The global pins and sockets market is experiencing steady growth, driven by rising demand across industries such as automotive, industrial machinery, consumer electronics, and telecommunications. According to Mordor Intelligence, the global electrical connectors market—of which pins and sockets are a critical component—was valued at USD 86.75 billion in 2023 and is projected to reach USD 118.16 billion by 2029, growing at a CAGR of 5.24% during the forecast period. This expansion is fueled by increasing automation, advancements in electric vehicles, and the proliferation of IoT-enabled devices requiring reliable electrical interconnections. As the backbone of nearly every electronic system, high-precision pins and sockets are essential for ensuring signal integrity, power transmission, and system reliability. With stringent performance requirements and evolving miniaturization trends, manufacturers are focusing on innovation in materials, durability, and design. In this competitive landscape, a select group of global suppliers has emerged as leaders, combining technological expertise, broad product portfolios, and global reach to meet the escalating demands of modern electronics and industrial applications.

Top 10 Pins And Sockets Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Meltric

Domain Est. 1997

Website: meltric.com

Key Highlights: MELTRIC offers a full line of industrial plugs and receptacles, including our signature brand of UL-listed Switch-Rated devices with DECONTACTOR™ ……

#2 Connectors, Cables, Optics, RF, Silicon to Silicon Solutions

Domain Est. 1995

Website: samtec.com

Key Highlights: Samtec is the service leader in the electronic interconnect industry and a global manufacturer of Connectors, Cables, Optics and RF Systems, ……

#3 Connectors

Domain Est. 1996

Website: phoenixcontact.com

Key Highlights: Wide variety of connectors: from versatile circular connectors (M5 to M58), data, energy storage, and photovoltaic connectors to heavy-duty industrial ……

#4 Connectors Manufacturer

Domain Est. 1998

Website: precidip.com

Key Highlights: PRECI-DIP manufactures custom-designed and standard connectors and interconnect solutions for every need. Swiss quality, serving customers worldwide….

#5 Connectors

Domain Est. 1994

Website: molex.com

Key Highlights: Molex offers a wide variety of Board-to-Board Connectors for microminiature, high-speed, high-density, and high-power applications….

#6 Connectors

Domain Est. 1996

Website: amphenol.com

Key Highlights: Amphenol has been designing and manufacturing electrical and electronic connectors since the company’s inception in 1932….

#7 Electrical and Electronic Connectors

Domain Est. 1996

Website: hirose.com

Key Highlights: Connector Selector Categories, Applications, Customer Support, Partners, Locations, Contact Us, Privacy Policy | Terms of Use | Membership Agreement…

#8 LEMO – The Original Push-Pull Connector

Domain Est. 1998

Website: lemo.com

Key Highlights: LEMO produces an extensive range of high quality custom and modular connectors which provide exceptional reliability for a host of applications in the most ……

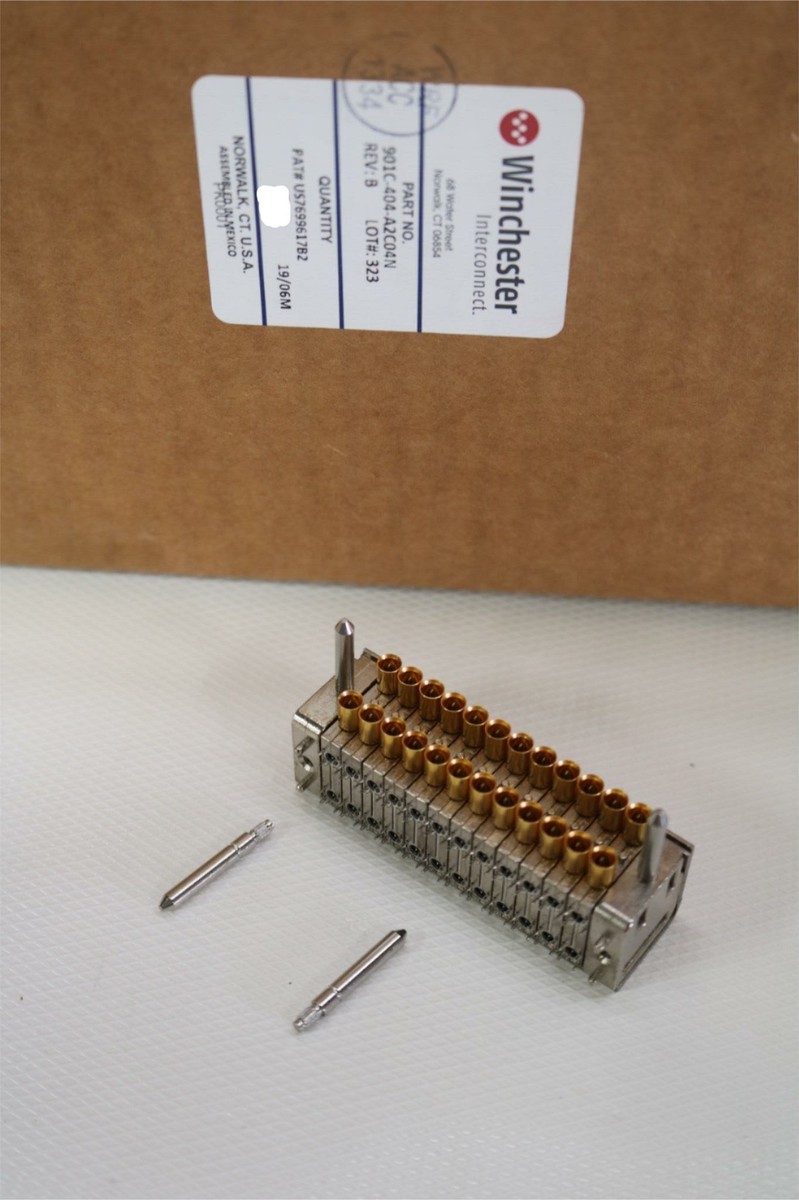

#9 Winchester Interconnect

Domain Est. 2016

Website: winconn.com

Key Highlights: Let’s Build It Together. From concept to production, we design and manufacture tailored interconnect systems for demanding, high-performance applications….

#10 Homepage

Founded: 1971

Website: mill-max.com

Key Highlights: Since 1971, Mill-Max has been manufacturing and designing high reliability precision-machined interconnect components & is a recognized global leader….

Expert Sourcing Insights for Pins And Sockets

2026 Market Trends for Pins and Sockets

The global pins and sockets market is poised for significant evolution by 2026, driven by technological advancements, shifting industry demands, and macroeconomic factors. Below is an analysis of key trends expected to shape the market landscape.

Expansion in Electric Vehicle (EV) and Charging Infrastructure

The surge in electric vehicle adoption is a primary growth catalyst. Pins and sockets are critical components in EV charging connectors, battery management systems, and onboard electronics. As governments push for carbon neutrality and consumers shift toward EVs, demand for high-reliability, high-current connectors will rise. The development of ultra-fast charging networks will further necessitate robust, thermally stable pin and socket solutions capable of handling increased power loads.

Miniaturization and High-Density Interconnects

Across consumer electronics, medical devices, and aerospace, there is a growing demand for smaller, lighter, and more efficient systems. This trend drives the need for miniaturized pins and sockets with high contact density. Innovations in micro and nano connectors—featuring tighter pitch, improved signal integrity, and enhanced durability—will be essential, particularly in wearables, IoT devices, and advanced computing platforms.

Growth in Renewable Energy and Smart Grid Applications

Renewable energy installations such as solar farms and wind turbines rely heavily on reliable electrical connections. Pins and sockets used in inverters, control systems, and grid interconnects must withstand harsh environmental conditions. The global push toward smart grids and energy storage systems will further increase demand for connectors with high durability, corrosion resistance, and long lifecycle performance.

Advancements in Signal Integrity and High-Speed Data Transmission

With the proliferation of 5G, AI, and edge computing, data transfer speeds are escalating. This necessitates pins and sockets capable of supporting high-frequency signals with minimal loss and electromagnetic interference (EMI). Connectors with enhanced shielding, precision alignment, and low insertion loss will gain prominence, especially in data centers, telecommunications, and automotive infotainment systems.

Emphasis on Sustainability and Material Innovation

Environmental regulations and corporate sustainability goals are pushing manufacturers to adopt eco-friendly materials and processes. By 2026, expect greater use of recyclable metals, reduced reliance on hazardous substances (e.g., lead-free finishes), and longer product lifecycles. Additionally, innovations in plating technologies—such as tin-silver and palladium-nickel coatings—will improve corrosion resistance while reducing environmental impact.

Supply Chain Localization and Resilience

Geopolitical tensions and recent supply chain disruptions have prompted a shift toward regional manufacturing and supply chain diversification. Companies are increasingly sourcing pins and sockets locally or near end-use markets to mitigate risks. This trend will benefit regional suppliers and encourage investments in automation and nearshoring, particularly in North America, Europe, and Southeast Asia.

Integration of Smart and Diagnostic Capabilities

Future connectors may embed sensors or diagnostic features to monitor connection status, temperature, and wear. This “smart connector” trend supports predictive maintenance in industrial automation, aerospace, and medical equipment. While still emerging, such innovations could redefine reliability standards and open new value-added opportunities by 2026.

In summary, the 2026 pins and sockets market will be shaped by electrification, miniaturization, sustainability, and digitalization. Manufacturers who innovate in design, materials, and reliability while adapting to regional and environmental demands will be best positioned to capture growth.

Common Pitfalls When Sourcing Pins and Sockets

Quality Inconsistencies

One of the most prevalent issues when sourcing pins and sockets is inconsistent quality. Suppliers—especially from less-regulated markets—may use substandard materials such as impure copper alloys or inferior plating (e.g., inadequate gold or tin thickness). This results in poor conductivity, increased contact resistance, and premature failure due to corrosion or wear. Without rigorous quality control and proper certifications (e.g., ISO 9001), buyers risk receiving batches with dimensional inaccuracies or mechanical weaknesses that compromise long-term reliability.

Lack of Ingress Protection (IP) Compliance

Many applications require pins and sockets to operate in harsh environments, making Ingress Protection (IP) ratings critical. A common pitfall is assuming a connector is IP-rated based on appearance or marketing claims. In reality, full IP compliance depends on the entire assembly—including mating components, seals, and proper installation. Using connectors not tested or certified to relevant IP standards (e.g., IP67, IP68) can lead to moisture, dust, or debris ingress, resulting in short circuits or signal degradation.

Insufficient Verification of Specifications

Buyers often overlook verifying electrical, thermal, and mechanical specifications. Pins and sockets must meet required current ratings, temperature ranges, insertion/extraction forces, and durability (mating cycles). Relying solely on datasheets without independent testing may lead to system failures under real-world conditions.

Counterfeit or Non-Compliant Components

The electronics supply chain is vulnerable to counterfeit parts. Fake connectors may mimic genuine products but fail under operational stress. Always source from authorized distributors or manufacturers and request traceability documentation to avoid counterfeit risks.

Inadequate Environmental and Regulatory Compliance

Ensure connectors comply with environmental standards such as RoHS, REACH, and UL/CSA certifications. Non-compliant parts can lead to legal issues, failed audits, or incompatibility with end-market requirements.

To mitigate these pitfalls, conduct thorough supplier audits, request sample testing, and verify compliance documentation before scaling procurement.

Logistics & Compliance Guide for Pins and Sockets

Pins and sockets—common electrical and mechanical components used in connectors, circuit boards, industrial machinery, and consumer electronics—require careful attention to logistics and regulatory compliance throughout their supply chain. This guide outlines key considerations to ensure safe, efficient, and legally compliant handling, transportation, and distribution.

Classification and Tariff Codes

Proper classification under international trade systems is essential. Pins and sockets are typically categorized under the Harmonized System (HS) code 8536, which covers electrical apparatus for switching or protecting electrical circuits (e.g., connectors, plugs, sockets). However, classification may vary based on:

- Material composition (e.g., brass, phosphor bronze, stainless steel, plastic)

- Application (e.g., automotive, aerospace, consumer electronics)

- Design specifications (e.g., gender, current rating, IP rating)

Always consult the latest customs tariff schedules (e.g., HTS in the U.S., CN in the EU) and consider obtaining a Binding Tariff Information (BTI) ruling for certainty.

Regulatory Compliance

RoHS (Restriction of Hazardous Substances)

Pins and sockets sold in the European Union and many other markets must comply with RoHS directives (2011/65/EU and 2015/863), restricting the use of lead, mercury, cadmium, hexavalent chromium, PBB, PBDE, and four phthalates. Ensure suppliers provide RoHS-compliant material declarations and test reports.

REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals)

Under EU REACH regulations, certain substances in pins and sockets (e.g., nickel in plating, certain plasticizers) may be subject to reporting or restriction. Confirm that substances of very high concern (SVHCs) are below reporting thresholds or properly disclosed.

Conflict Minerals

If exported to the U.S. or sold by public companies, compliance with the Dodd-Frank Act Section 1502 may be required. Tin, tungsten, tantalum, and gold (3TG) used in plating or manufacturing must be traced and reported if sourced from conflict-affected regions (e.g., DRC).

UL, CSA, and IEC Standards

Depending on application, pins and sockets may need certification to safety standards such as:

- UL 498 (U.S. standard for plugs and receptacles)

- CSA C22.2 No. 42 (Canadian equivalent)

- IEC 60320 (appliance couplers)

- IEC 60512 (connector testing methods)

Ensure products bear appropriate certification marks when required.

Packaging and Labeling Requirements

Proper packaging prevents physical damage and ensures compliance with transportation regulations.

- ESD Protection: Electrostatic discharge (ESD)-sensitive pins/sockets (e.g., used in electronics) must be packaged in static-shielding bags, conductive foam, or static-dissipative containers.

- Moisture Sensitivity: Components with moisture-sensitive levels (MSL) should be vacuum-sealed with desiccants and humidity indicator cards.

- Labeling: Packages must include:

- Product part number and description

- RoHS/REACH compliance symbols

- ESD-sensitive warnings (e.g., ESD logo)

- Country of origin

- Handling instructions (e.g., “Fragile,” “Do Not Stack”)

Transportation and Shipping

Domestic and International Shipping

- Incoterms: Clearly define responsibilities using standard Incoterms (e.g., EXW, FOB, DDP).

- Hazard Classification: Most pins and sockets are non-hazardous, but plated components with restricted substances may require special handling documentation.

- Export Controls: Check if components are subject to export control regimes (e.g., U.S. EAR, EU Dual-Use Regulation), especially if intended for military, aerospace, or telecommunications use.

Air and Sea Freight

- Use moisture-barrier packaging for sea freight to prevent corrosion.

- Ensure packaging meets ISTA 3A or similar standards for drop and vibration resistance.

- Declare accurate weights and dimensions to avoid freight recalculations.

Inventory and Warehousing

- Storage Conditions: Store in a dry, temperature-controlled environment (typically 15–25°C, 30–60% RH) to prevent oxidation and moisture damage.

- First-In, First-Out (FIFO): Implement FIFO practices, particularly for moisture-sensitive components with shelf-life limitations.

- Traceability: Maintain lot traceability through labeling and inventory management systems to support recalls or compliance audits.

End-of-Life and Environmental Considerations

- WEEE Directive (EU): Pins and sockets incorporated into EEE (electrical and electronic equipment) must support collection and recycling. Producers may be required to register and finance take-back programs.

- Recycling: Design for disassembly and use recyclable materials where possible. Provide recycling instructions if sold as standalone components.

Audit and Documentation

Maintain comprehensive documentation for compliance verification, including:

- Material declarations (RoHS, REACH)

- Certificates of Conformity (CoC)

- Test reports (e.g., insertion force, durability)

- Conflict minerals reporting template (CMRT)

- Bill of Materials (BOM) with supplier traceability

Regular audits of suppliers and internal processes help maintain compliance and identify risks early.

Summary

Effective logistics and compliance for pins and sockets require a proactive approach to classification, regulatory adherence, safe handling, and documentation. By integrating these practices, businesses can avoid delays, reduce risk, and ensure market access worldwide.

Conclusion for Sourcing Pins and Sockets:

Sourcing high-quality pins and sockets is a critical step in ensuring the reliability, durability, and performance of electrical and electronic connections in any application. Key considerations such as material composition, plating, current rating, mating cycles, environmental resistance, and compliance with industry standards (e.g., UL, RoHS, IEC) must be thoroughly evaluated. Establishing relationships with reputable suppliers, conducting rigorous quality assurance checks, and considering cost-efficiency without compromising performance are essential for long-term success. Additionally, aligning the selection with specific application requirements—whether for industrial machinery, automotive systems, or consumer electronics—helps prevent connection failures and maintenance issues. Ultimately, a strategic and informed sourcing approach ensures optimal functionality, safety, and cost-effectiveness in the final product.