The global photovoltaic (PV) panels market is experiencing robust expansion, driven by rising energy demands, favorable government policies, and declining technology costs. According to Mordor Intelligence, the market was valued at USD 165.4 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 7.8% from 2024 to 2029, reaching an estimated USD 260.6 billion by the end of the forecast period. This growth is further supported by increasing investments in renewable infrastructure and global decarbonization goals. With solar energy accounting for a growing share of new power capacity additions, particularly in Asia-Pacific, North America, and Europe, demand for high-efficiency, durable PV panels has surged. As a result, manufacturers are scaling production, innovating in cell technology—such as PERC, bifacial, and heterojunction designs—and expanding their global footprint. In this competitive landscape, ten key players have emerged as industry leaders, combining technological expertise, large-scale manufacturing capabilities, and strong supply chain integration to dominate the market.

Top 10 Photovoltaic Panels Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Suniva

Domain Est. 2005 | Founded: 2007

Website: suniva.com

Key Highlights: Suniva is America’s oldest and largest monocrystalline solar cell manufacturer in North America. Suniva was founded in 2007….

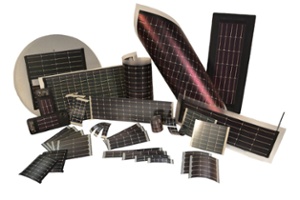

#2 PowerFilm Solar

Domain Est. 2005

Website: powerfilmsolar.com

Key Highlights: We design and manufacture custom solar cells, panels, and power solutions using proprietary thin-film or high-efficiency crystalline PV technology….

#3 Oxford PV

Domain Est. 2009

Website: oxfordpv.com

Key Highlights: Oxford PV – Solar that takes you further. Oxford PV is a leading innovator and manufacturer in the field of Perovskite-based PV, with over a decade of ……

#4 Illuminate USA

Domain Est. 2019

Website: illuminateusa.com

Key Highlights: Illuminate USA is the largest single-site solar panel manufacturer in North America, using advanced manufacturing to supply the American solar market….

#5 First Solar

Domain Est. 1999

#6 Solar Manufacturing Map

Domain Est. 1999

Website: energy.gov

Key Highlights: The US Solar Photovoltaic Manufacturing Map shows only active manufacturing sites that contribute to the solar photovoltaic supply chain….

#7 Canadian Solar

Domain Est. 2001

Website: canadiansolar.com

Key Highlights: Over 20 solar & energy storage manufacturing facilities. in Asia & Americas. Canadian Solar closely examines our supply chains to ensure goods imported are ……

#8 Solar for , Utility, and Commercial

Domain Est. 2004

Website: trinasolar.com

Key Highlights: Trina Solar is a world leader in solar energy innovation and reliability. Power your energy future with industry-leading solar panels and solutions….

#9 Onyx Solar, Building Integrated Photovoltaics Solutions

Domain Est. 2005

Website: onyxsolar.com

Key Highlights: Onyx Solar is a global leader in manufacturing photovoltaic (PV) glass, turning buildings into energy-efficient structures….

#10 ENF List of Solar Companies and Products

Domain Est. 2009

Website: enfsolar.com

Key Highlights: ENF Solar is the top source of photovoltaic information connecting solar suppliers and customers. We list all photovoltaic manufacturing companies, ……

Expert Sourcing Insights for Photovoltaic Panels

H2: 2026 Market Trends for Photovoltaic Panels

By 2026, the global photovoltaic (PV) panel market is poised for transformative growth, driven by accelerating decarbonization policies, technological innovation, cost reductions, and evolving supply chain dynamics. Key trends shaping the landscape include:

1. Exponential Market Growth and Grid Integration: Global PV installations are projected to exceed 500 GW annually by 2026, fueled by national net-zero commitments (e.g., EU Green Deal, U.S. Inflation Reduction Act) and utility-scale project pipelines. This surge necessitates advanced grid modernization, smart inverters, and hybrid systems integrating storage (batteries) to manage intermittency. Demand for PV-integrated infrastructure (solar rooftops, agrivoltaics, floating PV) will rise significantly.

2. Dominance of Advanced Cell Technologies: N-type technologies (TOPCon, HJT, IBC) will surpass traditional PERC cells, capturing over 60% of market share. TOPCon’s balance of efficiency (25%+) and manufacturability will drive adoption, while HJT gains traction in premium segments. Perovskite-silicon tandem cells will transition from R&D to early commercialization, achieving lab efficiencies >30% and pilot production lines.

3. Cost Optimization and Manufacturing Shifts: LCOE (Levelized Cost of Electricity) will drop below $20/MWh in optimal regions. Automation, larger wafers (G12), and thinner cells reduce production costs. China will maintain dominance (>70% global supply), but U.S., Indian, and Southeast Asian manufacturing will expand due to trade policies (e.g., UFLPA, EU CBAM) and localization incentives.

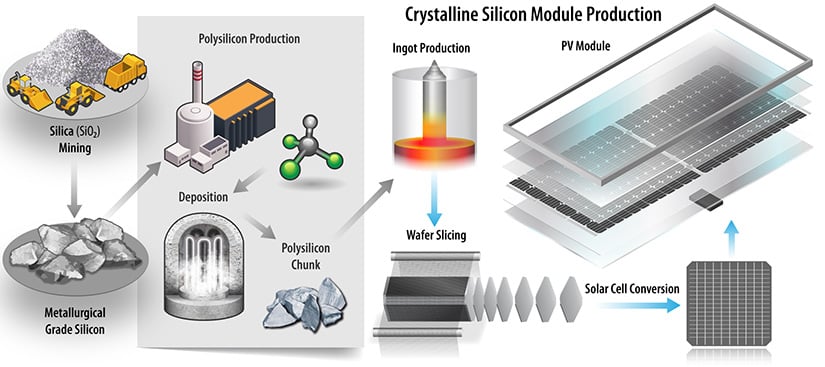

4. Supply Chain Resilience and Sustainability: Critical mineral (polysilicon, silver, copper) supply chains will face scrutiny. Recycling rates for end-of-life panels will improve with EU/China regulations, while silver usage declines via copper plating and multi-wire tech. ESG compliance and carbon footprint tracking will become procurement requirements.

5. Digitalization and AI Integration: AI-driven predictive maintenance, drone-based inspection, and digital twins will optimize O&M efficiency. Blockchain may enhance supply chain transparency. Residential/commercial segments will leverage smart energy management systems for self-consumption maximization.

Outlook: By 2026, PV will be the cornerstone of global energy transition, with innovation focused on efficiency, sustainability, and system-level integration. Companies mastering technology adaptation, supply chain agility, and digital solutions will lead the market.

Common Pitfalls in Sourcing Photovoltaic Panels (Quality, IP)

Sourcing photovoltaic (PV) panels involves navigating complex supply chains where quality inconsistencies and intellectual property (IP) risks can significantly impact project performance, financial returns, and legal compliance. Understanding and mitigating these pitfalls is crucial for developers, EPC contractors, and investors.

Quality-Related Pitfalls

Inconsistent Manufacturing Standards and Defects

Not all PV manufacturers adhere to the same quality control rigor. Sourcing from suppliers with inconsistent production processes increases the risk of cell microcracks, delamination, poor soldering, or PID (Potential Induced Degradation). These defects may not be visible during initial inspection but lead to premature power degradation and shortened panel lifespan. Relying solely on datasheet specifications without verified third-party testing (e.g., TÜV Rheinland, UL) can result in underperforming installations.

Overstated Performance Ratings and Binning Issues

Some suppliers may misrepresent power output (e.g., “nameplate wattage”) or use aggressive binning—where panels are graded into power output categories—to market lower-tier modules as higher-wattage products. Panels operating below their rated capacity reduce energy yield and ROI. Without independent performance validation, buyers may overpay for underperforming equipment.

Lack of Long-Term Reliability Data

Emerging manufacturers may offer competitive pricing but lack proven field performance data over 10–25 years. This absence of reliability history increases the risk of unexpected degradation rates or warranty claims being denied. Relying on short-term cost savings can lead to higher lifetime costs due to early replacement or underproduction.

Weak or Unenforceable Warranties

Many suppliers offer 25-year performance and product warranties, but the enforceability depends on the manufacturer’s financial stability and service network. Sourcing from companies without strong balance sheets or global service support can leave buyers stranded when claims arise. Warranties may also exclude certain failure modes (e.g., hotspot heating, frame corrosion), leaving gaps in protection.

Intellectual Property-Related Pitfalls

Infringement of Patented Technologies

PV technology involves numerous patented innovations—ranging from cell architecture (e.g., PERC, TOPCon) to manufacturing processes. Sourcing panels from suppliers that use patented technologies without licensing exposes buyers to secondary infringement risks. In some jurisdictions, even end-users or project owners could face legal action or customs seizures if panels are found to infringe valid IP rights.

Use of Counterfeit or Clone Panels

The market includes counterfeit modules that mimic reputable brands or replicate designs without authorization. These clones often use substandard materials and lack proper certifications, posing safety and performance risks. They may also violate design patents or trademarks, leading to supply chain disruptions and reputational damage.

Ambiguous Supply Chain Transparency

Opaque supply chains make it difficult to trace the origin of cells and modules. A panel may be branded by one company but assembled using components from multiple unknown sources, increasing the risk of unintentional IP violations. Without full disclosure and audit rights, buyers cannot ensure compliance with IP laws or corporate sustainability policies.

Insufficient Due Diligence on Supplier IP Compliance

Buyers often focus on price and delivery timelines, neglecting to verify whether suppliers have proper IP licenses or freedom-to-operate documentation. This oversight can result in project delays, import bans (e.g., via U.S. Section 301 or Uyghur Forced Labor Prevention Act), or costly litigation. Proactive IP due diligence, including supplier audits and legal opinions, is essential to mitigate these risks.

Logistics & Compliance Guide for Photovoltaic Panels

Overview

This guide provides essential information on the logistics and compliance considerations involved in transporting and deploying photovoltaic (PV) panels globally. Proper handling, packaging, documentation, and adherence to regulatory standards are critical to ensure product integrity, safety, and legal compliance throughout the supply chain.

Packaging and Handling Requirements

PV panels are fragile and sensitive to environmental conditions. Proper packaging is essential to prevent breakage, moisture ingress, and electrical damage.

– Use robust, wooden or recyclable composite pallets with corner protectors and edge guards.

– Panels must be packed vertically or horizontally as specified by the manufacturer; improper orientation can cause microcracks.

– Include moisture-absorbing desiccants and waterproof wrapping to prevent condensation during transit.

– Clearly label packages with “Fragile,” “This Side Up,” and “Do Not Stack” indicators.

– Avoid exposure to extreme temperatures, humidity, or direct sunlight during storage and transport.

Transportation Modes and Considerations

Selecting the appropriate transportation method depends on volume, distance, destination, and cost.

Ocean Freight

- Most cost-effective for large-scale shipments.

- Panels should be secured in containers using dunnage and anti-slip materials.

- Use dry, ventilated containers and monitor humidity levels.

- Comply with International Maritime Dangerous Goods (IMDG) Code if batteries are shipped with panels.

Air Freight

- Suitable for urgent or time-sensitive deliveries.

- Higher cost and weight restrictions apply.

- Ensure compliance with IATA Dangerous Goods Regulations, particularly for lithium batteries in associated inverters or storage systems.

Overland Transport (Truck/Rail)

- Ideal for regional distribution.

- Use vehicles with suspension systems to minimize vibration.

- Secure loads with straps and avoid abrupt braking or acceleration.

Regulatory Compliance

International Trade Regulations

- Obtain proper export/import licenses based on country-specific requirements.

- Classify PV panels under the correct Harmonized System (HS) code (e.g., 8541.40 for solar cells/modules).

- Ensure adherence to trade sanctions and embargoes (e.g., OFAC regulations in the U.S.).

Environmental and Safety Standards

- Comply with REACH (EU) and RoHS (EU) directives restricting hazardous substances.

- Adhere to IEC 61215 (design qualification) and IEC 61730 (safety qualification) standards.

- In the U.S., follow NFPA 70 (National Electrical Code) and UL 1703 certification requirements.

Country-Specific Requirements

- European Union: CE marking required; comply with WEEE Directive for end-of-life recycling.

- United States: FCC Part 15 compliance if inverters emit radio frequency; state-level solar incentives may require additional documentation.

- China: CCC certification may apply depending on panel configuration.

- India: BIS (Bureau of Indian Standards) certification mandated for solar modules.

Customs Documentation

Accurate documentation is vital for smooth customs clearance.

– Commercial Invoice

– Packing List

– Bill of Lading or Air Waybill

– Certificate of Origin

– Test Reports and Certifications (e.g., IEC, UL)

– Import/Export Declaration Forms

End-of-Life and Recycling Compliance

- Follow extended producer responsibility (EPR) laws in applicable jurisdictions.

- In the EU, register with national WEEE compliance schemes and report panel take-back data.

- Provide customers with recycling instructions and disposal guidelines.

Risk Mitigation and Insurance

- Insure shipments against damage, theft, and delays.

- Conduct pre-shipment inspections to verify quality and compliance.

- Partner with logistics providers experienced in handling renewable energy equipment.

Conclusion

Successfully managing the logistics and compliance of photovoltaic panels requires a detailed understanding of technical, regulatory, and logistical factors. By adhering to international standards, ensuring proper handling, and maintaining accurate documentation, stakeholders can minimize risks, reduce costs, and support the sustainable deployment of solar energy systems worldwide.

Conclusion: Sourcing Photovoltaic Panel Suppliers

Sourcing photovoltaic (PV) panel suppliers is a critical step in ensuring the success, efficiency, and long-term viability of solar energy projects. A thorough and strategic supplier selection process enables organizations to secure high-quality, reliable, and cost-effective solar panels that meet technical, financial, and sustainability goals. Key factors such as product efficiency, durability, warranty terms, certifications, production capacity, and the supplier’s track record must be carefully evaluated.

Diversifying the supplier base across different regions can mitigate risks related to geopolitical instability, supply chain disruptions, and trade barriers. Additionally, prioritizing suppliers with strong environmental, social, and governance (ESG) practices supports sustainable energy transitions and aligns with corporate responsibility objectives.

Ongoing due diligence, performance monitoring, and maintaining strong supplier relationships are essential for long-term success. By leveraging market intelligence, engaging in competitive bidding, and staying informed about technological advancements, stakeholders can make informed procurement decisions that optimize value and support the global shift toward renewable energy.

Ultimately, effective PV panel sourcing not only impacts project economics and performance but also contributes significantly to achieving energy independence, reducing carbon emissions, and advancing the clean energy agenda.