The global perforated aluminum market is experiencing robust growth, driven by rising demand across architectural, industrial, and transportation sectors. According to Grand View Research, the global aluminum mesh market size was valued at USD 2.8 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.3% from 2023 to 2030. This growth is fueled by the increasing adoption of lightweight, corrosion-resistant materials in building facades, acoustic panels, and interior design. Additionally, perforated aluminum’s versatility in aesthetic customization and sustainability aligns with green building initiatives, further accelerating market adoption. As demand surges, manufacturers are scaling innovation in perforation patterns, coating technologies, and production efficiency. In this competitive landscape, the following ten companies have emerged as leaders based on production capacity, global reach, product diversity, and technological advancement—setting the benchmark in the perforated aluminum industry.

Top 10 Perforated Aluminum Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Perforated Aluminum Manufacturers Suppliers

Domain Est. 2001

Website: perforated-metals.com

Key Highlights: Accurate Perforating is a one-stop shop for complete perforated metal solutions. We can perforate, fabricate and finish almost any metal for almost any use….

#2 Perforated Metal Manufacturer

Domain Est. 2015

Website: hendrickcorp.com

Key Highlights: We’re a top-rated perforated sheet metal manufacturer. We have a variety of perforation patterns and can create custom perforated sheet metal. Contact Us!…

#3 Diamond Manufacturing Company

Domain Est. 1996

Website: diamondman.com

Key Highlights: Diamond perforates a wide variety of materials including carbon steel, aluminum, stainless steel, other alloys and plastics. We are capable of perforating ……

#4 Perforated

Domain Est. 1996

Website: ametco.com

Key Highlights: Ametco’s perforated sheet metal and plastic products have a wide variety of applications in construction projects, including acoustical wall and ceiling panels….

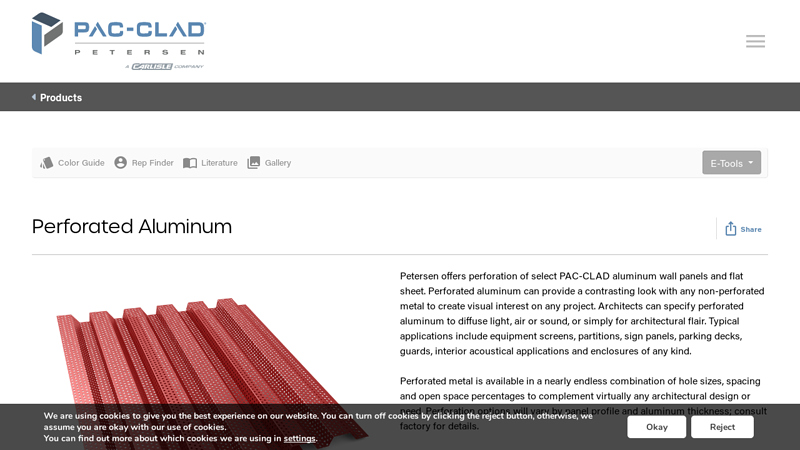

#5 Perforated Metal Aluminum Wall Panels & Flat Sheet

Domain Est. 1996

Website: pac-clad.com

Key Highlights: Perforated Aluminum Petersen offers perforation of select PAC-CLAD aluminum wall panels and flat sheet. Perforated aluminum can provide a contrasting look with ……

#6 Ferguson Perforating Company

Domain Est. 1997

Website: fergusonperf.com

Key Highlights: Ferguson leads the perforating industry in producing exceptional products, custom designs, manufacturing capabilities and flexibility….

#7 Perforated Aluminum Sheet

Domain Est. 1997

Website: accurateperforating.com

Key Highlights: Accurate Perforating has the equipment and the capabilities to punch aluminum sheets with holes in a wide range of sizes, shapes, and patterns….

#8 Fry Reglet

Domain Est. 1998 | Founded: 1949

Website: fryreglet.com

Key Highlights: Established in 1949, Fry Reglet engineers and manufactures precision architectural metal systems. We take pride in quality craftsmanship, ……

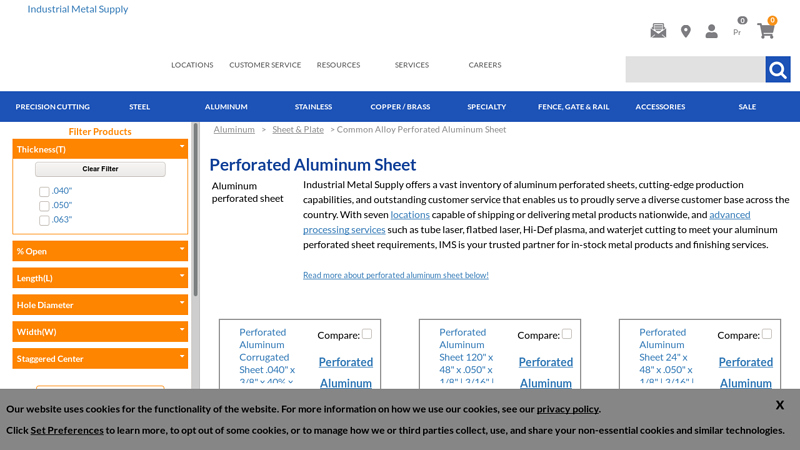

#9 Aluminum Perforated Sheet Supplier

Domain Est. 1999

#10 Perforated Sheets Metal

Domain Est. 2014

Website: perforated-sheet.com

Key Highlights: Perforated aluminum sheet offers design flexibility, acoustic control, and sustainable performance for commercial and public ceiling projects….

Expert Sourcing Insights for Perforated Aluminum

H2: Projected 2026 Market Trends for Perforated Aluminum

Based on current trajectories and emerging drivers, the global perforated aluminum market is poised for significant evolution and growth by 2026. Key trends shaping the landscape include:

1. Accelerated Demand in Sustainable Architecture & Facades:

* Driver: Intensifying focus on energy efficiency, LEED/BREEAM certifications, and net-zero buildings.

* Trend: Perforated aluminum will see dominant application in dynamic building facades and sunshades. Its ability to provide daylight harvesting, solar control, natural ventilation, and aesthetic flexibility makes it ideal for sustainable design. Expect increased demand for complex geometries, integrated photovoltaics, and smart shading systems using perforated panels.

* Impact by 2026: This segment will likely be the largest growth engine, driven by urbanization and green building regulations in APAC, North America, and Europe.

2. Expansion Beyond Traditional Aesthetics: Functional Integration:

* Driver: Need for multifunctional building materials and industrial solutions.

* Trend: Perforated aluminum will increasingly be valued for integrated functionalities:

* Acoustic Performance: Advanced designs (variable perforation, backed with acoustic materials) for noise control in offices, transportation hubs, and industrial settings.

* Lighting & Signage: Seamless integration with LED systems for illuminated facades, soffits, and interior feature walls.

* Filtration & Airflow: Growth in specialized industrial applications (HVAC components, machinery guards, speaker grilles) requiring precise airflow control and particle filtration.

* Security & Screening: Use in modern balustrades, privacy screens, and security grilles combining strength with design.

* Impact by 2026: Market share will shift towards higher-value, function-driven products, moving beyond purely decorative uses.

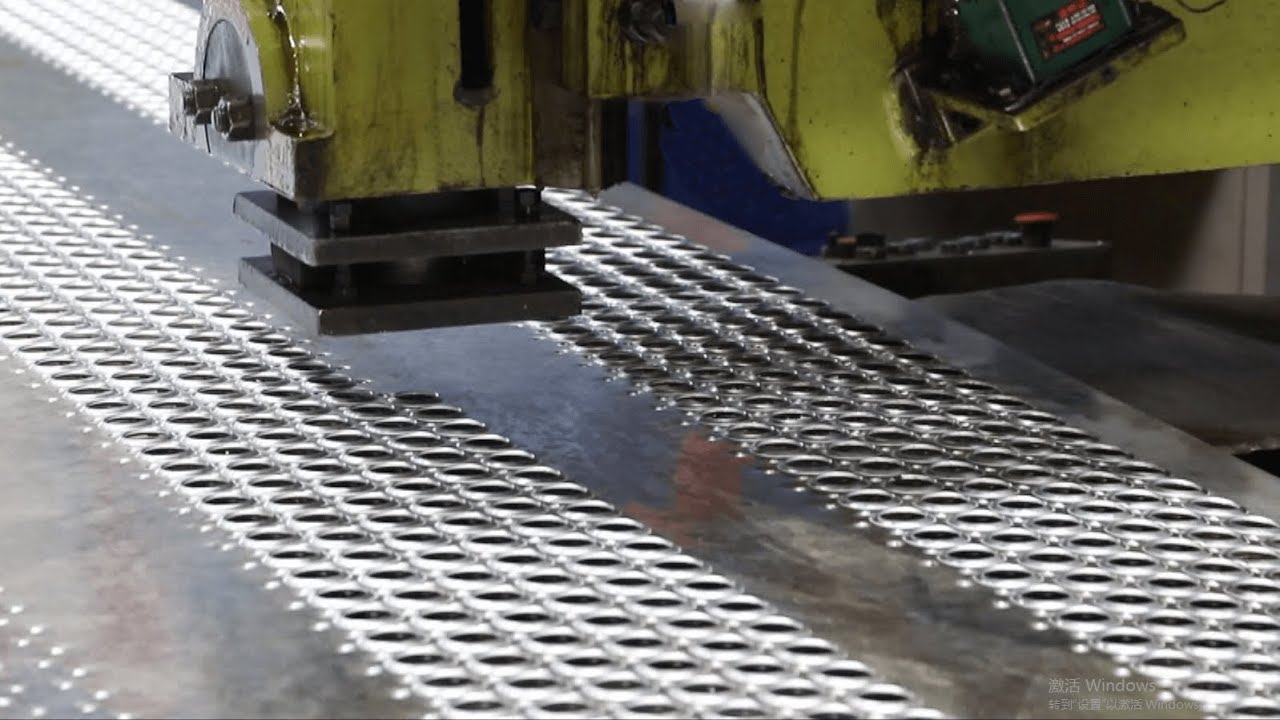

3. Technological Advancements in Manufacturing & Design:

* Driver: Demand for customization, complex designs, and cost efficiency.

* Trend:

* Advanced CNC & Laser Perforation: Enables intricate, non-standard patterns, variable hole sizes/densities, and complex 3D shaping with higher precision and faster turnaround.

* Digital Design & BIM: Seamless integration with Building Information Modeling (BIM) for precise prefabrication, reducing waste and installation time.

* Automation: Increased automation in cutting, perforation, and finishing lines to improve consistency and reduce labor costs.

* Impact by 2026: Lower barriers to customization will fuel design innovation and make bespoke solutions more accessible, particularly for architectural projects.

4. Sustainability & Circular Economy Focus:

* Driver: Regulatory pressure (e.g., EU Green Deal), corporate ESG goals, and consumer demand.

* Trend:

* High Recycled Content: Increased use of aluminum with high post-consumer recycled content (PCR) in perforated products, reducing the carbon footprint.

* Recyclability Emphasis: Marketing and specification will heavily highlight the inherent 100% recyclability of aluminum at end-of-life.

* Sustainable Sourcing: Greater scrutiny on the origin of raw materials and energy used in production (e.g., low-carbon aluminum).

* Impact by 2026: Sustainability credentials will become a mandatory competitive differentiator, influencing procurement decisions across the value chain.

5. Regional Growth Divergence:

* APAC (Asia-Pacific): Expected to remain the largest and fastest-growing market, driven by massive infrastructure development (China, India, Southeast Asia), urbanization, and government push for modern, energy-efficient buildings. Demand for cost-effective solutions will be strong.

* North America & Europe: Growth driven by renovation, retrofitting for energy efficiency, and high-end commercial/residential projects. Focus will be on premium, sustainable, and technologically advanced solutions. Strict environmental regulations will accelerate the adoption of recycled content.

* Middle East: Continued investment in iconic architecture and large-scale developments will sustain demand, particularly for high-end facade applications.

6. Competitive Landscape Evolution:

* Trend: Consolidation among large players and growth of specialized niche manufacturers.

* Focus: Competition will intensify on value-added services: design support, engineering expertise, BIM integration, sustainability data (EPDs), and lifecycle management. Price competition will persist in basic commodity segments, but differentiation through innovation and service will be key for premium positioning.

Conclusion for 2026:

The perforated aluminum market in 2026 will be characterized by a strong shift from a commodity material to a high-performance, multifunctional, and sustainable building system. Success will depend on embracing technological innovation, demonstrating robust environmental credentials (especially recycled content), and providing integrated solutions that address the complex needs of sustainable architecture and advanced industrial applications. The convergence of aesthetics, functionality, and sustainability will define the market leaders.

Common Pitfalls When Sourcing Perforated Aluminum (Quality, IP)

Sourcing perforated aluminum involves more than just selecting hole patterns and sizes. Overlooking critical quality and intellectual property (IP) aspects can lead to substandard materials, delays, legal risks, and increased costs. Below are key pitfalls to avoid:

Poor Material Quality and Consistency

One of the most frequent issues is receiving perforated aluminum sheets that fail to meet required mechanical or aesthetic standards. This includes inconsistent alloy composition, incorrect temper (e.g., 5052-H32 vs. 3003-H14), or variations in thickness. Low-quality materials may compromise structural integrity, corrosion resistance, or finish durability—especially in architectural or outdoor applications.

Inaccurate Perforation Tolerances

Tight tolerances are crucial for fit, function, and visual appeal. Poorly executed perforations—such as uneven hole spacing, burrs, or distorted patterns—can render panels unusable. Suppliers lacking precision tooling or quality control may deliver products that don’t align with design specifications, leading to rework or rejection.

Inadequate Surface Finish and Coating Defects

Perforated aluminum is often used in visible applications where surface quality matters. Pitfalls include inconsistent anodizing, uneven powder coating, or micro-scratches introduced during perforation. These flaws affect both appearance and long-term performance, particularly in corrosive environments.

Lack of Compliance with Standards and Certifications

Failing to verify that the aluminum meets industry standards (e.g., ASTM B209, ISO 6892) or project-specific certifications (e.g., LEED, fire ratings) can result in non-compliance. Reputable suppliers should provide mill test reports and compliance documentation—omission is a red flag.

Intellectual Property Infringement Risks

Using proprietary perforation patterns, especially in architectural designs, without proper licensing can expose buyers to IP litigation. Some design firms or manufacturers hold copyrights or design patents on unique patterns. Sourcing from unauthorized vendors or replicating protected designs—even unintentionally—may lead to legal disputes and costly redesigns.

Unverified Supplier Capabilities and Traceability

Engaging suppliers without robust quality management systems (e.g., ISO 9001) increases risk. Lack of traceability in material sourcing or manufacturing processes makes it difficult to address defects or ensure consistency across batches. Always audit supplier credentials and request samples before full-scale orders.

Hidden Costs from Rework and Delays

Low initial pricing may reflect compromised quality. Defective or non-conforming materials lead to delays, shipping costs for replacements, and labor for rework—eroding any cost savings. A holistic cost assessment should include quality assurance and reliability, not just unit price.

Avoiding these pitfalls requires due diligence: define clear specifications, vet suppliers thoroughly, request samples and certifications, and ensure IP compliance—especially when using custom or branded designs.

Logistics & Compliance Guide for Perforated Aluminum

Overview of Perforated Aluminum

Perforated aluminum is a lightweight, corrosion-resistant metal sheet featuring precisely punched holes in various patterns and sizes. It is widely used in architectural facades, acoustic panels, filtration systems, and decorative elements. Due to its specific physical and chemical properties, proper handling, transportation, and regulatory compliance are essential throughout the supply chain.

Packaging and Handling

Proper packaging ensures that perforated aluminum arrives at its destination without damage or deformation.

- Protective Wrapping: Sheets should be wrapped in moisture-resistant plastic film to prevent oxidation and surface scratches.

- Edge Protection: Use cardboard or plastic corner guards to shield sheet edges during handling and transport.

- Palletization: Stack sheets on wooden or plastic pallets, separated by interleaving paper or foam to avoid surface marring. Secure loads with strapping or stretch wrap.

- Handling Equipment: Use forklifts or cranes with padded clamps to prevent denting. Avoid dragging or dropping materials.

Storage Requirements

To maintain material integrity, follow these storage best practices:

- Indoor Storage: Store in a dry, well-ventilated indoor environment to prevent moisture exposure and corrosion.

- Elevation: Keep pallets off the ground using pallet racks to avoid water accumulation and contamination.

- Stacking Limits: Adhere to manufacturer-recommended stacking heights to prevent bottom-layer deformation.

- Separation: Keep away from acidic or abrasive materials that could cause chemical reactions or surface damage.

Transportation Guidelines

Ensure safe and efficient transport of perforated aluminum across various modes.

- Land Transport: Secure loads with straps or chains. Use tarps to protect against weather during open-truck transit.

- Marine Shipping: Use moisture-barrier packaging and silica gel desiccants to prevent saltwater-induced corrosion. Ensure containers are watertight and properly ventilated.

- Air Freight: Comply with airline weight and dimension restrictions. Use lightweight but durable packaging to reduce shipping costs.

- Documentation: Include detailed packing lists, material specifications, and safety data sheets (SDS) with shipments.

Regulatory Compliance

Perforated aluminum must meet international, national, and industry-specific standards.

- Material Standards: Comply with ASTM B209 (Standard Specification for Aluminum and Aluminum-Alloy Sheet and Plate) and ISO 6361 (Wrought Aluminium and Aluminium Alloy Sheets, Strips, and Plates).

- Environmental Regulations: Adhere to REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) and RoHS (Restriction of Hazardous Substances) directives when exporting to the EU.

- Customs Documentation: Provide accurate HS Code classification—typically 7606.12 (Aluminum plates, sheets, and strip, of thickness not exceeding 0.2 mm) or 7606.91 (non-alloy aluminum, over 0.2 mm thick).

- Import/Export Permits: Verify requirements based on country of origin and destination. Some regions may impose tariffs or anti-dumping duties on aluminum products.

Safety and Hazard Communication

While perforated aluminum is generally non-hazardous, safety protocols should be observed.

- Safety Data Sheets (SDS): Maintain up-to-date SDS in accordance with GHS (Globally Harmonized System of Classification and Labelling of Chemicals).

- Dust Control: During cutting or machining, aluminum dust can be flammable. Use proper ventilation and dust collection systems.

- Personal Protective Equipment (PPE): Recommend gloves, safety glasses, and cut-resistant sleeves when handling sharp-edged sheets.

Sustainability and Recycling

Aluminum is highly recyclable, supporting environmental compliance and circular economy goals.

- Recycling Codes: Label products with recycling symbol “♻” and alloy designation (e.g., 3003, 5052, 6061).

- Waste Management: Collect and recycle production scrap through certified recyclers. Maintain documentation for compliance audits.

- Carbon Footprint Reporting: Provide lifecycle assessment (LCA) data upon request, especially for green building certifications like LEED.

Quality Assurance and Traceability

Maintaining product integrity and regulatory traceability is critical.

- Certifications: Ensure mill test certificates (MTCs) are available for each batch, confirming chemical composition and mechanical properties.

- Lot Tracking: Implement a traceability system using batch/lot numbers for raw material sourcing through final shipment.

- Inspection Protocols: Conduct pre-shipment inspections to verify hole pattern accuracy, dimensional tolerances, and surface finish per customer specifications.

Conclusion

Effective logistics and compliance management for perforated aluminum requires attention to packaging, transportation, regulatory standards, and sustainability. By following this guide, businesses can ensure product quality, reduce risks, and meet global market requirements efficiently.

Conclusion for Sourcing Perforated Aluminum

Sourcing perforated aluminum requires a strategic approach that balances quality, cost, customization capabilities, and supplier reliability. Aluminum’s inherent advantages—such as lightweight properties, corrosion resistance, aesthetic appeal, and acoustic performance—make it an ideal choice for diverse applications in architecture, transportation, industrial equipment, and design.

When sourcing, it is essential to partner with reputable suppliers or manufacturers who offer consistent material quality, precise perforation patterns, and finishing options tailored to project requirements. Evaluating factors such as hole size, shape, open area percentage, material gauge, and surface treatments (e.g., anodized, powder-coated) ensures optimal performance and longevity.

Additionally, considering lead times, MOQs (minimum order quantities), and logistical capabilities can enhance supply chain efficiency. Sustainability and recyclability of aluminum also support environmentally responsible sourcing decisions.

In summary, a well-informed sourcing strategy for perforated aluminum—grounded in technical specifications, supplier vetting, and lifecycle value—enables cost-effective, durable, and aesthetically pleasing solutions across multiple industries.