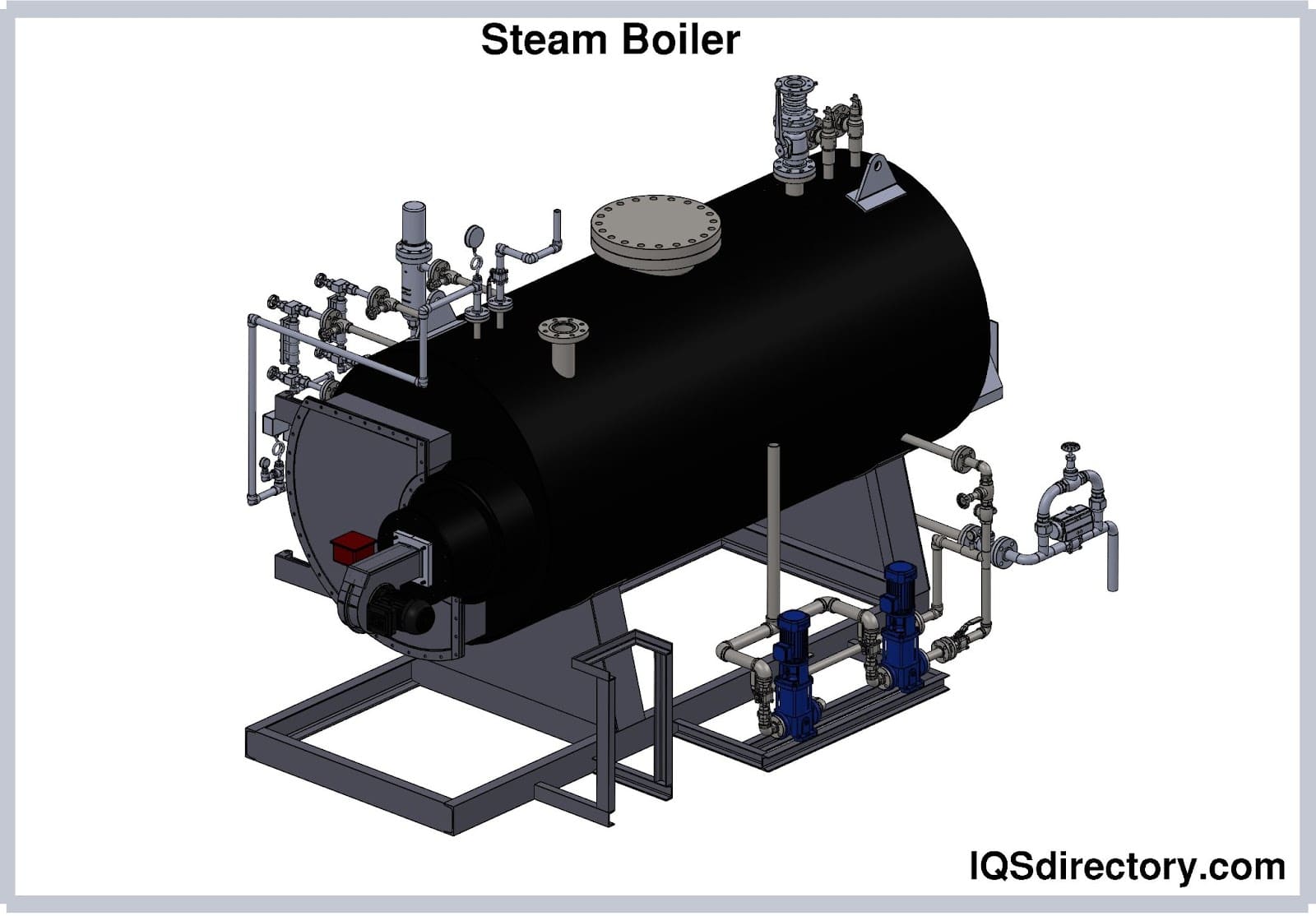

The global boiler manufacturing market is experiencing robust growth, driven by rising energy demands, industrialization, and increasing investments in power generation and district heating systems. According to a report by Mordor Intelligence, the boiler market was valued at USD 54.7 billion in 2023 and is projected to grow at a CAGR of over 5.8% from 2024 to 2029. Similarly, Grand View Research estimates the market size could reach USD 74.3 billion by 2030, underscoring sustained demand across industrial, commercial, and residential sectors. As efficiency, emissions regulations, and digital integration become key differentiators, boiler manufacturers are focusing on optimizing critical components to enhance performance and reliability. Below are the top 10 essential parts that define the engineering excellence and competitive edge of leading boiler manufacturers in this expanding market landscape.

Top 10 Parts Of Boiler Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Hurst Boiler

Domain Est. 1998

Website: hurstboiler.com

Key Highlights: Hurst Boiler, Inc. is the leading manufacturer of gas, oil, wood, coal, solid fuel, solid waste, biomass and hybrid fuel-fired steam and hot water boilers….

#2 OEM Boiler Parts

Domain Est. 2011

Website: oemboilerparts.com

Key Highlights: OEM Boiler Parts is the only manufacturer of genuine replacement parts for Kewanee® boilers and Iron Fireman® burners, as we own the drawings….

#3 U.S. Boiler Company

Domain Est. 2010

Website: usboiler.net

Key Highlights: US Boiler Company is a leading manufacturer of home heating equipment, water boilers, steam boilers, hot water heaters, radiators and boiler control systems….

#4 Superior Boiler

Domain Est. 1997

Website: superiorboiler.com

Key Highlights: Superior Boiler solves your most complex boiler challenges so you can get down to business – sterilizing essential hospital equipment, heating large facilities….

#5 Aldrich Company

Domain Est. 1997 | Founded: 1936

Website: aldrichco.com

Key Highlights: Aldrich Company has been designing, engineering and manufacturing boilers and water heaters since 1936. All of our boilers and water heaters are constructed, ……

#6 Laars Boilers and Water Heaters for Residential and Commercial …

Domain Est. 1998

Website: laars.com

Key Highlights: Our award-winning product line includes residential and commercial boilers and water heaters, controls, tanks, and accessories….

#7 Cleaver

Domain Est. 1998

Website: cleaverbrooks.com

Key Highlights: Cleaver-Brooks is your total solution provider for boilers and boiler room systems, including rentals, maintenance programs, parts, and training….

#8 Smith Boilers

Domain Est. 1998

Website: smithboiler.com

Key Highlights: Smith Cast Iron Boilers are known throughout North America for their rugged reliability, operating efficiencies and longevity….

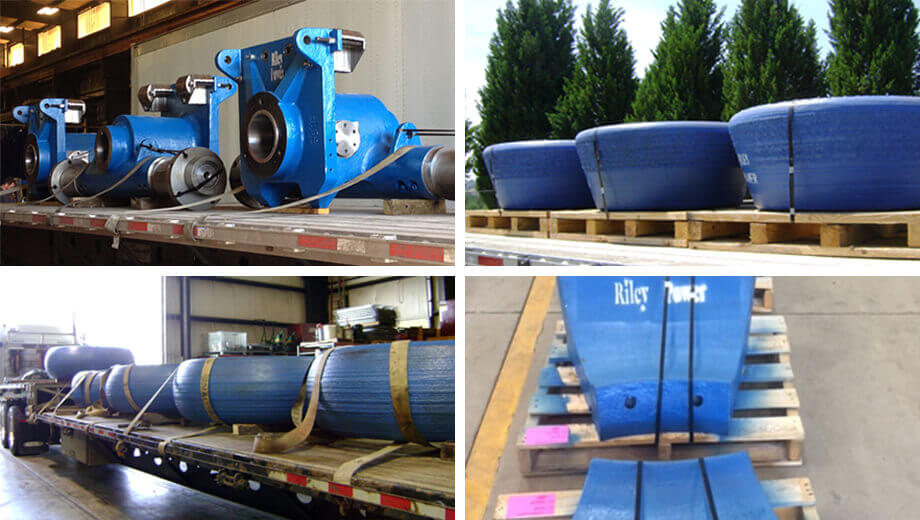

#9 Riley Power

Domain Est. 2002

Website: babcockpower.com

Key Highlights: Riley Power is a one-stop shop for new or replacement boilers and boiler parts, as well as everything you need to keep existing equipment running optimally….

#10 NTI Boilers

Domain Est. 2013

Website: ntiboilers.com

Key Highlights: Residential. Gas Boilers · Water Heating · Combi Furnaces · Heat Pumps · Oil & Wood Boilers · Accessories · Discontinued · View All · Compare. Commercial….

Expert Sourcing Insights for Parts Of Boiler

H2: 2026 Market Trends for Parts of Boiler

The global market for boiler parts is poised for significant transformation by 2026, driven by technological innovation, regulatory shifts, and evolving energy demands. As industries and governments prioritize energy efficiency and decarbonization, the boiler components sector is adapting to meet new performance and sustainability standards.

-

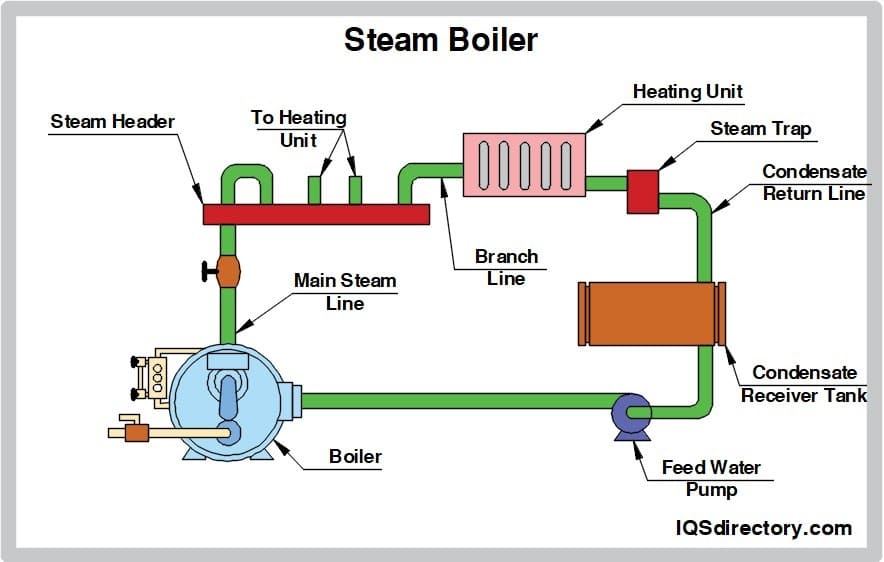

Increased Demand for Energy-Efficient Components

By 2026, there will be a heightened demand for high-efficiency boiler parts such as advanced heat exchangers, low-NOx burners, and intelligent control systems. These components are essential for reducing fuel consumption and minimizing greenhouse gas emissions. Governments in North America, Europe, and parts of Asia-Pacific are enforcing stricter energy performance regulations, pushing original equipment manufacturers (OEMs) and service providers to adopt more efficient parts. -

Growth in Replacement and Retrofit Markets

A significant portion of the boiler parts market will stem from retrofitting aging infrastructure, especially in industrial and district heating applications. Many existing boiler systems, particularly in Europe and North America, were installed decades ago and require upgrades to comply with modern environmental standards. This trend is fueling demand for replacement parts like economizers, soot blowers, water level gauges, and automated valves. -

Adoption of Smart and IoT-Enabled Components

Digitalization is reshaping the boiler parts landscape. By 2026, smart sensors, remote monitoring systems, and predictive maintenance modules will become standard in modern boiler setups. These IoT-enabled parts allow real-time tracking of boiler performance, enabling early fault detection and reducing downtime. This shift is particularly noticeable in commercial and industrial sectors seeking to optimize operational efficiency. -

Rise in Alternative Fuel Compatibility

With the global push toward carbon neutrality, boiler parts compatible with alternative fuels such as hydrogen, biogas, and syngas are gaining traction. Manufacturers are redesigning burners, fuel injectors, and combustion chambers to support hybrid or full alternative fuel operations. This trend is supported by pilot projects in Germany, the UK, and Japan, where hydrogen-ready boilers are being tested. -

Regional Market Divergence

Market dynamics will vary by region. In Asia-Pacific—especially in China, India, and Southeast Asia—industrialization and urban development will drive demand for new boiler installations and associated parts. In contrast, mature markets like Western Europe and North America will focus more on maintenance, upgrades, and compliance-related replacements. Meanwhile, the Middle East and Africa will see growth in oil- and gas-fired boiler parts due to ongoing energy infrastructure development. -

Sustainability and Circular Economy Practices

By 2026, sustainability will influence not just product design but also supply chains. Reconditioned or remanufactured boiler parts are expected to gain market share as businesses seek cost-effective and eco-friendly alternatives. Additionally, manufacturers are increasingly using recyclable materials and designing parts for easier disassembly and repair. -

Impact of Supply Chain Resilience

Recent global disruptions have prompted boiler part suppliers to localize production and diversify sourcing. Companies are investing in regional manufacturing hubs to reduce lead times and mitigate geopolitical risks. This trend supports faster delivery of critical components like pressure gauges, safety valves, and feedwater pumps.

In conclusion, the 2026 boiler parts market will be defined by efficiency, digitization, and sustainability. Stakeholders across the value chain—from manufacturers to end-users—must adapt to these trends to remain competitive in an increasingly regulated and technology-driven environment.

Common Pitfalls When Sourcing Parts for Boilers: Quality and Intellectual Property (IP) Concerns

Sourcing boiler components involves navigating a complex landscape where technical performance, safety, and legal compliance are paramount. Two of the most critical areas prone to pitfalls are part quality and intellectual property (IP) risks. Overlooking these can lead to operational failures, safety hazards, legal disputes, and reputational damage.

Quality-Related Pitfalls

-

Inadequate Material Specifications

A frequent issue is procuring parts made from substandard materials that do not meet required pressure, temperature, or corrosion resistance standards. For example, using carbon steel instead of specified stainless or alloy steel in high-temperature zones can lead to premature failure, leaks, or ruptures, compromising system safety and efficiency. -

Poor Manufacturing Tolerances

Boiler components such as tubes, headers, and valves require precise dimensional accuracy. Parts with poor tolerances can cause misalignment, inefficient heat transfer, or sealing problems, leading to reduced boiler efficiency, increased maintenance, and potential downtime. -

Lack of Certifications and Traceability

Reputable boiler parts must come with certification (e.g., ASME, ISO, EN standards) and full material traceability (mill test reports, heat numbers). Sourcing from suppliers who cannot provide these documents increases the risk of non-compliance and may void insurance or regulatory approvals. -

Counterfeit or Refurbished Parts Marketed as New

The market for boiler components includes counterfeit or used parts that are reconditioned and sold as new. These parts often lack durability and fail under operational stress, posing serious safety risks and increasing lifecycle costs. -

Insufficient Testing and Quality Control

Suppliers with weak quality management systems may skip critical tests such as non-destructive testing (NDT), hydrostatic testing, or metallurgical analysis. This results in undetected defects that manifest during operation, potentially leading to catastrophic failures.

Intellectual Property (IP)-Related Pitfalls

-

Unauthorized Replication of OEM Designs

Many boiler parts, especially proprietary components like burner nozzles, control systems, or heat exchanger designs, are protected by patents or design rights. Sourcing from third parties that reverse-engineer and produce copies infringes on IP, exposing the buyer to legal liability, injunctions, or financial penalties. -

Voiding Warranties and Service Agreements

Using non-OEM or IP-infringing parts often voids the original equipment manufacturer’s warranty. Additionally, OEM service contracts may refuse support if unauthorized parts are detected, increasing long-term maintenance costs and operational risks. -

Grey Market and Parallel Imports

Purchasing parts through unofficial distribution channels may result in IP violations, even if the parts appear genuine. These channels may distribute parts outside authorized territories, breaching licensing agreements and exposing the buyer to legal risks. -

Lack of Design Validation

IP-protected parts are typically backed by extensive R&D and validation testing. Imitation parts may not undergo similar testing, leading to performance inconsistencies, safety issues, and liability in case of malfunction or accidents. -

Difficulty in Proving IP Compliance

Buyers may struggle to verify whether a supplier legally holds the rights to manufacture a part. Without clear documentation or licensing agreements, it becomes challenging to defend against IP infringement claims, especially in regulated industries.

Mitigation Strategies

To avoid these pitfalls, organizations should:

– Prioritize certified suppliers with documented quality management systems (e.g., ISO 9001).

– Require full material certifications and traceability documentation.

– Conduct factory audits and third-party inspections.

– Verify IP rights and request proof of licensing for proprietary designs.

– Establish contracts that clearly define quality standards, liability, and IP indemnification.

By addressing quality and IP concerns proactively, companies can ensure reliable boiler performance, regulatory compliance, and long-term cost efficiency.

Logistics & Compliance Guide for Parts of Boiler

Classification and Harmonized System (HS) Codes

Proper classification of boiler parts under the Harmonized System (HS) is essential for international trade compliance. Boiler components may fall under various HS codes depending on their function, material, and design. Common HS codes include:

- 8402.90: Parts of boilers (for central heating, steam, or other vapor generating boilers)

- 8403.90: Parts of central heating boilers

- 8481.80: Valves and fittings used in boiler systems

- 7307.99: Pipe fittings of iron or steel used in boiler assembly

Always verify the correct HS code with the destination country’s customs authority, as classifications may vary.

Import/Export Documentation Requirements

Accurate and complete documentation ensures smooth customs clearance:

- Commercial Invoice: Must detail product description, quantity, value, country of origin, and HS code.

- Packing List: Includes weight, dimensions, packaging type, and marks/numbers.

- Certificate of Origin: Required by some countries to determine tariff eligibility or preferential treatment.

- Bill of Lading/Air Waybill: Proof of shipment and contract of carriage.

- Export Declaration: Filed with customs in the exporting country (e.g., AES in the U.S.).

- Import License or Permit: Required in certain jurisdictions for industrial machinery parts.

Regulatory Compliance

Boiler parts are often subject to stringent safety and environmental regulations due to their use in high-pressure and high-temperature systems.

Key Standards and Certifications

- ASME Certification (American Society of Mechanical Engineers): Required for pressure parts in North America. Look for the ASME “U” or “S” stamp.

- PED (Pressure Equipment Directive 2014/68/EU): Mandatory for boiler components placed on the EU market. Involves CE marking and conformity assessment.

- ISO Standards: Such as ISO 9001 for quality management, and ISO 16528 for boiler and pressure vessel standards.

- CRN (Canadian Registration Number): Required in Canada for pressure-retaining components.

Ensure all parts are accompanied by technical documentation, including material test reports (MTRs), design specifications, and compliance certificates.

Packaging and Handling

Boiler parts often include precision-machined components, castings, and pressure vessels that require protective packaging:

- Use moisture-resistant wrapping and desiccants to prevent corrosion.

- Secure heavy parts with bracing in crates to avoid movement during transit.

- Clearly label packages with handling instructions: “Fragile,” “This Side Up,” and “Do Not Stack.”

- Include protective caps on threaded ends and flanges.

Transportation Considerations

- Mode of Transport: Choose based on size, weight, and urgency. Large or heavy parts may require ocean freight with flat-rack containers or break-bulk shipping.

- Incoterms: Clearly define responsibilities using standard Incoterms (e.g., FOB, CIF, DDP) to allocate costs and risks between buyer and seller.

- Customs Delays: Avoid delays by ensuring all documents are accurate and submitted in advance. Use customs brokers where necessary.

Country-Specific Requirements

- United States: Boilers and components must meet ASME standards. EPA regulations may apply if parts involve emissions controls.

- European Union: CE marking under PED is mandatory. Notify a Notified Body for conformity assessment if required.

- China: CCC (China Compulsory Certification) may apply for certain industrial components. Check AQSIQ requirements.

- India: BIS (Bureau of Indian Standards) certification may be required for certain metal components.

Always research and comply with local technical regulations and conformity assessment procedures.

Recordkeeping and Traceability

Maintain detailed records for compliance audits and traceability:

- Track serial numbers, batch numbers, and material certifications.

- Store copies of all export/import documentation for at least 5 years (or per local law).

- Implement a quality management system (QMS) to ensure ongoing compliance.

Summary

Transporting boiler parts across borders requires careful attention to classification, certification, and documentation. Adherence to international standards and local regulations ensures legal compliance, avoids customs delays, and supports safety in end-use applications. Engage with legal, logistics, and compliance experts to tailor procedures to your specific products and markets.

Conclusion for Sourcing Parts of a Boiler:

Sourcing boiler parts requires a strategic approach that balances quality, cost, availability, and compatibility. It is essential to identify reliable suppliers—whether original equipment manufacturers (OEMs), authorized distributors, or reputable third-party vendors—to ensure the components meet required safety standards and specifications. Evaluating factors such as lead time, warranty, technical support, and after-sales service contributes to long-term operational efficiency and minimizes downtime. Additionally, maintaining accurate records of parts’ specifications and sourcing channels supports consistent maintenance and future procurement. By establishing a well-structured sourcing strategy, organizations can enhance boiler reliability, extend equipment lifespan, and ensure safe and efficient operations.