The global epoxy coatings market is experiencing robust growth, driven by rising demand across industrial, automotive, and marine sectors. According to a 2023 report by Mordor Intelligence, the market was valued at USD 12.6 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2028. This expansion is fueled by the superior durability, chemical resistance, and adhesion properties of epoxy-based paints, making them a preferred choice for protective and decorative applications. With growing infrastructure investments and stricter environmental regulations promoting low-VOC formulations, manufacturers are increasingly innovating to meet performance and sustainability benchmarks. In this evolving landscape, nine key players have emerged as leaders in pintura epoxica (epoxy paint) production, combining technological expertise, global reach, and a strong commitment to quality to capture significant market share.

Top 9 Pintura Epoxica Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

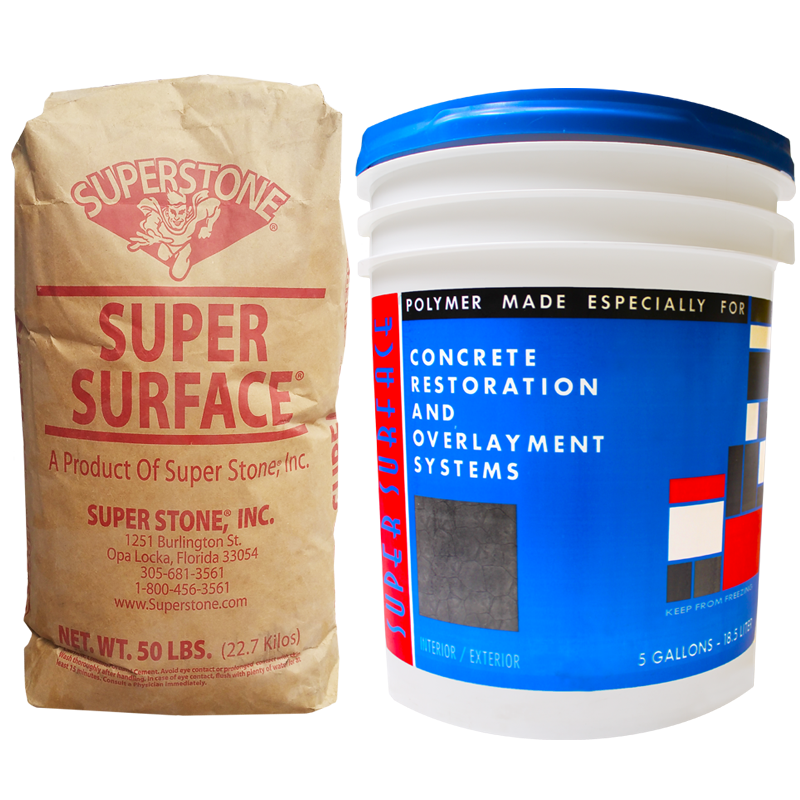

#1 Super Stone, Inc.

Domain Est. 1997 | Founded: 1961

Website: superstone.com

Key Highlights: Manufacturing and Supplying contractors around the world with affordable and reliable products and tools for decorative concrete since 1961….

#2 High Performance Flooring

Domain Est. 1998

Website: industrial.sherwin-williams.com

Key Highlights: Sherwin-Williams High Performance Flooring offers durable, seamless resinous systems for commercial and industrial applications. Get in touch with us today!…

#3 PurEpoxy – Professional

Domain Est. 2016

Website: purepoxy.com

Key Highlights: PurEpoxy is a leading manufacturer of high-performance liquid polymer products for commercial and residential applications. Our skilled chemists bring deep ……

#4 Pintura Epoxi para Suelos de Fábrica

Website: pinturaseverest.es

Key Highlights: In stock Rating 5.0 (1) Pintura para suelos industrial de grado epoxi sin disolventes. Para uso en fábricas, almacenes y unidades industriales. De larga duración y alta durabilid…

#5 Mapei

Domain Est. 1996

Website: mapei.com

Key Highlights: Mapei is a leading company in the field of adhesives, sealants and chemical products for building. 80 years of excellence, explore the Mapei world!…

#6 Pinturas PROA – Calidad Profesional y Durabilidad

Domain Est. 1998

Website: pinturasproa.com

Key Highlights: Pinturas y barnices para la industria y el hogar. Alta calidad, gran variedad de colores. Certificados de calidad y medio ambiente….

#7 Enhancing Everyday Spaces

Domain Est. 1999

Website: torginol.com

Key Highlights: For over 60 years, Torginol has been enhancing everyday spaces with innovative materials that inspire creativity. Find your perfect product today….

#8 HIGH GLOSS EPOXY

Domain Est. 2004

Website: ppgpaints.com

Key Highlights: Rating 5.0 (1) · 90-day returnsHPC High Gloss Epoxy is a two-component, high solids, low VOC epoxy topcoat. It provides a hard “tile-like” finish that can be used in chemical s…

#9 Hexion

Domain Est. 2005

Website: hexion.com

Key Highlights: Hexion is your technical partner. It’s not just about creating products. It’s about building expansive networks and the foundation for long term success….

Expert Sourcing Insights for Pintura Epoxica

H2: 2026 Market Trends for Pintura Epoxica (Epoxy Paint)

The global epoxy paint market is poised for steady growth through 2026, driven by increasing demand across key industrial and commercial sectors, technological advancements, and a growing focus on durability and performance. Here’s an analysis of the key trends shaping the market:

1. Sustained Growth in Industrial & Infrastructure Sectors:

The primary driver for epoxy paint demand remains robust industrial activity and infrastructure development. Expanding manufacturing facilities, power generation plants (including renewables), water and wastewater treatment infrastructure, and port/harbor construction will continue to require high-performance protective coatings. Epoxy coatings are favored for their exceptional resistance to chemicals, corrosion, abrasion, and moisture, making them indispensable in these demanding environments. Government investments in infrastructure, particularly in emerging economies, will further boost demand.

2. Rising Demand in Commercial & Institutional Buildings:

The commercial real estate sector, including warehouses, logistics centers, retail spaces, and healthcare facilities, is a significant consumer. The trend towards large-scale automated warehouses and cold storage facilities necessitates durable, seamless, and hygienic flooring solutions – a core application for epoxy systems. Hospitals and laboratories also rely on epoxy coatings for their cleanability, chemical resistance, and ability to create bacteria-resistant surfaces.

3. Technological Innovation & Product Development:

Manufacturers are investing heavily in R&D to meet evolving market needs:

* Low-VOC & Water-Based Epoxy Systems: Environmental regulations (VOC limits) and sustainability goals are accelerating the shift from solvent-borne to water-based and 100% solids epoxy formulations. These offer reduced environmental impact and improved worker safety without significantly compromising performance.

* Enhanced Performance Characteristics: Development continues on epoxies with improved UV resistance (reducing chalking and yellowing), faster curing times (increasing project efficiency), higher flexibility, and superior chemical resistance for specialized applications.

* Functional Additives: Integration of antimicrobial agents, anti-slip aggregates, conductive elements (ESD floors), and self-cleaning properties is expanding the functional scope of epoxy paints.

4. Sustainability & Environmental Regulations as Key Drivers:

Environmental compliance is no longer optional. Stringent regulations (like EU REACH, US EPA standards) are phasing out high-VOC solvents, pushing the industry towards greener alternatives. This trend favors manufacturers who can offer compliant, high-performance low-VOC and bio-based epoxy solutions. Life cycle assessments and sustainability reporting will become increasingly important for market access and customer preference.

5. Growth in the Refurbishment & Maintenance Segment:

As existing industrial and commercial infrastructure ages, the need for recoating and protection against corrosion and wear is growing significantly. Epoxy systems are often the preferred choice for maintenance and repair due to their strong adhesion to properly prepared substrates and proven long-term protection, representing a stable and growing market segment.

6. Regional Growth Dynamics:

Asia-Pacific: Expected to remain the fastest-growing region, fueled by rapid industrialization, massive infrastructure projects (especially in China, India, Southeast Asia), and booming construction in commercial and logistics sectors.

* North America & Europe: Mature markets with steady growth driven by infrastructure renewal, industrial maintenance, and the strong adoption of advanced, environmentally compliant products. Regulatory pressure is particularly strong here.

* Middle East & Africa:* Growth driven by oil & gas infrastructure, port development, and urbanization, though potentially more volatile due to economic fluctuations.

7. Competitive Landscape & Consolidation:

The market features a mix of large multinational chemical companies (e.g., PPG, Sherwin-Williams, AkzoNobel, BASF, Jotun) and specialized regional players. Competition is intense, focusing on technological differentiation, sustainability credentials, global supply chains, and value-added services (technical support, specification assistance). Strategic partnerships, acquisitions, and geographic expansion are common strategies.

Conclusion for 2026:

The epoxy paint market in 2026 will be characterized by steady global growth, driven by industrial and infrastructure demand, but increasingly shaped by the imperatives of sustainability and technological innovation. Success will depend on manufacturers’ ability to offer high-performance, environmentally responsible products (especially low-VOC/water-based), meet stringent regulations, cater to specific application needs through advanced formulations, and support large-scale infrastructure and industrial projects worldwide, particularly in the Asia-Pacific region. The focus will shift beyond just protection to include enhanced functionality and lifecycle sustainability.

Common Pitfalls When Sourcing Pintura Epoxica (Quality and IP)

Sourcing Pintura Epoxica (epoxy paint) requires careful attention to both quality standards and intellectual property (IP) considerations. Many buyers, especially in industrial and construction sectors, face recurring challenges that can lead to substandard performance, legal risks, or supply chain disruptions. Below are key pitfalls to avoid.

Quality-Related Pitfalls

1. Inadequate Adhesion and Chemical Resistance

One of the most common quality issues with epoxy paint is poor adhesion to substrates or insufficient resistance to chemicals, moisture, and abrasion. Low-quality formulations may fail prematurely in demanding environments such as factories, marine structures, or chemical plants. Always verify technical data sheets (TDS) and request third-party test certifications (e.g., ISO 12944 for corrosion protection).

2. Inconsistent Batch-to-Batch Performance

Some suppliers, particularly smaller or unverified manufacturers, may lack stringent quality control, leading to variability in viscosity, curing time, or color. This inconsistency can result in application failures or rework. Ensure the supplier follows standardized production processes and provides batch-specific quality reports.

3. Misrepresentation of Product Specifications

Be wary of suppliers exaggerating performance claims such as “industrial-grade” or “marine-resistant” without supporting documentation. Request independent lab testing results and verify compliance with relevant standards (e.g., ASTM, ISO, or NACE).

4. Poor Curing and Application Issues

Epoxy paints require correct mixing ratios (resin to hardener) and proper curing conditions. Substandard products may not cure properly, leading to tacky surfaces or delamination. Confirm that the supplier provides clear mixing, application, and curing guidelines.

Intellectual Property (IP) Pitfalls

1. Use of Counterfeit or Imitation Brands

Some suppliers market epoxy paints under names that closely resemble well-known brands (e.g., “EpoxiGuard” vs. “EpoxyGuard”), potentially infringing on trademarks. This not only poses legal risks but also often indicates inferior quality. Always verify the authenticity of the brand and check trademark registrations in your region.

2. Unauthorized Distribution Channels

Purchasing from unauthorized resellers increases the risk of receiving counterfeit or expired products. Stick to authorized distributors or directly engage with the manufacturer to ensure IP compliance and product legitimacy.

3. Lack of Licensing for Formulations

Certain high-performance epoxy formulations are protected by patents. Using or sourcing paints that incorporate patented chemistries without proper licensing can expose your business to IP litigation. When in doubt, confirm the formulation’s IP status with the supplier.

4. Generic Labels Without Traceability

Suppliers offering “generic” epoxy paint without disclosing the manufacturer or formulation source may be circumventing IP protections. Insist on full transparency regarding origin, formulation, and compliance with IP laws.

Conclusion

To mitigate risks when sourcing Pintura Epoxica, prioritize suppliers with verifiable quality certifications, transparent manufacturing practices, and clear IP compliance. Conduct due diligence through audits, sample testing, and legal review when necessary to ensure both performance reliability and regulatory safety.

Logistics & Compliance Guide for Pintura Epóxica

Product Classification and Regulatory Overview

Pintura Epóxica (epoxy paint) is classified as a hazardous material due to its chemical composition, typically containing epoxy resins and hardeners that may include volatile organic compounds (VOCs), solvents, and potentially hazardous substances such as bisphenol A (BPA). Compliance with international, regional, and local regulations is essential for safe handling, transportation, storage, and disposal. Key regulatory frameworks include GHS (Globally Harmonized System), REACH (EU), TSCA (USA), and local environmental and workplace safety standards.

Packaging and Labeling Requirements

Pintura Epóxica must be packaged in UN-certified containers suitable for flammable liquids or corrosive materials, depending on formulation. All packaging must be sealed to prevent leaks and equipped with pressure-relief mechanisms if necessary. Labels must comply with GHS standards, including:

– Pictograms (e.g., flame, exclamation mark, health hazard)

– Signal words (“Danger” or “Warning”)

– Hazard statements (e.g., H226: Flammable liquid and vapor)

– Precautionary statements (e.g., P210: Keep away from heat/sparks/open flames)

– Full ingredient disclosure as required by REACH or other local regulations

Transportation and Shipping Regulations

Transport of Pintura Epóxica is regulated under ADR (Europe), IMDG (sea), IATA (air), and 49 CFR (USA). Key considerations include:

– Proper UN number assignment (e.g., UN1263 for flammable liquid, paint)

– Hazard class designation (typically Class 3: Flammable Liquids)

– Use of approved packaging with compatibility checks

– Documentation: Safety Data Sheet (SDS), dangerous goods declaration, and transport emergency card (TREM card if applicable)

– Segregation from incompatible materials (e.g., oxidizers, acids)

Storage and Handling Procedures

Store Pintura Epóxica in a cool, dry, well-ventilated area away from direct sunlight and sources of ignition. Use non-sparking tools and grounding equipment during handling to prevent static discharge. Storage areas must be:

– Equipped with spill containment (e.g., bunded flooring)

– Labeled with hazard signage

– Kept away from incompatible substances

– Access restricted to trained personnel only

– Regularly inspected for container integrity and leaks

Safety Data Sheet (SDS) Compliance

A current, compliant SDS (in the local language) must be available for each batch of Pintura Epóxica. The SDS must include 16 sections as per GHS and regional regulations, covering:

– Identification

– Hazard(s) identification

– Composition/information on ingredients

– First-aid measures

– Fire-fighting measures

– Accidental release measures

– Handling and storage

– Exposure controls/personal protection

– Physical and chemical properties

– Stability and reactivity

– Toxicological information

– Ecological information

– Disposal considerations

– Transport information

– Regulatory information

– Other information (e.g., revision date)

Worker Safety and Personal Protective Equipment (PPE)

Personnel handling Pintura Epóxica must be trained in chemical safety and emergency response. Required PPE includes:

– Chemical-resistant gloves (e.g., nitrile or neoprene)

– Safety goggles or face shield

– Respiratory protection (organic vapor cartridge if ventilation is inadequate)

– Protective clothing (aprons, coveralls)

– Footwear resistant to chemical exposure

Environmental and Disposal Compliance

Disposal of Pintura Epóxica and contaminated materials must follow local waste regulations. Never dispose of in drains or with household waste. Options include:

– Return to supplier under take-back programs

– Treatment by licensed hazardous waste handlers

– Incineration in authorized facilities

Spills must be contained using absorbent materials (e.g., vermiculite, sand) and disposed of as hazardous waste. Report significant spills to environmental authorities as required.

Import and Export Documentation

For international trade, ensure compliance with:

– Import/export licenses (if required)

– Customs declarations with correct HS codes (e.g., 3208.10 for epoxy resin paints)

– REACH registration (EU) or equivalent (e.g., K-REACH in South Korea)

– TSCA certification (USA)

– Biocidal Product Regulation (BPR) if biocides are added

Maintain records for traceability and audits.

Training and Recordkeeping

All personnel involved in logistics, handling, or application must receive regular training on:

– GHS labeling and SDS interpretation

– Emergency procedures

– Spill response

– PPE use

– Regulatory updates

Maintain training logs, SDS files, shipping records, and incident reports for a minimum of 5 years or as required by local law.

Emergency Response and Incident Reporting

In case of fire, exposure, or spill:

– Evacuate area and ventilate

– Use dry chemical or CO₂ extinguishers for fires

– For skin contact: wash with soap and water; for eye contact: flush with water for 15 minutes

– Seek medical attention if symptoms persist

Report incidents to relevant authorities (e.g., OSHA, ECHA, local environmental agency) as required by regulation.

Conclusion on Sourcing Epoxy Paint (Pintura Epóxica):

Sourcing high-quality epoxy paint (pintura epóxica) requires a strategic approach that balances performance, cost, and supplier reliability. After evaluating various suppliers, product specifications, and market options, it is clear that selecting the right epoxy paint involves considering key factors such as chemical and abrasion resistance, curing time, application method, and environmental conditions where the coating will be used.

Sourcing from reputable manufacturers or certified distributors ensures product consistency, technical support, and compliance with industry standards (e.g., ISO, ASTM). Additionally, comparing both local and international suppliers can lead to cost savings without compromising quality—especially when factoring in logistics, lead times, and bulk purchasing options.

In industries requiring durable, long-lasting protection—such as construction, marine, automotive, and industrial flooring—investing in premium epoxy paint is critical. Therefore, the conclusion is that a well-researched sourcing strategy focused on quality assurance, technical compatibility, and strong supplier relationships will lead to optimal performance and lifecycle cost savings. Regular evaluation and testing of sourced materials are recommended to maintain high standards and adapt to evolving project requirements.