The global pigtail harness market is experiencing steady growth, driven by increasing demand across automotive, aerospace, telecommunications, and industrial automation sectors. According to a report by Mordor Intelligence, the global wire and cable market—of which pigtail harnesses are a critical component—is projected to grow at a CAGR of over 5.2% from 2023 to 2028. Factors such as the rise in electric vehicle (EV) production, enhanced connectivity requirements in 5G infrastructure, and the need for reliable signal transmission systems are accelerating adoption. Grand View Research further supports this trend, estimating that the global automotive wiring harness market alone will expand at a CAGR of 7.5% from 2023 to 2030, underpinned by vehicle electrification and advanced driver assistance systems (ADAS). As demand for customized, high-performance pigtail harnesses rises, manufacturers are focusing on precision engineering, material innovation, and automation to meet rigorous industry standards. In this evolving landscape, a select group of manufacturers have emerged as leaders in quality, scalability, and technical expertise—shaping the future of connectivity across industries.

Top 10 Pigtail Harness Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 UNICOR Electronics Wiring Harnesses and Harness Assemblies

Domain Est. 1997

Website: unicor.gov

Key Highlights: The UNICOR Electronics Group has been an important and long-time producer and distributor of wire harnesses for the military and OEMs….

#2 Custom Wire Harness Manufacturer – High

Domain Est. 2023

Website: romtronic.com

Key Highlights: Custom wire harnesses built to meet automotive, medical, and industrial needs. Benefit from 28 years of expertise and ISO/IATF certifications….

#3 Wiring Harness

Domain Est. 1997

Website: motherson.com

Key Highlights: The company is one of the largest manufacturers of wiring harnesses and electrical components globally and is a complete solutions provider to all its customers ……

#4 Wire Harness Manufacturers

Domain Est. 2000

Website: pca-llc.com

Key Highlights: PCA is the leading Wire Harness Manufacturer and Cable Harness Manufacturer with a global presence servicing a wide variety of industries and applications….

#5 Wiring Harness Manufacturer

Domain Est. 2008

Website: wiring-harness-manufacturer.com

Key Highlights: Vanguard Manufacturing specializes in designing and manufacturing innovative wiring harness solutions for various industries worldwide….

#6 Peterson: A World

Domain Est. 2021

Website: petersonlightsandharness.com

Key Highlights: Peterson Manufacturing innovates vehicle safety lighting and wiring harness systems that improve performance and reduce operational costs….

#7 Custom Wire Harness Manufacturing

Domain Est. 1996

Website: wiringharness.com

Key Highlights: We can build pigtails or harnesses from your engineering drawings/blueprints, or our engineering team can help you design a harness from scratch….

#8

Domain Est. 1997

Website: dmctools.com

Key Highlights: For 75 years, DMC® has manufactured tooling for mission-critical electrical systems in aerospace and defense, rail, marine, and several other industries….

#9 JST Sales America: Cutting

Domain Est. 1998

Website: jst.com

Key Highlights: Discover how our product line of over 100000 electrical connectors provides our customers with the tools they need for endless innovation….

#10 Aeromotive

Domain Est. 2008

Website: aeromotive.us

Key Highlights: The Commercial division at Aeromotive offers connectors and 1-off answers for on-road, off-road, heavy duty, agricultural and construction equipment….

Expert Sourcing Insights for Pigtail Harness

H2: 2026 Market Trends for Pigtail Harness

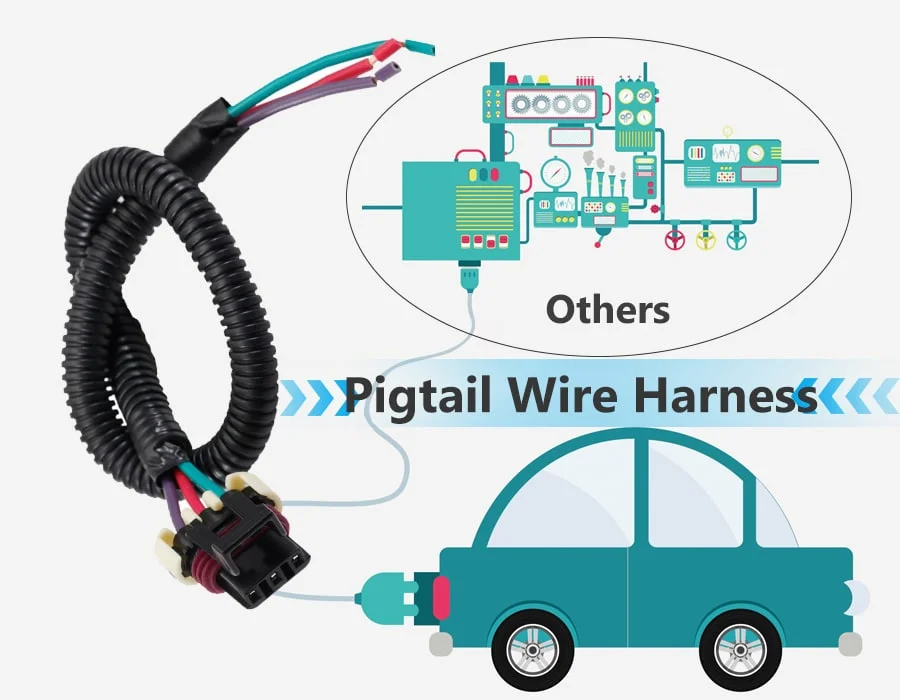

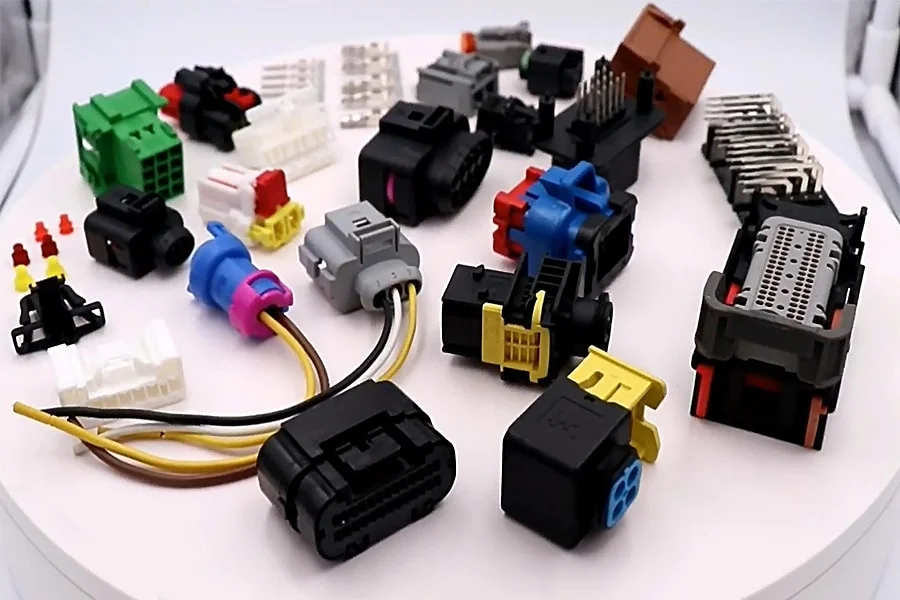

The global pigtail harness market is poised for notable transformation by 2026, driven by advancements in automotive electronics, increasing demand for electric vehicles (EVs), and the expansion of telecommunications infrastructure. Pigtail harnesses—short wire assemblies used to connect electronic components—play a critical role in ensuring reliable signal and power transmission across industries such as automotive, aerospace, telecommunications, and industrial automation.

One of the primary drivers shaping the 2026 landscape is the rapid electrification of vehicles. As automakers accelerate their transition toward EVs and hybrid models, the need for compact, high-performance wiring solutions like pigtail harnesses has surged. These harnesses are essential in battery management systems (BMS), onboard chargers, and sensor networks, where reliability and space efficiency are paramount. The integration of advanced driver-assistance systems (ADAS) and vehicle-to-everything (V2X) technologies further amplifies demand for customized pigtail solutions capable of supporting high-speed data transmission.

In the telecommunications sector, the rollout of 5G networks continues to bolster the pigtail harness market. Fiber optic pigtails, used in data centers and network cabinets, are experiencing increased adoption due to the need for seamless connectivity and minimal signal loss. By 2026, the expansion of edge computing and smart city initiatives will further drive the need for robust, high-density pigtail assemblies in optical fiber networks.

Regional trends also highlight growth momentum. Asia-Pacific, led by China, Japan, and South Korea, is expected to dominate the market due to strong manufacturing bases and government support for EV and 5G deployment. Meanwhile, North America and Europe are focusing on sustainability and lightweight materials, pushing manufacturers to develop eco-friendly pigtail harnesses with improved thermal and electrical performance.

Technological innovation will also define the 2026 pigtail harness market. Trends include the use of miniaturized connectors, automated manufacturing processes, and the adoption of smart harnesses equipped with diagnostic capabilities. Additionally, increased emphasis on supply chain resilience is prompting companies to localize production and strengthen partnerships with Tier-1 suppliers.

In summary, the 2026 pigtail harness market will be shaped by electrification, digitalization, and sustainability. Companies that invest in R&D, embrace modular designs, and align with evolving industry standards will be well-positioned to capitalize on emerging opportunities across key verticals.

Common Pitfalls When Sourcing Pigtail Harnesses (Quality and IP)

Sourcing pigtail harnesses—short wire assemblies used to connect electronic components—can be deceptively complex. Overlooking key quality and intellectual property (IP) considerations often leads to supply chain disruptions, product failures, or legal risks. Below are common pitfalls to avoid:

Poor Quality Control and Inconsistent Manufacturing

One of the most frequent issues is inconsistent build quality from suppliers, especially those offering low-cost options. Defects such as cold solder joints, incorrect wire gauges, poor crimping, or substandard insulation can lead to intermittent connections or premature failure in the field. Without rigorous quality assurance processes—such as in-line inspections, sample testing, and adherence to standards like IPC/WHMA-A-620—defective harnesses may pass initial checks but fail under real-world conditions.

Lack of Compliance with Environmental and Industry Standards

Many pigtail harnesses are used in demanding environments (e.g., automotive, industrial, or outdoor applications). Failure to ensure compliance with relevant standards—such as UL, RoHS, REACH, or IP (Ingress Protection) ratings—can result in non-compliant products. For example, sourcing a harness labeled as “IP67” without verified test reports may lead to water or dust ingress, causing system failure. Buyers must verify that suppliers provide certified test data and use materials suited to the intended operating environment.

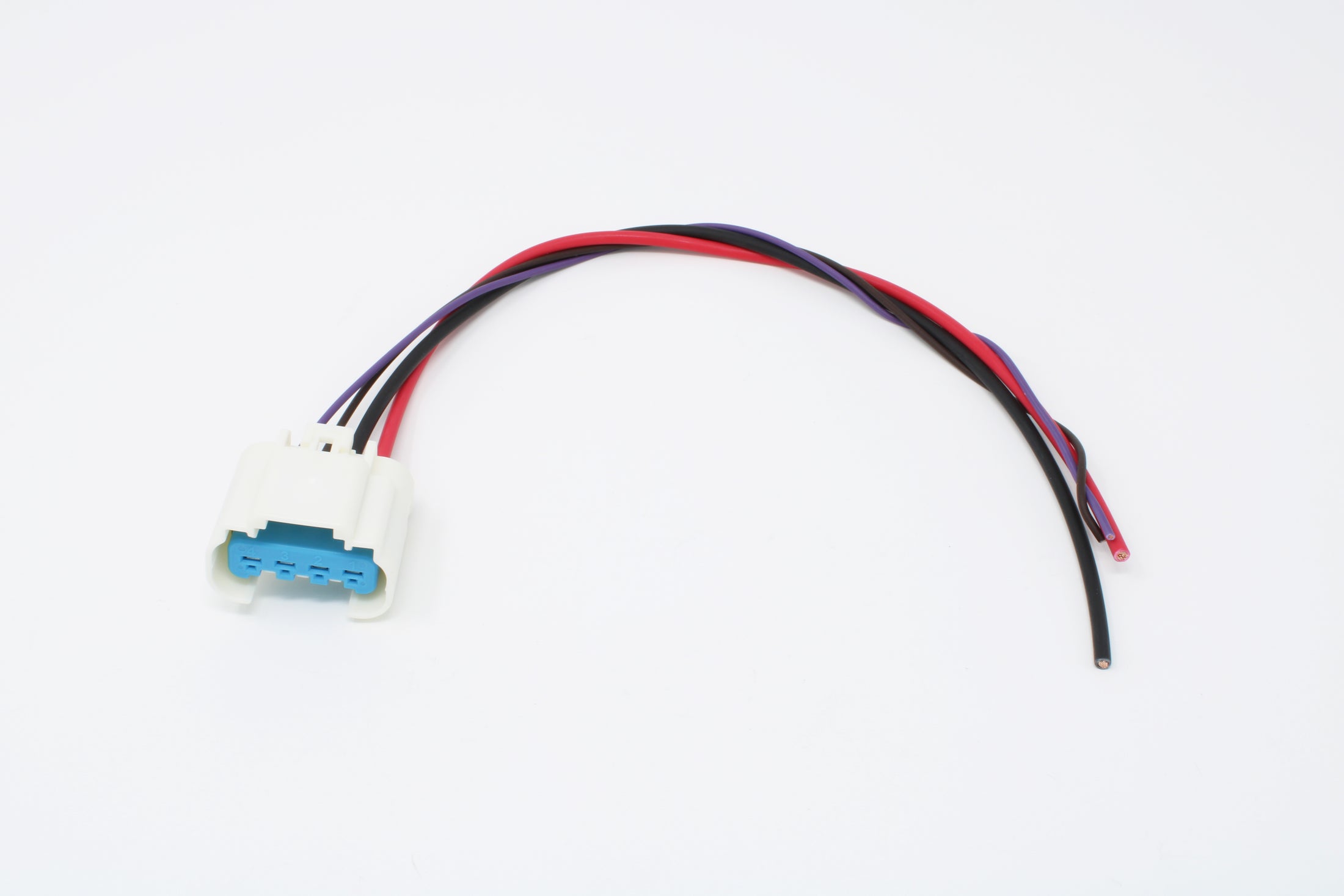

Inadequate Documentation and Traceability

Poor or missing documentation—such as schematics, BOMs (Bill of Materials), test reports, and lot traceability—can severely impact quality control and troubleshooting. Without traceability, identifying the source of a defect during a product recall becomes nearly impossible. Additionally, unclear documentation can lead to incorrect assembly or integration, especially if wire colors, pinouts, or connector types don’t match specifications.

Intellectual Property (IP) Infringement Risks

Sourcing pigtail harnesses from third-party manufacturers carries IP risks, especially if the design closely mimics proprietary connectors or patented configurations. Using reverse-engineered or counterfeit parts—even unknowingly—can expose your company to legal liability. Always ensure that your supplier has the right to manufacture the design and that custom harnesses do not infringe on existing patents or trademarks. For high-risk applications, consider having legal counsel review designs and supplier agreements.

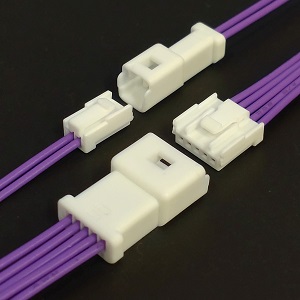

Overlooking Customization Versus Off-the-Shelf Trade-offs

While off-the-shelf harnesses may seem cost-effective, they often lack the precise specifications needed for specialized applications. Conversely, custom harnesses require careful design validation and tooling investment. A common pitfall is assuming that minor modifications to a stock harness will suffice, only to discover signal integrity or fitment issues later. Always validate custom designs with prototypes and ensure the supplier can consistently reproduce the exact configuration.

Supply Chain and Long-Term Availability Risks

Many pigtail harnesses use specific connectors or cables with limited suppliers. Relying on obsolete or single-source components can lead to supply disruptions. Failing to plan for end-of-life (EOL) components or secure long-term supply agreements may force costly redesigns. Conduct lifecycle assessments and ensure the supplier provides obsolescence management and long-term availability commitments.

By addressing these pitfalls proactively—through due diligence, supplier audits, contractual safeguards, and design validation—companies can ensure reliable, compliant, and legally sound sourcing of pigtail harnesses.

Logistics & Compliance Guide for Pigtail Harness

Overview

A pigtail harness is a specialized electrical or fiber optic cable assembly used to connect devices to larger systems, commonly found in telecommunications, automotive, and industrial applications. Proper logistics and compliance management are critical to ensure safe, legal, and efficient distribution and use.

Regulatory Compliance

International Standards

Pigtail harnesses must comply with region-specific and industry-specific regulations. Key international standards include:

– IEC 60332 – Flame propagation tests for electric cables.

– IEC 60754 – Tests on gases evolved during combustion (halogen acid gas emission).

– IEC 61034 – Measurement of smoke density during combustion.

– RoHS (EU Directive 2011/65/EU) – Restriction of Hazardous Substances in electrical equipment.

– REACH (EC 1907/2006) – Registration, Evaluation, Authorization, and Restriction of Chemicals.

North American Regulations

- UL/CSA Certification – Required for electrical safety in the U.S. and Canada.

- NEC (National Electrical Code) – Governs installation standards, especially for fire-resistant cabling.

- FCC Part 15 – Electromagnetic interference (EMI) compliance for data transmission cables.

Regional Requirements

- UKCA Marking – Required for sale in the UK post-Brexit (replaces CE in certain contexts).

- CCC (China Compulsory Certification) – Mandatory for cabling products sold in China.

- KC Mark (Korea) – Safety certification for electronic components.

Packaging and Labeling

Packaging Standards

- Use moisture-resistant, anti-static packaging for electronic pigtails.

- Secure harnesses to prevent tangling or physical damage during transit.

- Include cushioning materials (e.g., foam inserts) for shock protection.

Labeling Requirements

- Product name, model number, and revision.

- Manufacturer name and address.

- Compliance marks (e.g., CE, UL, RoHS).

- Lot or serial number for traceability.

- Handling symbols (e.g., “Fragile,” “Do Not Bend”).

Shipping and Transportation

Domestic & International Shipping

- Classify under correct HS Code (e.g., 8544.42 for insulated electric conductors).

- Prepare commercial invoice, packing list, and certificate of origin.

- Declare proper hazardous/non-hazardous status (most pigtails are non-hazardous).

Temperature and Environmental Controls

- Store and ship in temperatures between -10°C to 50°C unless specified otherwise.

- Avoid prolonged exposure to humidity (>85% RH) to prevent insulation degradation.

Carrier and Mode Selection

- Use carriers experienced in handling sensitive electronic components.

- Air freight recommended for time-sensitive or high-value shipments.

- Ground transport acceptable for bulk, non-urgent deliveries.

Customs Clearance

Documentation

- Ensure accurate product description aligned with tariff classifications.

- Provide test reports or compliance certificates upon request.

- Include import/export licenses if required by destination country.

Duties and Tariffs

- Research duty rates based on destination and material composition.

- Leverage free trade agreements (e.g., USMCA, ASEAN) where applicable.

Quality Assurance and Traceability

Incoming and Outgoing Inspections

- Verify harness length, connector types, shielding, and labeling.

- Perform continuity and insulation resistance tests.

- Audit packaging integrity prior to dispatch.

Batch Tracking

- Implement a traceability system using batch/lot numbers.

- Maintain records of manufacturing date, test results, and shipping details for at least 5 years.

Environmental and End-of-Life Management

Recycling and Disposal

- Follow WEEE (Waste Electrical and Electronic Equipment) guidelines in the EU.

- Partner with certified e-waste recyclers for end-of-life harnesses.

- Avoid landfill disposal due to plastic and metal content.

Conclusion

Proper logistics and compliance management for pigtail harnesses ensures regulatory adherence, reduces shipment delays, and enhances customer trust. Manufacturers and distributors must stay updated on evolving standards and maintain rigorous documentation throughout the supply chain.

Conclusion for Sourcing Pigtail Harness:

Sourcing pigtail harnesses requires a strategic approach that balances quality, cost, reliability, and compliance with industry standards. After evaluating potential suppliers, technical specifications, and long-term support capabilities, it is essential to select a partner that not only meets current project requirements but also offers scalability and responsiveness for future needs. Emphasis should be placed on suppliers with proven expertise in wiring harness manufacturing, adherence to international quality standards (such as ISO/TS 16949, UL, or IPC/WHMA-A-620), and the ability to provide customized solutions with consistent lead times.

Additionally, conducting thorough due diligence—through sample testing, audits, and reference checks—ensures the chosen supplier can deliver durable, high-performance pigtail harnesses suitable for the intended application, whether in automotive, industrial, or electronics sectors. Ultimately, a well-structured sourcing strategy minimizes risks, enhances supply chain resilience, and supports the overall efficiency and reliability of the final product.