where necessary.

6. Supply Chain Transparency Issues

Opaqueness in the supply chain—such as undisclosed subcontractors or component sources—increases the risk of quality lapses and IP theft.

Mitigation: Require full disclosure of manufacturing locations and critical component sources, and conduct supplier audits.

7. Non-Compliance with Regional Standards

Strainers designed for one market (e.g., ANSI in the U.S.) may not meet standards in another (e.g., DIN in Europe). Using non-compliant products can void warranties and violate local regulations.

Mitigation: Clearly specify required regional and industry standards in procurement contracts.

By proactively addressing these quality and IP-related pitfalls, organizations can ensure the reliability, safety, and legal compliance of sourced pipeline strainers.

Logistics & Compliance Guide for Pipeline Strainers

This guide outlines the essential logistics and compliance considerations for the procurement, transportation, handling, and installation of pipeline strainers in industrial applications. Proper adherence ensures operational efficiency, safety, and regulatory compliance.

Procurement and Specification Compliance

Ensure pipeline strainers are procured according to applicable industry standards and project specifications. Key compliance benchmarks include:

– ASME B16.34: Covers pressure-temperature ratings, materials, dimensions, and testing for valves and strainers.

– API 6D: Specifies requirements for pipeline valves, including strainer components in pipeline systems.

– ISO 9001: Verify supplier compliance with quality management systems to ensure product consistency and traceability.

– Material Certifications: Request Mill Test Certificates (MTCs) or Material Test Reports (MTRs) confirming compliance with specified materials (e.g., ASTM A216 for carbon steel, ASTM A351 for stainless steel).

– NACE MR0175/ISO 15156: Required for strainers used in sour service environments to prevent sulfide stress cracking.

Packaging and Handling Requirements

Proper packaging prevents damage during transit and storage:

– End Caps and Plugs: All flanged or threaded openings must be sealed with protective caps or blind flanges to prevent contamination and physical damage.

– Crating: Use sturdy wooden or metal crates for large or heavy strainers. Include internal supports to prevent movement.

– Lifting Points: Ensure strainers are equipped with or clearly marked for safe lifting. Never lift by stems, handles, or attached instrumentation.

– Labeling: Clearly label each unit with part number, material, size, pressure rating, flow direction, and handling instructions (e.g., “This Side Up,” “Do Not Stack”).

Transportation and Storage

Follow best practices for shipping and on-site storage:

– Transport Method: Use flatbed trucks or enclosed carriers depending on size and environmental exposure risk. Secure loads with straps and dunnage.

– Environmental Protection: Store strainers indoors or under cover to avoid exposure to rain, snow, and corrosive elements. Elevate from ground level using pallets.

– Inventory Management: Implement a first-in, first-out (FIFO) system. Protect gasket surfaces and internal screens from debris and corrosion.

– Freeze Protection: In cold climates, ensure no water remains in strainer bodies to prevent cracking.

Import/Export and Regulatory Compliance

For international shipments, comply with:

– Customs Documentation: Provide commercial invoices, packing lists, and certificates of origin. Accurately classify strainers under the Harmonized System (HS Code), typically under 8481.80 (parts for taps, cocks, and valves).

– REACH and RoHS: Confirm materials comply with EU regulations on hazardous substances, especially for projects in Europe.

– PED (Pressure Equipment Directive 2014/68/EU): Required for strainers used in the European market with a maximum allowable pressure >0.5 bar. CE marking and EU Declaration of Conformity are mandatory.

– Country-Specific Approvals: Some regions may require additional certifications (e.g., CRN in Canada, GOST in Russia).

Installation and Commissioning Compliance

Follow engineering and safety protocols during installation:

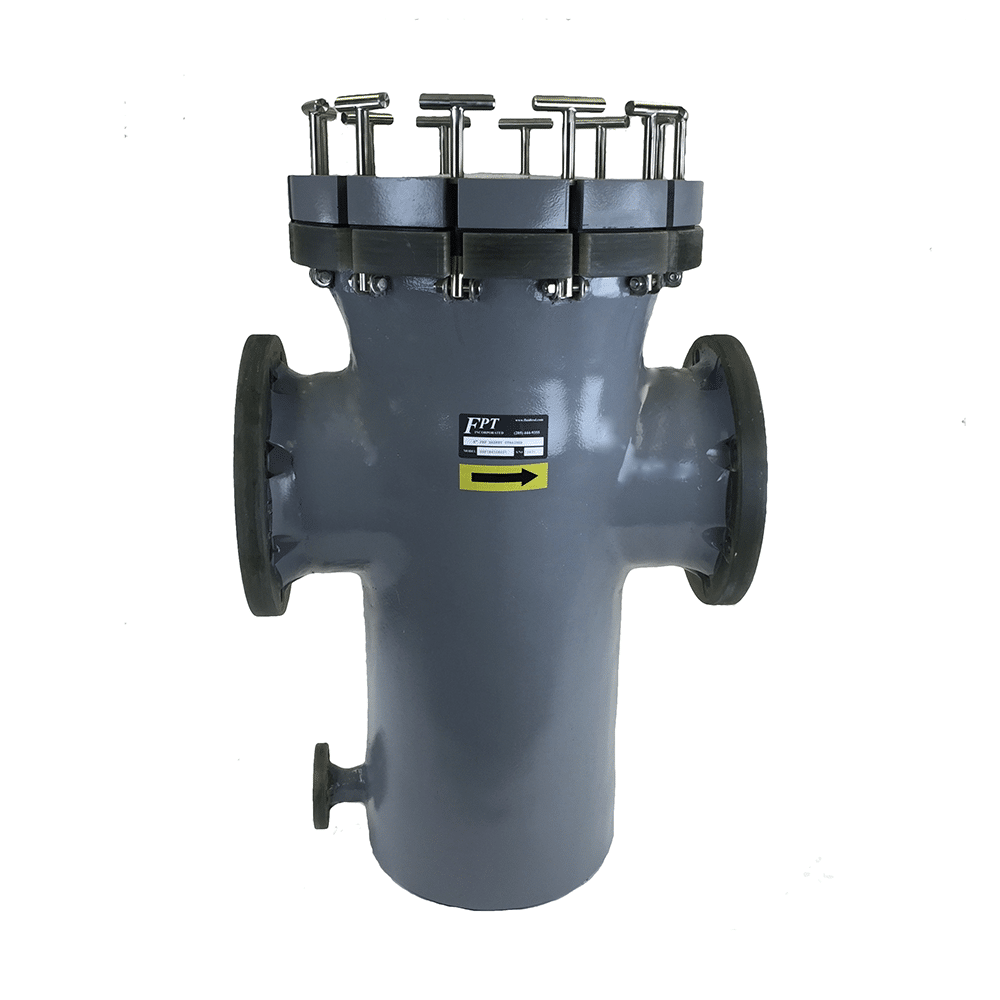

– Orientation: Install in correct flow direction as indicated by the arrow on the body.

– Support Structures: Ensure adjacent piping is properly supported; avoid placing stress on the strainer body.

– Welding Precautions: If welding near the strainer, protect internal components from spatter and heat. Remove screen baskets before welding to prevent warping.

– Inspection and Testing: Perform hydrostatic testing per ASME B31.3 or project requirements. Inspect screen baskets for damage before startup.

– Permits and Documentation: Maintain records of installation, pressure tests, and as-built drawings for audit and compliance purposes.

Maintenance and Regulatory Recordkeeping

Support long-term compliance through:

– Scheduled Maintenance: Regularly inspect and clean strainer baskets to prevent clogging and maintain system efficiency.

– Replacement Parts: Use OEM or certified replacement screens and gaskets to maintain compliance with original design standards.

– Documentation Retention: Keep procurement records, test reports, maintenance logs, and compliance certificates for the asset’s lifecycle or as required by jurisdiction (typically 10+ years).

Adhering to this guide ensures pipeline strainers are handled, installed, and maintained in full compliance with technical, safety, and regulatory standards across global operations.

Conclusion on Sourcing Pipeline Strainers

In conclusion, sourcing pipeline strainers requires a comprehensive evaluation of technical specifications, material compatibility, operational conditions, and supplier reliability. Selecting the right strainer—be it simplex, duplex, Y-type, basket, or inline—depends on the specific application, including flow rate, pressure, fluid type, and required filtration level. Prioritizing quality and compliance with industry standards (such as API, ASME, or ISO) ensures long-term performance, minimizes downtime, and protects downstream equipment.

Additionally, establishing relationships with reputable suppliers offering competitive pricing, timely delivery, and robust after-sales support contributes to a resilient and cost-effective procurement strategy. Conducting regular vendor assessments, considering lifecycle costs over initial purchase price, and staying updated on technological advancements further enhance sourcing effectiveness.

Ultimately, a strategic and informed approach to sourcing pipeline strainers not only safeguards system integrity but also supports operational efficiency, safety, and sustainability across industrial, commercial, and municipal fluid systems.