The global pipe and tubing market has experienced steady expansion driven by rising demand across industries such as oil and gas, construction, automotive, and water treatment. According to Grand View Research, the market was valued at USD 185.6 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. This growth is fueled by infrastructure development, increasing urbanization, and the need for efficient fluid and gas transportation systems. Mordor Intelligence further highlights that Asia-Pacific dominates the market, accounting for over 40% of global consumption, led by rapid industrialization in China and India. Against this backdrop of rising demand and competitive dynamics, identifying the leading manufacturers becomes critical for procurement professionals, engineers, and project planners. Here’s a data-driven look at the top 10 pipe and tubing manufacturers shaping the industry landscape in 2024.

Top 10 Pipe And Tubing Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

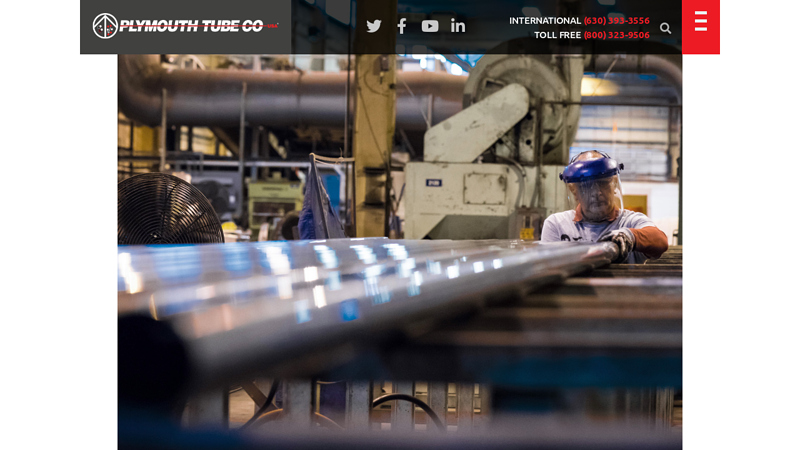

#1 Stainless Steel Tubing Manufacturing

Domain Est. 1995

Website: plymouth.com

Key Highlights: Plymouth Tube Company is a global specialty manufacturer of carbon alloy, nickel alloy, and stainless precision steel tubing….

#2 Atlas Tube

Domain Est. 1995

Website: atlastube.com

Key Highlights: As the leading manufacturer of structural steel tube, we’re here to help you. From conceptual design through project completion, our engineering team, design ……

#3 Pipe Supplies

Domain Est. 1996

Website: southernpipe.com

Key Highlights: Southern Pipe & Supply is a leading online HVAC, air conditioning, mechanical, industrial pipe, valves and fittings, waterworks, and plumbing supply store…

#4 Zekelman Industries

Domain Est. 2002

Website: zekelman.com

Key Highlights: Zekelman Industries is the largest independent steel tube and pipe manufacturer in North America and an innovator in modular construction….

#5 Wheatland Tube

Domain Est. 1995

Website: wheatland.com

Key Highlights: American-made steel pipe and tube for electrical, process, fire suppression, fence framework, mechanical and energy systems….

#6 U.S. Pipe

Domain Est. 1995

Website: uspipe.com

Key Highlights: US Pipe, a Quikrete company, offers a complete range of Ductile Iron Pipe, Restrained Joint Pipe, Fabrication, Gaskets, and Fittings….

#7 Kelly Pipe

Domain Est. 1996

Website: kellypipe.com

Key Highlights: Since 1898, Kelly Pipe Co., LLC has been the industry leader among carbon steel pipe suppliers in the United States and abroad….

#8 Heavy Wall Steel Pipe and Tubing

Domain Est. 1996

Website: specialtypipe.com

Key Highlights: For more than 50 years, Specialty Pipe & Tube has been the #1 source for heavy wall steel pipe and tubing….

#9

Domain Est. 1998

Website: consolidatedpipe.com

Key Highlights: A national leader in piping, fittings, valves, and all accessories for the energy, oil & gas, utility, construction, water and sewer industries….

#10 SPS Companies, Inc

Domain Est. 1999

Website: spsci.com

Key Highlights: Tubular USA, located in St. Louis, is one of the nation’s largest suppliers of in-line galvanized tubing and pipe and has an impressive history of fabricating ……

Expert Sourcing Insights for Pipe And Tubing

2026 Market Trends for Pipe and Tubing: Key Developments and Growth Drivers

The global pipe and tubing market is poised for significant transformation by 2026, shaped by evolving industrial demands, sustainability mandates, technological innovation, and geopolitical dynamics. This analysis highlights the critical trends expected to define the sector in the coming years.

Accelerated Shift Toward Sustainable and Corrosion-Resistant Materials

Environmental regulations and lifecycle cost considerations are driving increased adoption of non-metallic and advanced alloy piping. High-density polyethylene (HDPE), cross-linked polyethylene (PEX), and fiberglass-reinforced plastic (FRP) are gaining market share in water, chemical, and oil & gas applications due to their corrosion resistance, longevity, and lower carbon footprint compared to traditional steel. Regulatory pressures in regions like the EU and North America are pushing industries to replace aging metallic infrastructure with sustainable alternatives, particularly in municipal water systems and industrial plants aiming for net-zero goals.

Expansion in Energy Transition Infrastructure

The global push toward clean energy is creating new demand vectors for specialized tubing. Hydrogen-ready pipelines, both for transportation and industrial use, are expected to see substantial investment, particularly in North America and Europe. Similarly, the growth of carbon capture, utilization, and storage (CCUS) projects will require high-integrity tubular solutions capable of handling pressurized CO₂. Offshore wind farms will also drive demand for subsea piping and riser systems, spurring innovation in materials and installation techniques.

Digitalization and Smart Piping Systems

By 2026, digital integration will become a key differentiator. The adoption of smart pipes embedded with sensors for real-time monitoring of pressure, temperature, flow, and structural integrity is increasing, particularly in oil & gas, water utilities, and chemical processing. These IoT-enabled systems enhance predictive maintenance, reduce downtime, and improve safety. Digital twins—virtual replicas of piping networks—are being used for design optimization, performance simulation, and asset management, improving efficiency across the project lifecycle.

Regional Rebalancing and Supply Chain Resilience

Geopolitical tensions and post-pandemic supply chain disruptions have prompted a strategic reevaluation of sourcing. Nearshoring and friend-shoring initiatives, particularly in the U.S. and Europe, are boosting local manufacturing of critical piping components. The U.S. Infrastructure Investment and Jobs Act continues to fuel domestic demand, while Asia-Pacific—led by China, India, and Southeast Asia—remains the fastest-growing region due to rapid urbanization and industrial expansion. However, trade policies and raw material availability (e.g., steel, polymers) will remain pivotal cost and supply factors.

Technological Advancements in Manufacturing and Materials

Advances in manufacturing, such as automated welding, laser cutting, and additive manufacturing for complex tubular components, are improving precision and reducing waste. In materials science, the development of high-strength, lightweight alloys and composite tubing is enabling performance gains in aerospace, automotive, and deepwater applications. Additionally, recycled content in plastic piping is gaining traction, aligning with circular economy goals and enhancing sustainability credentials.

Rising Demand in Non-Traditional Sectors

Beyond traditional oil & gas and construction, emerging applications are driving growth. The semiconductor industry requires ultra-pure tubing for gas and chemical delivery systems, creating demand for high-integrity stainless steel and specialty polymers. Data centers, with their massive cooling requirements, are increasing the need for efficient piping in liquid cooling systems. The agriculture sector is also adopting more sophisticated irrigation tubing, driven by water conservation needs.

In summary, the 2026 pipe and tubing market will be defined by sustainability, digital integration, energy transition investments, and regional supply chain adaptations. Companies that innovate in materials, embrace Industry 4.0 technologies, and align with decarbonization goals will be best positioned to capture growth in this evolving landscape.

Common Pitfalls Sourcing Pipe and Tubing (Quality, IP)

Sourcing pipe and tubing involves critical considerations to ensure performance, safety, and compliance—particularly regarding quality and intellectual property (IP). Overlooking these factors can lead to project delays, safety hazards, legal issues, and financial losses. Below are key pitfalls to avoid:

Poor Quality Control and Material Verification

One of the most frequent issues in sourcing pipe and tubing is receiving substandard materials that do not meet specified standards (e.g., ASTM, ASME, ISO). Suppliers, especially overseas or non-certified vendors, may provide materials with incorrect alloy composition, inadequate wall thickness, or poor surface finish. Without proper certification (e.g., Mill Test Reports or MTRs) and third-party inspections, buyers risk structural failure, leaks, or non-compliance with industry regulations.

Lack of Traceability and Certification

Traceability is essential for quality assurance and regulatory compliance. Pipes and tubing used in critical applications (e.g., oil & gas, pharmaceuticals, aerospace) require full material traceability back to the heat number and manufacturing batch. Sourcing without proper documentation undermines quality verification and can result in rejection during audits or inspections.

Intellectual Property Infringement Risks

Using or sourcing proprietary pipe and tubing designs, coatings, or manufacturing processes without proper licensing can lead to IP violations. For example, certain high-performance alloys or patented manufacturing techniques (such as seamless drawing or specific anti-corrosion treatments) are protected. Unauthorized replication or supply of such products exposes buyers and suppliers to legal action, fines, and reputational damage.

Counterfeit or Non-Compliant Products

The market sometimes includes counterfeit or misrepresented products labeled as compliant with certain standards but failing to meet them. This is particularly common with stainless steel and high-alloy tubing. Relying solely on supplier claims without independent verification (e.g., PMI testing—Positive Material Identification) increases the risk of receiving fraudulent materials.

Inadequate Supplier Qualification

Failing to conduct due diligence on suppliers—such as auditing manufacturing facilities, reviewing quality management systems (e.g., ISO 9001), and assessing past performance—can lead to inconsistent quality and delivery issues. Unqualified suppliers may lack the technical capability to meet tight tolerances or specialized requirements.

Misalignment with Application Requirements

Selecting pipe or tubing based solely on price or availability, without considering the operational environment (e.g., pressure, temperature, corrosive media), leads to premature failure. For instance, using carbon steel tubing in a high-chloride environment without proper corrosion resistance can result in rapid deterioration.

Overlooking Packaging and Handling Requirements

Improper packaging during shipping can damage precision tubing (e.g., bending, scratching, or contamination), compromising integrity. Especially for clean applications like semiconductor or medical tubing, contamination from poor handling invalidates the product despite meeting material specs.

Failure to Protect Sourced IP in Custom Designs

When working with custom-engineered pipe or tubing solutions, buyers must ensure contracts include IP ownership clauses. Without clear agreements, suppliers may retain rights to designs or reuse them for competitors, eroding competitive advantage.

Avoiding these pitfalls requires rigorous supplier vetting, enforceable contracts, independent quality verification, and a clear understanding of both technical specifications and IP rights.

Logistics & Compliance Guide for Pipe and Tubing

Proper logistics and compliance management are essential when transporting and handling pipe and tubing across domestic and international markets. This guide outlines key considerations to ensure safe, efficient, and legally compliant operations.

Supply Chain and Transportation Logistics

Efficient movement of pipe and tubing requires careful planning due to their size, weight, and susceptibility to damage. Standard transportation methods include flatbed trucks, railcars, and shipping containers for overseas freight. Loads must be properly secured using straps, dunnage, and chocks to prevent shifting or impact damage during transit. Over-dimensional loads may require special permits and routing considerations. Coordination with carriers experienced in handling long or heavy cargo is recommended. Just-in-time (JIT) delivery strategies can help minimize on-site storage while ensuring project timelines are met.

Packaging and Handling Requirements

Proper packaging protects pipe and tubing from corrosion, dents, and surface damage. Common methods include bundling with protective wrapping, end caps, and rust-inhibiting coatings. Plastic or metal caps are used to shield threaded ends. Bundles should be labeled clearly with product specifications, batch numbers, and handling instructions. During loading and unloading, appropriate lifting equipment such as cranes, forklifts with pipe clamps, or slings must be used to avoid deformation. Pipes should never be dropped or dragged, and storage areas should be dry and elevated to prevent exposure to moisture and soil contaminants.

Regulatory Compliance and Standards

Pipe and tubing must comply with industry-specific standards and regulations depending on their application and destination. Key standards include:

– ASTM International: Governs material properties and testing methods (e.g., ASTM A53 for steel pipe).

– ASME B31 Series: Covers design and construction of piping systems for power, process, and pipeline applications.

– API Specifications: Relevant for oil and gas sectors (e.g., API 5L for line pipe).

– ISO Standards: Widely accepted internationally (e.g., ISO 3183 for pipeline systems).

– PED (Pressure Equipment Directive): Required for CE marking in the European Union.

– DOT Regulations: Apply to transportation of hazardous materials in the U.S., particularly for pressurized or coated pipes.

Documentation and Traceability

Comprehensive documentation ensures regulatory compliance and quality assurance. Required documents typically include:

– Mill Test Certificates (MTC) or Material Test Reports (MTR)

– Certificates of Conformance (CoC)

– Packing lists and shipping manifests

– Dangerous Goods Declarations (if applicable)

– Import/export declarations and customs forms

Full traceability from manufacturer to end-user is critical, especially in regulated industries. Each batch should be traceable by heat number, production date, and inspection records.

Environmental, Health, and Safety (EHS) Considerations

Handling pipe and tubing involves risks such as heavy lifting, sharp edges, and exposure to coatings or residues. Workers must use appropriate personal protective equipment (PPE), including gloves, safety glasses, and steel-toed boots. Environmental compliance includes proper disposal of packaging materials and managing runoff from outdoor storage. For pipes coated with substances like coal tar or lead-based paints, adherence to hazardous material handling regulations (e.g., OSHA, EPA, REACH) is mandatory.

Import/Export and Customs Compliance

International shipments of pipe and tubing are subject to customs regulations, tariffs, and trade agreements. Key steps include:

– Correct HS (Harmonized System) code classification (e.g., 7304 for seamless steel pipes)

– Compliance with anti-dumping and countervailing duties, where applicable

– Adherence to country-specific import standards (e.g., GOST for Russia, INMETRO for Brazil)

– Use of Incoterms (e.g., FOB, CIF) to define responsibilities between buyer and seller

– Sanctions screening and export control compliance (e.g., EAR, ITAR)

Engaging a licensed customs broker is advisable for complex shipments.

Quality Assurance and Inspection Protocols

Pre-shipment inspections verify dimensional accuracy, material composition, and surface integrity. Non-destructive testing (NDT) methods such as ultrasonic, radiographic, or hydrostatic testing may be required. Third-party inspection agencies (e.g., SGS, Bureau Veritas) are often used to provide independent certification. Inspection reports should be retained for audit and compliance purposes.

Storage and Inventory Management

Proper storage prevents degradation and maintains product integrity. Pipes should be stored horizontally on level supports with adequate spacing to avoid bending. Exposure to moisture, extreme temperatures, and corrosive environments should be minimized. First-in, first-out (FIFO) inventory practices help ensure older stock is used first, reducing the risk of material obsolescence or corrosion. Digital inventory systems can improve tracking and reduce handling errors.

Adhering to this logistics and compliance framework ensures safe, timely, and lawful delivery of pipe and tubing products while minimizing risks and costs across the supply chain.

In conclusion, sourcing pipe and tubing suppliers requires a strategic approach that balances quality, cost, reliability, and compliance. A thorough evaluation of potential suppliers—considering factors such as material specifications, manufacturing capabilities, certifications, lead times, and geographic location—is essential to ensure a consistent supply of high-performance components. Building strong, long-term relationships with suppliers who demonstrate technical expertise, scalability, and a commitment to quality control enhances supply chain resilience. Additionally, conducting regular audits and staying informed about market trends and material innovations will support continuous improvement and risk mitigation. Ultimately, a well-executed sourcing strategy not only meets current project requirements but also positions the organization for long-term efficiency and competitiveness in its industry.