The global welding equipment market continues to expand, driven by rising industrialization, infrastructure development, and increasing demand across the automotive, construction, and energy sectors. According to a 2023 report by Mordor Intelligence, the market was valued at USD 25.6 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.8% through 2028. Similarly, Grand View Research estimates the market to reach USD 34.7 billion by 2030, fueled by advancements in automated and robotic welding technologies. Against this backdrop, the top five welding manufacturers—Lincoln Electric, Illinois Tool Works Inc. (Miller Electric), ESAB, Panasonic Welding Systems, and Kobe Steel (Kobelco Welding)—hold a dominant market share, with combined penetration exceeding 45% globally. Their strategic expansions, technological innovation, and extensive distribution networks have solidified their positions as industry leaders in an increasingly competitive landscape.

Top 5 Penetration Of Welding Manufacturers (2026 Audit Report)

(Ranked by Factory Capability & Trust Score)

#1 [PDF] Machinery and Equipment Welding Specification

Website: pubs.aws.org

Key Highlights: This specification establishes design, manufacture, quality, inspection, and repair requirements for carbon, low-alloy, and….

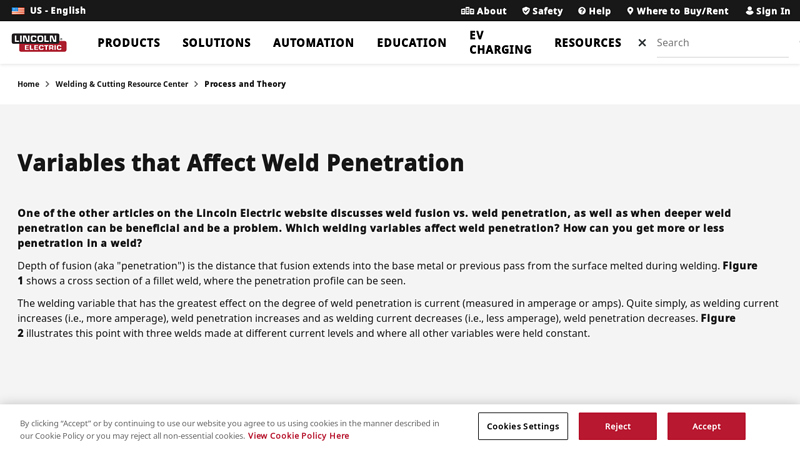

#2 Variables that Affect Weld Penetration

Website: lincolnelectric.com

Key Highlights: The welding variable that has the greatest effect on the degree of weld penetration is current (measured in amperage or amps)….

#3 Weld Penetration Defects and Streamlining of Measurement and …

Website: keyence.com

Key Highlights: This section describes the relationship between welding strength and penetration depth, precautions against full and partial penetration, and methods and ……

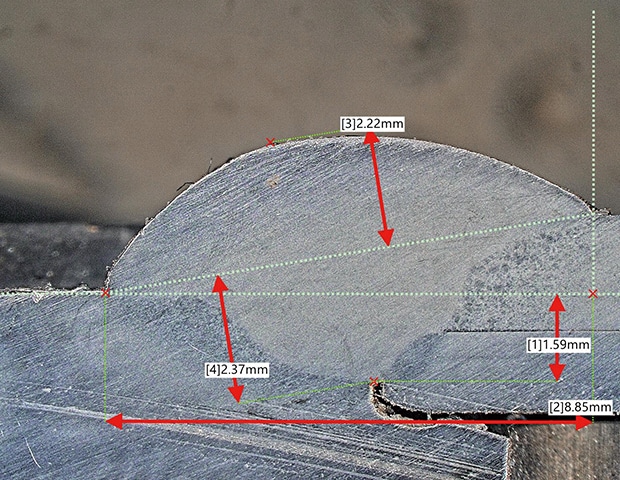

#4 Weld Defects / Imperfections

Website: twi-global.com

Key Highlights: For Quality Level D (moderate) short lack of or incomplete penetration imperfections are permitted. Incomplete root penetration is not permitted in the ……

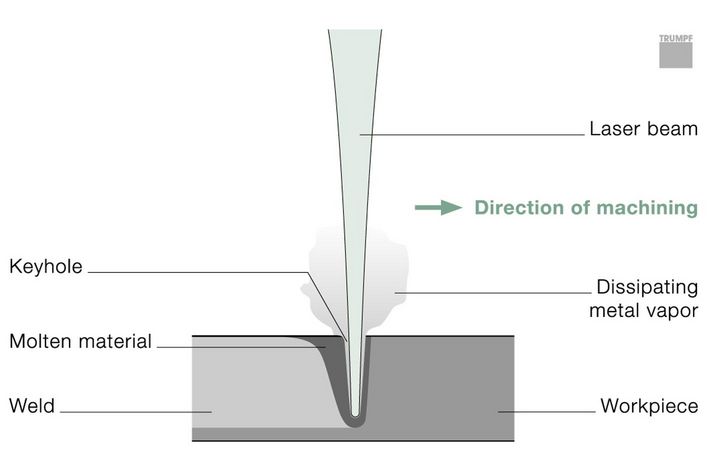

#5 Deep penetration welding

Website: trumpf.com

Key Highlights: Deep penetration welding requires extremely high power densities of about 1 megawatt per square centimeter. In this process, the laser beam not only melts the ……

Expert Sourcing Insights for Penetration Of Welding

H2: Projected Market Trends for the Penetration of Welding Technology by 2026

By 2026, the penetration of welding technology across global industries is expected to deepen significantly, driven by advancements in automation, demand for high-integrity joining solutions, and the expansion of key end-use sectors. The integration of digitalization, smart manufacturing, and sustainable practices is reshaping how welding technologies are adopted and optimized.

One of the primary drivers of increased welding penetration is the rapid growth of the electric vehicle (EV) and renewable energy sectors. As automakers transition to EV production, the need for precision welding—particularly in battery pack assembly, motor fabrication, and lightweight frame construction—has surged. Laser welding and resistance spot welding are seeing heightened adoption due to their accuracy, speed, and compatibility with aluminum and high-strength steel.

In the construction and infrastructure domain, the demand for durable, long-lasting structures continues to boost the use of advanced arc welding techniques such as Gas Metal Arc Welding (GMAW) and Flux-Cored Arc Welding (FCAW). Urbanization in emerging economies, coupled with government-led infrastructure projects, is expected to sustain demand for skilled welding services and automated welding systems.

The oil and gas industry, despite facing structural shifts toward clean energy, still relies heavily on high-penetration welding for pipeline construction and offshore platforms. Here, automated and robotic welding solutions are gaining ground to enhance safety, consistency, and cost-efficiency under harsh environments.

Moreover, Industry 4.0 is transforming welding operations through the integration of IoT-enabled welding equipment, real-time monitoring, and AI-driven quality control. These technologies enable predictive maintenance, reduce defects, and improve traceability—particularly in regulated industries like aerospace and defense.

Geographically, Asia-Pacific is anticipated to lead in welding technology penetration, fueled by industrial growth in China, India, and Southeast Asia. North America and Europe are focusing on modernizing aging infrastructure and adopting green manufacturing practices, further accelerating the shift toward automated and energy-efficient welding processes.

In summary, by 2026, the penetration of welding technology will be characterized by a strategic shift from manual to automated and intelligent systems, driven by the need for precision, efficiency, and sustainability across high-growth industries.

Common Pitfalls in Sourcing Penetration in Welding (Quality, IP)

When sourcing welding services or evaluating weld quality, ensuring proper penetration is critical for structural integrity and performance. However, several common pitfalls can compromise penetration and lead to defects, safety hazards, or intellectual property (IP) concerns. Below are key challenges to watch for:

Inadequate Process Parameter Control

Improper settings for current, voltage, travel speed, or shielding gas can result in insufficient or excessive penetration. Sourcing from vendors without strict process controls or documented welding procedures (WPS) increases the risk of inconsistent penetration, especially in high-stakes applications.

Poor Joint Preparation and Fit-Up

Gaps, misalignment, or inadequate bevel angles in joint preparation prevent uniform penetration. Sourcing welders who overlook fit-up standards (e.g., AWS D1.1) may lead to weak joints, porosity, or incomplete fusion—even if the welding technique appears sound.

Lack of Qualified Personnel and Certification

Engaging welders or fabricators without proper certification (e.g., ASME, AWS, ISO 9606) increases the likelihood of poor technique and inadequate penetration. Always verify welder qualifications and ensure they are certified for the specific process and materials used.

Insufficient or Ineffective Inspection and NDT

Relying solely on visual inspection misses subsurface penetration issues. Pitfalls include skipping essential non-destructive testing (NDT) methods like ultrasonic testing (UT) or radiographic testing (RT), or using unqualified personnel to interpret results. This can allow defective welds to pass quality checks.

Use of Substandard or Unverified Materials

Sourcing base or filler materials without proper material test reports (MTRs) can lead to mismatched compositions, affecting weldability and penetration. Unknown material properties may cause cracking, poor fusion, or embrittlement.

Inadequate Documentation and Traceability

Poor record-keeping of welding procedures, welder IDs, or inspection reports complicates quality audits and liability tracing. In industries like aerospace or energy, this lack of traceability poses safety and compliance risks.

Intellectual Property (IP) Risks in Process Disclosure

When sharing detailed welding specifications or proprietary joint designs with third-party suppliers, there’s a risk of IP exposure. Ensure robust non-disclosure agreements (NDAs) and limit access to sensitive design or process data to protect innovation.

Overreliance on Subcontractors Without Oversight

Outsourcing welding without direct supervision or consistent audits increases variability. Sub-tier suppliers may cut corners on penetration quality to reduce costs, especially if performance metrics aren’t contractually enforced.

Avoiding these pitfalls requires thorough supplier vetting, clear technical specifications, certified processes, and stringent quality assurance protocols—including both technical validation and IP protection measures.

Logistics & Compliance Guide for Penetration of Welding

Penetration in welding refers to the depth that a weld extends into the base metal or the root of a joint. Ensuring proper penetration is critical for weld integrity, structural strength, and compliance with industry standards. This guide outlines key logistics and compliance considerations related to achieving and verifying adequate weld penetration.

Understanding Weld Penetration Requirements

Different welding applications require specific levels of penetration based on material thickness, joint design, and intended use. Full penetration welds are typically required in high-stress or safety-critical structures (e.g., pressure vessels, bridges, pipelines), while partial penetration may suffice in less critical applications. Proper specifications should be defined in welding procedure specifications (WPS) and supported by qualified welding procedure records (PQR).

Regulatory and Standards Compliance

Compliance with recognized codes and standards is essential for ensuring acceptable weld penetration. Key standards include:

- ASME Section IX – Governs qualification of welding procedures and personnel in the U.S., specifying requirements for penetration in welds used in boilers and pressure vessels.

- AWS D1.1/D1.1M – Structural Welding Code – Steel, which defines penetration criteria for structural steel welding, including acceptance standards for incomplete penetration.

- ISO 5817 – Provides quality levels for fusion welding of steel, with acceptance criteria for penetration based on weld imperfections.

- API 1104 – Covers welding of pipelines and related facilities, including requirements for root penetration in pipeline girth welds.

All welding operations must adhere to the applicable standard, with documented procedures, welder qualifications, and inspection protocols.

Pre-Welding Logistics and Planning

Effective logistics begin before welding commences:

- Joint Design & Fit-Up: Ensure proper bevel angles, root gaps, and alignment to facilitate full penetration. Misalignment or excessive root face can lead to incomplete fusion or inadequate penetration.

- Welding Procedure Specification (WPS): Use an approved WPS that details parameters such as current, voltage, travel speed, shielding gas, and electrode type to ensure consistent penetration.

- Welder Qualification: Only certified welders qualified under the relevant code (e.g., ASME, AWS) should perform critical welding tasks.

- Material Traceability: Maintain records of base material grades and filler metals to ensure compatibility and traceability.

In-Process Quality Control

Monitoring penetration during welding is vital:

- Visual Inspection: Monitor root pass from the backside when possible (e.g., using backing bars or open roots) to verify penetration.

- Parameter Monitoring: Use data loggers or real-time monitoring systems to ensure welding parameters remain within WPS limits.

- Interpass Cleaning: Ensure proper cleaning between passes to avoid slag inclusions or lack of fusion that could mask penetration issues.

Post-Weld Inspection and Testing

Verification of penetration is typically performed after welding:

- Visual Testing (VT): Initial inspection to check surface continuity and potential undercut or insufficient penetration.

- Radiographic Testing (RT): Commonly used to assess internal penetration, especially in pipe and pressure vessel welds.

- Ultrasonic Testing (UT): Effective for detecting lack of penetration and internal flaws, especially in thick-section welds.

- Macro Etch Testing: Destructive test where a cross-section of the weld is cut, polished, and etched to visually measure penetration depth.

- Dye Penetrant (PT) or Magnetic Particle Testing (MT): Used primarily for surface-breaking defects, but can support overall weld quality assessment.

Documentation and Traceability

Maintain detailed records for compliance and audits:

- Weld maps identifying weld locations and responsible welders

- WPS and PQR documentation

- Inspection reports (VT, RT, UT, etc.)

- Welder qualification records

- Non-conformance reports and corrective actions

Corrective Actions and Re-work

If inadequate penetration is detected:

- Identify root cause (e.g., incorrect parameters, poor fit-up, operator error)

- Perform rework per approved repair procedures

- Re-inspect repaired welds to ensure compliance

- Document all rework activities

Training and Continuous Improvement

Invest in regular training for welders, inspectors, and supervisors on:

- Penetration requirements per applicable standards

- Proper welding techniques to achieve consistent penetration

- Interpretation of NDT results

- Updates to codes and procedures

Summary

Achieving and verifying proper weld penetration is a cornerstone of welding quality and structural safety. By adhering to recognized standards, implementing robust logistics from planning through inspection, and maintaining thorough documentation, organizations can ensure compliance and deliver reliable, code-conforming welded structures.

Conclusion on Sourcing Penetration in Welding

The sourcing penetration of welding services and equipment reflects a strategic shift toward optimizing costs, enhancing quality, and ensuring timely project delivery across various industries such as construction, manufacturing, automotive, and energy. As globalization and supply chain integration continue to evolve, companies are increasingly outsourcing welding operations or sourcing critical welding materials and technologies from specialized suppliers—both locally and internationally.

Key factors driving this penetration include advancements in welding technologies (e.g., automated and robotic welding), the need for compliance with stringent safety and quality standards, and the growing emphasis on supply chain efficiency. Additionally, the adoption of strategic sourcing practices enables organizations to access skilled labor, innovative solutions, and cost-effective materials without the overhead of maintaining in-house welding capabilities.

However, challenges such as quality control, supplier reliability, logistics, and adherence to international standards must be carefully managed. Successful sourcing penetration in welding ultimately depends on building strong supplier relationships, continuous performance monitoring, and integrating digital tools for supply chain transparency.

In conclusion, strategic sourcing in the welding domain offers significant opportunities for operational efficiency and competitiveness. Organizations that effectively navigate the complexities of global and local sourcing will be better positioned to meet evolving industry demands, foster innovation, and maintain high standards of safety and quality in their welding applications.

![[PDF] Machinery and Equipment Welding Specification](https://www.sohoinchina.com/wp-content/uploads/2025/12/pdf-machinery-and-equipment-welding-specification-789.jpg)