The global shower valve market is experiencing steady growth, driven by rising residential and commercial construction, increasing demand for water-efficient fixtures, and a growing preference for premium bathroom products. According to Grand View Research, the global bathroom fixtures market—of which shower valves are a critical component—was valued at over USD 44 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 4.8% from 2023 to 2030. Similarly, Mordor Intelligence estimates a CAGR of approximately 4.5% for the bathroom fittings market through 2028, citing urbanization and renovation activities as key growth drivers. Amid this expanding landscape, shower valve manufacturers are differentiating themselves through innovation in valve technology, material durability, design aesthetics, and integration with smart plumbing systems. As demand intensifies, nine key components—from cartridge systems to thermostatic mixing valves—have emerged as critical differentiators among leading manufacturers, shaping performance, safety, and user experience in modern shower systems.

Top 9 Parts Of Shower Valve Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Symmons

Domain Est. 1996

Website: symmons.com

Key Highlights: Symmons is renowned for its wide range of durable, reliable commercial-grade plumbing products for Educational, Healthcare, Hospitality, Industrial, and ……

#2 Sigma Faucet Parts

Domain Est. 2020

Website: sigmafaucetparts.com

Key Highlights: Factory-authorized, national distributer specializing in original Sigma shower parts, Sigma valves and cartridges, Sigma faucet parts, Sigmatherm parts, ……

#3 KOHLER Service & Replacement Parts

Domain Est. 1994

Website: kohler.com

Key Highlights: View Parts Diagram. The parts diagram is located under the Installation and Service Parts section of the product page, or directly below the image in the search ……

#4 Shower Valves and Trims Archives

Domain Est. 1996

Website: speakman.com

Key Highlights: Showing 1–12 of 92 results. 2-Way Diverter Transfer Valve. $220.50 Add to cart · 3-Way Transfer Valve. $220.50 Add to cart · 3-Way Transfer Valve, Press….

#5 Leonard Valve Company

Domain Est. 1996

Website: leonardvalve.com

Key Highlights: Today we supply high/low master mixers, complete water tempering systems, emergency mixing valves, and shower valves, along with a myriad of other valve ……

#6 Kissler & Co.

Domain Est. 1996

Website: kissler.com

Key Highlights: We are the leader of plumbing repair parts! Browse through our catalogs and find thousands of the most popular plumbing repair essentials….

#7 Tub & Shower Sets

Domain Est. 1996

Website: pioneerind.com

Key Highlights: Tub & Shower Sets · Roman Tubs · Valves · Hardware · Accessories · Grab Bars · New Products. PIONEER. Sink Faucets · Tub & Shower Sets · Roman Tubs · Valves….

#8 Showers & Shower Systems

Domain Est. 2002

Website: grohe.us

Key Highlights: 30-day returnsModel: 14468. Pressure Balance Valve Trim with Cartridge · Starting at $213.00 ; Model: 14472. Pressure Balance Valve Trim with Cartridge · Starting at $274.00….

#9 Showers Parts and Service Guides

Domain Est. 1995

Website: bradleycorp.com

Key Highlights: Parts and Service Guides: Valves, Air Metering Valve, Valve Parts for Individual, Econo-Wall, Wall Saver and Panelon Showers….

Expert Sourcing Insights for Parts Of Shower Valve

H2: 2026 Market Trends for Parts of Shower Valve

The global market for parts of shower valves is poised for significant transformation by 2026, driven by technological innovation, evolving consumer preferences, and a heightened focus on sustainability. Key trends shaping the industry include the rise of smart plumbing systems, increased demand for water-efficient components, and the expansion of modular and customizable valve solutions.

One of the most prominent trends is the integration of smart technology into shower valve components. By 2026, smart thermostatic mixing valves and digital shower systems are expected to gain substantial market share. These devices offer precise temperature control, remote operation via smartphone apps, and compatibility with home automation platforms. Consumers increasingly seek convenience and personalized experiences, fueling demand for intelligent parts such as digital actuators, sensors, and electronic cartridge systems.

Water conservation remains a critical driver in the shower valve components market. With growing regulatory pressures and environmental awareness, manufacturers are focusing on low-flow and pressure-balancing cartridges that maintain performance while reducing water usage. Governments in regions such as North America and Western Europe are implementing stricter water efficiency standards, prompting innovation in eco-friendly valve trims, cartridges, and flow regulators.

Additionally, the shift toward modern bathroom aesthetics is influencing demand for minimalist, high-end finishes. Components such as ceramic disc cartridges, brass valve bodies, and stainless steel trims are being designed with durability and style in mind. Finishes like brushed nickel, matte black, and chrome are gaining popularity, reflecting broader interior design trends.

Supply chain resilience and materials sourcing are also gaining attention. By 2026, manufacturers are expected to prioritize sustainable sourcing of raw materials and adopt circular economy principles—recycling metals and reducing waste in production. This is particularly evident in Europe and parts of Asia, where environmental regulations are more stringent.

Lastly, the aftermarket segment for replacement parts—such as washers, cartridges, and handles—is expanding due to aging plumbing infrastructure in developed markets and growing DIY renovation activity. Online retail platforms are making it easier for consumers to source compatible parts, further boosting accessibility and market growth.

In summary, by 2026, the parts of shower valve market will be shaped by smart technology adoption, water efficiency mandates, design innovation, and sustainability initiatives, creating opportunities for manufacturers who can align with these evolving demands.

Common Pitfalls When Sourcing Parts of Shower Valve (Quality, IP)

When sourcing components for shower valves—such as cartridges, handles, trim kits, mixing units, or thermostatic elements—buyers often encounter challenges that can compromise performance, safety, and compliance. Below are key pitfalls related to quality and Ingress Protection (IP) ratings to avoid:

Poor Material Quality and Durability

Using substandard materials like low-grade brass, plastic, or zinc alloys can lead to premature failure, leaks, and corrosion. Inferior cartridge seals may degrade quickly when exposed to chlorine or hard water, resulting in drips or inconsistent temperature control. Always verify material specifications and opt for manufacturers using dezincification-resistant (DZR) brass and ceramic discs for longevity.

Inconsistent Dimensional Tolerances

Many generic or off-brand shower valve parts lack precision engineering, causing fitment issues during installation. Even small deviations in thread size, spindle length, or bore diameter can prevent proper assembly or lead to internal leakage. Always cross-reference OEM specifications and request samples before bulk procurement.

Misrepresentation of IP Ratings

Ingress Protection (IP) ratings are critical for electronic or digital shower components (e.g., digital thermostatic modules or touch controls). A common pitfall is suppliers falsely claiming high IP ratings (e.g., IP67) without independent certification. Always request test reports from accredited labs—IPX4 is typically required for splash resistance in bathrooms, while higher ratings (IP65/IP67) are needed for fully enclosed electronic modules.

Lack of Compliance with Regional Standards

Shower valve parts must meet regional plumbing and safety standards (e.g., NSF/ANSI 61, WRAS, ACS, or DVGW). Sourcing non-compliant parts can lead to legal liabilities, failed inspections, or contamination risks. Confirm that components are certified for potable water use and labeled accordingly.

Inadequate Temperature Safety Features

Low-quality thermostatic cartridges may fail to maintain safe outlet temperatures, increasing scald risk. Look for parts with built-in anti-scald protection (e.g., maximum 49°C fail-safe) and thermal shut-off mechanisms. Verify performance under variable water pressure conditions.

Counterfeit or Non-OEM Replacement Parts

While third-party replacements may be cheaper, they often mimic OEM designs without matching reliability. Counterfeit parts may use inferior springs, seals, or calibration, leading to inconsistent flow and temperature. When possible, source from authorized distributors or brands with traceable quality control.

Overlooking Warranty and Support

Many low-cost suppliers offer little to no warranty or technical support. When a valve fails due to a faulty component, the absence of post-sale support can result in costly downtime or recalls. Choose suppliers with clear warranty terms and responsive customer service.

Avoiding these pitfalls requires due diligence—conduct supplier audits, request certifications, and perform sample testing to ensure both quality and IP compliance are genuinely met.

Logistics & Compliance Guide for Parts of Shower Valve

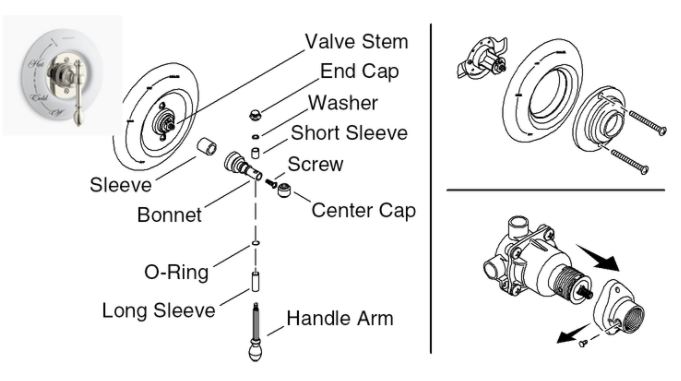

Overview of Shower Valve Components

Shower valve parts typically include cartridges, stems, seals, handles, trim kits, thermostatic elements, and mixing valves. These components may be made from brass, plastic, stainless steel, or ceramic, and are subject to various international regulations due to their use in plumbing and water distribution systems.

Classification and HS Codes

Accurate classification under the Harmonized System (HS) is critical for international shipping and customs clearance. Common HS codes for shower valve parts include:

– 8481.80: Tap, cocks, and valves (including thermostatic mixing valves)

– 8481.90: Parts of taps, cocks, and valves

– 7412.20: Valves of copper (if applicable)

– 3926.30: Plastic parts of plumbing fixtures

Note: Classification may vary by country and specific part function. Always confirm with local customs authorities.

Regulatory Compliance Requirements

Drinking Water Safety Standards

Shower valve parts that contact potable water must comply with lead content and material safety regulations:

– USA: NSF/ANSI 61 and NSF/ANSI 372 (lead-free compliance under the Safe Drinking Water Act)

– Canada: CSA B125 series and compliance with the Canadian Safe Drinking Water Act

– European Union: EN 817 and EN 12545 under the Construction Products Regulation (CPR)

– Australia: AS/NZS 3500 and WaterMark Certification

– UK: UKCA marking with compliance to BS EN 817 post-Brexit

Manufacturers must provide certification documentation (e.g., NSF certification, Declaration of Performance) for customs and market access.

Environmental and Chemical Regulations

- REACH (EU): Registration, Evaluation, Authorization, and Restriction of Chemicals – applies to metals and plastics used

- RoHS (EU): Restriction of Hazardous Substances in electrical components (if applicable, e.g., thermostatic sensors)

- Proposition 65 (California, USA): Warning requirements for products containing listed chemicals like lead

Ensure material declarations (SDS or IPC-1752) are available for audit.

Packaging and Labeling Requirements

Packaging

- Use protective packaging to prevent damage during transit (e.g., foam inserts, sealed polybags)

- Label outer cartons with handling symbols (e.g., “Fragile,” “This Way Up”)

- Include anti-corrosion protection for metal components (e.g., VCI paper)

Labeling

- Clearly mark product name, part number, batch/lot number, and country of origin

- Include compliance marks (e.g., NSF, WRAS, DVGW, ACS) where required

- For EU: Affix CE or UKCA marking with traceability information

Import and Export Documentation

Essential documentation includes:

– Commercial Invoice (with detailed description, value, and HS code)

– Packing List

– Certificate of Origin

– Test Reports and Compliance Certificates (NSF, WRAS, etc.)

– Bill of Lading or Air Waybill

– Import Licenses (if required by destination country)

Ensure all documents are in the official language of the importing country or accompanied by a certified translation.

Transportation and Logistics Considerations

Mode of Transport

- Air Freight: Recommended for small, high-value components or urgent shipments

- Ocean Freight: Cost-effective for bulk shipments; use dry containers with moisture protection

- Ground Transport: Suitable for regional distribution within compliance zones (e.g., EU, NAFTA)

Customs Clearance

- Pre-clear goods using Advance Commercial Information (ACI) or Import Control System (ICS)

- Use a licensed customs broker familiar with plumbing product regulations

- Be prepared for inspections, especially for water-related products

Country-Specific Requirements

United States

- EPA Lead-Free Compliance (maximum weighted average lead content of 0.25%)

- FTC labeling rules for country of origin

- FDA does not regulate but EPA and state agencies (e.g., California) may impose additional rules

European Union

- CE marking under Construction Products Regulation (CPR) for certain valve types

- Notified Body involvement may be required for performance certification

China

- China Compulsory Certification (CCC) not typically required for valve parts, but GB standards apply (e.g., GB/T 18145)

- CIQ inspection may be required upon import

Middle East (e.g., UAE, Saudi Arabia)

- SASO certification (Saudi) or ESMA (UAE) may be required

- PVOC (Pre-Export Verification of Conformity) programs apply in some countries

Quality Assurance and Traceability

- Maintain batch traceability for all components

- Implement a quality management system (e.g., ISO 9001)

- Retain compliance documentation for a minimum of 10 years (as required in EU CPR)

Conclusion

Successfully managing the logistics and compliance of shower valve parts requires attention to material safety, accurate classification, proper documentation, and adherence to regional regulations. Partnering with certified suppliers and experienced logistics providers ensures smooth global distribution and market access.

In conclusion, sourcing parts for a shower valve requires careful consideration of compatibility, quality, and supplier reliability. It is essential to accurately identify the make, model, and type of the existing valve to ensure that replacement parts fit and function correctly. Whether obtaining components from original equipment manufacturers (OEMs), plumbing supply stores, or online retailers, verifying specifications and material standards—such as brass construction or adherence to plumbing codes—helps ensure durability and performance. Additionally, consulting with plumbing professionals or technical support can prevent costly mistakes and installation issues. By taking a thorough and informed approach, homeowners and contractors can efficiently source the right parts, restore proper functionality to the shower system, and extend the lifespan of the plumbing fixture.