The global pipe beveling equipment market is experiencing robust growth, driven by expanding infrastructure, increasing investments in oil & gas, and the rising demand for precision pipeline fabrication. According to a report by Mordor Intelligence, the pipe beveling machine market is projected to grow at a CAGR of over 4.8% from 2024 to 2029. This upward trajectory is fueled by heightened construction activity in emerging economies, coupled with stringent industry standards necessitating accurate edge preparation in welding applications. Additionally, advancements in portable and automated beveling solutions are enhancing operational efficiency across onshore and offshore projects. As the industry scales to meet these evolving demands, a select group of manufacturers have emerged as leaders—combining innovation, reliability, and global reach. In this data-driven landscape, identifying the top players becomes essential for procurement teams and project planners seeking high-performance beveling solutions. Here are the top 10 pipe beveling manufacturers shaping the future of pipeline construction and maintenance.

Top 10 Pipe Beveling Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

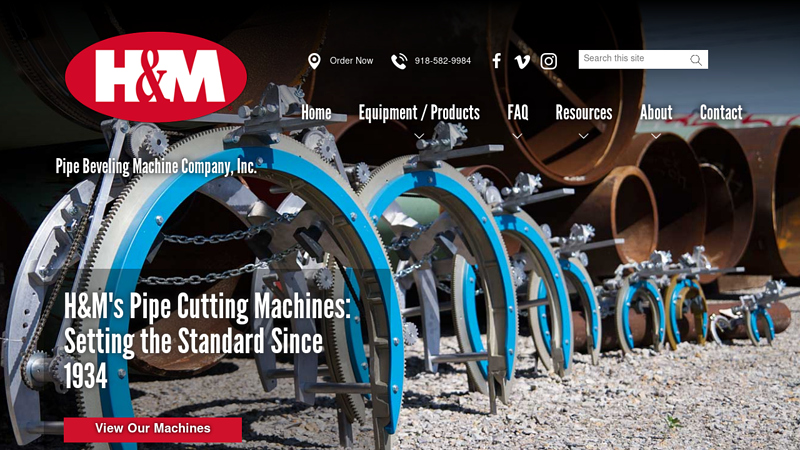

#1 H&M Pipe Beveling

Domain Est. 1995 | Founded: 1934

Website: hmpipe.com

Key Highlights: H&M Pipe Beveling Machine Company, Inc. Pipe Beveling Machine Company, Inc. Family owned company since 1934. Order Now · 918-582-9984….

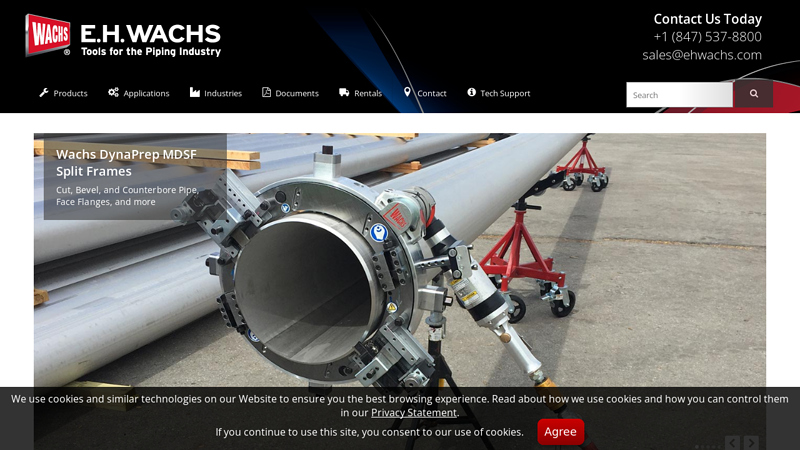

#2 E.H. Wachs Industrial Products

Domain Est. 2009

Website: ehwachs.com

Key Highlights: Pipe Cutters, Bevelers, and Flange Facers for onsite machining of pipe, vessels, and flanges from .5in-120in in diameter. Tools for the Piping Industry….

#3 Industrial Pipe & Plate Beveling Machines

Domain Est. 2013

Website: gbcspa.com

Key Highlights: For over 40 years, G.B.C. has been a global benchmark in tube and sheet metal cutting and beveling for the industrial and Oil & Gas sectors….

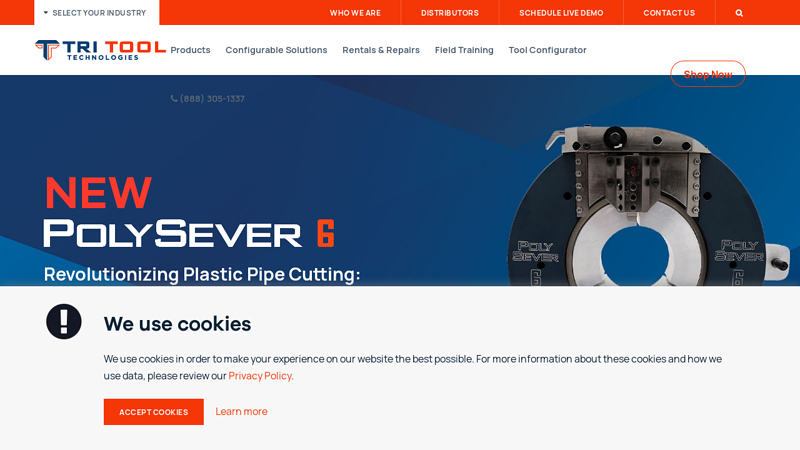

#4 Tri Tool Technologies

Domain Est. 1995

Website: tritool.com

Key Highlights: At Tri Tool, we cut through complexity and provide industry leading custom solutions, off-the-shelf pipe beveling and flange facing tools, and expert field ……

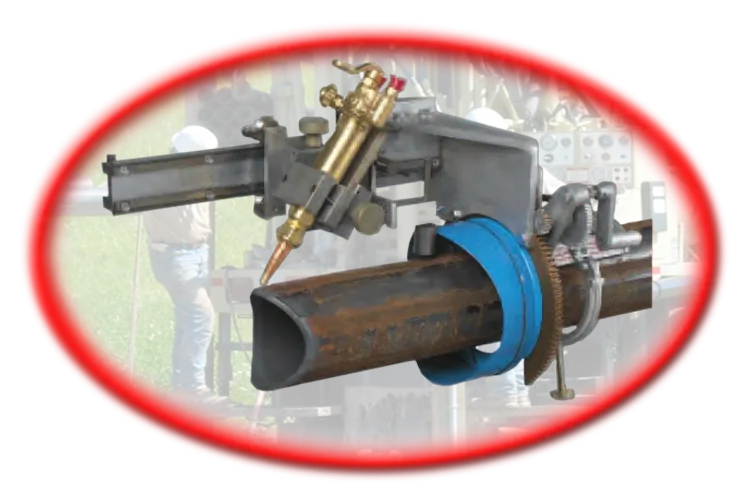

#5 Pipe Flame Cutting & Beveling Machines

Domain Est. 1995

Website: mathey.com

Key Highlights: If you’re seeking reliable equipment for large-scale projects, Mathey Dearman offers a range of industry-leading oxy-acetylene pipe beveling and cutting ……

#6 ESCO TOOL

Domain Est. 1997

Website: escotool.com

Key Highlights: Get Your field machining tools today! Pipe & tube cutters / bevelers. Flange facers. Air powered saws. Tube expanders. Call (800) 343-6926!…

#7 BevelTools: Unique beveling machines

Domain Est. 2013

Website: beveltools.com

Key Highlights: Experience a new solution for weld edge preparation, chamfering, and metal rounding through our cutting-edge machines and advanced carbide bevel heads….

#8 TAG Pipe

Domain Est. 2014

Website: tag-pipe.com

Key Highlights: Here at TAG Pipe Equipment Specialists we provide the best quality pipe equipment, platework and cutting/beveling machines around….

#9 DWT PipeTools

Domain Est. 2017

Website: dwt-pipetools.com

Key Highlights: We are specialized in pipe beveling machines ID mount, pipe beveler OD mount, pipe cold cutting machines and accessories for welded pipes in pipe welding ……

#10 Copier

Domain Est. 2020

Website: copiermachinery.com

Key Highlights: Copier Machinery is a globally leading supplier of pipe machining products for demanding applications across various industries….

Expert Sourcing Insights for Pipe Beveling

H2: 2026 Market Trends for Pipe Beveling

The global pipe beveling market is projected to undergo significant transformation by 2026, driven by advancements in automation, rising infrastructure investments, and growing demand across key industrial sectors. As industries prioritize efficiency, safety, and precision in pipeline construction and maintenance, pipe beveling technologies are evolving to meet these demands. The following analysis outlines the major trends expected to shape the pipe beveling market in 2026.

1. Increased Adoption of Automated and CNC Beveling Machines

One of the most prominent trends by 2026 is the widespread adoption of computer numerical control (CNC) and automated pipe beveling systems. These technologies offer high precision, reduced labor costs, and faster turnaround times, making them ideal for large-scale projects in oil & gas, petrochemicals, and power generation. Automation minimizes human error and enhances repeatability, particularly for complex bevel angles required in welding applications.

2. Growth in Renewable Energy and Infrastructure Projects

The global push toward renewable energy—particularly offshore wind farms and hydrogen pipeline networks—will drive demand for high-quality pipe beveling. These projects require durable, leak-proof joints, emphasizing the need for consistent and accurate beveling. Additionally, government-backed infrastructure modernization programs in North America, Asia-Pacific, and the Middle East will further stimulate market growth.

3. Expansion of Portable Beveling Solutions

Field operations in remote or challenging environments are increasingly relying on portable and modular beveling equipment. By 2026, manufacturers are expected to focus on lightweight, battery-powered, and hydraulic-driven portable beveling tools that offer flexibility without sacrificing performance. This trend is particularly strong in pipeline construction and repair operations where mobility is critical.

4. Emphasis on Safety and Compliance Standards

Regulatory bodies and industry standards such as ASME, API, and ISO are placing greater emphasis on weld integrity and workplace safety. As a result, pipe beveling processes are being refined to meet stringent quality requirements. In 2026, beveling equipment will increasingly feature safety interlocks, real-time monitoring, and compliance tracking systems to support audit-ready operations.

5. Integration of IoT and Smart Monitoring

The integration of Internet of Things (IoT) technology into beveling machines is emerging as a key trend. Smart beveling systems equipped with sensors and data analytics capabilities enable predictive maintenance, performance optimization, and remote monitoring. By 2026, such connected tools are expected to become standard in large industrial operations, improving uptime and reducing operational costs.

6. Regional Market Dynamics

The Asia-Pacific region is anticipated to dominate the pipe beveling market by 2026, fueled by rapid industrialization, urbanization, and energy infrastructure development in countries like China, India, and Southeast Asian nations. Meanwhile, North America and Europe will see steady growth driven by pipeline rehabilitation projects and the transition to clean energy systems.

7. Sustainability and Eco-Friendly Practices

Sustainability concerns are influencing equipment design and operational practices. By 2026, manufacturers are expected to prioritize energy-efficient motors, recyclable materials, and reduced coolant usage in beveling machines. Additionally, companies are adopting circular economy principles by refurbishing and reconditioning used equipment.

In conclusion, the 2026 pipe beveling market will be defined by technological innovation, regulatory compliance, and sector-specific demand. Companies that invest in automation, portability, and digital integration will be best positioned to capitalize on emerging opportunities across global energy and infrastructure landscapes.

Common Pitfalls Sourcing Pipe Beveling (Quality, IP)

When sourcing pipe beveling services—especially in industries like oil & gas, petrochemical, and power generation—ensuring both high quality and proper Intellectual Property (IP) protection is critical. Overlooking these aspects can lead to project delays, safety risks, cost overruns, and legal complications. Below are key pitfalls to avoid:

1. Inadequate Quality Control Processes

One of the most frequent issues is selecting a supplier without robust quality assurance procedures. Poor beveling can result in weak weld joints, leading to leaks or structural failure.

- Lack of certifications: Suppliers without ISO 9001, ASME, or API certifications may not adhere to industry standards.

- Inconsistent tolerances: Improper bevel angles or surface finish can compromise weld integrity.

- No documentation: Missing inspection reports (e.g., PMI, NDT) or traceability records makes quality verification difficult.

Mitigation: Require third-party inspections, review the supplier’s quality management system, and insist on detailed documentation for every batch.

2. Failure to Specify Beveling Standards Clearly

Vague or incomplete technical specifications can lead to mismatched expectations.

- Missing parameters: Not specifying bevel angle, root face, land, or surface roughness (e.g., per ASME B31.3 or ANSI B16.25).

- Material-specific needs: Different alloys (e.g., stainless steel, duplex) may require specialized tools or processes to avoid work hardening.

Mitigation: Use standardized drawings and clear technical data sheets. Reference applicable codes and include acceptance criteria.

3. Overlooking Intellectual Property (IP) Risks

When proprietary designs, tooling, or processes are involved, IP protection is often underestimated.

- Unprotected designs: Sharing detailed fabrication drawings without non-disclosure agreements (NDAs) exposes sensitive project information.

- Tooling ownership: If custom beveling fixtures or cutting programs are developed, unclear ownership can lead to reuse or replication by the supplier.

- Reverse engineering: Suppliers may analyze beveled components to deduce design intent or material specifications.

Mitigation: Execute strong NDAs, define IP ownership in contracts, and limit access to sensitive design data on a need-to-know basis.

4. Selecting Vendors Based Solely on Cost

Opting for the lowest bid can compromise both quality and IP security.

- Corner-cutting: Low-cost providers may use outdated equipment or untrained personnel, risking dimensional inaccuracies.

- Hidden risks: They may subcontract work without consent, increasing IP exposure and reducing traceability.

Mitigation: Conduct thorough vendor assessments, including site audits and reviews of past performance, not just pricing.

5. Insufficient Process Validation and Traceability

Without proper validation, it’s difficult to ensure consistency, especially for critical applications.

- No process qualification: Lack of Procedure Qualification Records (PQRs) or Welding Procedure Specifications (WPS) alignment.

- Poor traceability: Inability to link beveled pipes to specific batches, machines, or operators hampers root cause analysis if failures occur.

Mitigation: Require documented process validation and implement a traceability system (e.g., barcoding, digital logs).

6. Ignoring Environmental and Safety Compliance

Beveling processes (e.g., thermal cutting, grinding) can produce hazardous byproducts.

- Non-compliance: Suppliers may not follow OSHA, EPA, or local environmental regulations, leading to legal liabilities.

- Worker safety: Poorly maintained equipment or inadequate PPE increases accident risks, potentially affecting project timelines.

Mitigation: Audit supplier safety records and ensure compliance with relevant HSE standards.

By proactively addressing these pitfalls, organizations can ensure that sourced pipe beveling meets stringent quality requirements while safeguarding critical intellectual property.

Logistics & Compliance Guide for Pipe Beveling

This guide outlines key logistics considerations and compliance requirements for pipe beveling operations, ensuring safe, efficient, and regulatory-compliant processes in pipeline, construction, and industrial fabrication projects.

Equipment Preparation and Mobilization

Ensure all beveling equipment—such as portable beveling machines, CNC beveling lathes, or handheld grinders—is properly maintained, calibrated, and certified before mobilization. Conduct pre-job inspections to verify operational readiness. Coordinate transportation logistics for heavy or specialized machinery, including route planning, permits for oversized loads, and site access considerations. Confirm compatibility with pipe material (carbon steel, stainless steel, etc.) and diameters to be processed.

Material Handling and Storage

Store pipes in a clean, dry, and level area to prevent deformation or contamination prior to beveling. Use appropriate cradles or supports to avoid surface damage. Segregate materials by grade, size, and project phase to prevent mix-ups. Implement handling procedures that minimize risk of damage to pipe ends—critical since beveling requires precise edge preparation. Use lifting slings and equipment rated for the pipe weight to ensure safety.

Worksite Safety and Environmental Compliance

Adhere to OSHA (Occupational Safety and Health Administration) standards and site-specific safety plans. Require personal protective equipment (PPE) including safety glasses, hearing protection, gloves, and flame-resistant clothing. Control metal dust and sparks through local exhaust ventilation or dust collection systems, especially when grinding stainless steel (which may release hazardous hexavalent chromium). Follow EPA and local environmental regulations for disposal of metal shavings and coolant byproducts.

Beveling Specifications and Quality Control

Execute beveling per engineering drawings and welding procedure specifications (WPS). Common bevel types include single or double bevels with angles typically ranging from 30° to 37.5°, depending on welding method. Use calibrated measuring tools (bevel protractors, profile gauges) to verify angle, root face, and root gap dimensions. Document inspections through checklists or non-conformance reports (NCRs) if tolerances are exceeded.

Regulatory and Industry Standards Compliance

Ensure all beveling activities comply with relevant codes and standards such as:

– ASME B31.3 (Process Piping)

– API 1104 (Welding of Pipelines and Related Facilities)

– AWS D1.1 (Structural Welding Code – Steel)

– ISO 9001 for quality management systems

Maintain traceability of materials and processes through proper tagging and documentation. Third-party inspections may be required for critical applications such as oil & gas or high-pressure systems.

Personnel Qualifications and Training

Only trained and certified personnel should operate beveling equipment. Ensure operators are familiar with machine setup, safety protocols, and emergency procedures. Provide ongoing training on changes in standards, new equipment, or project-specific requirements. Maintain training records as part of compliance audits.

Documentation and Traceability

Keep detailed records of each beveling operation, including:

– Pipe identification (heat number, serial number)

– Bevel dimensions and inspection results

– Date, operator, and equipment used

– Non-destructive examination (NDE) results if required

This documentation supports weld traceability, quality assurance, and regulatory audits throughout the project lifecycle.

Post-Beveling Handling and Preservation

After beveling, protect pipe ends using end caps or tape to prevent damage, corrosion, or contamination during storage or transit. Clearly label beveled sections to distinguish them from raw pipe. Avoid dragging or dropping beveled ends, which can compromise weld integrity.

By implementing these logistics and compliance practices, organizations can ensure pipe beveling operations contribute to safe, high-quality, and code-compliant welding and assembly processes.

Conclusion for Sourcing Pipe Beveling:

Sourcing pipe beveling services requires a strategic approach that balances quality, cost, lead time, and technical capability. Whether performed in-house or outsourced to a specialized fabricator, the beveling process is critical to ensuring strong, reliable welds in piping systems across industries such as oil and gas, construction, power generation, and process manufacturing.

Key considerations in the sourcing decision include the precision of bevel angles, material compatibility, equipment availability (e.g., automated CNC beveling machines vs. portable tools), and compliance with industry standards such as ASME, API, or ISO. Partnering with a reputable supplier that offers consistent quality, certification documentation, and on-time delivery can significantly reduce project risks and rework costs.

Additionally, evaluating total cost of ownership—factoring in transportation, labor, and potential delays—is essential for making a cost-effective choice. In many cases, outsourcing to a specialized provider offers economies of scale, advanced technology, and expertise that may not be feasible to maintain internally.

In conclusion, effective sourcing of pipe beveling services supports project efficiency, weld integrity, and overall system safety. A well-informed selection process, grounded in technical requirements and supplier performance, ensures optimal results and long-term value.