The global paper tube and core manufacturing market has experienced steady growth, driven by rising demand for sustainable packaging solutions across industries such as construction, textiles, food & beverage, and chemicals. According to Grand View Research, the global paperboard tubes and cores market size was valued at USD 5.7 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 4.3% from 2023 to 2030. This growth is fueled by increasing environmental regulations and a shift away from plastic-based packaging toward recyclable and biodegradable alternatives. Paper tubes, known for their high strength-to-weight ratio and customizability, have become a preferred choice for both industrial and consumer packaging applications. As sustainability continues to shape purchasing decisions, leading manufacturers are investing in advanced production technologies and eco-friendly materials to meet expanding market demands. In this evolving landscape, the top three paper tube manufacturers have distinguished themselves through innovation, global reach, and consistent quality.

Top 3 Paper Tube Co Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Paper Tube Manufacturer for Retail & Industrial Applications

Domain Est. 1997

Website: papertube.com

Key Highlights: A leading paper tube manufacturer for retail and industrial applications, Jonesville Paper Tube creates custom paper tubes for your exact needs….

#2 The Paper Tube Co.

Domain Est. 2002

Website: paper-tubes.net

Key Highlights: We help authentic companies thrive in a crowded marketplace through eco-friendly packaging that gets noticed, elevates the unboxing experience, and sells more ……

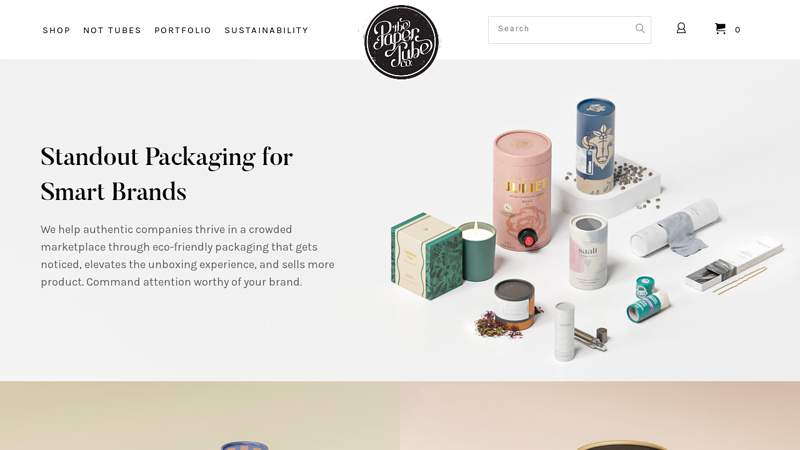

#3 Paper Tube Co.

Domain Est. 2013

Website: papertube.co

Key Highlights: We design, engineer, and manufacture custom paper tube packaging that stands out, gets noticed, and sells more products. Used by global consumer brands and ……

Expert Sourcing Insights for Paper Tube Co

H2: 2026 Market Trends Analysis for Paper Tube Co.

As Paper Tube Co. looks toward 2026, several key market trends are expected to shape the industry landscape, presenting both opportunities and challenges. These trends are driven by evolving consumer preferences, regulatory shifts, technological advancements, and global sustainability initiatives. A strategic analysis of these forces will be critical for the company to maintain competitiveness, innovate its product offerings, and expand market share.

1. Accelerated Demand for Sustainable Packaging

By 2026, sustainability will remain a dominant driver in packaging decisions across consumer goods, cosmetics, pharmaceuticals, and food sectors. Paper tubes—being recyclable, biodegradable, and derived from renewable resources—position Paper Tube Co. favorably. Increasing regulations banning single-use plastics in regions like the EU, Canada, and parts of Asia-Pacific will further boost demand for paper-based alternatives. Companies seeking eco-friendly packaging solutions will likely prioritize suppliers with strong environmental credentials, offering Paper Tube Co. an opportunity to highlight its sustainable manufacturing processes and certifications (e.g., FSC, PEFC).

2. Growth in E-Commerce and Premium Packaging

The continued expansion of e-commerce is expected to fuel demand for durable, lightweight, and aesthetically appealing packaging. Paper tubes are increasingly used for premium product presentation—such as luxury cosmetics, artisanal foods, and subscription boxes. By 2026, consumers will continue to value unboxing experiences, encouraging brands to invest in high-quality, customizable paper tube packaging. Paper Tube Co. can capitalize on this by offering advanced printing, embossing, and lamination options, as well as integrating smart packaging features like QR codes.

3. Technological Advancements in Manufacturing

Automation and digitalization will play a pivotal role in enhancing production efficiency and customization capabilities. By 2026, Paper Tube Co. may benefit from adopting Industry 4.0 technologies such as AI-driven quality control, real-time production monitoring, and flexible manufacturing systems that allow rapid switching between product configurations. These innovations can reduce waste, lower costs, and support shorter lead times—key differentiators in a fast-paced market.

4. Supply Chain Resilience and Local Sourcing

Global supply chain disruptions observed in recent years have prompted brands to reevaluate sourcing strategies. By 2026, there will be a stronger emphasis on regional manufacturing and localized supply chains to mitigate risks. Paper Tube Co. can strengthen its value proposition by emphasizing domestic production capabilities, shorter delivery times, and reduced carbon footprint through localized operations. This regional focus also aligns with growing “buy local” consumer sentiment.

5. Regulatory and Compliance Pressures

Environmental regulations are expected to tighten by 2026, with extended producer responsibility (EPR) schemes, carbon labeling, and stricter recycling mandates becoming more widespread. Paper Tube Co. must stay ahead of compliance requirements by investing in transparent supply chains, conducting lifecycle assessments (LCA), and ensuring full traceability of raw materials. Proactive engagement with regulators and industry groups will help shape favorable policy outcomes.

6. Competitive Landscape and Market Consolidation

The paper packaging sector is likely to see increased consolidation as larger players acquire niche manufacturers to broaden their sustainable portfolios. Paper Tube Co. may face intensified competition from both established packaging giants expanding into paper tubes and agile startups offering innovative designs. To differentiate, the company should focus on niche applications (e.g., pharmaceutical roll cores, eco-friendly gift packaging) and build strong B2B partnerships with brands committed to sustainability.

7. Consumer and Brand Transparency Expectations

By 2026, consumers and corporate clients will demand greater transparency regarding environmental impact, labor practices, and sourcing ethics. Paper Tube Co. can build trust by publishing sustainability reports, utilizing third-party verifications, and communicating its environmental savings (e.g., CO2 reductions, water usage) clearly to clients.

Conclusion

The 2026 market environment presents significant growth potential for Paper Tube Co., particularly as sustainability, digital transformation, and supply chain resilience converge. To thrive, the company should invest in innovation, strengthen its sustainability narrative, and deepen customer relationships through customization and reliability. By aligning its strategy with these macro trends, Paper Tube Co. can solidify its position as a leader in the eco-conscious packaging sector.

Common Pitfalls When Sourcing from Paper Tube Co (Quality, IP)

Sourcing from Paper Tube Co, or similar specialized manufacturers, can present specific challenges, particularly in the areas of quality consistency and intellectual property (IP) protection. Being aware of these pitfalls helps mitigate risks and ensures a successful partnership.

Quality Inconsistencies

One major risk when sourcing from Paper Tube Co is inconsistent product quality. Variations can occur due to differences in raw materials, production processes, or lack of standardized quality control protocols. For instance, paper tube thickness, seam strength, moisture resistance, or dimensional accuracy may fluctuate between batches, leading to defects in end-use applications such as packaging, textiles, or industrial components. Without clear specifications and regular audits, these inconsistencies can result in rejected shipments, production delays, or increased costs for rework.

Inadequate Intellectual Property Safeguards

Another significant pitfall is insufficient protection of intellectual property. When sharing custom designs, proprietary dimensions, or patented tube configurations with Paper Tube Co, there’s a risk of unauthorized replication or use of your IP for third-party clients. Many suppliers, especially in less-regulated regions, may not have robust confidentiality agreements or IP assignment clauses in place. Without clear contracts and legal safeguards, your innovations could be exposed to reverse engineering or misuse, undermining your competitive advantage and potentially leading to legal disputes.

Logistics & Compliance Guide for Paper Tube Co.

This guide outlines the essential logistics and compliance procedures for Paper Tube Co. to ensure efficient operations, regulatory adherence, and customer satisfaction.

Order Processing & Fulfillment

All customer orders must be entered into the company’s ERP system within 24 hours of receipt. Orders are reviewed for product specifications, quantities, delivery timelines, and special packaging requirements. Once confirmed, production schedules are updated accordingly, and warehouse teams are notified to prepare for fulfillment.

Packaging Standards

Paper tubes must be packaged according to customer specifications and industry best practices to prevent damage during transit. Standard packaging includes moisture-resistant wrapping, corner protectors for fragile shipments, and secure strapping on pallets. Custom packaging requests must be documented and approved by the Quality Assurance team prior to implementation.

Shipping & Carrier Coordination

Paper Tube Co. partners with certified freight carriers experienced in handling paper-based industrial goods. Shipping methods (LTL, FTL, or parcel) are selected based on order size, destination, and delivery urgency. Bills of lading must be accurately completed, and tracking information is shared with customers upon shipment.

Domestic & International Compliance

All shipments must comply with relevant transportation regulations. Domestic shipments adhere to FMCSA guidelines, while international shipments follow ISPM-15 for wood packaging materials (if applicable) and customs documentation requirements (e.g., commercial invoices, packing lists, and certificates of origin). Export licenses are obtained when required by the U.S. Department of Commerce.

Hazardous Materials & Environmental Regulations

Paper tubes are non-hazardous; however, inks and adhesives used in production may be subject to EPA and OSHA regulations. Safety Data Sheets (SDS) are maintained for all chemicals, and storage procedures follow fire code standards. The company complies with environmental regulations regarding waste paper recycling and emissions from production processes.

Documentation & Recordkeeping

All logistics and compliance documents—including shipping records, customs forms, SDS, and audit trails—are retained for a minimum of seven years. Digital copies are backed up monthly and stored securely in accordance with data protection policies.

Quality & Audit Readiness

Regular internal audits ensure compliance with ISO 9001 standards and customer-specific requirements. Logistics and production teams participate in annual training on compliance updates, safety protocols, and continuous improvement practices. Corrective actions are documented and implemented promptly in response to audit findings.

Customer Communication & Issue Resolution

Proactive communication is maintained throughout the logistics process. In the event of delays or compliance issues, customers are notified immediately with a clear resolution plan. A formal complaint handling procedure is in place to address and document all customer concerns related to shipping or product compliance.

Continuous Improvement

Logistics performance is measured through KPIs such as on-time delivery rate, damage claims, and compliance audit results. Feedback from customers and carriers is reviewed quarterly to identify opportunities for process optimization and regulatory alignment.

Conclusion for Sourcing Paper Tube Company

In conclusion, sourcing a reliable and efficient paper tube manufacturer is a critical step in ensuring the sustainability, quality, and cost-effectiveness of packaging solutions. After thorough evaluation of potential suppliers, key factors such as production capacity, material sourcing, environmental certifications, quality control processes, and geographic location should align with the company’s operational and sustainability goals.

Partnering with a reputable paper tube company not only supports eco-friendly packaging initiatives but also enhances brand image among environmentally conscious consumers. It is recommended to establish long-term relationships with suppliers who demonstrate innovation, transparency, and a commitment to continuous improvement. Conducting regular performance reviews and maintaining open communication will further ensure consistency and responsiveness to evolving business needs.

Ultimately, the right sourcing decision will balance cost, quality, and sustainability—contributing to both operational success and environmental responsibility.