The global printed circuit board (PCB) market is experiencing robust growth, driven by rising demand in consumer electronics, automotive, telecommunications, and industrial automation sectors. According to Mordor Intelligence, the PCB market was valued at USD 80.21 billion in 2023 and is projected to reach USD 107.33 billion by 2029, growing at a compound annual growth rate (CAGR) of 5.04% during the forecast period. This expansion is further bolstered by advancements in HDI (High-Density Interconnect) technologies, miniaturization of electronic components, and the proliferation of 5G infrastructure. As demand for high-precision and automated PCB production escalates, manufacturers are increasingly investing in advanced PCB machinery to enhance throughput, yield, and accuracy. In this evolving landscape, a select group of equipment manufacturers has emerged as industry leaders, offering innovative solutions that underpin modern electronics manufacturing. The following overview highlights the top nine PCB machine manufacturers shaping the future of circuit board production through technological excellence and global reach.

Top 9 Pcb Machine Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 TTM Technologies

Domain Est. 1995

Website: ttm.com

Key Highlights: TTM Technologies is an advanced Printed Circuit Board (PCB) manufacturer and a leading supplier in technology solutions….

#2 Printed Circuit Board Manufacturer

Domain Est. 1998

Website: pcbnet.com

Key Highlights: Imagineering is a trusted printed circuit board manufacturer, offering precision PCB assembly, fabrication, & protoype services with quick turnaround….

#3 NCAB Group: Printed circuit boards

Domain Est. 2009

Website: ncabgroup.com

Key Highlights: A leading PCB producer, printed circuit boards, we produce PCBs for demanding customers in several industries – contact us!…

#4 China PCB Prototype & Fabrication Manufacturer

Domain Est. 2012

#5 PCB Technologies

Domain Est. 2017

Website: pcb-technologies.com

Key Highlights: All-in-One PCB Manufacturer and Solutions Provider of Advanced IC Chip Packaging, PCB Fabrication & Full Turnkey PCBA Services….

#6 Sierra Circuits

Domain Est. 1997

Website: protoexpress.com

Key Highlights: Sierra Circuits can manufacture your PCB and have it expedited to you within 24 hours. Full turnkey boards, with assembly and components in as fast as 5 days….

#7 SOMACIS

Domain Est. 1998

Website: somacis.com

Key Highlights: For more than fifty years, SOMACIS has been a dynamic company producing high-tech HDI, rigid, rigid-flex and flex PCB and delivering innovative solutions….

#8 Titan Circuits: PCB Assembly USA

Domain Est. 1999

Website: pcbassembly.com

Key Highlights: PCB assembly services in the USA. An electronic manufacturing company specializing in prototype printed circuit board assembly with production capabilities ……

#9 ALLPCB

Domain Est. 2011

Website: allpcb.com

Key Highlights: Explore the ALLPCB approach to PCB manufacturing and assembly: From prototype to production, we’ve got you covered….

Expert Sourcing Insights for Pcb Machine

H2 2026 Market Trends for PCB Machines

As the global electronics industry continues to evolve, the Printed Circuit Board (PCB) manufacturing sector is witnessing transformative shifts driven by technological innovation, supply chain restructuring, and rising demand across key end-use industries. In H2 2026, the PCB machine market is expected to reflect several critical trends that underscore growth, regional dynamics, and technological advancement.

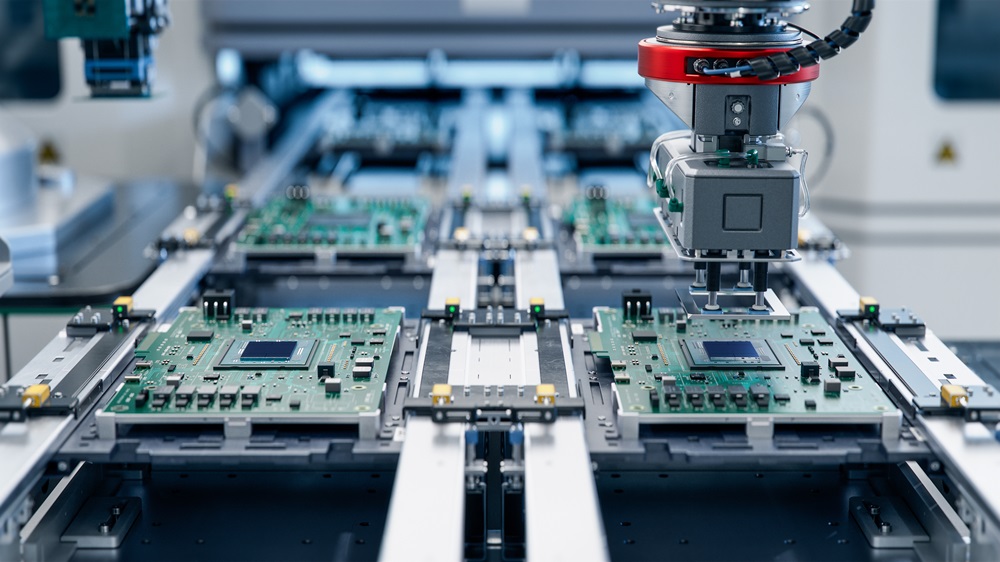

Increased Demand from Automotive and AI-Driven Electronics

One of the dominant drivers shaping the PCB machine market in H2 2026 is the rapid expansion of automotive electronics and artificial intelligence (AI) applications. The proliferation of electric vehicles (EVs), advanced driver-assistance systems (ADAS), and in-vehicle infotainment systems is fueling demand for high-density interconnect (HDI) and flexible PCBs. Consequently, manufacturers are investing heavily in advanced PCB machines capable of precision drilling, laser direct imaging (LDI), and automated optical inspection (AOI) to meet stringent automotive quality standards.

Simultaneously, AI-powered data centers and edge computing devices are demanding faster, more efficient PCBs with improved thermal management and signal integrity. This has led to increased adoption of additive manufacturing techniques and advanced lamination systems in PCB production lines.

Automation and Smart Manufacturing Integration

In H2 2026, the integration of Industry 4.0 principles into PCB manufacturing is accelerating. PCB machine vendors are embedding IoT connectivity, real-time monitoring, and predictive maintenance capabilities into their equipment. Smart factories are leveraging AI-driven analytics to optimize production workflows, reduce downtime, and improve yield rates.

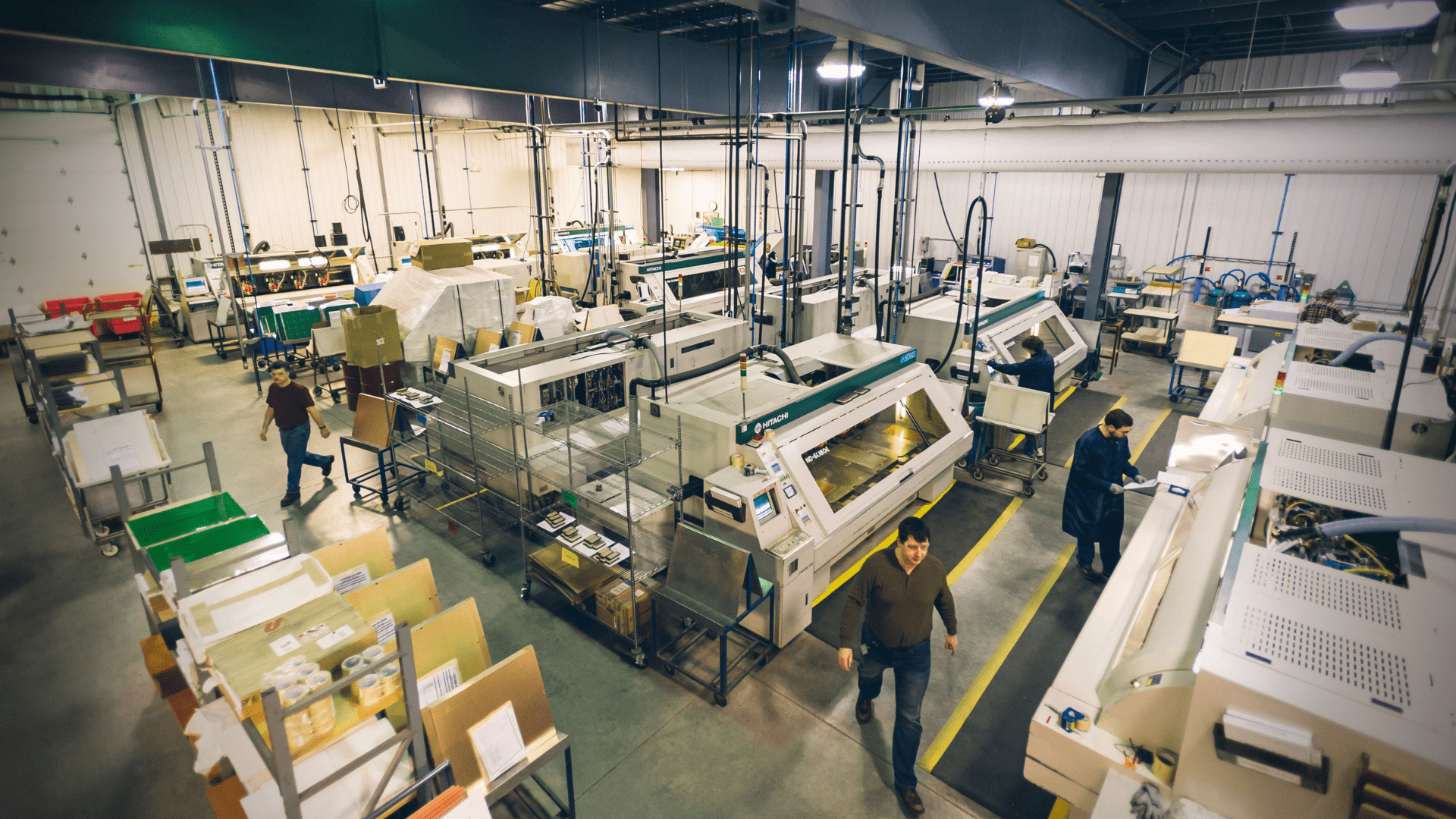

Automated material handling systems, robotic loading/unloading, and closed-loop quality control are becoming standard in mid-to-high-end PCB production facilities. This shift not only enhances throughput but also addresses labor shortages and rising operational costs, especially in developed markets such as North America and Western Europe.

Regional Shifts and Supply Chain Resilience

Geopolitical factors and supply chain vulnerabilities experienced during earlier years have prompted a strategic reevaluation of manufacturing footprints. In H2 2026, there is a noticeable shift toward regionalization, with increased PCB machine investments in India, Southeast Asia, and Mexico. These regions are emerging as alternative manufacturing hubs due to favorable government incentives, lower operational costs, and efforts to reduce dependency on single-source suppliers.

China remains a dominant player in both PCB production and machine manufacturing, but diversification efforts are driving market growth in other Asian countries such as Vietnam and Thailand, where new PCB fabrication plants are coming online with state-of-the-art machinery.

Advancements in HDI and Substrate-Like PCB (SLP) Technologies

The consumer electronics sector, particularly high-end smartphones and wearables, continues to push the boundaries of miniaturization. In response, PCB machine manufacturers are focusing on HDI and substrate-like PCB (SLP) production equipment. These technologies require ultra-fine line/space capabilities, sequential build-up (SBU) processes, and microvia drilling with laser precision.

By H2 2026, the availability of cost-effective SLP-compatible machines is expected to expand, enabling broader adoption beyond premium devices and into mid-tier electronics, further stimulating market demand.

Sustainability and Green Manufacturing Initiatives

Environmental regulations and corporate ESG (Environmental, Social, and Governance) goals are influencing PCB machine design and operation. In H2 2026, there is growing emphasis on energy-efficient machines, reduced chemical usage, and closed-loop water recycling systems. Equipment manufacturers are introducing eco-mode operations, low-waste lamination presses, and solvent-free cleaning systems to align with green manufacturing standards.

Regulatory pressures in the EU and North America are accelerating the adoption of sustainable practices, prompting PCB producers to upgrade legacy equipment with more environmentally friendly alternatives.

Conclusion

The H2 2026 outlook for the PCB machine market is characterized by technological sophistication, regional diversification, and a strong push toward automation and sustainability. Demand from automotive, AI, and consumer electronics sectors is driving innovation in machine capabilities, while supply chain resilience efforts are reshaping global investment patterns. As the industry adapts to these trends, manufacturers who embrace smart, flexible, and eco-conscious production solutions are likely to gain a competitive edge in the evolving landscape.

Common Pitfalls When Sourcing PCB Machines (Quality and IP Risks)

Poor Machine Quality and Reliability

Many suppliers, particularly from low-cost manufacturing regions, offer PCB machines with substandard components or inadequate build quality. These machines may suffer from frequent breakdowns, inconsistent performance, and shorter lifespans. Buyers often overlook certifications, service history, and third-party validation, leading to unplanned downtime and increased total cost of ownership.

Lack of After-Sales Support and Spare Parts Availability

A major pitfall is sourcing from suppliers who provide limited technical support, training, or access to spare parts. When machines fail, long lead times for repairs or unavailability of critical components can halt production. This is especially problematic when dealing with overseas suppliers lacking local service networks.

Inadequate Verification of Technical Specifications

Buyers sometimes assume advertised specifications match real-world performance. However, some machines may not deliver the precision, speed, or compatibility claimed. Without thorough testing or independent verification, companies risk investing in equipment that fails to meet production requirements.

Intellectual Property (IP) Infringement Risks

Sourcing PCB machines from unverified suppliers increases the risk of acquiring equipment that uses patented technologies without proper licensing. This exposes the buyer to legal liability, especially in regions with strict IP enforcement. Reverse-engineered or cloned machines may infringe on design, software, or process patents.

Embedded Software and Firmware IP Concerns

Many modern PCB machines rely on proprietary software for operation and optimization. Machines sourced from questionable suppliers may include pirated, modified, or illegally copied firmware. Using such software not only violates IP laws but may also introduce security vulnerabilities or operational instability.

Insufficient Due Diligence on Supplier Legitimacy

Failing to verify a supplier’s legal standing, manufacturing history, and reputation can lead to counterfeit products or fraudulent transactions. Some suppliers may operate as intermediaries without direct control over quality or IP compliance, increasing exposure to risk.

Hidden Costs from Non-Compliance and Recalls

Using machines that violate IP rights or fail to meet international safety and environmental standards (e.g., CE, UL) can result in product recalls, customs seizures, or regulatory fines. These hidden costs often outweigh initial savings from low purchase prices.

Logistics & Compliance Guide for PCB Machines

Overview

This guide outlines the essential logistics and compliance considerations for the transportation, import/export, and operation of Printed Circuit Board (PCB) manufacturing machines. These machines—such as CNC drilling machines, laser plotters, screen printers, and automated optical inspection (AOI) systems—are high-value, precision equipment subject to various international regulations, safety standards, and logistical requirements.

Packaging and Handling Requirements

PCB machines must be packaged to withstand long-distance shipping, including vibration, moisture, and temperature fluctuations. Use custom wooden crates with internal shock-absorbing materials (e.g., foam inserts, corner protectors). Clearly label crates with orientation arrows, fragile indicators, and handling instructions. Ensure all moving parts are secured and sensitive components (e.g., sensors, lenses) are protected.

Transportation Modes and Considerations

Choose transportation methods based on machine size, urgency, and destination. Air freight is faster but costlier and limited by size/weight; ideal for urgent or small components. Sea freight is economical for large, heavy machinery but requires longer lead times. Use flat-rack or open-top containers for oversized units. Always coordinate with freight forwarders experienced in industrial machinery logistics.

Export and Import Regulations

Comply with export control laws such as the U.S. Export Administration Regulations (EAR) or EU Dual-Use Regulation. Verify if the PCB machine contains controlled technologies (e.g., high-precision automation, laser systems). Obtain necessary export licenses where required. For import, provide accurate Harmonized System (HS) codes (e.g., 8479.89 for industrial robots and machinery) and customs documentation, including commercial invoice, packing list, and bill of lading.

Customs Documentation and Duties

Prepare a complete customs package including a commercial invoice with declared value, a certificate of origin, and any required permits. Duties and taxes vary by country; research local tariff schedules and potential exemptions for industrial machinery. Consider using an Incoterm (e.g., FOB, DDP) that clearly defines responsibilities for shipping, insurance, and customs clearance.

Electrical and Safety Compliance

Ensure machines comply with destination country electrical standards (e.g., CE marking for EU, UL listing for U.S., CCC for China). Voltage, frequency, and plug types must match local power supplies—use transformers or reconfigure if necessary. Include machine safety certifications (e.g., ISO 13849, IEC 60204-1) in documentation to facilitate customs and site acceptance.

Environmental and Waste Compliance

Adhere to environmental regulations such as RoHS (Restriction of Hazardous Substances) and WEEE (Waste Electrical and Electronic Equipment) directives, particularly if the machine contains electronic components or uses consumables. Provide documentation showing compliance with chemical handling and disposal requirements for inks, solvents, or coolants used in the machine’s operation.

Installation and Site Preparation

Coordinate with the end-user to ensure the installation site meets technical requirements: adequate floor load capacity, stable power supply, ventilation, and compressed air (if needed). Schedule delivery with clear access routes and sufficient manpower or lifting equipment for unloading. Retain technical manuals and calibration certificates for compliance audits.

Warranty and After-Sales Support Logistics

Define warranty terms and procedures for spare parts delivery and technician dispatch. Maintain an inventory of critical components in regional hubs to reduce downtime. Ensure compliance with local service regulations, including technician work permits for international support visits.

Recordkeeping and Audit Readiness

Maintain comprehensive records of shipping documents, compliance certifications, export licenses, and maintenance logs. These are essential for internal audits and regulatory inspections. Implement a digital document management system to track compliance status across shipments and jurisdictions.

Conclusion

Successfully managing the logistics and compliance of PCB machines requires proactive planning, adherence to international standards, and coordination across legal, technical, and operational teams. By following this guide, businesses can minimize delays, avoid penalties, and ensure safe and compliant deployment of PCB manufacturing equipment worldwide.

Conclusion for Sourcing a PCB Machine:

Sourcing a PCB (Printed Circuit Board) machine is a critical decision that significantly impacts the efficiency, quality, and scalability of electronics manufacturing operations. After thorough evaluation of available options—including PCB drilling, routing, printing, and automated optical inspection (AOI) machines—selecting the right equipment requires balancing performance, reliability, cost, and long-term support.

Key considerations such as production volume, required precision, automation level, compatibility with existing processes, and after-sales service must guide the purchasing decision. Whether opting for domestic suppliers for faster support or international vendors for cost efficiency, due diligence in supplier vetting, machine testing, and total cost of ownership analysis is essential.

Ultimately, investing in the right PCB machine enhances manufacturing capabilities, reduces downtime, improves product quality, and supports future growth. A well-sourced machine, backed by strong technical support and training, will deliver a strong return on investment and position the business competitively in the evolving electronics market.