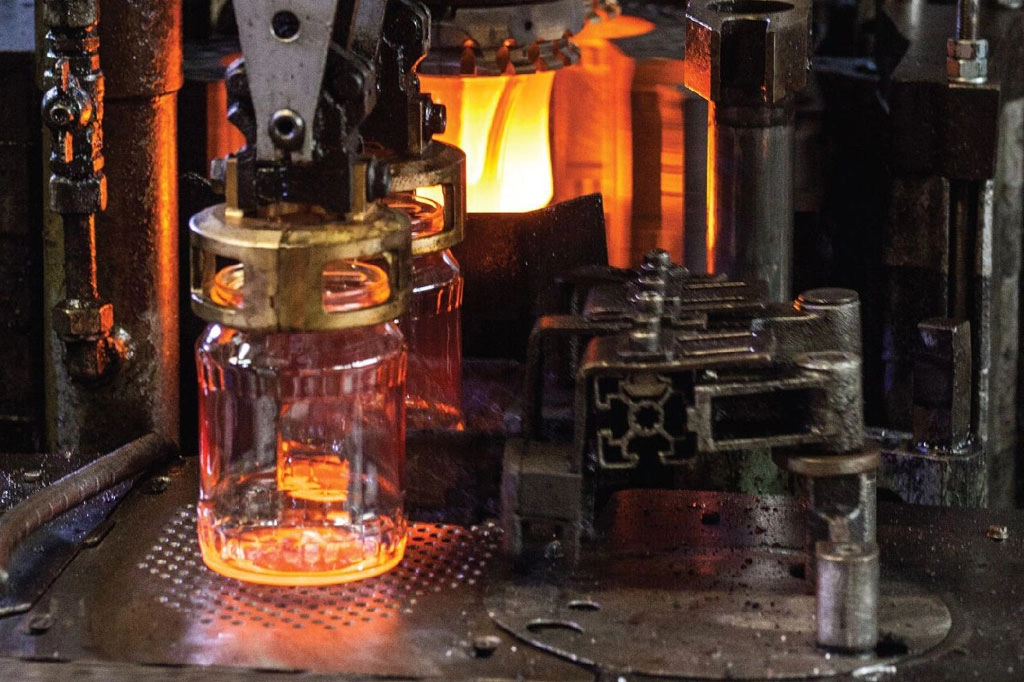

The global perfume market is experiencing robust expansion, driven by rising consumer demand for luxury personal care products and increasing brand investments in distinctive packaging. According to Grand View Research, the global perfume market size was valued at USD 53.9 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.4% from 2023 to 2030. This growth trajectory underscores the critical role of high-quality, aesthetically compelling perfume bottles, which not only protect the fragrance but also serve as a key differentiator in a competitive retail landscape. As brands prioritize sustainability, customization, and premium design, there has been a surge in demand for innovative manufacturing solutions. In response, leading perfume bottle manufacturers are leveraging advanced materials, precision glass and acrylic molding techniques, and eco-conscious production processes to meet evolving market needs. The following list highlights the top 10 manufacturers shaping this dynamic industry through technological expertise, design excellence, and scalable global operations.

Top 10 Perfume Bottle Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Perfume Glass Bottle Manufacturer » Explore

Domain Est. 1997

Website: stoelzle.com

Key Highlights: As a glass manufacturer of luxury perfumery bottles for more than 200 years, our top priority is to ensure that you will be proud of your product….

#2 Glass Bottles and containers for Perfumes Wholesale, Perfume …

Domain Est. 2000

Website: bestbottles.com

Key Highlights: BestBottles is a distributor, wholesale supplier and manufacturer of perfume bottles, glass bottles, perfume atomizers, fine mist sprayers, lotion bottles, ……

#3 Private label perfume manufacturer

Domain Est. 2019

Website: privelabel.com

Key Highlights: Complete turnkey solution to start your own perfume line. USA based, we create natural fine fragrances with niche quality packaging and bottles….

#4 PGP Glass Bottle and Glass Container Manufacturers

Domain Est. 2021

Website: pgpfirst.com

Key Highlights: Cosmetic and Perfumery We create customised as well as standard bottles for perfumery and cosmetics, like glass bottles for air fresheners, glass stoppers, ……

#5 Coverpla

Domain Est. 1997

Website: coverpla.com

Key Highlights: Make a standard bottle, into a 100% branded product. Coverpla, creator of turnkey perfumery and cosmetics solutions….

#6 Premium Glass Perfume Bottles

Domain Est. 2013

Website: calaso.com

Key Highlights: At Calaso, we offer an extensive range of premium glass packaging solutions designed for the fragrance industry, making them ideal for perfumes and colognes….

#7 Glass Perfume Bottles & Vials

Domain Est. 2013

Website: stocksmetic.com

Key Highlights: $21.20 deliveryGlass perfume bottles and vials: elegant and durable. Available in multiple sizes, ideal for professional fragrance lines….

#8 Verescence

Domain Est. 2016

Website: verescence.com

Key Highlights: Verescence · Global leader in luxury glass packaging, we manufacture glass bottles and jars for the biggest brands in the perfume and cosmetics industry….

#9 Our Company

Domain Est. 2022

Website: our-company.dsm-firmenich.com

Key Highlights: We’ve brought together a global leader in health, nutrition, and bioscience with the world’s largest privately-owned fragrance and taste company….

#10 Discover Custom Perfume Bottles by ABOLAND: Your Go

Domain Est. 2023

Website: gzaboland.com

Key Highlights: We manufacture high-end perfume bottle using premium quality raw materials to offer your brands the most stunning products….

Expert Sourcing Insights for Perfume Bottle

2026 Market Trends for Perfume Bottles

As the global fragrance industry evolves, the perfume bottle market is undergoing significant transformation driven by sustainability, innovation, and shifting consumer preferences. By 2026, several key trends are expected to shape the design, materials, and production of perfume bottles, reflecting broader changes in retail, technology, and environmental consciousness.

Sustainable and Eco-Friendly Packaging

Environmental concerns are at the forefront of consumer decision-making, pushing brands to adopt sustainable packaging solutions. By 2026, an increasing number of luxury and niche fragrance houses are expected to transition to recyclable, refillable, and biodegradable materials. Glass remains dominant due to its recyclability, but lightweight glass and post-consumer recycled (PCR) content will gain prominence. Additionally, brands may reduce secondary packaging, such as outer cartons, and explore innovative alternatives like molded pulp or plant-based plastics for caps and sprayers.

Minimalist and Functional Design

Minimalism continues to influence perfume bottle aesthetics, with clean lines, neutral tones, and functional shapes gaining favor—especially among younger, urban consumers. In 2026, brands will prioritize both visual elegance and practicality, such as ergonomically designed bottles that are easy to hold and spray. The trend reflects a broader movement toward authenticity and transparency, with packaging that communicates brand values through understated yet premium design.

Smart and Interactive Packaging

Advancements in technology are paving the way for smart perfume bottles. By 2026, expect limited but growing adoption of NFC (Near Field Communication) chips embedded in bottles, allowing consumers to access product origin, ingredient transparency, authenticity verification, or personalized scent recommendations via smartphone. Augmented reality (AR) labels could also enhance user experience, turning the bottle into an interactive storytelling tool.

Refillable and Modular Systems

Refillability is emerging as a key differentiator in the premium fragrance segment. Leading brands are expected to expand refill programs by 2026, offering in-store or at-home refill stations with reduced-price scent cartridges. This model supports circular economy principles and appeals to eco-conscious consumers willing to pay a premium for sustainable luxury. Modular bottle designs—where only the inner vial is replaced—will also become more common.

Customization and Personalization

Mass customization is gaining traction, with consumers seeking unique, personalized experiences. In 2026, perfume brands may offer customizable bottle engravings, color options, or interchangeable caps, enabled by digital manufacturing techniques like 3D printing. Limited-edition collaborations with artists or designers will further fuel demand for collectible and statement bottles.

Regional Market Diversification

Emerging markets in Asia-Pacific, the Middle East, and Africa are expected to drive growth in the perfume bottle industry by 2026. Local tastes, cultural aesthetics, and gifting traditions will influence regional bottle designs—such as ornate, opulent styles in the Middle East or sleek, tech-inspired forms in East Asia. This diversification will prompt manufacturers to adapt production and design strategies to suit local preferences.

Conclusion

By 2026, the perfume bottle market will be defined by a convergence of sustainability, technology, and personalization. Brands that successfully integrate eco-conscious materials, smart features, and consumer-centric design will lead the industry. As packaging becomes an extension of brand identity and values, perfume bottles will transcend their functional role to become symbols of innovation, responsibility, and individual expression.

Common Pitfalls When Sourcing Perfume Bottles: Quality and Intellectual Property Risks

Sourcing perfume bottles from suppliers, especially overseas, can be cost-effective, but it comes with significant risks related to both product quality and intellectual property (IP) protection. Being aware of these common pitfalls helps brands avoid costly mistakes, legal disputes, and reputational damage.

Quality-Related Pitfalls

Inconsistent Material Quality

Suppliers may use substandard glass, plastic, or metal that doesn’t meet durability or aesthetic expectations. Variations in thickness, clarity, or color can lead to breakage, leakage, or an unprofessional appearance. Without strict quality control protocols, batches may differ significantly, affecting brand consistency.

Poor Finishing and Craftsmanship

Defects such as rough edges, misaligned caps, uneven sprayers, or flawed engraving are common with low-cost manufacturers. These issues compromise both user experience and perceived product value. Automated production without thorough manual inspection often misses these flaws.

Non-Compliance with Safety and Regulatory Standards

Some suppliers may not adhere to international safety standards (e.g., REACH, FDA, or EU cosmetics regulations). Materials might leach harmful chemicals, or sprayers could fail under pressure. This poses health risks and potential liability for the brand.

Inadequate Packaging and Shipping Protection

Fragile perfume bottles require secure internal packaging to prevent damage during transit. Suppliers may cut corners by using insufficient padding or low-quality outer cartons, leading to high breakage rates and increased costs.

Lack of Quality Assurance Processes

Many suppliers, especially smaller or less experienced ones, lack formal quality control systems like ISO certification. Without documented inspection processes or third-party audits, ensuring consistent quality across production runs becomes difficult.

Intellectual Property (IP)-Related Pitfalls

Unauthorized Use of Protected Designs

Suppliers may offer bottles that mimic popular luxury or designer fragrances. While appealing due to their market familiarity, these designs often infringe on existing trademarks, patents, or copyrights. Using such bottles can expose your brand to cease-and-desist letters or lawsuits.

Supplier Resells Your Custom Design

If you commission a unique bottle design without proper legal safeguards, the supplier might replicate and sell it to competitors. This undermines your brand differentiation and dilutes your market advantage.

Lack of IP Assignment Agreements

Without a clear contract stating that all design rights transfer to your company, the supplier or designer may retain ownership. This can prevent you from modifying, trademarking, or protecting the design in the future.

Weak Contractual Protections

Many sourcing agreements fail to include clauses on IP ownership, confidentiality, or non-compete terms. This oversight makes it difficult to enforce rights or hold suppliers accountable for IP violations.

Counterfeit or Grey Market Risks

Some suppliers operate in regions with lax IP enforcement and may be involved in producing counterfeit bottles. Associating your brand with such a supply chain—even unknowingly—can damage credibility and invite legal scrutiny.

Mitigation Strategies

To avoid these pitfalls, conduct thorough due diligence on suppliers, request physical samples before bulk orders, implement third-party inspections, and use legally binding contracts that clearly define quality standards and IP ownership. Registering your bottle designs for trademark or design patents can also provide additional protection.

Logistics & Compliance Guide for Perfume Bottles

Product Classification & HS Code

Perfume bottles, especially when filled with perfume, are classified under the Harmonized System (HS) for international trade. The most common HS code is 3303.00, which covers “Perfumes and toilet waters.” This classification impacts import duties, customs clearance, and regulatory requirements in most countries. Empty perfume bottles may fall under different codes (e.g., glass or plastic containers), so accurate classification based on content and packaging is essential.

Packaging & Labeling Requirements

Perfume bottles must be securely packaged to prevent leakage, breakage, and contamination during transit. Use tamper-evident seals and protective materials such as bubble wrap, rigid boxes, and absorbent padding. Labeling must comply with destination country regulations and include:

– Product name and concentration (e.g., Eau de Parfum)

– List of ingredients (INCI names)

– Net quantity

– Manufacturer and importer details

– Batch number and expiration date (if applicable)

– Allergen disclosures (required in EU under Regulation (EC) No 1223/2009)

– Hazard symbols (if classified as flammable)

Dangerous Goods & IATA/ADR Regulations

Many perfumes contain alcohol (ethanol), which may be classified as a flammable liquid (UN 1266, Class 3) under the UN Model Regulations. If the flash point is below 60°C, air and road transport may be subject to IATA (air) and ADR (road) dangerous goods regulations. Exceptions may apply for limited quantities (e.g., small bottles under 500 ml and total net quantity per package limits). Always verify classification and use appropriate packaging marked with UN certification.

Import & Customs Compliance

Importers must provide accurate documentation including commercial invoice, packing list, bill of lading/airway bill, and potentially a certificate of origin. Some countries require additional permits or product notifications (e.g., EPA registration in the U.S., CPNP notification in the EU). Customs authorities may inspect shipments for compliance with labeling, safety, and tariff rules.

Regulatory Compliance by Region

- European Union: Must comply with EU Cosmetics Regulation (EC) No 1223/2009. Requires a Responsible Person, Product Information File (PIF), and CPNP notification. Allergens must be listed if above threshold levels.

- United States: Regulated by the FDA under the Federal Food, Drug, and Cosmetic Act. While pre-market approval is not required, products must be safe and properly labeled. Voluntary registration via the Voluntary Cosmetic Registration Program (VCRP) is encouraged.

- Canada: Must meet the requirements of the Cosmetic Regulations under the Food and Drugs Act. Submit a Cosmetic Notification Form (CNF) to Health Canada prior to sale.

- Other Markets: Countries such as China, UAE, and Australia have specific import and labeling rules. Pre-approval or local agent representation may be required.

Sustainability & Environmental Regulations

Increasingly, logistics and compliance must consider environmental standards. Many regions regulate packaging waste (e.g., EU Packaging and Packaging Waste Directive). Use recyclable materials where possible and ensure compliance with local extended producer responsibility (EPR) schemes. Avoid restricted substances (e.g., certain phthalates or animal-derived ingredients) that may be banned in specific markets.

Storage & Handling

Store perfume bottles in a cool, dry place away from direct sunlight and heat sources to preserve fragrance integrity and reduce flammability risk. Maintain proper segregation from incompatible goods (e.g., oxidizers). For warehousing, ensure adequate ventilation and fire suppression systems are in place, especially if storing large volumes of alcohol-based perfumes.

Recordkeeping & Traceability

Maintain detailed records of batch numbers, manufacturing dates, distribution, and compliance documentation for at least 3–5 years (depending on jurisdiction). Implement a traceability system to enable rapid recall if safety issues arise. This is a legal requirement in many regions, including the EU and U.S.

Conclusion

Successfully shipping and selling perfume bottles globally requires attention to classification, safety, labeling, and regional regulations. Partnering with experienced logistics providers and regulatory consultants can help ensure smooth customs clearance and ongoing compliance. Always verify requirements with local authorities or legal experts before shipment.

In conclusion, sourcing a reliable perfume bottle manufacturer requires a strategic approach that balances quality, cost, design capabilities, and sustainability. After thorough research and evaluation, it is evident that selecting a manufacturer with proven expertise in glass or alternative material production, strong customization options, and compliance with international standards is crucial for brand success. Factors such as MOQs, lead times, packaging solutions, and communication efficiency further influence the partnership’s effectiveness. Ultimately, establishing a long-term relationship with a trustworthy manufacturer not only ensures consistent product quality but also supports brand integrity and scalability in a competitive fragrance market. Careful due diligence and clear alignment of expectations will pave the way for a successful and sustainable sourcing strategy.