The global pipe staging market is experiencing robust growth, driven by rising demand in the oil & gas, petrochemical, and construction sectors. According to Grand View Research, the global scaffolding market—of which pipe staging is a critical component—was valued at USD 11.63 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 6.8% from 2024 to 2030. This growth is bolstered by increasing infrastructure development, stringent safety regulations, and the expansion of industrial plants, particularly in the Asia Pacific and Middle East regions. Additionally, Mordor Intelligence projects heightened demand for durable, modular, and reusable support systems, with pipe staging emerging as a preferred solution due to its strength, versatility, and ease of assembly. As industries prioritize efficiency and worker safety, manufacturers that innovate in load capacity, corrosion resistance, and rapid deployment are gaining competitive advantage. In this evolving landscape, identifying leading pipe staging manufacturers becomes essential for contractors and project managers seeking reliable, high-performance solutions.

Top 10 Pipe Staging Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Layher NA

Domain Est. 2005

Website: layherna.com

Key Highlights: As a leading scaffolding manufacturer USA & Canada, Layher NA offers superior industrial, commercial, and construction scaffolding systems….

#2 Apache Industrial

Domain Est. 2005

Website: apacheip.com

Key Highlights: Apache has extensive coatings and lining expertise in both shop and field projects, including fabricated pipe spools, straight-run pipe, tank plates ……

#3 Steel City Scaffolding of Pittsburgh

Domain Est. 2023

Website: scspgh.com

Key Highlights: Steel City Scaffolding is a full-service scaffolding and access provider to the commercial, light industrial and residential clients….

#4 Layher

Domain Est. 1996

Website: layher.com

Key Highlights: The integrated scaffolding system from Layher provides you with a wealth of complete solutions to give you a competitive edge. It ranges from innovative ……

#5 Rhino Staging » Professional Crews for Live Events

Domain Est. 1997

Website: rhinostaging.com

Key Highlights: We are the leading provider of the safest, most proficient professional stage crews for the entertainment industry nationwide….

#6 Scaffold

Domain Est. 1998

Website: universalscaffold.com

Key Highlights: We manufacture the highest-quality scaffolding equipment and custom access products including complete scaffold engineering and CAD design services….

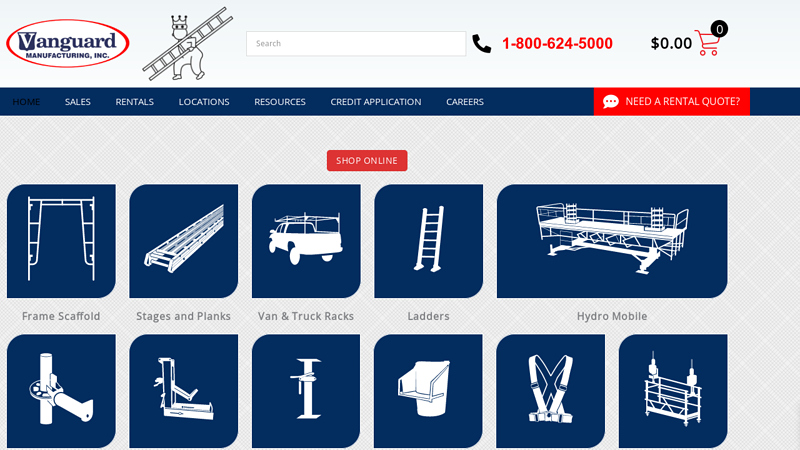

#7 Vanguard Manufacturing, Scaffolding, Staging, Truck, Van Racks …

Domain Est. 2000

Website: vanguardmanufacturing.com

Key Highlights: Vanguard Manufacturing provides sales and rental of scaffolding, staging, truck and van racks, equipment and accessories,…

#8 Staging Dimensions

Domain Est. 2001

Website: stagingdimensionsinc.com

Key Highlights: We offer Portable Staging, Permanent Staging, ADA Ramps, Choral Risers, Orchestra Pit Fillers, Round Stages, Rolling Risers, Stage Platforms, ……

#9 Urban Umbrella

Domain Est. 2001

Website: urbanumbrella.com

Key Highlights: Urban Umbrella is the sole designer, patent holder, supplier, and fabricator of the only city-approved alternative to traditional sidewalk scaffolding….

#10 Metaltech

Domain Est. 2011

Website: metaltech.co

Key Highlights: Our mission at Metaltech is to develop, manufacture and sell safe, reliable, innovative products that make work easier and faster to execute with built in ……

Expert Sourcing Insights for Pipe Staging

2026 Market Trends for Pipe Staging

The global pipe staging market is poised for notable evolution by 2026, driven by shifts in construction practices, safety regulations, sustainability demands, and technological innovation. Here are the key trends expected to shape the industry:

Increasing Demand in Infrastructure and Industrial Sectors

Accelerated public and private investments in infrastructure renewal—particularly in North America and Europe—and expanding industrial projects in emerging economies will drive demand for pipe staging. Renewal of aging pipelines, water treatment facilities, and energy infrastructure will require robust, reliable access solutions, with pipe staging favored for its strength and adaptability in complex, heavy-duty environments.

Stricter Global Safety and Regulatory Standards

Regulatory bodies worldwide are tightening scaffold safety codes, emphasizing load capacity, fall protection, and structural integrity. By 2026, compliance with updated OSHA, EN, and ISO standards will be non-negotiable. This will favor high-quality pipe staging systems over makeshift alternatives, promoting standardization and certified fabrication, especially in high-risk sectors like oil & gas and power generation.

Growth of Modular and Reusable Systems

Sustainability and cost-efficiency pressures are pushing contractors toward reusable, modular pipe staging. Systems designed for easy assembly, disassembly, and transport will dominate, reducing material waste and labor costs. Rental markets for pipe staging are expected to expand, particularly among SMEs seeking flexibility without capital investment.

Technological Integration and Digitalization

By 2026, digital tools such as BIM (Building Information Modeling) and scaffold design software will be standard in planning pipe staging setups. These tools enhance precision, reduce errors, and improve load calculations. Additionally, IoT-enabled sensors may begin emerging for real-time monitoring of structural stress and environmental conditions on large or long-term installations.

Material Innovation and Lightweight Alternatives

While traditional steel pipe staging remains dominant due to its strength, advancements in high-strength alloys and composite materials may introduce lighter, corrosion-resistant options. These innovations will cater to projects requiring portability or operating in harsh environments, such as offshore platforms or chemical plants.

Regional Market Diversification

Asia-Pacific will likely lead growth due to rapid urbanization and industrialization in countries like India and Vietnam. Meanwhile, North America and Europe will see steady demand driven by infrastructure modernization and retrofit projects. Latin America and Africa may experience increased activity, supported by foreign investment in energy and mining sectors.

Labor Shortages Driving Efficiency Solutions

With ongoing global construction labor shortages, contractors will prioritize staging systems that minimize setup time and require fewer skilled workers. Pre-engineered pipe staging kits with standardized components will gain favor, enhancing productivity and project timelines.

In summary, the 2026 pipe staging market will be defined by safety compliance, sustainability, digital integration, and regional expansion. Companies that innovate in design, embrace modular solutions, and align with regulatory and environmental goals will be best positioned to capture market share.

Common Pitfalls Sourcing Pipe Staging (Quality, IP)

Sourcing pipe staging—temporary structures used to support piping during construction, maintenance, or modification—can present significant challenges, particularly concerning quality assurance and intellectual property (IP) protection. Overlooking these aspects can lead to safety hazards, project delays, legal disputes, and financial losses. Below are key pitfalls to avoid:

Quality-Related Pitfalls

1. Inadequate Material Specifications

One of the most frequent issues is failing to define precise material requirements (e.g., steel grade, wall thickness, corrosion resistance). Sourcing from suppliers who substitute lower-grade materials to cut costs can compromise structural integrity, especially in high-pressure or hazardous environments.

2. Lack of Certified Fabrication Processes

Pipe staging often involves welding and load-bearing components. Sourcing from fabricators without proper certifications (e.g., AWS, ASME) or verified quality control (QC) procedures increases the risk of defective joints and premature failure.

3. Insufficient Load Testing and Documentation

Suppliers may deliver staging components without load test reports or engineering validation. Using untested structures can endanger worker safety and may violate OSHA or site-specific safety standards.

4. Poor Dimensional Accuracy and Tolerances

Off-the-shelf or poorly fabricated pipe staging may not align with actual piping layouts, leading to fit-up issues, rework, and project delays. Tolerance mismatches can also introduce stress points in the supported piping.

5. Inconsistent Coating and Corrosion Protection

In outdoor or corrosive environments, inadequate surface treatment (e.g., missing galvanization or poor paint application) can shorten the service life of staging and lead to unexpected maintenance.

Intellectual Property (IP)-Related Pitfalls

1. Unauthorized Use of Proprietary Designs

Some pipe staging systems are patented or protected by design IP. Sourcing from third parties who replicate patented systems without licensing exposes the buyer to infringement claims, especially if used in commercial or large-scale projects.

2. Lack of Design Ownership Clarity

When custom pipe staging is engineered for a specific project, unclear contracts may leave ownership of the design ambiguous. This can prevent reuse, modification, or future procurement without permission or additional fees.

3. Reverse Engineering by Suppliers

Suppliers might reverse engineer your custom designs to offer them to competitors. Without robust IP clauses in procurement agreements, your innovation could be commoditized.

4. Inadequate Protection in International Sourcing

Sourcing from jurisdictions with weak IP enforcement increases the risk of design theft. Even if the supplier is compliant initially, copied designs may appear in other markets, undermining competitive advantage.

5. Missing Confidentiality Agreements (NDAs)

Engaging suppliers without signed NDAs before sharing technical drawings or project-specific requirements leaves sensitive information exposed and difficult to protect legally.

Mitigation Strategies

- Require detailed material test reports (MTRs), weld procedures (WPS/PQR), and third-party inspection certifications.

- Specify compliance with recognized standards (e.g., API, ASTM, ASME).

- Conduct pre-award supplier audits and site visits.

- Include clear IP ownership clauses in contracts—specify who owns designs, drawings, and modifications.

- Use NDAs before disclosing any technical information.

- Opt for licensed or reputable suppliers with documented IP compliance.

Avoiding these pitfalls ensures safer, more reliable pipe staging solutions while protecting your organization’s technical investments and legal standing.

Logistics & Compliance Guide for Pipe Staging

Proper logistics and compliance management are essential for safe, efficient, and legally compliant pipe staging operations in construction, oil and gas, and industrial projects. This guide outlines key practices and regulatory considerations.

Planning and Site Layout

Develop a detailed staging plan before delivery. Identify designated pipe storage areas that are level, well-drained, and located close to the work zone to minimize handling. Ensure clear access routes for delivery trucks and material handling equipment. Mark staging zones with signage and barriers to prevent unauthorized access.

Receiving and Inspection

Verify all incoming pipe shipments against purchase orders and packing slips. Inspect each pipe for damage, corrosion, dents, or defects prior to acceptance. Document any discrepancies and non-conformances immediately. Maintain logs of received materials, including heat numbers, lot numbers, and certifications for traceability.

Storage and Handling

Store pipes on leveled skids or cradles to prevent contact with soil and reduce corrosion risk. Stack pipes in an organized manner using appropriate blocking and chocking to prevent rolling. Limit stack height according to pipe diameter and weight to avoid collapse. Use lifting slings, spreader bars, or pipe hooks designed for the pipe type during handling—never drag pipes across surfaces.

Safety Protocols

Ensure all personnel involved in pipe staging are trained in safe handling procedures. Enforce the use of PPE, including hard hats, gloves, steel-toed boots, and high-visibility vests. Implement traffic control measures for areas with vehicle and equipment movement. Conduct routine safety inspections of storage areas and handling equipment.

Environmental and Regulatory Compliance

Adhere to local, state, and federal environmental regulations. Prevent soil and water contamination by containing lubricants, coatings, or runoff from stored pipes. Follow OSHA standards for material storage and workplace safety. For international projects, comply with import/export regulations, customs documentation, and standards such as API, ASTM, or ISO as applicable.

Documentation and Traceability

Maintain accurate records for all staged materials, including mill test reports (MTRs), material certifications, and inspection reports. Implement a tracking system—barcodes or digital logs—to ensure full traceability from delivery to installation. Retain documentation for audit and quality assurance purposes.

Security and Inventory Control

Secure staging areas against theft or vandalism using fencing, lighting, and surveillance if necessary. Conduct regular inventory audits to track material usage and identify discrepancies. Report and investigate any missing or damaged items promptly.

By following this guide, project teams can ensure efficient logistics, maintain compliance, and support safe and high-quality project execution in pipe-intensive operations.

Conclusion for Sourcing Pipe Staging:

In conclusion, sourcing pipe staging requires a strategic approach that balances cost, quality, durability, safety compliance, and supplier reliability. After evaluating various suppliers, materials, and configurations, it is evident that investing in high-quality, standardized pipe staging systems from reputable manufacturers ensures long-term efficiency, worker safety, and reduced maintenance costs. Additionally, considering factors such as lead times, logistics, and customization options plays a crucial role in minimizing project delays and meeting specific site requirements. By adopting a well-structured sourcing strategy—supported by thorough due diligence and supplier assessments—organizations can secure pipe staging solutions that enhance operational productivity while adhering to industry safety standards. Ultimately, effective sourcing not only supports project success but also contributes to overall cost-effectiveness and sustainability in construction and industrial operations.