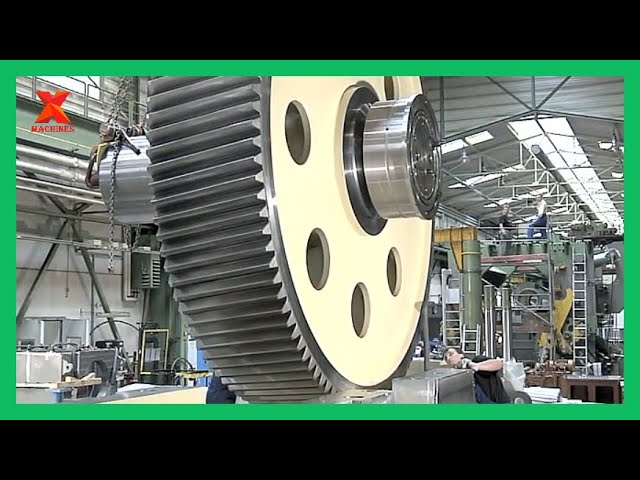

The global gear manufacturing market is experiencing robust growth, driven by rising demand across automotive, industrial machinery, renewable energy, and aerospace sectors. According to Mordor Intelligence, the global gear market was valued at USD 93.4 billion in 2023 and is projected to grow at a CAGR of over 6.5% from 2024 to 2029. This expansion is fueled by technological advancements in gear design, increasing automation in manufacturing, and the shift toward electric and hybrid vehicles that require precision transmission components. Additionally, the growing emphasis on energy efficiency and the proliferation of wind energy installations—where gearbox reliability is critical—are further accelerating demand. As industries continue to prioritize performance and durability, leading gear manufacturers are investing heavily in R&D and advanced materials. In this evolving landscape, identifying the top players in the space becomes essential for OEMs and supply chain stakeholders. Based on market share, innovation, global footprint, and production capabilities, here are the top 10 gear part manufacturers shaping the future of mechanical power transmission.

Top 10 Part Gear Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Philadelphia Gear

Domain Est. 1996

Website: philagear.com

Key Highlights: Philadelphia Gear is your one stop for new gearboxes, replacement gear drives, gear parts, gearbox repair and gear service….

#2 Auburn Gear

Domain Est. 1996

Website: auburngear.com

Key Highlights: Value-added, custom-engineered driveline solutions for your specific needs. Auburn Gear serves distributors and original equipment manufacturers….

#3 Gear Motions

Domain Est. 1997

Website: gearmotions.com

Key Highlights: Gear Motions is a leading gear manufacturer specializing in supplying high quality custom cut and ground precision gears made in the USA….

#4 American Gear Manufacturers Association

Domain Est. 1997

Website: agma.org

Key Highlights: AGMA is the global network for technical standards, education, and business information for manufacturers, suppliers, and users of gears and mechanical power ……

#5 KHK Gears

Domain Est. 2015

Website: khkgears.net

Key Highlights: KHK Gears (Kohara Gear Industry) is a leading manufacturer of stock gears handling production and distribution of a large variety of stock gears….

#6 Gleason Corporation

Domain Est. 1991

Website: gleason.com

Key Highlights: We are a leader in the development and manufacture of production systems for all types of gears including gear and transmission design software, machines, ……

#7 Martin Sprocket & Gear, Inc

Domain Est. 1995

Website: martinsprocket.com

Key Highlights: Martin Sprocket & Gear manufactures Power Transmission, Material Handling Solutions, and Hand Tools. Offering vast inventories & local field support….

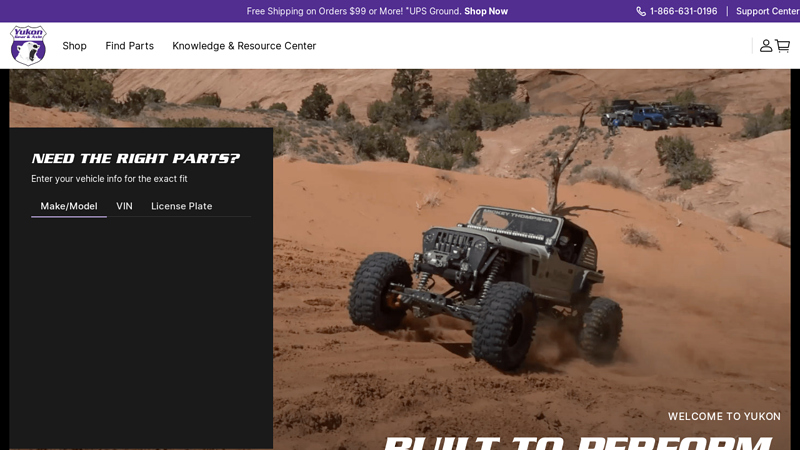

#8 Yukon Gear & Axle

Domain Est. 1999

Website: yukongear.com

Key Highlights: Shop Yukon Gear & Axle for premium drivetrain components including gears, axles, lockers, and differentials. Trusted by professionals and enthusiasts alike, ……

#9 Atlas Gear Company

Domain Est. 2003

Website: atlasgear.com

Key Highlights: Atlas Gear Company produces prototype and small-batch gears, shafts, and custom machined components to your exact specifications….

#10 Spicer Parts

Domain Est. 2004

Website: spicerparts.com

Key Highlights: Welcome to your resource for genuine Spicer parts. Go to Spicer North America. Choose another region. EMEA Europe | Middle East | Africa….

Expert Sourcing Insights for Part Gear

H2: Market Trends Analysis for Part Gear in 2026

As the global manufacturing and automotive sectors evolve, the market for component suppliers like Part Gear is undergoing significant transformation by 2026. Driven by technological innovation, sustainability mandates, and shifting supply chain dynamics, several key trends are shaping the landscape for Part Gear and similar players in the precision gear and drivetrain components industry.

- Electrification of Transportation

- The accelerating shift toward electric vehicles (EVs) is redefining gear requirements. While EVs require fewer gears than internal combustion engine (ICE) vehicles, they demand high-precision, low-noise, and highly efficient gear systems for single-speed transmissions and e-axles.

- Part Gear is likely to experience increased demand for specialized planetary gears, differential components, and integrated e-drive systems tailored for EV platforms.

-

Expansion into partnerships with EV OEMs and Tier 1 suppliers will be critical for growth.

-

Adoption of Advanced Manufacturing Technologies

- By 2026, smart manufacturing technologies—including AI-driven quality control, digital twins, and predictive maintenance—are becoming standard in gear production.

- Part Gear is expected to invest in Industry 4.0 infrastructure to improve precision, reduce waste, and enhance scalability.

-

Additive manufacturing (3D printing) is gaining traction for prototyping and producing complex gear geometries that were previously unfeasible with traditional methods.

-

Sustainability and Regulatory Pressure

- Environmental regulations across North America, Europe, and Asia are pushing manufacturers to reduce carbon footprints.

- Part Gear is likely focusing on lightweight materials (e.g., high-strength alloys, composites) and energy-efficient production processes to meet emissions targets.

-

Circular economy principles—such as remanufacturing and recycling of gear components—are emerging as competitive differentiators.

-

Supply Chain Resilience and Regionalization

- Ongoing geopolitical tensions and pandemic-related disruptions have prompted a shift toward regionalized supply chains.

- Part Gear may be expanding local production facilities or forming regional partnerships to reduce dependency on long-distance logistics.

-

Nearshoring and friend-shoring strategies are becoming key, especially in North America and the EU.

-

Growth in Industrial Automation and Robotics

- The rise of automation in manufacturing, logistics, and agriculture is increasing demand for precision gears in servo motors, robotic joints, and automated guided vehicles (AGVs).

- Part Gear stands to benefit from diversifying into industrial robotics, where reliability and miniaturization are paramount.

-

Customization and modular gear solutions are in higher demand to serve niche automation applications.

-

Digital Integration and Predictive Maintenance

- Integration of IoT sensors into gear systems allows for real-time performance monitoring and predictive maintenance.

- By 2026, Part Gear may be offering “smart gears” embedded with condition-monitoring capabilities, enabling customers to optimize equipment uptime and reduce maintenance costs.

-

Data analytics services could become a new revenue stream alongside physical components.

-

Competitive Landscape and Innovation Pressure

- Intensifying competition from low-cost manufacturers in Asia and technological leaders in Germany and Japan is pushing Part Gear to differentiate through R&D.

- Strategic investments in material science, noise reduction technologies (NVH), and thermal efficiency will be essential to maintain market share.

- Collaborations with research institutions and participation in industry consortia are likely on the rise.

Conclusion:

By 2026, Part Gear operates in a high-velocity, innovation-driven market shaped by electrification, digitalization, and sustainability. Success will depend on agility in adopting new technologies, diversifying into high-growth sectors like EVs and robotics, and building resilient, sustainable supply chains. Companies that proactively align with these H2 2026 market trends will be best positioned to capture value and lead in the next era of precision motion control.

Common Pitfalls Sourcing Part Gear (Quality, IP)

Sourcing part gear—whether mechanical components, software modules, or design elements—introduces significant risks related to both quality and intellectual property (IP). Failing to address these pitfalls can result in production delays, legal disputes, reputational damage, and financial losses. Below are key challenges to watch for:

Quality Inconsistencies and Non-Compliance

One of the most prevalent issues when sourcing part gear is inconsistent quality. Suppliers may deliver components that do not meet specified tolerances, material standards, or performance requirements. This can stem from inadequate quality control processes, use of substandard raw materials, or lack of certification (e.g., ISO, AS9100). Without rigorous incoming inspections or third-party audits, defective parts can enter the supply chain, leading to product failures, increased warranty claims, and potential safety hazards.

Lack of Traceability and Documentation

Poor documentation—such as missing material certifications, test reports, or manufacturing records—compromises quality assurance and regulatory compliance. In industries like aerospace, medical devices, or automotive, traceability is mandatory. The absence of clear records makes it difficult to validate part authenticity, conduct root cause analysis during failures, or respond to audits effectively.

Intellectual Property Infringement Risks

Sourcing part gear from third parties carries a high risk of unintentional IP infringement. Suppliers may use designs, software, or technologies protected by patents, copyrights, or trade secrets without proper licensing. When these components are integrated into your product, your company may become liable for infringement, facing lawsuits, injunctions, or forced redesigns. This risk is amplified when sourcing from regions with weak IP enforcement.

Unclear IP Ownership and Licensing Terms

Even when IP infringement is avoided, ambiguous contracts regarding IP ownership can create long-term problems. Suppliers might retain rights to custom-developed parts or embedded software, limiting your ability to modify, reproduce, or source alternatives. Without explicit agreements stating that IP transfers to the buyer or is fully licensed for intended use, you risk losing control over critical components.

Counterfeit or Grey Market Components

Part gear from unauthorized or unverified suppliers may be counterfeit, refurbished, or diverted from other markets. These components often fail prematurely and lack proper quality assurance. Counterfeit gear can also embed malicious hardware (in electronics) or violate IP rights, exposing the buyer to security and legal vulnerabilities.

Overreliance on Single or Unqualified Suppliers

Depending on a single source or unvetted supplier increases exposure to both quality and IP risks. If the supplier fails to deliver compliant parts or becomes embroiled in an IP dispute, your production and product roadmap can be severely disrupted. Supplier qualification processes—including technical assessments, site audits, and legal reviews—are essential but often overlooked.

Mitigation Strategies

To avoid these pitfalls, implement robust supplier qualification, enforce clear contractual terms on quality and IP, conduct regular audits, and require full documentation and IP warranties. Engaging legal and technical experts during procurement can significantly reduce exposure and ensure sustainable, compliant sourcing of part gear.

Logistics & Compliance Guide for Part Gear

This guide outlines the essential logistics and compliance procedures for handling, storing, transporting, and documenting Part Gear components. Adherence to these standards ensures operational efficiency, regulatory compliance, and product integrity across the supply chain.

Supply Chain Overview

Part Gear components move through a structured supply chain involving procurement, warehousing, distribution, and delivery. Key stakeholders include suppliers, internal logistics teams, third-party logistics (3PL) providers, and end customers. Each stage must follow documented procedures to maintain quality and traceability.

Inventory Management

Accurate inventory tracking is critical. Use barcode or RFID systems to log all Part Gear movements in the warehouse management system (WMS). Conduct regular cycle counts and scheduled audits to reconcile physical stock with digital records. Store Part Gear in designated zones with clear labeling, ensuring separation from non-compatible items.

Packaging Standards

All Part Gear shipments must be packaged according to approved specifications to prevent damage. Use anti-static materials where applicable, secure components to prevent movement, and seal containers properly. Label each package with the part number, quantity, batch/lot number, date of packaging, and handling instructions (e.g., “Fragile,” “Do Not Stack”).

Transportation Requirements

Engage certified carriers compliant with relevant transportation regulations (e.g., FMCSA in the U.S., ADR in Europe). Ensure temperature, humidity, and shock-sensitive requirements are met during transit. For international shipments, verify vehicle compliance with cross-border safety and environmental standards.

Export & Import Compliance

All international shipments of Part Gear must comply with export control regulations, including EAR (Export Administration Regulations) and ITAR if applicable. Obtain required licenses, complete accurate export documentation (e.g., commercial invoice, packing list, certificate of origin), and ensure Harmonized System (HS) codes are correctly assigned. Monitor changes in trade sanctions and embargoed destinations.

Customs Clearance Procedures

Submit complete and accurate documentation to customs authorities, including proper valuation and origin declarations. Partner with licensed customs brokers to facilitate timely clearance. Maintain records of all customs filings for a minimum of five years, in accordance with regulatory requirements.

Regulatory Documentation

Maintain a compliance file for each batch of Part Gear, including:

– Certificate of Conformance (CoC)

– Material Safety Data Sheet (MSDS/SDS), if applicable

– Traceability records (supplier lot numbers, production dates)

– Test and inspection reports

Handling & Storage Conditions

Store Part Gear in a climate-controlled environment within specified temperature and humidity ranges. Protect from dust, moisture, and direct sunlight. Enforce a first-in, first-out (FIFO) inventory rotation policy to minimize obsolescence.

Risk Mitigation & Contingency Planning

Identify potential supply chain disruptions (e.g., port delays, supplier outages) and develop mitigation strategies. Maintain safety stock levels for critical Part Gear components and validate alternate logistics routes or carriers. Regularly review and update the business continuity plan.

Audit & Continuous Improvement

Conduct internal logistics and compliance audits at least annually. Address non-conformities promptly and implement corrective actions. Solicit feedback from partners and customers to improve processes. Stay updated on regulatory changes and industry best practices to ensure ongoing compliance.

By following this guide, your organization ensures that Part Gear is handled efficiently and in full compliance with legal, safety, and quality standards.

Conclusion for Sourcing Gear Parts:

In conclusion, the successful sourcing of gear parts hinges on a well-structured procurement strategy that balances quality, cost, lead time, and supplier reliability. By clearly defining technical specifications, conducting thorough supplier evaluations, and considering factors such as material properties, manufacturing capabilities, and compliance with industry standards, organizations can ensure consistent performance and longevity of gear components in their applications. Additionally, fostering strong supplier relationships, exploring global and local sourcing options, and incorporating risk mitigation strategies contribute to supply chain resilience. Ultimately, strategic sourcing of gear parts not only supports operational efficiency but also enhances overall product reliability and competitiveness in the marketplace.