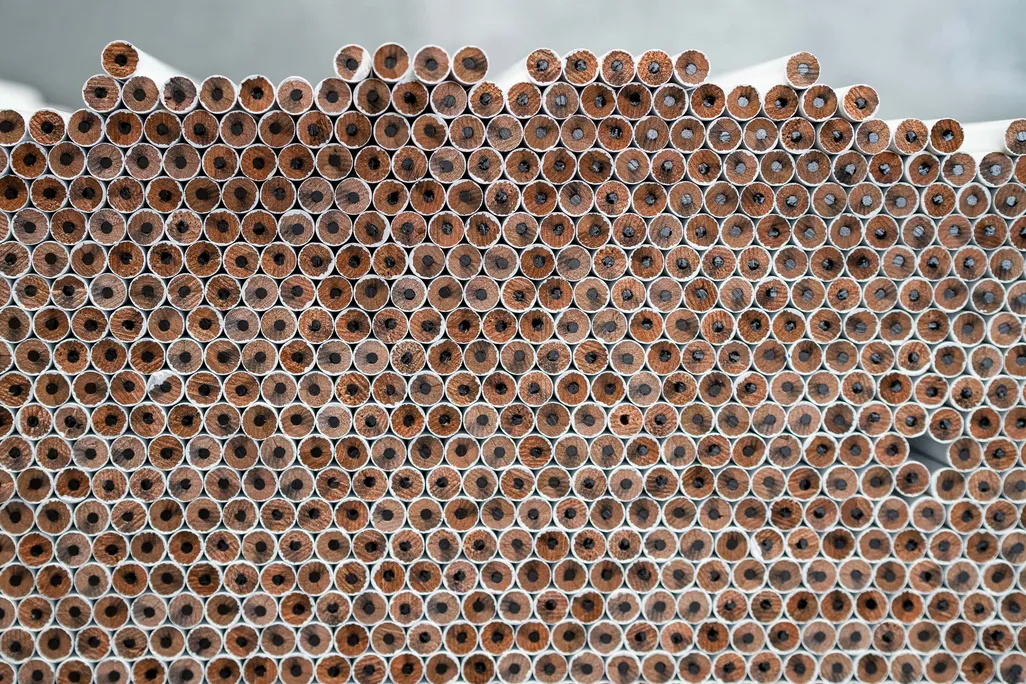

The global pencil carbon market has seen steady growth driven by rising demand for high-quality writing instruments, particularly in emerging economies with expanding educational infrastructure. According to Grand View Research, the global graphite market—closely tied to pencil carbon production—was valued at USD 15.2 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.3% from 2023 to 2030. This expansion is supported by increased industrial use of natural and synthetic graphite, including in pencils, where carbon-based cores remain a standard due to their reliability and cost-efficiency. With Asia Pacific accounting for over 50% of global graphite consumption—led by China and India—the region also dominates pencil carbon manufacturing, benefiting from vertically integrated supply chains and access to raw materials. As demand for sustainable and durable writing tools persists, manufacturers are focusing on refining carbon formulation and production techniques to enhance performance and reduce environmental impact. Based on market presence, production capacity, and technological advancement, the following are the top five pencil carbon manufacturers shaping the industry.

Top 5 Pencil Carbon Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 General Pencil Company, Inc.

Domain Est. 1996

#2 Industrial Materials

Website: mpuni.co.jp

Key Highlights: Mitsubishi Pencil has a longstanding tradition of integrating carbon materials into its writing instruments. Our Plastic Formed Carbon (PFC) product line ……

#3 Pencils for writing, drawing and true artists

Domain Est. 1996

Website: staedtler.com

Key Highlights: We offer high-quality pencils for every application in all conceivable hardness grades. Every user will find the right pencil for their specific needs in our ……

#4 Graphite and Carbon Wood Cased Pencils

Domain Est. 2005

Website: thepencompany.com

Key Highlights: Free delivery over $150 · 14-day returns…

#5 Pencils

Domain Est. 2021

Website: oxtoolsusa.com

Key Highlights: OX Tools Pro Tuff Carbon Pencil Value Pack | Includes Pencil & 3 Leads. OX-P503210. OX ……

Expert Sourcing Insights for Pencil Carbon

H2: 2026 Market Trends for Pencil Carbon

As we approach 2026, the pencil carbon market is undergoing notable shifts driven by evolving consumer preferences, sustainability concerns, technological advancements, and global supply chain dynamics. Pencil carbon—referring primarily to the graphite cores used in pencils—remains a niche yet essential component of the global writing instruments and industrial materials sectors. The following analysis outlines the key market trends expected to shape the pencil carbon industry in 2026.

1. Rising Demand for Sustainable and Eco-Friendly Materials

Environmental awareness is significantly influencing the pencil manufacturing industry. Consumers and regulatory bodies alike are pushing for sustainable sourcing of raw materials, including graphite. By 2026, pencil carbon producers are expected to prioritize responsibly mined graphite, with increased adoption of certifications such as FSC (Forest Stewardship Council) and ISO 14001. Recycled graphite and bio-based binders are also gaining traction as manufacturers aim to reduce their carbon footprint.

2. Growth in Educational and Artistic Applications

Despite digitalization, traditional writing and drawing tools continue to hold strong in educational systems and the art community. In emerging economies, increased investments in education infrastructure are boosting demand for affordable, high-quality pencils. Simultaneously, professional artists and hobbyists are driving demand for premium-grade pencil carbon with varying hardness and smoothness levels. This sustained demand supports stable growth in the pencil carbon segment.

3. Technological Advancements in Graphite Processing

Innovations in material science are enhancing the performance of pencil carbon. By 2026, manufacturers are expected to adopt advanced milling, blending, and extrusion techniques to improve consistency, break resistance, and lead smoothness. Some companies are experimenting with nano-coating and composite formulations to reduce smudging and increase durability—features particularly valued in technical and artistic pencils.

4. Supply Chain Diversification and Geopolitical Factors

China currently dominates global graphite production, accounting for over 60% of supply. However, geopolitical tensions and supply chain vulnerabilities are prompting pencil carbon buyers to diversify sourcing. Countries such as Madagascar, Mozambique, and Canada are emerging as alternative suppliers of high-purity graphite. This trend is expected to accelerate through 2026, leading to a more resilient and geographically balanced supply chain.

5. Integration with Digital Tools (Hybrid Products)

While not replacing digital writing, hybrid tools that combine analog pencil use with digital capture (e.g., smartpencils with graphite leads) are gaining popularity. These products rely on high-quality pencil carbon for tactile writing experience while syncing with apps and tablets. By 2026, demand for specialized pencil carbon optimized for use in hybrid devices may open a new revenue stream for manufacturers.

6. Price Volatility and Raw Material Costs

Graphite prices are subject to fluctuations due to mining regulations, energy costs, and export policies—particularly in key producing nations. In 2026, pencil carbon producers may face margin pressures unless they secure long-term contracts or vertically integrate into mining operations. Recycling programs and closed-loop manufacturing could help mitigate cost volatility.

7. Regional Market Dynamics

Asia-Pacific remains the largest market for pencils and, by extension, pencil carbon, driven by population size, educational demand, and manufacturing activity. However, North America and Europe are seeing renewed interest in artisanal and luxury pencils, favoring high-performance pencil carbon. African and Latin American markets are also expanding, supported by rising literacy rates and school enrollment.

Conclusion

By 2026, the pencil carbon market is expected to remain resilient despite broader digital transformation trends. Sustainability, product innovation, and supply chain resilience will be critical success factors. Companies that invest in eco-friendly sourcing, high-performance formulations, and diversified supply networks are likely to gain competitive advantage in an evolving global landscape.

Common Pitfalls Sourcing Pencil Carbon (Quality, IP)

Sourcing pencil carbon—particularly high-performance carbon-based materials used in applications like conductive coatings, battery components, or specialty inks—can be fraught with challenges related to both quality consistency and intellectual property (IP) risks. Overlooking these aspects can lead to production delays, product failures, and legal exposure. Below are key pitfalls to avoid:

Quality-Related Pitfalls

Inconsistent Material Specifications

Pencil carbon materials (e.g., graphite, carbon black, or specialty carbons) vary widely in particle size, purity, conductivity, and surface chemistry. Suppliers may provide materials that meet only basic specs, but subtle batch-to-batch variations can affect performance in sensitive applications. Without clear, enforceable technical specifications and robust incoming quality control, performance inconsistencies are likely.

Lack of Traceability and Certification

Many suppliers—especially in less-regulated regions—fail to provide full material traceability or certificates of analysis (CoA). This makes it difficult to verify claims about purity, absence of contaminants (e.g., heavy metals), or synthesis methods. Without proper documentation, product safety and compliance become uncertain.

Unverified Performance Claims

Some suppliers make exaggerated claims about conductivity, dispersibility, or process compatibility. These claims are often based on ideal lab conditions rather than real-world manufacturing environments. Failing to conduct independent testing or pilot trials before full-scale procurement can result in costly reformulations or process changes.

Inadequate Supplier Qualification

Relying on low-cost suppliers without auditing their facilities or quality management systems increases the risk of receiving substandard or adulterated materials. A qualified supplier should demonstrate consistent production processes, quality controls, and technical support.

Intellectual Property-Related Pitfalls

Unlicensed Use of Patented Materials or Processes

Some high-performance carbon materials are protected by patents covering synthesis methods, surface treatments, or specific applications. Sourcing from a supplier who uses patented technology without proper licensing exposes the buyer to IP infringement claims—even unintentional ones. Always verify freedom-to-operate (FTO) for critical materials.

Ambiguous or Absent IP Clauses in Contracts

Supplier agreements often lack clear terms about IP ownership, especially concerning custom formulations or jointly developed materials. Without explicit clauses, your company may lose rights to improvements or face restrictions on how the material can be used or resold.

Reverse Engineering Risks

If your product design or formulation is disclosed during sourcing discussions (e.g., to match a performance benchmark), there’s a risk the supplier could reverse engineer or replicate your technology—especially in jurisdictions with weak IP enforcement. Non-disclosure agreements (NDAs) are essential but often insufficient without jurisdiction-specific legal safeguards.

Gray Market or Diverted Materials

Some suppliers may source carbon materials through unauthorized channels, including diverted or counterfeit stock. These materials may infringe on IP rights or fail to meet quality standards, putting your supply chain at legal and operational risk.

Best Practices to Mitigate Risks

- Define precise technical and quality requirements with measurable KPIs.

- Conduct on-site audits and request full CoAs with every batch.

- Perform independent lab testing and pilot-scale validation.

- Perform IP due diligence, including patent landscape analysis.

- Use strong contracts with clear IP ownership, FTO warranties, and confidentiality terms.

- Source from reputable, legally compliant suppliers with transparent supply chains.

Avoiding these pitfalls ensures not only material reliability but also protects your company from legal and reputational damage.

Logistics & Compliance Guide for Pencil Carbon

Overview

This guide outlines the key logistics and compliance considerations for the manufacturing, transportation, import/export, and disposal of pencil carbon—referring to the graphite-based core used in pencils. Ensuring adherence to international, national, and regional regulations is essential for safe, efficient, and legally compliant operations.

Material Classification & Safety

Pencil carbon (primarily graphite and clay) is generally classified as a non-hazardous material. However, proper handling and classification under relevant systems such as GHS (Globally Harmonized System) and OSHA standards must be maintained. Safety Data Sheets (SDS) must be prepared and available, detailing composition, handling precautions, and emergency measures.

Packaging & Labeling

All shipments of pencil carbon must be packaged to prevent dust dispersion and physical contamination. Use sealed, moisture-resistant containers appropriate for bulk or retail packaging. Labeling must include:

– Product name (“Pencil Carbon” or “Graphite Core Mix”)

– Batch number and manufacturing date

– Net weight

– Manufacturer information

– Compliance with relevant standards (e.g., ASTM D4303 for graphite materials)

Transportation Regulations

Pencil carbon is typically transported via road, rail, or sea as a non-hazardous good. Confirm compliance with:

– IMDG Code (for sea freight)

– ADR (for European road transport)

– 49 CFR (for U.S. domestic transport)

No special placards are required unless mixed with regulated substances, but proper documentation (bill of lading, packing list) is mandatory.

Import/Export Compliance

Ensure compliance with customs regulations in both origin and destination countries. Key requirements include:

– HS Code classification (typically 8545.11 or 3801.10 for graphite)

– Import permits or licenses if required by destination country

– Certificate of Origin for preferential trade agreements

– Compliance with EPA, REACH, or RoHS where applicable (especially for trace elements in graphite)

Environmental & Sustainability Standards

Graphite mining and processing may raise environmental concerns. Ensure supply chain due diligence under:

– OECD Due Diligence Guidance for minerals

– Local environmental protection laws

– Carbon footprint reporting (if applicable under corporate sustainability programs)

Recycling and waste management procedures must align with local regulations for industrial byproducts.

Quality Control & Certification

Maintain consistent quality through:

– ISO 9001 certification for manufacturing processes

– Testing for graphite purity, hardness, and dimensional stability

– Traceability systems from raw material to finished core

Compliance with industry standards such as ISO 11540 (pencil performance) is recommended.

Worker Safety & Handling

Implement OSHA (or local equivalent) guidelines for workplace safety, including:

– Dust control measures (ventilation, PPE)

– Training for handling fine particulate materials

– Regular health monitoring if exposure levels are significant

Disposal & End-of-Life

Used pencil carbon or manufacturing waste should be disposed of according to local solid waste regulations. Graphite is non-toxic and generally landfill-safe, but recycling or repurposing (e.g., in lubricants or refractory materials) is encouraged for sustainability.

Regulatory Monitoring & Updates

Assign responsibility for monitoring changes in:

– Customs tariff schedules

– Chemical safety regulations (e.g., TSCA, REACH)

– Transportation safety rules

Maintain up-to-date compliance documentation and conduct regular internal audits.

Conclusion

Adhering to this logistics and compliance guide ensures the safe, legal, and sustainable handling of pencil carbon throughout its supply chain. Regular training, documentation, and supplier collaboration are critical to maintaining compliance and operational efficiency.

In conclusion, sourcing pencil carbon—typically referring to the graphite core in pencils—requires a careful evaluation of quality, sustainability, ethical practices, and supply chain reliability. High-quality graphite is primarily sourced from regions such as China, India, Brazil, and Madagascar, each offering varying grades and purity levels suitable for different pencil applications. Responsible sourcing involves ensuring environmentally sound mining practices, adherence to labor standards, and efforts to reduce carbon footprint throughout the production process. Additionally, partnering with certified suppliers, utilizing recycled or sustainably harvested materials, and investing in transparent supply chains can enhance the long-term viability and social responsibility of pencil manufacturing. Ultimately, a strategic and ethical approach to sourcing pencil carbon supports both product excellence and environmental stewardship in a competitive global market.