The global perfusion pump market is experiencing robust growth, driven by rising cardiovascular disease prevalence, increasing cardiac surgical procedures, and advancements in extracorporeal circulation technologies. According to Grand View Research, the global cardiopulmonary bypass machines market—of which perfusion pumps are a critical component—was valued at USD 2.1 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 7.3% from 2023 to 2030. Similarly, Mordor Intelligence projects a CAGR of approximately 7.5% over the forecast period (2023–2028), citing technological innovation and growing demand for minimally invasive cardiac surgeries as key growth drivers. With increasing hospital investments in advanced perfusion systems and the expanding role of perfusionists in complex surgeries, the competitive landscape is evolving. Here, we spotlight the top 9 perfusion pump manufacturers shaping the future of cardiac care through innovation, reliability, and global reach.

Top 9 Perfusion Pump Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Essenz Perfusion System

Domain Est. 2015

Website: livanova.com

Key Highlights: Essenz Perfusion System combines the state-of-the-art Essenz HLM with an intuitive Patient Monitor and accurate sensing technology, enabling data-driven ……

#2 Quantum Perfusion Systems

Domain Est. 1990

Website: europe.medtronic.com

Key Highlights: The flexible range of Quantum Perfusion Modules is a combination of world leading perfusion technologies and integrated patient safety systems….

#3 Closed Perfusion Pump

Domain Est. 1995

#4 Perfusion

Domain Est. 1999

Website: levitronix.com

Key Highlights: Levitronix pump systems are designed for demanding perfusion applications where ultra low shear and safe processing ensure the highest yield….

#5 ibidi Pump System

Domain Est. 1999

Website: ibidi.com

Key Highlights: A perfusion system to cultivate cells under physiological conditions | Perfusion and flow assays | ibidi Pump System for long-term cell culture under flow ……

#6 The Quantum Roller Pump

Domain Est. 2002

Website: spectrummedical.com

Key Highlights: The world’s first provider of roller pumps with three different race-way diameters. Having the ability to choose between a 4″, 6″ and 8″ race-ways eliminates ……

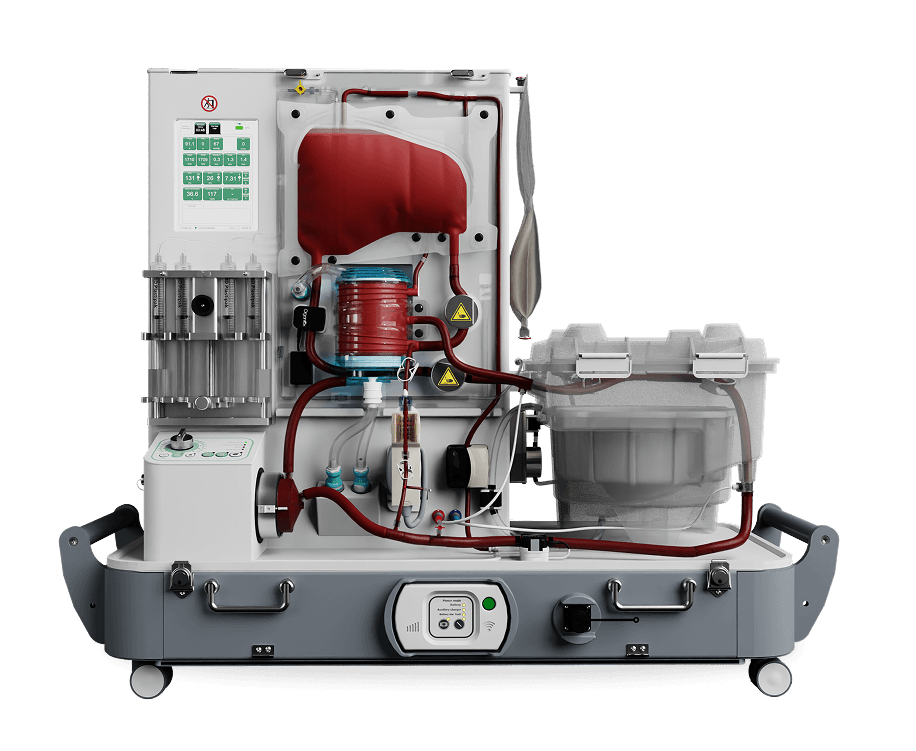

#7 The World’s First Normothermic Machine Perfusion (NMP) Platform

Domain Est. 2007

Website: organox.com

Key Highlights: Discover OrganOx metra®, a liver perfusion device that enhances organ preservation, assessment, and transplant success….

#8 Perfusion Solution

Domain Est. 2010

Website: perfusionsolution.com

Key Highlights: Committed to efficient healthcare spending through staffing, education, medical supplies, and hardware solutions tailored to your needs….

#9 Perfusion Products

Domain Est. 2020

Website: terumocv.com

Key Highlights: Terumo’s extensive perfusion product line includes the most technologically advanced heart-lung machine, the world’s best selling pediatric oxygenator….

Expert Sourcing Insights for Perfusion Pump

H2: Projected Market Trends for Perfusion Pumps in 2026

The global perfusion pump market is poised for significant transformation by 2026, driven by technological innovation, rising cardiovascular disease prevalence, and evolving surgical practices. Several key trends are expected to shape the market landscape in the coming years:

-

Increased Demand Due to Rising Cardiovascular Diseases

The growing incidence of heart failure, coronary artery disease, and congenital heart defects—especially in aging populations across North America, Europe, and parts of Asia—is expected to boost demand for cardiac surgeries requiring cardiopulmonary bypass. This will directly drive the need for advanced perfusion pumps, positioning them as critical components in operating rooms. -

Technological Advancements and Miniaturization

By 2026, perfusion pump systems are anticipated to become more compact, portable, and integrated with digital monitoring tools. Innovations such as centrifugal pump dominance, reduced priming volumes, and integration with real-time hemodynamic feedback systems will enhance patient safety and surgical efficiency. The shift toward miniaturized, low-cost perfusion systems could also expand access in ambulatory surgical centers and emerging markets. -

Growth in Minimally Invasive and Robotic-Assisted Surgeries

The trend toward less invasive cardiac procedures, including off-pump coronary artery bypass (OPCAB) and transcatheter interventions, may limit traditional pump use. However, hybrid procedures and the need for circulatory support during complex interventions will sustain demand. Perfusion pumps are increasingly being adapted for use in conjunction with robotic surgery platforms, creating new niche applications. -

Expansion in Emerging Markets

Regions such as Latin America, Southeast Asia, and the Middle East are expected to witness accelerated market growth due to improving healthcare infrastructure, rising disposable incomes, and increased government investment in cardiac care. Local manufacturing partnerships and cost-optimized pump models are likely to support market penetration. -

Integration with Digital Health and AI

By 2026, perfusion pumps are expected to feature enhanced connectivity with hospital information systems (HIS), electronic medical records (EMR), and AI-driven predictive analytics. Smart perfusion systems could offer automated flow rate adjustments, early warning alerts for hemodynamic instability, and data logging for quality assurance and training purposes. -

Regulatory and Safety Standards Evolution

As patient safety becomes a higher priority, regulatory bodies such as the FDA and EMA are likely to enforce stricter standards for perfusion equipment. This will push manufacturers to focus on fail-safe mechanisms, biocompatible materials, and cybersecurity for connected devices, especially in networked operating rooms. -

Competitive Landscape and Strategic Collaborations

The market will likely see increased consolidation, with major players such as Medtronic, LivaNova, Terumo, and Getinge expanding their portfolios through acquisitions and R&D partnerships. Startups focusing on disposable, single-use perfusion circuits and modular pump designs may also gain traction.

In summary, the 2026 perfusion pump market will be characterized by innovation-driven growth, digital integration, and geographic expansion. While challenges such as high equipment costs and training requirements persist, the overall outlook remains positive, supported by clinical demand and technological evolution.

Common Pitfalls When Sourcing Perfusion Pumps: Quality and Intellectual Property Risks

Sourcing perfusion pumps—critical devices used in medical applications such as organ preservation and extracorporeal support—requires careful due diligence. Two major areas of risk are product quality and intellectual property (IP) compliance. Overlooking these aspects can lead to regulatory delays, product recalls, legal disputes, and patient safety issues.

Quality-Related Pitfalls

1. Inadequate Regulatory Compliance

A common mistake is sourcing pumps from suppliers without proper certification for medical device standards (e.g., ISO 13485, FDA 21 CFR Part 820, or EU MDR). Pumps lacking necessary regulatory approvals may fail inspections or be barred from market entry.

2. Poor Manufacturing Controls

Suppliers with inconsistent quality management systems may produce pumps with variability in performance, calibration, or material biocompatibility. This compromises reliability, especially in long-duration perfusion applications.

3. Substandard Materials and Components

Using non-medical-grade materials (e.g., non-biocompatible tubing or seals) can lead to leaching, thrombogenicity, or device failure. Sourcing from low-cost manufacturers without material traceability increases this risk.

4. Lack of Validation and Testing Data

Reputable suppliers should provide comprehensive validation data, including flow accuracy, pressure tolerance, and sterility assurance. Omitting this verification can result in undetected performance flaws.

5. Insufficient After-Sales Support and Documentation

Poor technical support, incomplete user manuals, or missing maintenance protocols can hinder clinical use and regulatory audits.

Intellectual Property-Related Pitfalls

1. Infringement of Patented Technologies

Many perfusion pumps incorporate proprietary technologies (e.g., specialized pumping mechanisms, control algorithms, or sensor integration). Sourcing from suppliers using unlicensed innovations can expose the buyer to infringement lawsuits.

2. Ambiguous IP Ownership in Custom Designs

When co-developing or customizing pumps, failure to clearly define IP ownership in contracts may result in disputes over rights to improvements, manufacturing, or commercialization.

3. Use of Open-Source or Reverse-Engineered Designs

Some suppliers may base designs on patented systems without proper licensing, masquerading them as “generic” alternatives. This exposes the purchaser to legal liability even if unintentional.

4. Inadequate Due Diligence on Supplier IP Portfolio

Failing to verify whether the supplier holds valid IP rights or licenses for the technology used can lead to supply chain disruptions if third parties assert infringement claims.

5. Export and Licensing Restrictions

Certain perfusion pump technologies may be subject to export controls or licensing requirements (e.g., under ITAR or national security regulations), especially if they incorporate dual-use components.

Mitigation Strategies

- Conduct thorough supplier audits, including quality systems and regulatory history.

- Require full transparency on materials, design sources, and compliance certifications.

- Perform IP landscape analysis and legal review before procurement.

- Include robust IP indemnification clauses in sourcing contracts.

- Engage legal and regulatory experts early in the procurement process.

Avoiding these pitfalls ensures the safety, efficacy, and legal integrity of perfusion pump sourcing, protecting both patient outcomes and organizational reputation.

Logistics & Compliance Guide for Perfusion Pump

Regulatory Classification and Approvals

Perfusion pumps are classified as medical devices and are subject to stringent regulatory oversight. In the United States, the Food and Drug Administration (FDA) typically classifies perfusion pumps as Class II or Class III devices under 21 CFR 870.4420, depending on their intended use and risk profile. These devices generally require either a 510(k) premarket notification or Premarket Approval (PMA). In the European Union, perfusion pumps must comply with the Medical Device Regulation (MDR) (EU) 2017/745 and carry the CE mark. Manufacturers must ensure conformity through a Notified Body for higher-risk classifications. Similar regulatory frameworks apply in Canada (Health Canada), Australia (TGA), and other major markets, requiring local authorization prior to distribution.

Labeling and Packaging Requirements

Perfusion pumps must be labeled in compliance with applicable regulatory standards, including UDI (Unique Device Identification) requirements per FDA and EU MDR. Labels must include the device name, model number, serial number, manufacturer information, expiration date (if applicable), and any relevant warnings or contraindications. Packaging must be sterile if the device or its components are intended for single use and must maintain integrity during transport. Multilingual labeling is required in regions such as the EU and Canada. Barcodes and RFID tags may be used to support inventory and traceability systems. All packaging must withstand environmental stresses during shipping, including temperature, humidity, and shock.

Import and Export Documentation

International shipment of perfusion pumps requires accurate and complete documentation to ensure customs clearance and compliance. Essential documents include a commercial invoice, packing list, bill of lading or air waybill, and a Certificate of Conformity (CoC) indicating compliance with destination country regulations. For U.S. exports, an Electronic Export Information (EEI) filing via the Automated Export System (AES) may be required. Importers must provide local regulatory approval evidence (e.g., FDA registration number, CE Certificate, Health Canada license). Devices may also be subject to export controls under ITAR or EAR if they contain dual-use technologies, requiring appropriate licensing.

Temperature and Environmental Controls

Perfusion pumps, especially those with sensitive electronics or integrated sensors, must be stored and transported within specified environmental conditions. Unless otherwise specified by the manufacturer, typical storage conditions range from 10°C to 30°C (50°F to 86°F) with relative humidity between 30% and 70%. Temperature excursions must be monitored using data loggers during transit, particularly for international shipments or extreme climates. Devices should be protected from direct sunlight, moisture, and physical shock. If the pump includes batteries, IATA Dangerous Goods Regulations (DGR) apply for air transport, requiring proper packaging, labeling, and documentation (e.g., UN3481 for lithium-ion batteries).

Shipping and Carrier Compliance

Perfusion pumps must be shipped via carriers compliant with medical device transport standards. Use of validated shipping containers that maintain environmental conditions and protect against physical damage is recommended. Carriers should offer tracking, chain-of-custody documentation, and expedited delivery options when needed. For international shipments, ensure the carrier is experienced in handling regulated medical devices and can manage customs brokerage efficiently. Special handling labels (e.g., “Fragile,” “This Side Up,” “Do Not Freeze”) must be clearly displayed. Air transport must comply with IATA DGR, particularly for battery-powered units.

Inventory Management and Traceability

Robust inventory systems are essential for tracking perfusion pumps through the supply chain. Each unit must be traceable via its UDI to support recalls, field actions, and compliance reporting. ERP or specialized medical device inventory software should capture lot/serial numbers, manufacturing dates, expiration dates (if applicable), and distribution history. Regular audits and reconciliation processes ensure data accuracy. For implants or critical care devices, serialized tracking from manufacturing to end-user is often mandatory under FDA UDI Rule and EU MDR.

Post-Market Surveillance and Reporting

Once in distribution, perfusion pumps are subject to post-market surveillance requirements. Manufacturers and authorized representatives must establish systems for collecting and reviewing complaints, adverse events, and field safety corrective actions (FSCAs). Under FDA regulations, medical device reports (MDRs) must be filed for events that may have caused or contributed to death or serious injury. EU MDR requires reporting of serious incidents and field safety notices through Eudamed. These systems support ongoing compliance and help identify potential design or manufacturing issues.

Training and Onboarding for Distributors

Authorized distributors and logistics partners must be trained on the specific handling, storage, and compliance requirements for perfusion pumps. Training should cover regulatory obligations, temperature monitoring procedures, documentation requirements, and incident reporting protocols. Distributors must sign quality agreements outlining responsibilities under applicable regulations (e.g., FDA Quality System Regulation, EU MDR). Regular audits and performance reviews ensure continued compliance throughout the distribution network.

Recall Preparedness and Contingency Planning

A comprehensive recall plan must be in place for perfusion pumps. This includes procedures for rapid identification and quarantine of affected units, notification of regulatory authorities, communication with healthcare providers, and coordination with distributors. The plan should integrate with UDI traceability systems and define roles and escalation paths. Mock recalls should be conducted annually to validate effectiveness. Contingency logistics, such as alternate shipping routes or backup storage facilities, help maintain supply continuity during disruptions.

Conclusion for Sourcing a Perfusion Pump

In conclusion, the sourcing of a perfusion pump requires a comprehensive evaluation of clinical needs, technical specifications, regulatory compliance, cost-effectiveness, and vendor reliability. A well-informed procurement decision ensures the acquisition of a high-performance, safe, and reliable device that enhances patient outcomes and supports the efficiency of perfusion procedures. Key considerations such as pump type (roller vs. centrifugal), flow accuracy, biocompatibility, ease of use, service support, and integration with existing medical systems are critical in selecting the most suitable model. Additionally, engaging stakeholders—including perfusionists, biomedical engineers, and procurement specialists—strengthens the evaluation process. Ultimately, investing time and due diligence in sourcing the right perfusion pump contributes to the overall success and safety of cardiac and other extracorporeal support therapies within the healthcare facility.