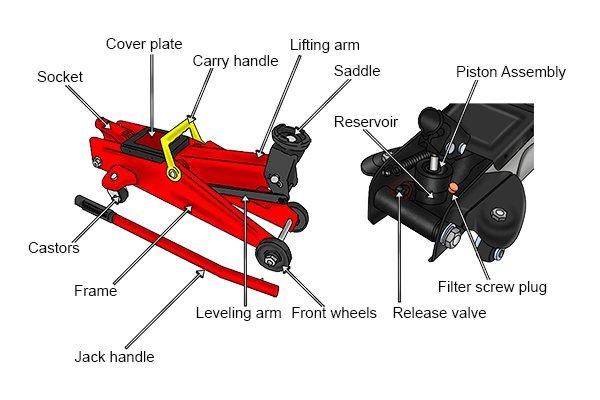

The global hydraulic jacks market is experiencing steady growth, driven by increasing demand across automotive, construction, and industrial maintenance sectors. According to Grand View Research, the global hydraulic tools market size was valued at USD 3.2 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. This growth is fueled by the rising need for efficient lifting equipment in industrial applications and infrastructure development. As demand surges, manufacturers are focusing on innovation, durability, and precision in key hydraulic jack components such as pistons, seals, release valves, pump plungers, reservoirs, housings, check valves, couplers, and cylinder tubes. These nine critical parts form the backbone of reliable performance, with leading manufacturers investing heavily in material science and quality control to meet stringent operational standards. This report highlights the top manufacturers excelling in the production and integration of these essential hydraulic jack components, shaping the future of lifting technology.

Top 9 Parts For Hydraulic Jacks Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Torin Jacks

Domain Est. 2000 | Founded: 1995

Website: torinjacks.com

Key Highlights: Founded in 1995, Torin Inc. produces quality automotive products for service professionals. As a manufacturer, a marketer and a developer of automotive ……

#2 Stillwell, Inc.

Domain Est. 2020

Website: stillwellinc.com

Key Highlights: Stillwell offers a wide variety of hydraulic trailer jacks to fit any application. The complete line up of Stillwell Jacks are sourced from US materials….

#3 U.S. Jack

Domain Est. 1997

Website: usjack.com

Key Highlights: U.S. Jack Company provides a number of OEMs with custom-made hydraulic jacks, with an emphasis on quality, durability, and longevity. Instead of your having to ……

#4 Hydraulic Cylinders, Jacks, Rams

Domain Est. 1995

Website: enerpac.com

Key Highlights: Free delivery over $100Enerpac provides the largest selection of hydraulic cylinders, jacks and rams, fully supported and available through the most extensive network of distributo…

#5 Jack Parts

Domain Est. 1996

#6 Hydra

Domain Est. 1997

Website: hydra-tech.net

Key Highlights: Enhance safety and efficiency with Hydra-Tech’s hydraulic jacks, stands and special tools for Railroad, Mining, and Construction industries….

#7 Blackhawk Automotive Homepage Hydraulic Lifting Jacks …

Domain Est. 2004

Website: blackhawk-automotive.com

Key Highlights: Hydraulic Bottle Jacks · Air Operated Bottle Jacks · Service Jacks · Service Jack Combo Kit · Long Chassis Service Jacks · Transmission Jacks ……

#8 Parts

Domain Est. 2011

#9 Hydraulic Cylinders, Valves, Pumps and Components from Bailey …

Domain Est. 2013

Website: baileyhydraulics.com

Key Highlights: Free delivery over $35 45-day returnsOur experienced team of engineers will work with you to build out a custom line of hydraulic parts and systems to your exacting specifications….

Expert Sourcing Insights for Parts For Hydraulic Jacks

H2: 2026 Market Trends for Parts for Hydraulic Jacks

The global market for parts for hydraulic jacks is poised for steady growth and transformation through 2026, driven by increasing industrialization, infrastructure development, and advancements in hydraulic technology. Key trends shaping the market include:

-

Rising Demand from Automotive and Manufacturing Sectors

The automotive repair and manufacturing industries remain the largest consumers of hydraulic jack parts. As vehicle production and maintenance activities increase—particularly in emerging economies like India, Brazil, and Southeast Asian nations—demand for durable and reliable hydraulic components such as pistons, seals, cylinders, and pumps is expected to rise. The shift toward electric vehicles (EVs) may also influence jack design requirements, creating opportunities for specialized lifting solutions and compatible replacement parts. -

Growth in Construction and Heavy Equipment Maintenance

Infrastructure expansion projects globally, especially in regions like Africa, the Middle East, and South Asia, are fueling demand for heavy-duty hydraulic jacks used in construction and civil engineering. This, in turn, drives the need for replacement and maintenance parts. With equipment operating under high stress, wear-prone components require frequent servicing, supporting aftermarket part sales through 2026. -

Increased Focus on Durability and Material Innovation

Manufacturers are investing in high-strength materials such as hardened steel, aluminum alloys, and engineered polymers to enhance the lifespan and performance of hydraulic jack components. Seals and gaskets are being upgraded with advanced elastomers resistant to high pressure and temperature fluctuations, improving system reliability and reducing downtime. -

Expansion of the Aftermarket and E-Commerce Platforms

The replacement parts segment is growing rapidly due to cost-efficiency and sustainability trends. Independent repair shops and DIY users increasingly source parts online, boosting e-commerce channels. Marketplaces like Amazon, Alibaba, and specialized industrial parts platforms are streamlining access to OEM and compatible components, intensifying competition and lowering prices. -

Technological Integration and Smart Hydraulics

While traditional hydraulic jacks remain dominant, there is a gradual integration of smart sensors and digital monitoring in industrial applications. This trend may influence part design—e.g., intelligent cylinders with embedded diagnostics—creating demand for upgraded or retrofit components by 2026, particularly in automated manufacturing and logistics. -

Regional Market Shifts and Supply Chain Localization

Geopolitical factors and supply chain resilience concerns are prompting manufacturers to localize production. Regions like Eastern Europe, Mexico, and Southeast Asia are emerging as hubs for hydraulic component manufacturing. This localization reduces lead times and tariffs, making parts more accessible and affordable, especially in developing markets. -

Sustainability and Circular Economy Practices

Environmental regulations and corporate sustainability goals are encouraging remanufacturing and recycling of hydraulic jack parts. Rebuilt pumps, reconditioned cylinders, and recycled metals are gaining traction, particularly in Europe and North America. This shift supports a circular economy and reduces raw material dependency.

In summary, the 2026 outlook for parts for hydraulic jacks reflects a market adapting to evolving industrial needs, technological progress, and sustainability imperatives. Stakeholders who invest in quality, innovation, and efficient distribution channels are likely to gain competitive advantage in this resilient and essential niche of the industrial equipment sector.

Common Pitfalls When Sourcing Parts for Hydraulic Jacks (Quality and Intellectual Property)

Sourcing replacement or OEM parts for hydraulic jacks involves navigating several potential risks, particularly concerning part quality and intellectual property (IP) rights. Overlooking these pitfalls can lead to safety hazards, equipment failure, legal issues, and damage to brand reputation.

Poor Quality Components

One of the most significant risks in sourcing hydraulic jack parts is receiving substandard components that compromise performance and safety. Low-quality seals, pistons, or valves may not withstand hydraulic pressure, leading to leaks, system failure, or even catastrophic breakdowns under load. These failures not only result in costly downtime but can also pose serious safety risks to operators. Additionally, counterfeit or poorly manufactured parts often use inferior materials or imprecise tolerances, which can accelerate wear on other components and reduce the overall lifespan of the jack. Buyers may be tempted by low prices from unverified suppliers, but such savings are often outweighed by long-term maintenance costs and liability risks.

Intellectual Property Infringement

Another critical pitfall is the unintentional sourcing of parts that infringe on intellectual property rights. Many hydraulic jack designs, including proprietary valves, pump mechanisms, and structural components, are protected by patents, trademarks, or design rights. Sourcing generic or aftermarket parts that closely replicate these protected designs—especially from suppliers in regions with lax IP enforcement—can expose buyers and distributors to legal action from original equipment manufacturers (OEMs). Even if the parts are functionally equivalent, using branded logos or copying patented engineering features without authorization constitutes infringement. This not only risks lawsuits and financial penalties but can also lead to shipment seizures, reputational damage, and loss of business partnerships.

Avoiding these pitfalls requires due diligence: verifying supplier credentials, requesting material certifications, conducting quality inspections, and ensuring parts do not mimic patented designs or trademarks. Partnering with reputable suppliers and consulting legal experts on IP compliance can mitigate these risks effectively.

Logistics & Compliance Guide for Parts for Hydraulic Jacks

Understanding Product Classification and HS Codes

Accurate classification of hydraulic jack parts is essential for international trade compliance. These components are typically categorized under specific Harmonized System (HS) codes depending on their function and material composition. Common classifications include:

- 8413.60: Parts of hydraulic pumps or motors (for pump assemblies, valves, and cylinders)

- 8431.39: Parts of lifting machinery (including jacks)

- 7326.90: Other articles of steel (for structural or load-bearing components)

Always confirm the correct HS code with local customs authorities or a qualified trade advisor, as misclassification can lead to delays, fines, or penalties.

Import/Export Documentation Requirements

Complete and accurate documentation is critical for smooth logistics. Required documents typically include:

- Commercial Invoice: Must detail the description, quantity, value, and country of origin of each hydraulic jack part.

- Packing List: Specifies weight, dimensions, and packaging details for each shipment.

- Bill of Lading (B/L) or Air Waybill (AWB): Contract of carriage; must match all other documents.

- Certificate of Origin: May be required to qualify for preferential tariffs under trade agreements.

- Export Declaration: Required in the country of origin for shipments above certain value thresholds.

Ensure all documents use consistent terminology and comply with destination country standards.

Regulatory and Safety Compliance

Hydraulic jack parts must meet safety and technical standards in both exporting and importing countries. Key considerations include:

- CE Marking (EU): Required for parts sold within the European Economic Area, indicating compliance with health, safety, and environmental protection standards.

- OSHA and ANSI (USA): Parts must support equipment that complies with safety standards for lifting devices.

- RoHS and REACH (EU): Restrictions on hazardous substances in electrical and mechanical components.

- Pressure Equipment Directive (PED): May apply if parts are used in pressurized systems.

Verify compliance with relevant standards before shipment to avoid rejection at customs or liability issues.

Packaging and Labeling Standards

Proper packaging ensures parts arrive undamaged and meet regulatory requirements.

- Use protective packaging (foam, corrugated cardboard, wooden crates) to prevent damage during transit.

- Clearly label packages with:

- Product name and part number

- Net and gross weights

- Handling instructions (e.g., “Fragile,” “Do Not Stack”)

- Manufacturer/importer details and country of origin

- Include safety warnings if applicable (e.g., high-pressure components)

Barcodes and RFID tags may be required for inventory tracking by distributors.

Transportation and Freight Considerations

Choose the appropriate mode of transport based on urgency, cost, and part size/weight.

- Air Freight: Best for small, high-value, or urgent parts.

- Ocean Freight: Cost-effective for large volumes or heavy components.

- Ground Transport: Suitable for regional distribution.

Ensure compliance with IATA (air) or IMDG (sea) regulations if shipping parts containing hydraulic fluids or pressurized elements.

Customs Clearance and Duties

Prepare for customs by:

- Providing accurate product descriptions and declared values.

- Paying applicable import duties and taxes (rates vary by country and HS code).

- Submitting to possible inspections, especially for industrial machinery components.

Utilize a licensed customs broker in the destination country to streamline clearance.

Recordkeeping and Audit Readiness

Maintain detailed records for at least five years, including:

- Transaction records (invoices, shipping documents)

- Compliance certifications (test reports, conformity declarations)

- Correspondence with regulatory bodies

Regular internal audits help ensure ongoing compliance and readiness for inspections.

Environmental and End-of-Life Compliance

Be aware of environmental regulations related to disposal and recycling:

- WEEE Directive (EU): May apply if parts include electronic components.

- Local Recycling Laws: Some countries require producers to manage end-of-life product recovery.

Design with recyclability in mind and provide disassembly guidelines when applicable.

Conclusion

Successfully managing the logistics and compliance of hydraulic jack parts requires attention to detail across classification, documentation, safety standards, and transportation. Partnering with experienced freight forwarders, customs brokers, and compliance consultants ensures adherence to international regulations and smooth supply chain operations.

In conclusion, sourcing parts for hydraulic jacks requires a strategic approach that balances quality, cost, reliability, and timeliness. It is essential to identify reputable suppliers with proven track records in manufacturing or distributing durable and compatible components. Prioritizing parts that meet industry standards ensures optimal performance, safety, and longevity of the hydraulic jack systems. Additionally, maintaining strong supplier relationships, considering both local and global sourcing options, and implementing quality control measures can significantly reduce downtime and repair costs. Ultimately, effective sourcing not only supports efficient operations but also contributes to overall equipment reliability and customer satisfaction in industrial, automotive, and construction applications.