The global photo frames market is experiencing steady growth, driven by rising demand for personalized home décor and digital printing technologies. According to Grand View Research, the global photo frame market size was valued at USD 11.3 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2030. This growth is fueled by increasing consumer preference for customized gifts, advancements in eco-friendly materials, and the proliferation of online retail platforms. As the market evolves, manufacturers are leveraging digital production techniques and sustainable sourcing to meet both aesthetic and environmental demands. In this dynamic landscape, a select group of leading photo frame manufacturers have emerged, combining innovation, scalability, and design excellence to capture significant market share. Based on production capacity, global reach, and technological advancement, here are the top 10 photo frame manufacturers shaping the industry today.

Top 10 Photo Frames Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 American Picture Framing, Inc. Quality Custom Framing

Domain Est. 2005

Website: americanpictureframing.com

Key Highlights: American Picture Framing, Inc. is a wholesale/retail custom picture framing shop. We have provided the Philadelphia area with custom, quality picture framing, ……

#2 Leader Frames

Domain Est. 1996

Website: leaderframes.com

Key Highlights: Leader Frames & Significant Impact is a proud leader in the FRAMING Industry. We are dedicated to ensuring that all of our products are ethically produced and ……

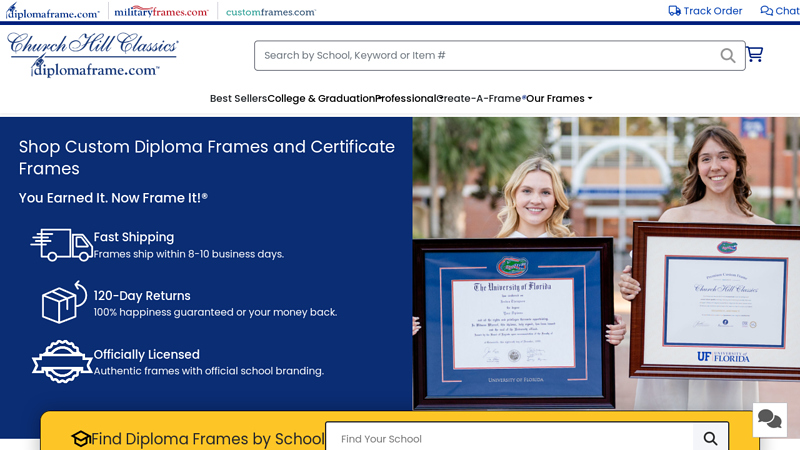

#3 Church Hill Classics

Domain Est. 1997

Website: diplomaframe.com

Key Highlights: 120-day returnsChurch Hill Classics is the #1 trusted leader in custom diploma frames including college diploma frames, certificate frames, and more. Shop our frames now!…

#4 Custom Frames for Certificates, Photos, and Recognition Awards …

Domain Est. 1997

Website: customframes.com

Key Highlights: $22.95 delivery 120-day returnsCustom frames and awards for corporate recognition. Showcase achievements with branded frames, plaques, and crystals. Celebrate success with our prem…

#5 JFM Enterprises: Gallery Style Frames

Domain Est. 1998

Website: jfm.net

Key Highlights: We provide artists, galleries, designers, photographers, framers and other wholesalers with the world’s most beautiful and affordable hand-finished mouldings….

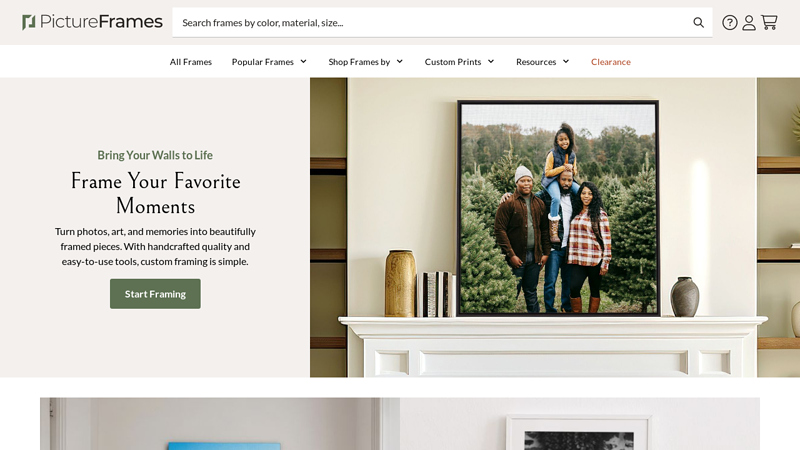

#6 Picture Frames & Custom Framing Online

Domain Est. 1999

Website: pictureframes.com

Key Highlights: Assembled in America and customized to match your vision, pictureframes.com has the top-quality frame to match any piece and make it shine!…

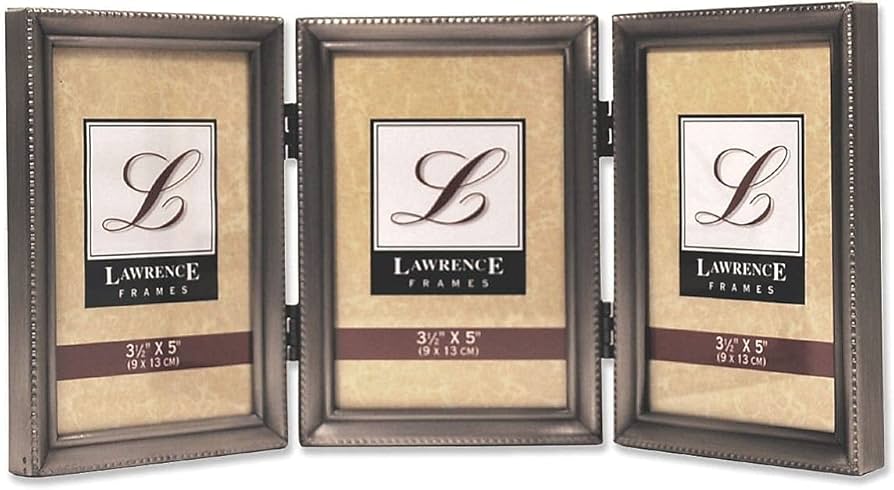

#7 Lawrence Frames

Domain Est. 2000

Website: lawrenceframes.com

Key Highlights: Founded in 1898 by Fred M. Lawrence, Lawrence Frames is the longest operating frame brand in the industry. Now a third generation family business….

#8 Shop Stylish Picture Frames for Every Space at Craig Frames

Domain Est. 2003

#9 Wholesale Picture Frame Supplies & Moulding

Domain Est. 2003

Website: finerworks.com

Key Highlights: Rating 4.9 (50) · $15.95 deliveryOver 200 frames styles to choose from. Each frame is custom cut & joined to order with pricing at wholesale rates. Additional discount savings …

#10 Michaels Custom Framing

Domain Est. 2016

Expert Sourcing Insights for Photo Frames

H2: 2026 Market Trends for Photo Frames

The photo frame market is undergoing a significant transformation as consumer preferences, technological advancements, and sustainability concerns shape demand through 2026. This analysis outlines key trends expected to influence the industry in the coming years.

H2: Digital Integration and Smart Frames Gain Momentum

One of the most prominent trends in the 2026 photo frame market is the rise of digital and smart photo frames. Enhanced connectivity, improved display technology, and integration with cloud services and AI are driving adoption. Consumers are increasingly drawn to frames that automatically curate and display photos from social media, smartphones, and cloud storage. Features like voice control, motion sensors, and remote updating via mobile apps are becoming standard, particularly in premium segments. The market for smart frames is projected to grow at a CAGR of over 12% through 2026, fueled by aging populations seeking easy ways to share memories and tech-savvy millennials embracing connected home devices.

H2: Sustainability Drives Material Innovation

Environmental consciousness is reshaping product design and materials. By 2026, eco-friendly photo frames made from recycled wood, bamboo, bioplastics, and reclaimed materials are gaining market share. Consumers, especially in North America and Europe, are prioritizing sustainable brands, prompting manufacturers to reduce plastic use and adopt carbon-neutral production methods. Certifications such as FSC (Forest Stewardship Council) and Cradle to Cradle are becoming important differentiators. Additionally, modular and refillable frame designs are emerging to extend product life and reduce waste.

H2: Personalization and Customization Surge

Personalized photo frames remain a strong trend, with advances in digital printing, engraving, and online design tools enabling highly customized products. In 2026, brands are leveraging AI to offer curated design suggestions based on user-uploaded photos or occasions (e.g., weddings, anniversaries). Subscription-based models for seasonal or rotating frame designs are also gaining traction, especially in e-commerce channels. This trend is largely driven by the gifting market, where unique and sentimental items hold high perceived value.

H2: E-Commerce and Direct-to-Consumer Models Dominate

Online retail continues to dominate photo frame sales, with platforms like Amazon, Etsy, and brand-owned websites leading the way. By 2026, immersive shopping experiences—such as augmented reality (AR) previews that let users visualize frames on their walls—are becoming standard. Direct-to-consumer (DTC) brands are thriving by offering competitive pricing, faster delivery, and niche aesthetics that traditional retailers often miss. Social media marketing, especially via Instagram and Pinterest, plays a crucial role in driving discovery and purchase decisions.

H2: Minimalist and Multifunctional Designs Rise in Popularity

Interior design trends favoring minimalism and multifunctionality are influencing frame styles. Sleek, frameless, or floating designs in neutral colors such as matte black, white, and wood tones are increasingly popular. Additionally, hybrid products—such as photo frames with built-in wireless chargers, clocks, or mirrors—are capturing consumer interest. These multifunctional frames appeal to urban dwellers with limited space and a preference for decluttered living environments.

H2: Regional Market Variations and Growth Opportunities

While North America and Europe lead in smart and sustainable frame adoption, emerging markets in Asia-Pacific, particularly India and Southeast Asia, are showing rapid growth due to rising disposable incomes and digital penetration. Localized designs that reflect cultural aesthetics and festive gifting traditions are creating new opportunities. Meanwhile, the Middle East and Latin America are witnessing increased demand for luxury and artisanal frames, often used in home décor and hospitality sectors.

In conclusion, the 2026 photo frame market is defined by innovation, personalization, and sustainability. Brands that embrace digital transformation, eco-conscious manufacturing, and evolving consumer lifestyles are best positioned to succeed in this dynamic landscape.

Common Pitfalls Sourcing Photo Frames (Quality, IP)

Sourcing photo frames, especially from overseas or third-party suppliers, can present several challenges that impact both product quality and legal compliance. Being aware of these common pitfalls helps mitigate risks and ensures a successful product launch.

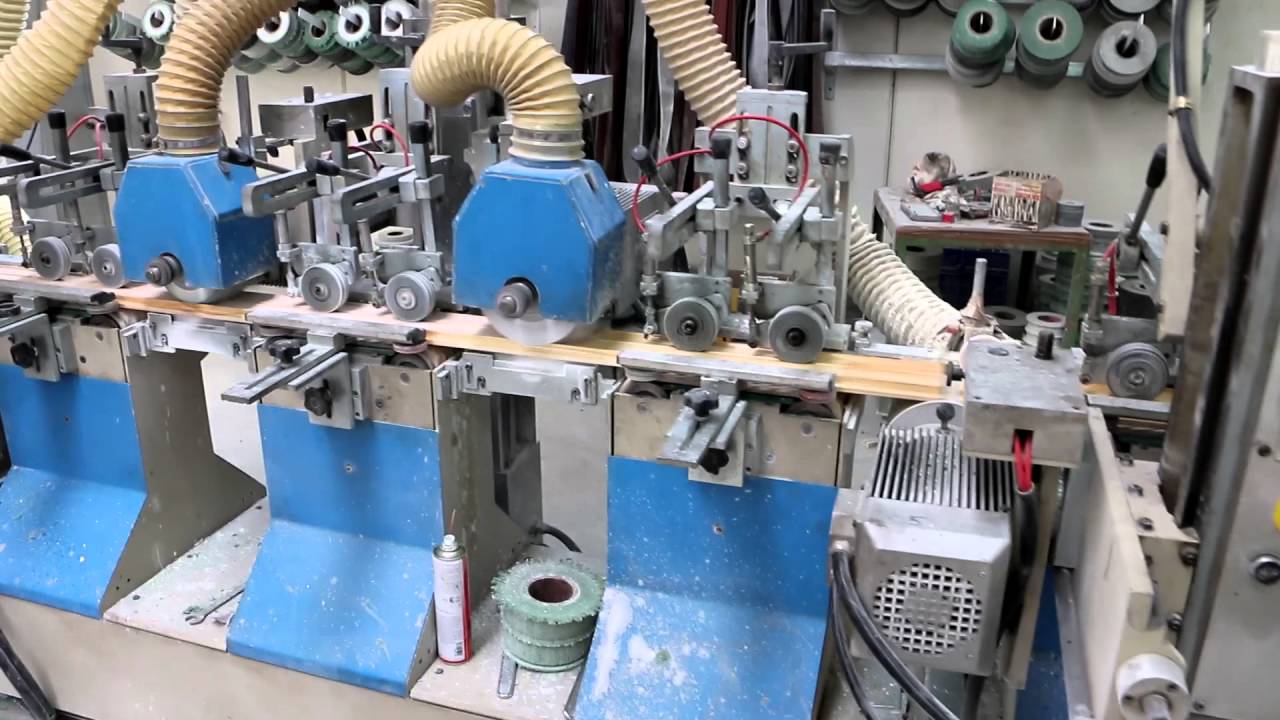

Poor Material and Construction Quality

One of the most frequent issues is receiving photo frames that do not meet expected durability or aesthetic standards. This includes warped or uneven frames, low-quality finishes, weak joints, or fragile glass/acrylic. Materials like MDF (medium-density fiberboard) may swell or deteriorate in humid conditions if not properly sealed. Thin or flimsy backing boards can also lead to damage during shipping or use.

Inconsistent Finish and Color Matching

Color variation between batches is a common quality control problem. Frames may appear different under various lighting conditions or fail to match the approved sample due to inconsistent paint, stain, or laminate application. This inconsistency can damage brand reputation, especially for retailers offering coordinated home decor lines.

Misalignment with Design Specifications

Suppliers may deviate from design specifications—altering proportions, corner miter angles, or mounting hardware—without approval. These subtle changes can affect the look and functionality of the frame, leading to customer complaints and returns.

Intellectual Property (IP) Infringement Risks

Sourcing frames with copyrighted designs, logos, or patented structural features can expose your business to legal liability. Many suppliers, particularly in regions with lax IP enforcement, may replicate popular designer frames or use trademarked patterns without authorization. Importing such products can lead to customs seizures, lawsuits, or forced product recalls.

Use of Unlicensed Brand Imitations

Some suppliers offer frames that closely mimic high-end brands (e.g., faux versions of知名品牌 designs). Even if not labeled with the brand name, these products may still infringe on design patents or trade dress rights, putting your company at risk of infringement claims.

Lack of IP Documentation and Due Diligence

Failing to obtain written confirmation from suppliers that designs are original or properly licensed is a critical oversight. Without proper vetting—such as design freedom-to-operate searches or supplier warranties—you may unknowingly distribute infringing products.

Hidden Costs from Rework and Rejection

Poor quality or IP issues often result in rejected shipments, costly rework, or last-minute redesigns. These delays can disrupt inventory planning and increase overall sourcing costs, eroding profit margins.

Mitigation Strategies

To avoid these pitfalls, conduct thorough supplier audits, request detailed material specifications, perform third-party quality inspections, and consult legal counsel to verify IP compliance. Always secure design licenses when necessary and maintain clear documentation throughout the sourcing process.

Logistics & Compliance Guide for Photo Frames

Product Classification and HS Code

Photo frames are typically classified under the Harmonized System (HS) code 4414.00 for wooden frames, 7616.99 for aluminum frames, or 3926.30 for plastic frames, depending on the primary material. Accurate classification is essential for customs clearance, duty calculation, and compliance with international trade regulations. Always verify the correct HS code based on the frame’s composition, country of manufacture, and destination.

Packaging and Labeling Requirements

Photo frames must be packaged to prevent damage during transit, using protective materials such as bubble wrap, foam corners, or corrugated inserts. Packaging should meet ISTA or ASTM standards for drop and vibration resistance where applicable. Labels must include product identification, country of origin, handling instructions (e.g., “Fragile,” “This Side Up”), and barcodes for inventory tracking. Retail packaging may also require bilingual labeling depending on the destination market.

Import/Export Documentation

Standard documentation includes a commercial invoice, packing list, bill of lading (or air waybill), and certificate of origin. Some countries may require additional documents such as a conformity assessment or import license. Ensure the commercial invoice clearly describes the product, quantity, value, HS code, and Incoterms (e.g., FOB, DDP) to avoid customs delays.

Regulatory Compliance

Photo frames must comply with safety and environmental regulations in the destination market. In the EU, frames with electrical components (e.g., digital photo frames) must meet CE marking requirements and RoHS directives. Wooden frames may be subject to ISPM 15 regulations for treated wood packaging. In the U.S., compliance with CPSIA may be required if the product is marketed to children and contains accessible surface coatings or small parts.

Restricted Materials and Substances

Ensure that materials used in photo frames—especially paints, adhesives, and substrates—do not contain restricted substances such as lead, phthalates, or formaldehyde above permissible levels. Verify compliance with REACH (EU), Prop 65 (California), and other regional chemical regulations. Suppliers should provide material declarations or test reports upon request.

Transportation and Handling

Due to their fragile nature, photo frames should be shipped on pallets with edge protectors and stretch-wrapped securely. Avoid overstacking to prevent crushing. Air freight is recommended for high-value or time-sensitive shipments, while ocean freight is cost-effective for bulk orders. Use carriers experienced in handling delicate goods and consider shipping insurance.

Duty and Tax Considerations

Import duties vary by country and material composition. Utilize free trade agreements (e.g., USMCA, RCEP) where applicable to reduce or eliminate tariffs. Be aware of VAT, GST, or other local consumption taxes that may apply upon import. Accurate valuation is critical—include all costs (e.g., packaging, tooling) in the declared value to avoid penalties.

Return and Reverse Logistics

Establish a clear returns policy for damaged or defective items. Partner with logistics providers who offer reverse logistics solutions, including inspection, refurbishment, or disposal in compliance with local waste regulations (e.g., WEEE for electronic frames). Minimize environmental impact through recyclable packaging and take-back programs where feasible.

Recordkeeping and Audit Readiness

Maintain records of compliance documentation, test reports, supplier certifications, and shipping records for a minimum of five years. This ensures readiness for customs audits or regulatory inspections and supports traceability in case of recalls or disputes.

Sustainability and ESG Compliance

Prioritize suppliers that follow sustainable forestry practices (FSC/PEFC certification for wood) and minimize plastic use. Report on carbon footprint from transportation and encourage eco-friendly packaging. Align logistics operations with corporate ESG goals to meet growing consumer and regulatory expectations.

In conclusion, sourcing photo frame suppliers requires a strategic approach that balances quality, cost, reliability, and scalability. After evaluating various suppliers based on factors such as product variety, material quality, production capacity, pricing, lead times, and ethical practices, it is evident that establishing partnerships with suppliers who align with your brand values and operational needs is crucial. Whether sourcing locally or internationally, conducting thorough due diligence, requesting samples, and maintaining clear communication will help ensure consistent product standards and on-time deliveries. Additionally, building strong, long-term relationships with a few trusted suppliers can lead to better negotiation terms, improved responsiveness, and greater supply chain resilience. Ultimately, the right supplier partnership will not only support your business goals but also enhance customer satisfaction through high-quality, beautifully crafted photo frames.